Key Take-way of the decision of the Hon’ble Supreme Court (SC)

1. The Hon’ble SC has refused to interfere in the order as passed by the Hon’ble High Court of Rajasthan and accordingly confirmed that no late fee […]

Disclosures in GST audit report:

Draft disclosures in GST audit report for use of all professional. A list of 15 possible disclosures in GST audit report. These disclosures will be quite useful for you. […]

Case Studies on Presentation of Input Tax Credit in Annual Return

There have been lot many errors while claiming Input Tax Credit by the Taxpayers. Some of very common errors was inadvertently claiming Excess […]

GST Case 18- Kundan Misthan Bhandar

In the GST case of Kundan Misthan Bhandar, the applicant has raised the query regarding the supply made by a sweetshop cum restaurant of the pure food.

Query:

Whether s […]

GST Case 20 of Ashok Kumar Basu

In the GST case of Ashok Kumar Basu, the applicant has raised the query regarding the taxability of the Printing of Examination Question Papers. Because Printing of Exam […]

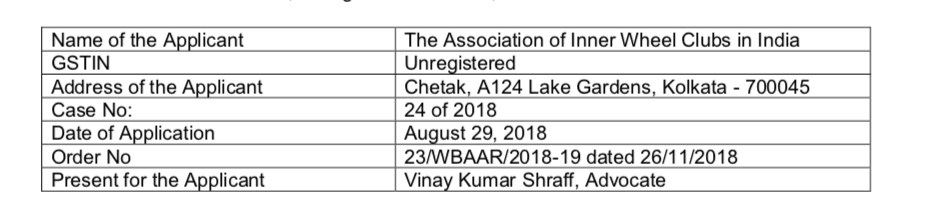

GST Case – 19 Association of Inner Wheel Clubs in India

In the GST case of Association of Inner Wheel Clubs in India. The Taxability of funds received through Annual Subscription, Sponsorship Fees and Sale Of S […]

GSTCase-18- Tax rate on supply of pure food items

This article is in series of my updates on advanced rulings. Today I will be discussing the advance ruling by AAR Uttrakhand. This Advanced ruling is for tax rate […]

GST Case-17- K.P.H. Dream Cricket (P.) Ltd

In the GST Case of the KPH Dream Cricket private limited, the applicant has raised the query regarding the nature of the “complimentary tickets'” given by the applicant. […]

GST Case 16- NHPC Ltd

1. Query:

Query 1:-

Whether NHPC Limited required to pay GST under reverse charge of Notification No. 13/2017 while making payment to PWD, Uttrakhand for construction of road?

Query […]

GST Case 15-Goa Tourism Development Corporation Ltd.

In the GST Case of Goa Tourism Development Corporation Ltd. The applicant has raised the query regarding “Whether GST is applicable on One Time Concession […]

GST AR Case-13 Taxability of Discount received by Del Credre Agent

Taxability of Discount received by Del Credre Agent from its principal and passed onto the Customers. This issues is discussed in this […]

GST Case-12 Crux of KIMS Healthcare AAR:

In this write up the crux of KIMS healthcare AAR is drafted. It is a very important decision for the healthcare industry.

GST Case 11-Nagaur Mukangarh Highways (P.) Ltd.

In the GST case of the Nagaur Mukhangarh Highways (P.) Ltd. The Applicant has raised the query regarding the eligibility of ITC taken or to be taken by him on c […]

GST Case 10- Jaimin Engineering Pvt. Ltd.

In the GST case of Jaimin Engineering Pvt. Ltd. The applicant has raised the query regarding the liability to take registration in the different state.

Query: […]

Levy of GST on Liquor License Fees: Minutes of the Meeting Of GST Council

The much awaited minutes of GST Council, have been release and have been updated till 4th May 2018. The first and one of the most […]

GST Case 9-United Breweries Ltd.

In this GST Case the M/s. united Breweries has raised the query regarding the applicability of the GST on the services provided by them. Following are observation and order in […]

Levy of GST on Liquor License Fees:

The much awaited minutes of GST Council, have been release and have been updated till 4th May 2018. The first and one of the most important part of the minutes of the meeting […]

GST Case 8- Prodair Air Products India Pvt. Ltd.

In GST Case of Prodair Air Products India Pvt. Ltd., the applicant has raised the query in relation to the services provided by him as “Job Work”. So, let us dis […]

GST Case6- Saji s. v. Commissioner, State GST Department

In GST Case of Saji s. v. Commissioner, the state GST Department, the demand of the IGST is adjusted with the refund of the SGST of the […]

CA Arpit Haldia

@arpith

Not recently activeCA Arpit Haldia

OOPS!

No Packages Added by CA Arpit Haldia. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Arpit Haldia wrote a new post, Key Take-way of the decision of the Hon’ble Supreme Court (SC) 6 years ago

Key Take-way of the decision of the Hon’ble Supreme Court (SC)

1. The Hon’ble SC has refused to interfere in the order as passed by the Hon’ble High Court of Rajasthan and accordingly confirmed that no late fee […]

CA Arpit Haldia wrote a new post, Draft disclosures in GST audit report 6 years, 6 months ago

Disclosures in GST audit report:

Draft disclosures in GST audit report for use of all professional. A list of 15 possible disclosures in GST audit report. These disclosures will be quite useful for you. […]

CA Arpit Haldia wrote a new post, Presentation of Input Tax Credit in Annual Return 6 years, 8 months ago

Case Studies on Presentation of Input Tax Credit in Annual Return

There have been lot many errors while claiming Input Tax Credit by the Taxpayers. Some of very common errors was inadvertently claiming Excess […]

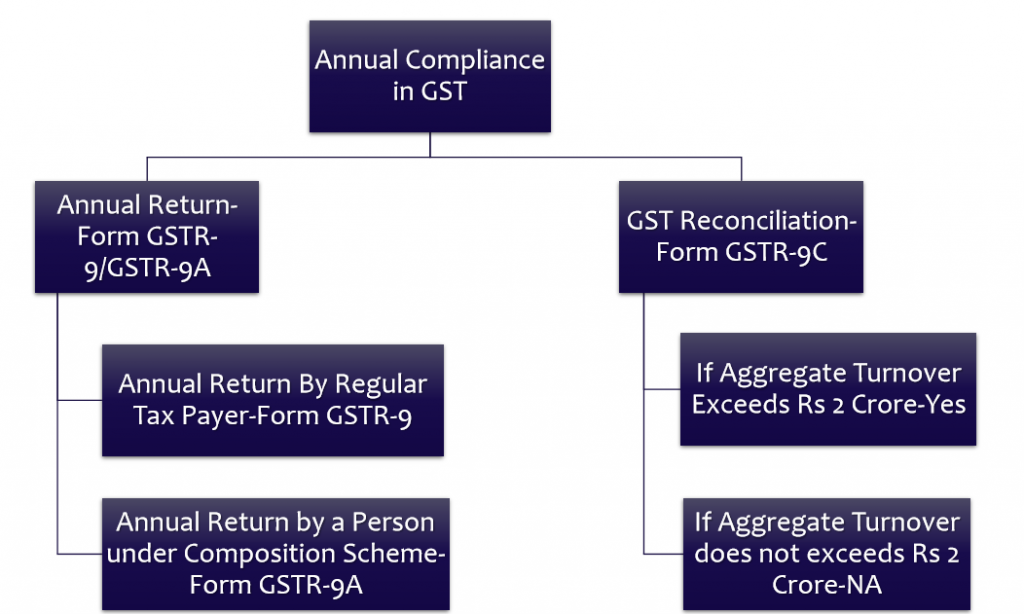

CA Arpit Haldia wrote a new post, Best PPT on Annual Return 6 years, 10 months ago

RELEVANT SECTION, RULE, NOTIFICATIONS, AND ROD

Relevant Section: Section 44 read with Rule 80

Relevant Notification: Notification No. 74/2018-Central Tax Dated 31st December 2018

Order No. 1/2018 – Central […]

CA Arpit Haldia wrote a new post, GST Case 18- Kundan Misthan Bhandar 7 years, 2 months ago

GST Case 18- Kundan Misthan Bhandar

In the GST case of Kundan Misthan Bhandar, the applicant has raised the query regarding the supply made by a sweetshop cum restaurant of the pure food.

Query:

Whether s […]

CA Arpit Haldia wrote a new post, GST Case 20 of Ashok Kumar Basu 7 years, 2 months ago

GST Case 20 of Ashok Kumar Basu

In the GST case of Ashok Kumar Basu, the applicant has raised the query regarding the taxability of the Printing of Examination Question Papers. Because Printing of Exam […]

CA Arpit Haldia wrote a new post, GST Case – 19 Association of Inner Wheel Clubs in India 7 years, 2 months ago

GST Case – 19 Association of Inner Wheel Clubs in India

In the GST case of Association of Inner Wheel Clubs in India. The Taxability of funds received through Annual Subscription, Sponsorship Fees and Sale Of S […]

CA Arpit Haldia wrote a new post, GSTCase18 Tax rate on supply of pure food items 7 years, 2 months ago

GSTCase-18- Tax rate on supply of pure food items

This article is in series of my updates on advanced rulings. Today I will be discussing the advance ruling by AAR Uttrakhand. This Advanced ruling is for tax rate […]

CA Arpit Haldia wrote a new post, GST Case-17- K.P.H. Dream Cricket (P.) Ltd 7 years, 2 months ago

GST Case-17- K.P.H. Dream Cricket (P.) Ltd

In the GST Case of the KPH Dream Cricket private limited, the applicant has raised the query regarding the nature of the “complimentary tickets'” given by the applicant. […]

CA Arpit Haldia wrote a new post, GST Case 16- NHPC Ltd 7 years, 2 months ago

GST Case 16- NHPC Ltd

1. Query:

Query 1:-

Whether NHPC Limited required to pay GST under reverse charge of Notification No. 13/2017 while making payment to PWD, Uttrakhand for construction of road?

Query […]

CA Arpit Haldia wrote a new post, GST Case 15-Goa Tourism Development Corporation Ltd. 7 years, 2 months ago

GST Case 15-Goa Tourism Development Corporation Ltd.

In the GST Case of Goa Tourism Development Corporation Ltd. The applicant has raised the query regarding “Whether GST is applicable on One Time Concession […]

CA Arpit Haldia wrote a new post, GST AR Case-13 Taxability of Discount received by Del Credre Agent 7 years, 2 months ago

GST AR Case-13 Taxability of Discount received by Del Credre Agent

Taxability of Discount received by Del Credre Agent from its principal and passed onto the Customers. This issues is discussed in this […]

CA Arpit Haldia wrote a new post, GST Case-12-Crux of KIMS Healthcare AAR 7 years, 2 months ago

GST Case-12 Crux of KIMS Healthcare AAR:

In this write up the crux of KIMS healthcare AAR is drafted. It is a very important decision for the healthcare industry.

1.

Query […]

CA Arpit Haldia wrote a new post, GST Case 11-Nagaur Mukangarh Highways (P.) Ltd. 7 years, 2 months ago

GST Case 11-Nagaur Mukangarh Highways (P.) Ltd.

In the GST case of the Nagaur Mukhangarh Highways (P.) Ltd. The Applicant has raised the query regarding the eligibility of ITC taken or to be taken by him on c […]

CA Arpit Haldia wrote a new post, GST Case 10- Jaimin Engineering Pvt. Ltd. 7 years, 2 months ago

GST Case 10- Jaimin Engineering Pvt. Ltd.

In the GST case of Jaimin Engineering Pvt. Ltd. The applicant has raised the query regarding the liability to take registration in the different state.

Query: […]

CA Arpit Haldia wrote a new post, Levy of GST on Liquor License Fees 7 years, 2 months ago

Levy of GST on Liquor License Fees: Minutes of the Meeting Of GST Council

The much awaited minutes of GST Council, have been release and have been updated till 4th May 2018. The first and one of the most […]

CA Arpit Haldia wrote a new post, GST Case 9-United Breweries Ltd. 7 years, 2 months ago

GST Case 9-United Breweries Ltd.

In this GST Case the M/s. united Breweries has raised the query regarding the applicability of the GST on the services provided by them. Following are observation and order in […]

CA Arpit Haldia wrote a new post, Levy of GST on Liquor License Fees 7 years, 3 months ago

Levy of GST on Liquor License Fees:

The much awaited minutes of GST Council, have been release and have been updated till 4th May 2018. The first and one of the most important part of the minutes of the meeting […]

CA Arpit Haldia wrote a new post, GST Case 8- Prodair Air Products India Pvt. Ltd. 7 years, 3 months ago

GST Case 8- Prodair Air Products India Pvt. Ltd.

In GST Case of Prodair Air Products India Pvt. Ltd., the applicant has raised the query in relation to the services provided by him as “Job Work”. So, let us dis […]

CA Arpit Haldia wrote a new post, GST Case 6- Saji s. v. Commissioner, State GST Department 7 years, 3 months ago

GST Case6- Saji s. v. Commissioner, State GST Department

In GST Case of Saji s. v. Commissioner, the state GST Department, the demand of the IGST is adjusted with the refund of the SGST of the […]