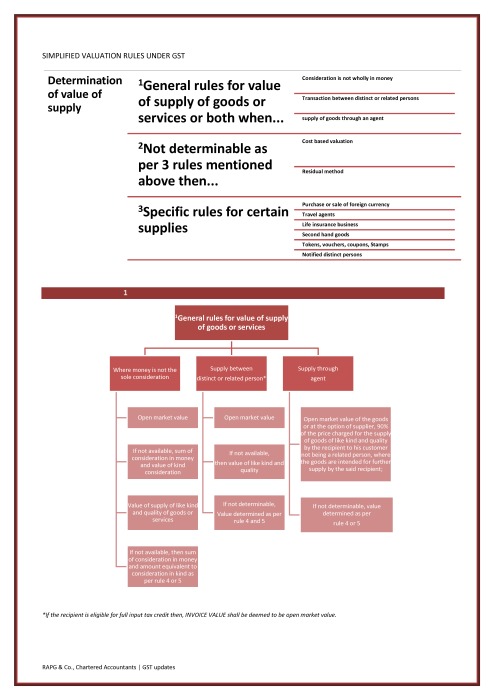

GST Valuation rules flowchart

GST valuation rules are recently released. In this article we have prepared GST valuation rules flow chart. These rules are helpful in deciding the value of a supply. GST levy refers the section 15 for valuation and in normal cases the taxable value is transaction value. But in some cases we will have to refer the rules.

Main provisions covered in these rules are:

Value of supply of goods or services or both

- where the consideration is not wholly in money

- between distinct or related persons, other than through an agent

- Based on cost

- Residual method for determination of value of supply of goods or services or both