2021 (6) TMI 516 – Delhi High Court in Central Goods and Service Tax Delhi East Versus Sh. Naval Kumar &Ors.

Allegation.

1. M/s Milkfood Limited is at the center of this network and has availed huge ITC from […]

Formations of Reasons to Believe to be based on Cogent and Tangible Material

Information received from external agencies or other departments. Based on such information received, the information and records […]

Cost of Rs. 10,000/- imposed on Department for abuse of Power

2021 (6) TMI 378 – Telangana High Court in M/s Satyam Shivam Papers Pvt. Ltd. Versus Asst. Commissioner St And 4 Others

Facts

Interest Liability on the amount paid through Electronic Cash Ledger shall be applicable retrospectively from 01.07.2017

Notification No. 16/2021 – Central Tax

Section 112 of the Finance Act, 2021 shall be […]

2021 (2) TMI 49 – CESTAT New Delhi in M/S Tcl – MMPL Consortium Versus Commissioner Central Excise Commissionerate, Jodhpur

Facts, Appellant Contention, and Department View

1. Appellant is engaged in pr […]

2021 (4) TMI 1137 – Tripura High Court in M/S Sarvasiddhi Agrotech Pvt. Ltd. Versus The Union Of India

Petitioner Pleading

1. The company supplies Non-Basmati un-branded rice.

2021 (4) TMI 1094 – Kerala High Court in SR. Sheetal Jain, S/O Dilip Kumar, M/S. Sri Sital Jewellers Versus The State Of Kerala, The State Tax Officer (Intelligence)

2021 (4) TMI 1097 – Patna High Court in Vidyarthi Construction Private Limited Versus The State Of Bihar, The Commissioner Of Taxes, Bihar, Patna., The Joint Commissioner, State Taxes, East Circle, Muzaffarpur, […]

2021 (3) TMI 1020 – Madras High Court in M/S. D.Y. Beathel Enterprises Versus The State Tax Officer (Data Cell), (Investigation Wing) Commercial Tax Buildings, Tirunelveli.

Facts

1. Petitioner had purchased […]

In an Application filed before AAR, Karnataka by M/S. Bharat Earth Movers Limited, (BEML)

Facts:

The applicant has participated in the Tender and was a successful bidder for the Supply of “150 numbers of S […]

In an appeal filed before Divisional Bench of Karnataka High Court in Union Of India Ministry Of Finance, Department Of Revenue, Through Its Secretary (Revenue) Versus M/S Asaid Paints Limited

Assumption And Presumption — Taxing Statute

Reasons are the flesh and blood of any Adjudication Proceedings. Any assumptions and presumptions must be supported by reasons and corroborative evidence. It is not o […]

Bail Petition Accepted- Petitioner compliance to Summons, No Tampering of Evidence, Section 167 of Cr. Pc

2021 (3) TMI 541 – Bombay High Court in Sunil Kumar Jha And Akshay Chhabra Versus Union Of India & […]

Property of Wife cannot be encumbered for the Excise Duty Liability of Husband unless the same is inherited from Husband

2021 (3) TMI 168 – CESTAT Ahmedabad in Mrs. Meena Krishna Agarwal Vs C.C.E & S.T, […]

Liquidated Damage- No Service Tax on Penalty for Un-authorize Use of Electricity

2021 (2) TMI 821 – CESTAT New Delhi in M.P. Poorva Kshetra Vidyut Vitran Co. Ltd. Versus Principal Commissioner CGST And C.E […]

Withholding of Refund Order was Quashed as no Reasons of Fraud or Malfeasance

2021 (2) TMI 924 – Allahabad High Court in M/S Bushrah Export House Thru Sole Prop. Asif Ali Versus U.O.I. Thru Secy. Finance Ministry […]

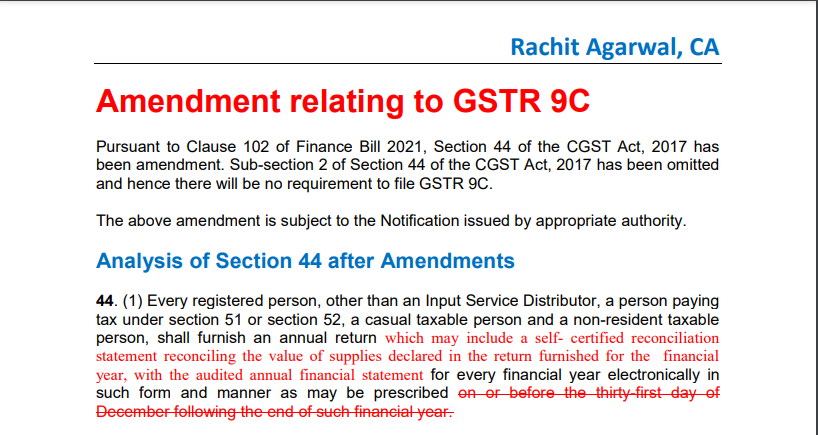

Amendment relating to GSTR 9C

Pursuant to Clause 102 of Finance Bill 2021, Section 44 of the CGST Act, 2017 has been amended. Sub-section 2 of Section 44 of the CGST Act, 2017 has been omitted and hence there […]

CA Rachit Agarwal

@ca-rachit-agarwal

active 5 years, 9 months agoCA Rachit Agarwal

OOPS!

No Packages Added by CA Rachit Agarwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Rachit Agarwal wrote a new post, Bail Once Granted cannot be Cancelled in Mechanical Manner 4 years, 7 months ago

2021 (6) TMI 516 – Delhi High Court in Central Goods and Service Tax Delhi East Versus Sh. Naval Kumar &Ors.

Allegation.

1. M/s Milkfood Limited is at the center of this network and has availed huge ITC from […]

CA Rachit Agarwal wrote a new post, Income Escaping Assessment, Reasons to Believe- Based on the Judicial Pronouncements and Principles 4 years, 7 months ago

Formations of Reasons to Believe to be based on Cogent and Tangible Material

Information received from external agencies or other departments. Based on such information received, the information and records […]

CA Rachit Agarwal wrote a new post, Tax/Penalty not Payable on account of Expiry of Way Bill in Transit if no evasion of Tax. 4 years, 7 months ago

Cost of Rs. 10,000/- imposed on Department for abuse of Power

2021 (6) TMI 378 – Telangana High Court in M/s Satyam Shivam Papers Pvt. Ltd. Versus Asst. Commissioner St And 4 Others

Facts

The admitted […]

CA Rachit Agarwal wrote a new post, Brief Synopsis of Amendments as Notified CBIC on 01.06.2021 4 years, 8 months ago

Interest Liability on the amount paid through Electronic Cash Ledger shall be applicable retrospectively from 01.07.2017

Notification No. 16/2021 – Central Tax

Section 112 of the Finance Act, 2021 shall be […]

CA Rachit Agarwal wrote a new post, Value of Free Supply of Material to the Supplier shall not form part of value for levy of Service Tax 4 years, 8 months ago

2021 (2) TMI 49 – CESTAT New Delhi in M/S Tcl – MMPL Consortium Versus Commissioner Central Excise Commissionerate, Jodhpur

Facts, Appellant Contention, and Department View

1. Appellant is engaged in pr […]

CA Rachit Agarwal wrote a new post, Vague and Improper Show Cause Notice for Cancellation of Registration is Quashed 4 years, 8 months ago

2021 (4) TMI 1203 – Tripura High Court in Dayamay Enterprise Versus State Of Tripura And 3 Ors.

Show Cause Notice issued-“it appears that your registration is liable to be cancelled for the following re […]

CA Rachit Agarwal wrote a new post, Sale of Rice under an Unregistered Brand name liable to GST if actionable claim or enforceable right has not been foregone not proved 4 years, 9 months ago

2021 (4) TMI 1137 – Tripura High Court in M/S Sarvasiddhi Agrotech Pvt. Ltd. Versus The Union Of India

Petitioner Pleading

1. The company supplies Non-Basmati un-branded rice.

2. The stand of the […]

CA Rachit Agarwal wrote a new post, Gold Confiscated from Person coming out of Jewellery Shop as no documents evidencing Payment of Tax could be furnished 4 years, 9 months ago

2021 (4) TMI 1094 – Kerala High Court in SR. Sheetal Jain, S/O Dilip Kumar, M/S. Sri Sital Jewellers Versus The State Of Kerala, The State Tax Officer (Intelligence)

1. Department during shadow operation […]

CA Rachit Agarwal wrote a new post, Best Judgement Order passed without Opportunity of Being Heard 4 years, 9 months ago

2021 (4) TMI 1097 – Patna High Court in Vidyarthi Construction Private Limited Versus The State Of Bihar, The Commissioner Of Taxes, Bihar, Patna., The Joint Commissioner, State Taxes, East Circle, Muzaffarpur, […]

CA Rachit Agarwal wrote a new post, Confiscation of Goods?- Books of Accounts could not be produced at the time of visit 4 years, 9 months ago

2020 (12) TMI 790 – Allahabad High Court in M/s Metenere Ltd. Versus Union Of India And Another

(i) Whether the respondents were justified in recording that the petitioner-appellant has failed to maintain the […]

CA Rachit Agarwal wrote a new post, Jurisprudence on Provisional Attachment of Bank Account 4 years, 9 months ago

Hon’ble Supreme Court in M/s Radha Krishan Industries Versus State Of Himachal Pradesh & Ors.

Writ Petition under Article 226 of the Constitution is maintainable in case of Provisional Attachment in sp […]

CA Rachit Agarwal wrote a new post, Input Tax Credit availed by Buyer, Tax not paid by Supplier, Recovery Proceedings quashed against Buyer, Remitted Back to Officer 4 years, 9 months ago

2021 (3) TMI 1020 – Madras High Court in M/S. D.Y. Beathel Enterprises Versus The State Tax Officer (Data Cell), (Investigation Wing) Commercial Tax Buildings, Tirunelveli.

Facts

1. Petitioner had purchased […]

CA Rachit Agarwal wrote a new post, Supply of Goods with Installation Services- Composite Supply or Independent Supply? 4 years, 9 months ago

In an Application filed before AAR, Karnataka by M/S. Bharat Earth Movers Limited, (BEML)

Facts:

The applicant has participated in the Tender and was a successful bidder for the Supply of “150 numbers of S […]

CA Rachit Agarwal wrote a new post, Narrow Meaning of the term “Technical Difficulty” not to be adopted in the Indian context where there are small, medium, and large scale business. 4 years, 10 months ago

In an appeal filed before Divisional Bench of Karnataka High Court in Union Of India Ministry Of Finance, Department Of Revenue, Through Its Secretary (Revenue) Versus M/S Asaid Paints Limited

1. Rule […]

CA Rachit Agarwal wrote a new post, Assumption And Presumption — Taxing Statute 4 years, 10 months ago

Assumption And Presumption — Taxing Statute

Reasons are the flesh and blood of any Adjudication Proceedings. Any assumptions and presumptions must be supported by reasons and corroborative evidence. It is not o […]

CA Rachit Agarwal wrote a new post, Bail Petition Accepted- Petitioner compliance to Summons, No Tampering of Evidence, Section 167 of Cr. Pc 4 years, 10 months ago

Bail Petition Accepted- Petitioner compliance to Summons, No Tampering of Evidence, Section 167 of Cr. Pc

2021 (3) TMI 541 – Bombay High Court in Sunil Kumar Jha And Akshay Chhabra Versus Union Of India & […]

CA Rachit Agarwal wrote a new post, Property of Wife cannot be encumbered for the Excise Duty Liability of Husband unless the same is inherited from Husband 4 years, 10 months ago

Property of Wife cannot be encumbered for the Excise Duty Liability of Husband unless the same is inherited from Husband

2021 (3) TMI 168 – CESTAT Ahmedabad in Mrs. Meena Krishna Agarwal Vs C.C.E & S.T, […]

CA Rachit Agarwal wrote a new post, Liquidated Damage- No Service Tax on Penalty for Un-authorize Use of Electricity 4 years, 11 months ago

Liquidated Damage- No Service Tax on Penalty for Un-authorize Use of Electricity

2021 (2) TMI 821 – CESTAT New Delhi in M.P. Poorva Kshetra Vidyut Vitran Co. Ltd. Versus Principal Commissioner CGST And C.E […]

CA Rachit Agarwal wrote a new post, Withholding of Refund Order was Quashed as no Reasons of Fraud or Malfeasance 4 years, 11 months ago

Withholding of Refund Order was Quashed as no Reasons of Fraud or Malfeasance

2021 (2) TMI 924 – Allahabad High Court in M/S Bushrah Export House Thru Sole Prop. Asif Ali Versus U.O.I. Thru Secy. Finance Ministry […]

CA Rachit Agarwal wrote a new post, Amendment relating to GSTR 9C 5 years ago

Amendment relating to GSTR 9C

Pursuant to Clause 102 of Finance Bill 2021, Section 44 of the CGST Act, 2017 has been amended. Sub-section 2 of Section 44 of the CGST Act, 2017 has been omitted and hence there […]