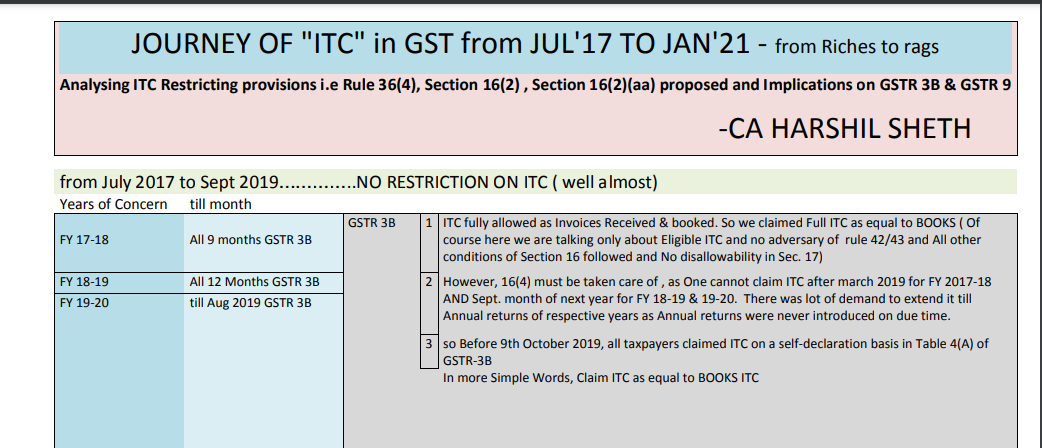

The journey of ITC From July-2017 to Jan-2021…and onwards

Analyzing ITC Restricting provisions i.e Rule 36(4), Section 16(2), Section 16(2)(aa) proposed and Implications on GSTR 3B & GSTR 9

from July 2017 to […]

Suggestions to Rationalise Current Direct Tax Structure

1 Allow Filling ITR After 31-March of AY

Allow filling Income Tax return after 31st March of Assessment year ( Ofcourse with Higher late fees than […]

Areas They Ignored In 20 Lac Cr. Economic Package Announced

In 5 days long announcements for reforms & reliefs to the Indian Economy, There are some really good announcements. Like, 1 nation 1 ration card, […]

EXTENDED DUE DATE SCHEDULE FOR GST RETURNS TILL JUNE 2020 MONTH

As you aware that Due Dates extended for providing relief to taxpayers in view of COVID-19 pandemic, Below is the schedule for GST R […]

Automatic Calculator for Interest on the delayed filling of GSTR – 3B for FY 17-18, FY 18-19, FY 19-20

This article gives you a brief idea on the topic of Interest under GST & AN AUTOMATIC EXCEL UTILITY for […]

BRIEF

The budget was expected to be a path-breaking one, being the first budget of the new decade. However, as has been the case with earlier budgets, it is bound to fall short of middle-class expectations, […]

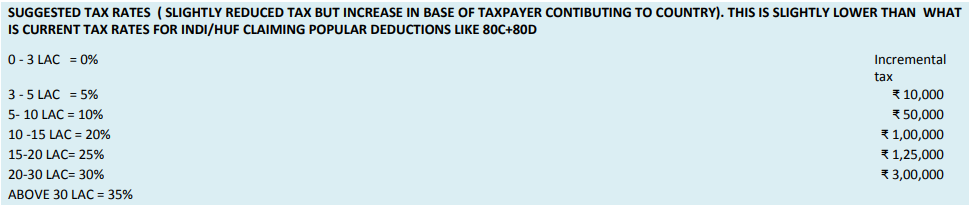

9 IDEAS TO REFORM INCOME TAX ACT ( OR IT MAY BE INCORPORATED IN DTC )

1. SOLUTION TO GIVE RELEIF TO MIDDLE CLASS & LOWER CLASS FROM INCOME TAX WITHOUT DECREASING REVENUE

THIS SHOULD BE INCOME TAX SLABS. REMOVE […]

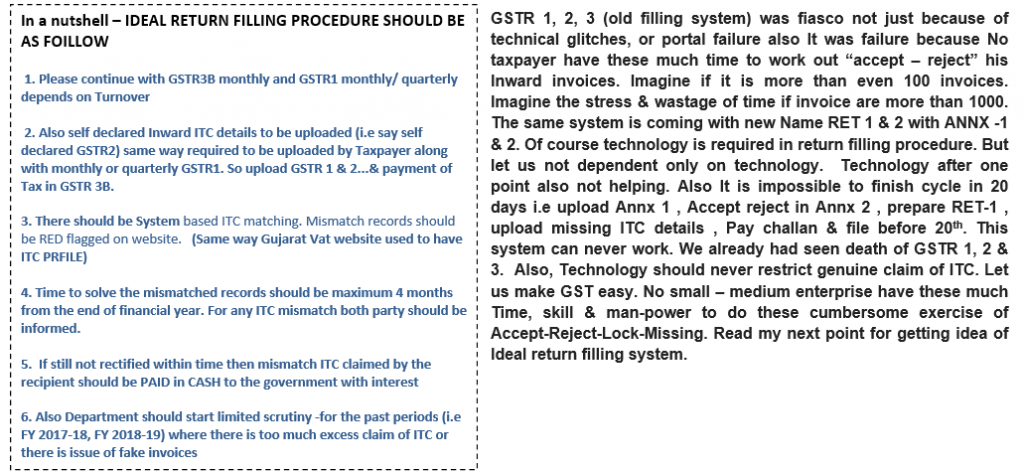

PART A – Suggestions on IDEAL RETURN FILLING PROCEDURE under GST

PART B – SUGGESTIONS for SIMPLIFICATION OF GST LAW & POLICIES

PART C – SUGGESTIONS FOR Increase in Government Revenue […]

ALL JOB WORK RATES SUMMARISED – AFTER OCTOBER 2019 NOTIFICATION CHANGED RATES OF JOB WORK

JOB WORK RATE 5% –

1.Services by way of JOB WORK OF GOODS BELONGING TO ANOTHER REGISTERED PERSON in relati […]

12 SUGGESTIONS FOR SIMPLIFICATION OF GST LAW, PROCEDURES & FORMS

It is to provide ease of business to dealers & to make GST “simple” and Help to clear mess created under GST so that compliance level can be inc […]

Job work and Notification 20/2019 dated 1-10-2019

Earlier, Excise and service tax always fights in deciding whether particular transaction is Manufacture or Whether its service Intention of GST introduction was […]

Introduction:

Hello, looking to lesser number of filling GSTR 9, I would like to give some inputs which might motivate to those who have yet not started filling GSTR 9. So, we have created a GSTR 9 – Kit for St […]

One page guide for GSTR 9 help: FIle it in minutes

GSTR 9 help for taxpayers need to file it. After reading this article you will be able to resolve all your issues. The last date for filing of Annual return […]

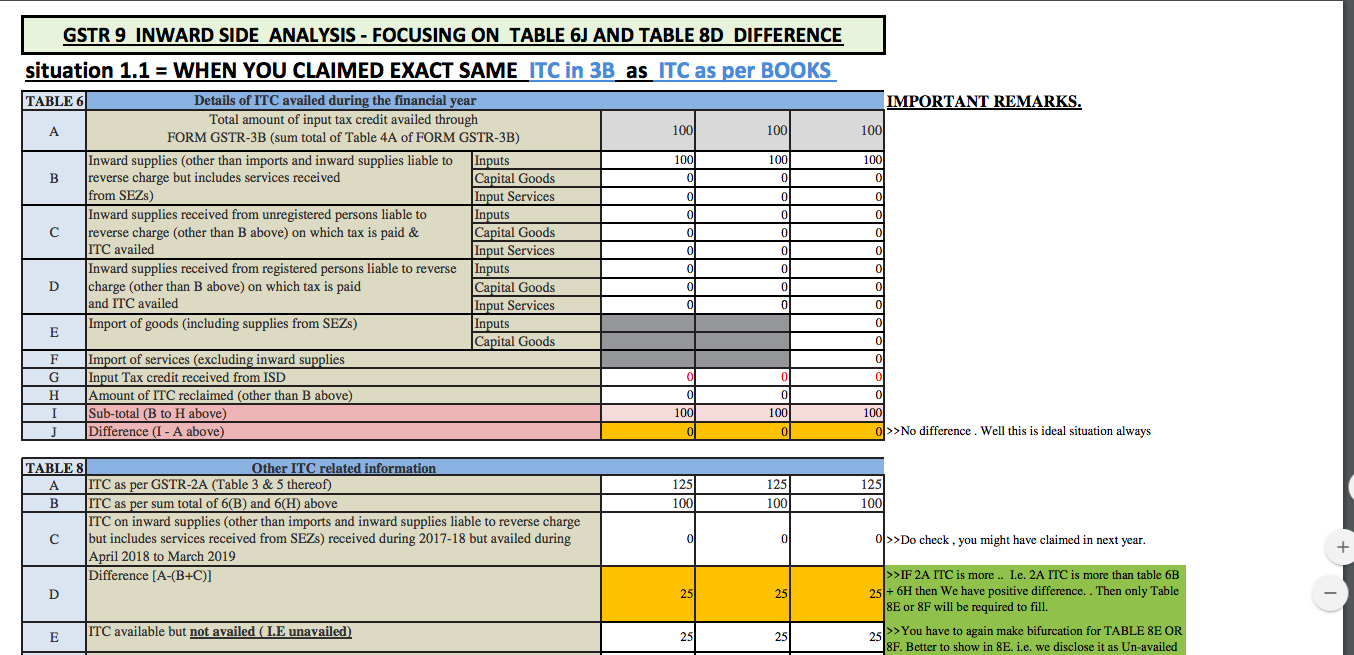

GSTR 9 Inward side Analysis – Focusing on Table 6J and Table 8D difference

We have created various possible situation on the ITC part of the GSTR 9 and we have created the GSTR 9 Inward Side Analysis, which is […]

CA Harshil Sheth

@ca-harshil-sheth

active 1 month, 2 weeks agoCA Harshil Sheth

OOPS!

No Packages Added by CA Harshil Sheth. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

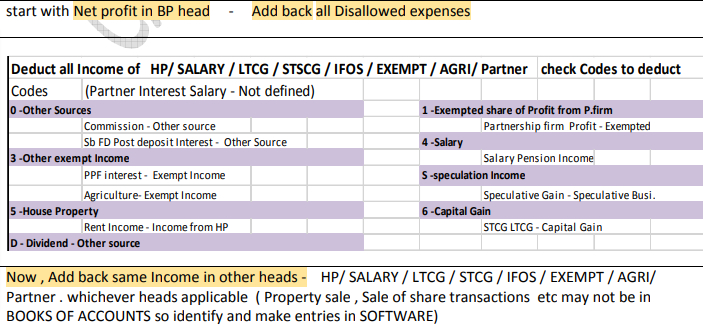

Read InterviewCA Harshil Sheth wrote a new post, 35 ITR CHECKLIST STEPS 3 years, 7 months ago

DOCUMENTS

Make sure to have all COPIES OF FOLLOWINGS DOCUMENTS & CHECK EVERYTHING in ONE GO to decide the SCOPE OF WORK

Balance sheet, Profit Loss A/c, Capital A/c, Fixed Asset Ledgers, Indirect Incomes […]

CA Harshil Sheth wrote a new post, The journey of ITC From July-2017 to Jan-2021…and onwards 5 years ago

The journey of ITC From July-2017 to Jan-2021…and onwards

Analyzing ITC Restricting provisions i.e Rule 36(4), Section 16(2), Section 16(2)(aa) proposed and Implications on GSTR 3B & GSTR 9

from July 2017 to […]

CA Harshil Sheth wrote a new post, Suggestions to Rationalise Current Direct Tax Structure 5 years, 1 month ago

Suggestions to Rationalise Current Direct Tax Structure

1 Allow Filling ITR After 31-March of AY

Allow filling Income Tax return after 31st March of Assessment year ( Ofcourse with Higher late fees than […]

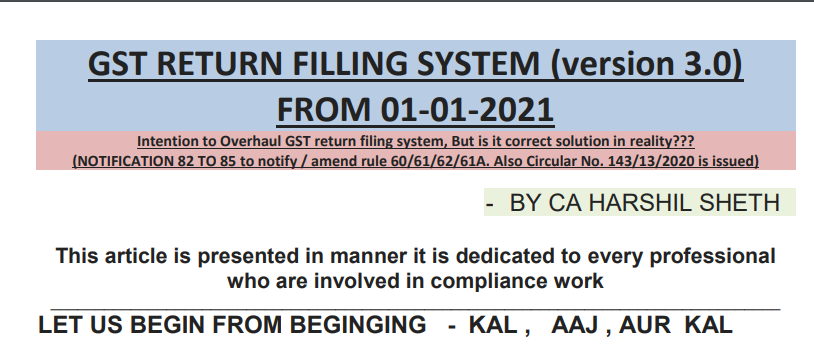

CA Harshil Sheth wrote a new post, GST Return Filing System (version 3.0) From 01-01-2021 5 years, 3 months ago

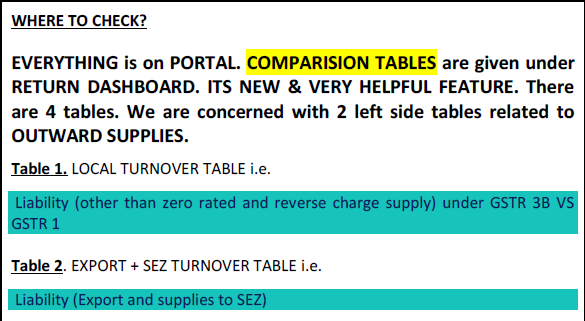

GST Return Filing System (version 3.0) From 01-01-2021

Intention to Overhaul GST return filing system, But is it correct solution in reality???

(NOTIFICATION 82 TO 85 to notify/amend rule 60/61/62/61A. Also […]

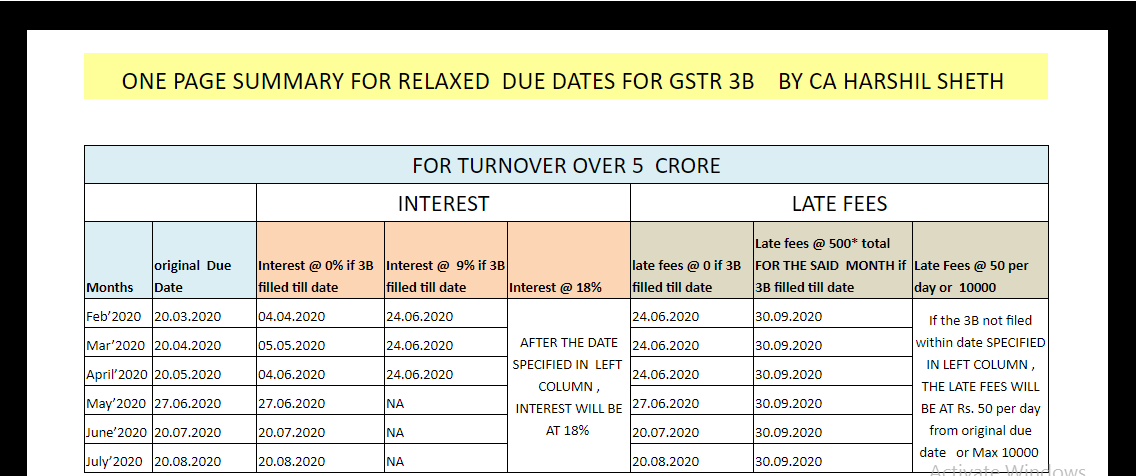

CA Harshil Sheth wrote a new post, One Page Summary For Relaxed Due Dates For GSTR 3B 5 years, 7 months ago

One Page Summary For Relaxed Due Dates For GSTR 3B

FOR TURNOVER OVER 5 CRORE

INTEREST

LATE FEES

original Due Date

Interest @ 0% if 3B filled till date

Interest @ 9 […]

CA Harshil Sheth wrote a new post, Areas They Ignored In 20 Lac Cr. Economic Package Announced 5 years, 9 months ago

Areas They Ignored In 20 Lac Cr. Economic Package Announced

In 5 days long announcements for reforms & reliefs to the Indian Economy, There are some really good announcements. Like, 1 nation 1 ration card, […]

CA Harshil Sheth wrote a new post, Revised Dates of Various Compliances or Payments under Income Tax Act 5 years, 10 months ago

Revised Dates of Various Compliances or Payments under Income Tax Act

Sr. No.

Return/ Payment date

Earlier Date

Revised Date

1

Last date of Return filing for FY 2018-19

31st March 2020

30th June […]

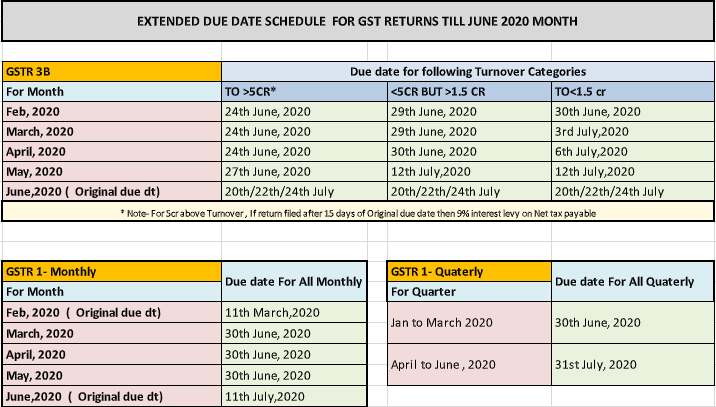

CA Harshil Sheth wrote a new post, Extended due dates schedule for GST returns till June 2020 5 years, 10 months ago

EXTENDED DUE DATE SCHEDULE FOR GST RETURNS TILL JUNE 2020 MONTH

As you aware that Due Dates extended for providing relief to taxpayers in view of COVID-19 pandemic, Below is the schedule for GST R […]

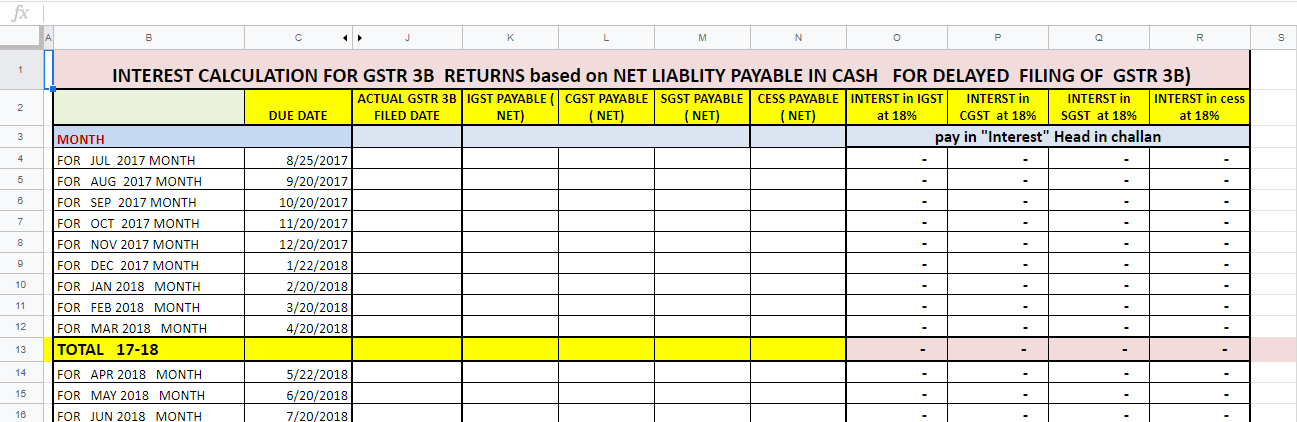

CA Harshil Sheth wrote a new post, Download Automatic Calculator for Interest on the delayed filling of GSTR – 3B 5 years, 11 months ago

Automatic Calculator for Interest on the delayed filling of GSTR – 3B for FY 17-18, FY 18-19, FY 19-20

This article gives you a brief idea on the topic of Interest under GST & AN AUTOMATIC EXCEL UTILITY for […]

CA Harshil Sheth wrote a new post, COMPARISON OF OLD VS NEW REGIME OF INCOME TAX – Budget 2020 6 years ago

BRIEF

The budget was expected to be a path-breaking one, being the first budget of the new decade. However, as has been the case with earlier budgets, it is bound to fall short of middle-class expectations, […]

CA Harshil Sheth wrote a new post, 9 IDEAS TO REFORM INCOME TAX ACT 6 years, 1 month ago

9 IDEAS TO REFORM INCOME TAX ACT ( OR IT MAY BE INCORPORATED IN DTC )

1. SOLUTION TO GIVE RELEIF TO MIDDLE CLASS & LOWER CLASS FROM INCOME TAX WITHOUT DECREASING REVENUE

THIS SHOULD BE INCOME TAX SLABS. REMOVE […]

CA Harshil Sheth wrote a new post, 15 suggestions on GST RETURNS, PROCEDURES, LAW & POLICIES – December 2019 6 years, 2 months ago

PART A – Suggestions on IDEAL RETURN FILLING PROCEDURE under GST

PART B – SUGGESTIONS for SIMPLIFICATION OF GST LAW & POLICIES

PART C – SUGGESTIONS FOR Increase in Government Revenue […]

CA Harshil Sheth wrote a new post, ALL JOB WORK RATES SUMMARISED 6 years, 2 months ago

ALL JOB WORK RATES SUMMARISED – AFTER OCTOBER 2019 NOTIFICATION CHANGED RATES OF JOB WORK

JOB WORK RATE 5% –

1.Services by way of JOB WORK OF GOODS BELONGING TO ANOTHER REGISTERED PERSON in relati […]

CA Harshil Sheth wrote a new post, 12 SUGGESTIONS FOR SIMPLIFICATION OF GST LAW 6 years, 4 months ago

12 SUGGESTIONS FOR SIMPLIFICATION OF GST LAW, PROCEDURES & FORMS

It is to provide ease of business to dealers & to make GST “simple” and Help to clear mess created under GST so that compliance level can be inc […]

CA Harshil Sheth wrote a new post, 4 BIG COMMON Mistakes in GSTR- 3B 6 years, 4 months ago

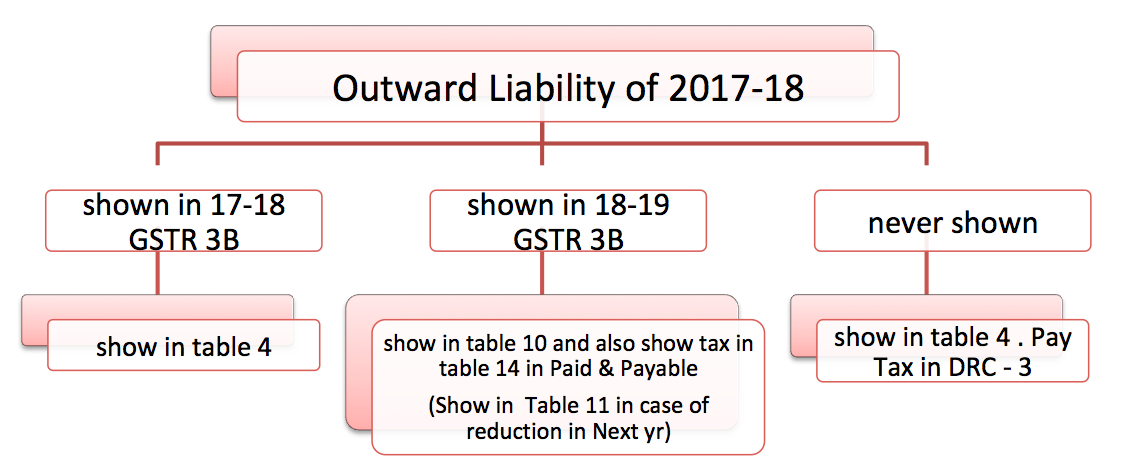

4 BIG COMMON Mistakes People making in GSTR- 3B

( & that leads to wrong reporting in GSTR 9

4 BIG COMMON Mistakes in GSTR- 3B.After filling some Annual return GSTR 9, WE have found that , many people […]

CA Harshil Sheth wrote a new post, Job work and Notification 20/2019 dated 1-10-2019 6 years, 4 months ago

Job work and Notification 20/2019 dated 1-10-2019

Earlier, Excise and service tax always fights in deciding whether particular transaction is Manufacture or Whether its service Intention of GST introduction was […]

CA Harshil Sheth wrote a new post, GSTR 9 – Kit for Starters to file annual retrun 6 years, 6 months ago

Introduction:

Hello, looking to lesser number of filling GSTR 9, I would like to give some inputs which might motivate to those who have yet not started filling GSTR 9. So, we have created a GSTR 9 – Kit for St […]

CA Harshil Sheth wrote a new post, GSTR 9 help – One page guide 6 years, 6 months ago

One page guide for GSTR 9 help: FIle it in minutes

GSTR 9 help for taxpayers need to file it. After reading this article you will be able to resolve all your issues. The last date for filing of Annual return […]

CA Harshil Sheth wrote a new post, GSTR 9 Inward side Analysis 6 years, 8 months ago

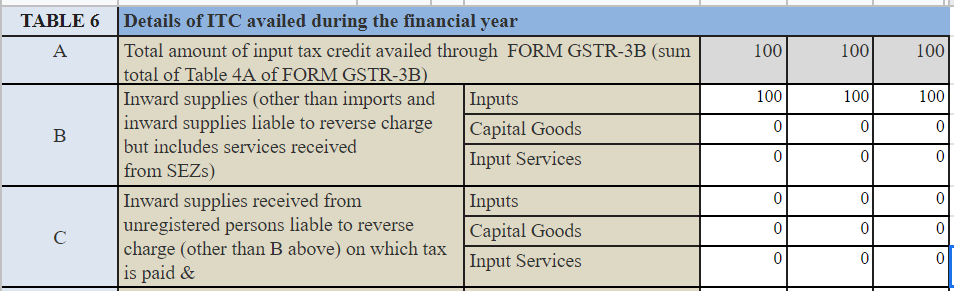

GSTR 9 Inward side Analysis – Focusing on Table 6J and Table 8D difference

We have created various possible situation on the ITC part of the GSTR 9 and we have created the GSTR 9 Inward Side Analysis, which is […]

CA Harshil Sheth wrote a new post, GSTR 9 INWARD SIDE ANALYSIS – FOCUSING ON TABLE 6J AND TABLE 8D DIFFERENCE 6 years, 9 months ago

situation 1.1 = WHEN YOU CLAIMED EXACT SAME ITC in 3B as ITC as per BOOKS

situation 1.1 = WHEN YOU CLAIMED EXACT SAME ITC in 3B as ITC as per […]