PK Mittal

BCom Delhi university 1975

LLB Delhi University 1978

FCS Fellow Member of ICSI 1992

1982 to 1992 as CS in Corporate

Head Legal Apollo Tyres Ltd 1986 to 1992

1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date.

Written more than 100 Article on Company Law and Corporate laws Indirect Tax

Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations

Convenor Core Group on GST of ICSI

In this presentation, vexed issue as to whether GST Paid on Medical/Health Insurance cover in respect of all employees (including employees drawing salary more than Rs.21,000/-) is allowable as ITC in view of the […]

Whether Service Tax Payable On Constructed Area Falling To The Share of Land-Owner Under Joint Development Agreement?

It is very common in the Real Estate Industry, the land-owner does not the wherewithal for c […]

Services Provided By Director (Foreign National, NRI & Indian Citizen As Wholetime, Non-Execute, Nominee, And Independent Under Companies Act, 2013, And Its Taxability Under GST.

In this article, an attempt has […]

Principle Governing Attachment of Property Under Section 83 CGST Act, 2017

Section 83 of Central Goods & Services Act, 2017 (hereinafter called CGST Act) says that Commissioner is of the opinion that any procee […]

Taxability of Service of Club-Association Under GST Law?

In this article, an attempt has been made to deal with the vexed issue of levy of GST on various transactions entered into between the Club or […]

Summons, Cross-Examination, And Arrest, Under CGST Act, 2017

As a prelude to initiation of action under Section 69 of Goods & Service Tax, 2017 (hereinafter called CGST Act) for the arrest of wrong-doer, there […]

Inspection, Search and Seizure- Legal Safeguards

I have written an Article on Section 67 CGST Act on the issue of ” Inspection, Search and Seizure ” it’s meaning, scope, and jurisdiction. It also deals with […]

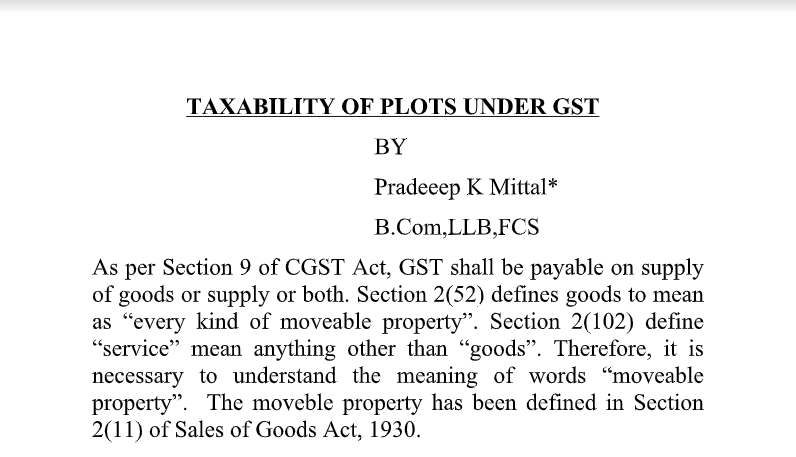

Taxability of Plots Under GST

As per Section 9 of the CGST Act, GST shall be payable on the supply of goods or supply or both. Section 2(52) defines goods to mean as “every kind of moveable property”. Section 2(1 […]

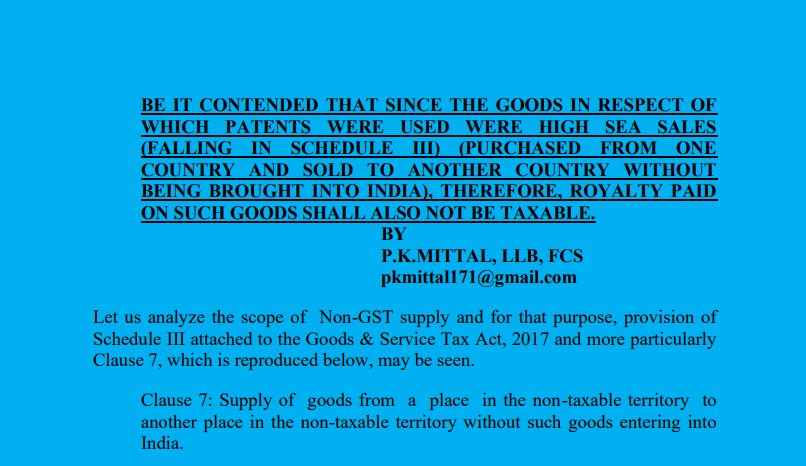

Article on Royalty Part-II

Be it contended that since the Goods in respect of which patents were used High Sea sales (Falling in Schedule III (Purchased from one country and sold to another country without […]

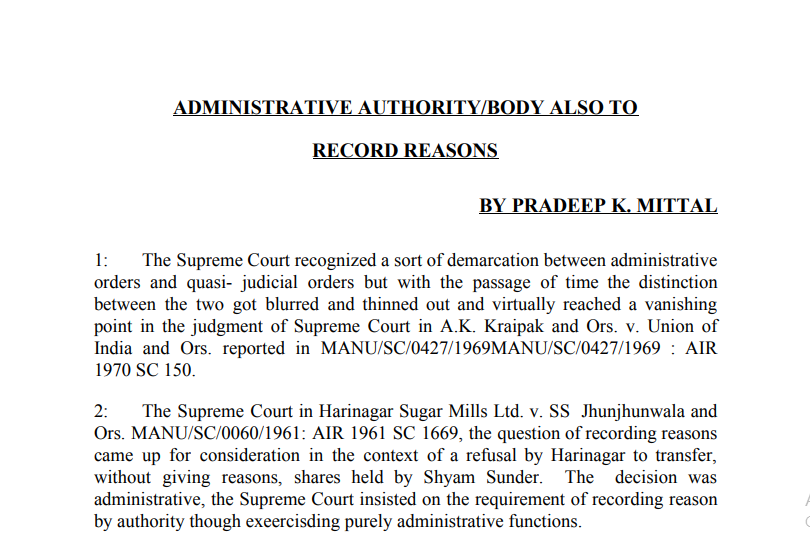

Administrative Authority/Body Also To Record Reasons

1: The Supreme Court recognized a sort of demarcation between administrative orders and quasi-judicial orders but with the passage of time the distinction […]

Retrospective Withdrawal of Export Benefits –Permissible?

The Delhi High Court in Indian Aluminium Co. Ltd. v. UOI, 1983 (12) ELT 349, held that it is not open to the Board of Central Excise and Customs in its a […]

Section 10(1)(a) IGST Act –Place of Supply

In the present Article, I am raising a very interesting issue about the place of supply of goods as envisaged under Section 10(1)(a) of IGST Act. Practically, in all s […]

Delay In Adjudication of SCN

Under many corporate laws and also erstwhile Central Excise Act, Service Tax law, Customs Act, Foreign Trade( Development & Regulation )Act, there is no time limit prescribed under […]

Critical Issues of GST

This presentation is on the Critical Issues of GST. It is drafted by Advocate PK Mittal. This presentation covers the various issues in GST and various judgements in this […]

Quasi-Judicial Authorities Must Record Reasons While Passing Order

1: Siemens Engineering and Manufacturing Co. of India Ltd. v. The Union of India MANU/SC/0211/1976: AIR 1976 SC 1785, the SC held that it is far […]

In Devangere Cotton Mills Vs. CCE 2006(198) ELT 482 SC, SC held that Tribunal is not right in refusing new ground only on the ground that the ground was not raised earlier.

T […]

Right of Appeal not inherent right but to be regulated as per Law. CCE. Vs. SAIL 2010(10) SCC 744.

An appeal can be filed even when duty/tax has been paid without a mark of p […]

Advocate Pradeep Kumar

@pkm

Not recently activeAdvocate Pradeep Kumar

PK Mittal BCom Delhi university 1975 LLB Delhi University 1978 FCS Fellow Member of ICSI 1992 1982 to 1992 as CS in Corporate Head Legal Apollo Tyres Ltd 1986 to 1992 1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date. Written more than 100 Article on Company Law and Corporate laws Indirect Tax Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations Convenor Core Group on GST of ICSI

OOPS!

No Packages Added by Advocate Pradeep Kumar. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAdvocate Pradeep Kumar wrote a new post, Allowability of Itc on Gst Paid on Group Medical Insurance, Health or Medical Insurance Cover for All Categories of Employees 4 years, 10 months ago

In this presentation, vexed issue as to whether GST Paid on Medical/Health Insurance cover in respect of all employees (including employees drawing salary more than Rs.21,000/-) is allowable as ITC in view of the […]

Advocate Pradeep Kumar wrote a new post, Highlights of Tata Sons Judgement 4 years, 10 months ago

TATA CONSULTANCY SERVICES LIMITED VS. CYRUS INVESTMENTS PVT LTD AND ORS CIVIL APPEAL NO.440 441 OF 2020

The following are some of the important highlights of the judgment rendered by the Hon’ble Supreme Court […]

Advocate Pradeep Kumar wrote a new post, Onus to Pay Fresh Tax or Increase in Rate of GST in Supply of Goods or Services 4 years, 11 months ago

The onus to Pay Fresh Tax or Increase in Rate of GST in Supply of Goods or Services

In day-to-day life, invariably Agreements are entered into with the Principal who is Government or Government Department […]

Advocate Pradeep Kumar wrote a new post, Whether Service Tax Payable On Constructed Area Falling To The Share of Land-Owner Under Joint Development Agreement? 4 years, 11 months ago

Whether Service Tax Payable On Constructed Area Falling To The Share of Land-Owner Under Joint Development Agreement?

It is very common in the Real Estate Industry, the land-owner does not the wherewithal for c […]

Advocate Pradeep Kumar wrote a new post, Services Provided By Director 5 years, 5 months ago

Services Provided By Director (Foreign National, NRI & Indian Citizen As Wholetime, Non-Execute, Nominee, And Independent Under Companies Act, 2013, And Its Taxability Under GST.

In this article, an attempt has […]

Advocate Pradeep Kumar wrote a new post, Principle Governing Attachment of Property Under Section 83 CGST Act, 2017 5 years, 7 months ago

Principle Governing Attachment of Property Under Section 83 CGST Act, 2017

Section 83 of Central Goods & Services Act, 2017 (hereinafter called CGST Act) says that Commissioner is of the opinion that any procee […]

Advocate Pradeep Kumar wrote a new post, Taxability of Service of Club-Association Under GST Law? 5 years, 7 months ago

Taxability of Service of Club-Association Under GST Law?

In this article, an attempt has been made to deal with the vexed issue of levy of GST on various transactions entered into between the Club or […]

Advocate Pradeep Kumar wrote a new post, Summons, Cross-Examination, And Arrest, Under CGST Act, 2017 5 years, 7 months ago

Summons, Cross-Examination, And Arrest, Under CGST Act, 2017

As a prelude to initiation of action under Section 69 of Goods & Service Tax, 2017 (hereinafter called CGST Act) for the arrest of wrong-doer, there […]

Advocate Pradeep Kumar wrote a new post, Inspection, Search and Seizure- Legal Safeguards 5 years, 7 months ago

Inspection, Search and Seizure- Legal Safeguards

I have written an Article on Section 67 CGST Act on the issue of ” Inspection, Search and Seizure ” it’s meaning, scope, and jurisdiction. It also deals with […]

Advocate Pradeep Kumar wrote a new post, Taxability of Plots Under GST 5 years, 7 months ago

Taxability of Plots Under GST

As per Section 9 of the CGST Act, GST shall be payable on the supply of goods or supply or both. Section 2(52) defines goods to mean as “every kind of moveable property”. Section 2(1 […]

Advocate Pradeep Kumar wrote a new post, Article on Royalty Part-II 5 years, 8 months ago

Article on Royalty Part-II

Be it contended that since the Goods in respect of which patents were used High Sea sales (Falling in Schedule III (Purchased from one country and sold to another country without […]

Advocate Pradeep Kumar wrote a new post, Administrative Authority/Body Also To Record Reasons 5 years, 8 months ago

Administrative Authority/Body Also To Record Reasons

1: The Supreme Court recognized a sort of demarcation between administrative orders and quasi-judicial orders but with the passage of time the distinction […]

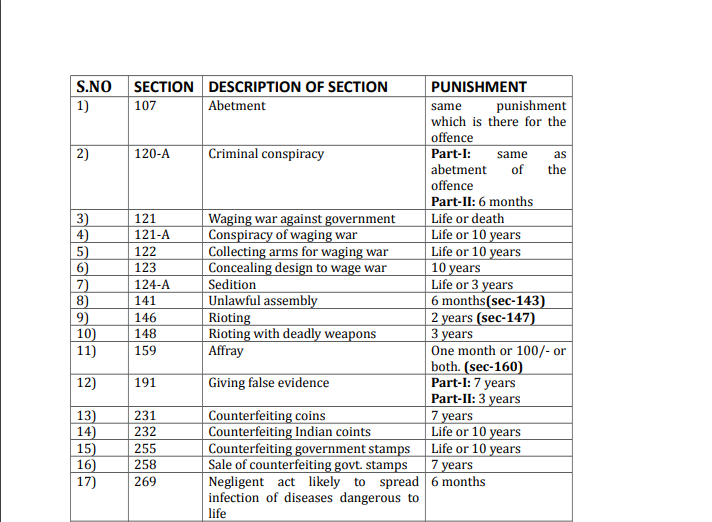

Advocate Pradeep Kumar wrote a new post, The Section of IPC and Respective Punishment 5 years, 8 months ago

The Section of IPC and Respective Punishment

S.NO

SECTION

DESCRIPTION OF SECTION

PUNISHMENT

1

107

Abetment

same punishment which is there for the offense

2

120-A

Criminal […]

Advocate Pradeep Kumar wrote a new post, Retrospective Withdrawal of Export Benefits –Permissible? 5 years, 8 months ago

Retrospective Withdrawal of Export Benefits –Permissible?

The Delhi High Court in Indian Aluminium Co. Ltd. v. UOI, 1983 (12) ELT 349, held that it is not open to the Board of Central Excise and Customs in its a […]

Advocate Pradeep Kumar wrote a new post, Section 10(1)(a) IGST Act –Place of Supply 5 years, 8 months ago

Section 10(1)(a) IGST Act –Place of Supply

In the present Article, I am raising a very interesting issue about the place of supply of goods as envisaged under Section 10(1)(a) of IGST Act. Practically, in all s […]

Advocate Pradeep Kumar wrote a new post, Delay In Adjudication of SCN 5 years, 8 months ago

Delay In Adjudication of SCN

Under many corporate laws and also erstwhile Central Excise Act, Service Tax law, Customs Act, Foreign Trade( Development & Regulation )Act, there is no time limit prescribed under […]

Advocate Pradeep Kumar wrote a new post, Critical Issues of GST 5 years, 8 months ago

Critical Issues of GST

This presentation is on the Critical Issues of GST. It is drafted by Advocate PK Mittal. This presentation covers the various issues in GST and various judgements in this […]

Advocate Pradeep Kumar wrote a new post, Quasi-Judicial Authorities Must Record Reasons While Passing Order 5 years, 8 months ago

Quasi-Judicial Authorities Must Record Reasons While Passing Order

1: Siemens Engineering and Manufacturing Co. of India Ltd. v. The Union of India MANU/SC/0211/1976: AIR 1976 SC 1785, the SC held that it is far […]

Advocate Pradeep Kumar wrote a new post, Fundamental Principle of Appeal 5 years, 8 months ago

New Ground of Facts And Law

In Devangere Cotton Mills Vs. CCE 2006(198) ELT 482 SC, SC held that Tribunal is not right in refusing new ground only on the ground that the ground was not raised earlier.

T […]

Advocate Pradeep Kumar wrote a new post, Basic Principle of Appeal 5 years, 8 months ago

Basic Principle of Appeal

Right of Appeal not inherent right but to be regulated as per Law. CCE. Vs. SAIL 2010(10) SCC 744.

An appeal can be filed even when duty/tax has been paid without a mark of p […]