Detention of Goods on account for Discrepancy in Address of Actual Supply and Address as per Way Bill

Telangana High Court in M/S. Sree Rama Steels Versus The Deputy State Tax Officer And 3 Others

Facts

The […]

Taxability on Retention of Advance Money upon Cancellation of Contract

2019 (7) TMI 767 – CESTAT New Delhi in M/S Lemon Tree Hotel Versus Commissioner, Goods & Service Tax, Central Excise & Custom […]

Relaxations Not Available For FY 2019-20 And Onwards In Filing GSTR 9 And 9C

Furnishing of Annual Return by Small Supplier

Registered Person had the option not to file the Annual Return GSTR 9 provided the […]

Violation of Natural Justice, Petitioner Plea Rejected Without Any Reasons

2021 (1) TMI 59 – Madras High Court in M/S. Sangeeteha Match Works, Versus The State Tax Officer (Inspection Cell), […]

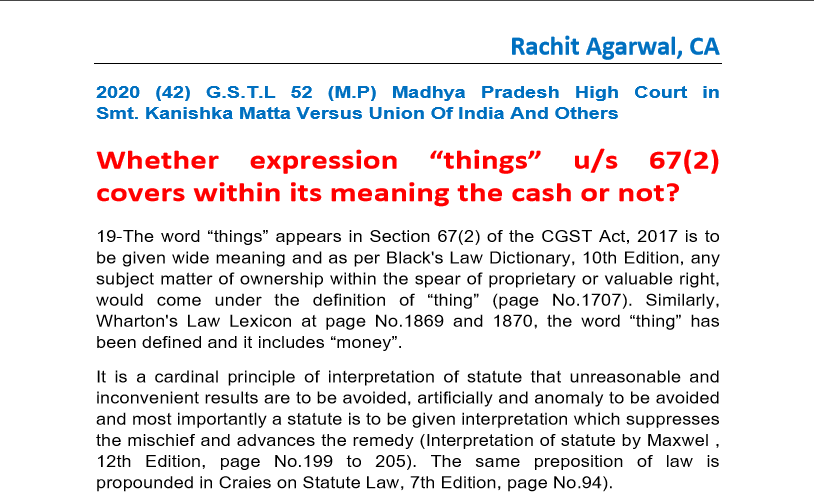

5 Definition of Things During Seizure and Retracted Confessional Statements

2020 (42) G.S.T.L 52 (M.P) Madhya Pradesh High Court in Smt. Kanishka Matta Versus Union Of India And Others

Whether the expression […]

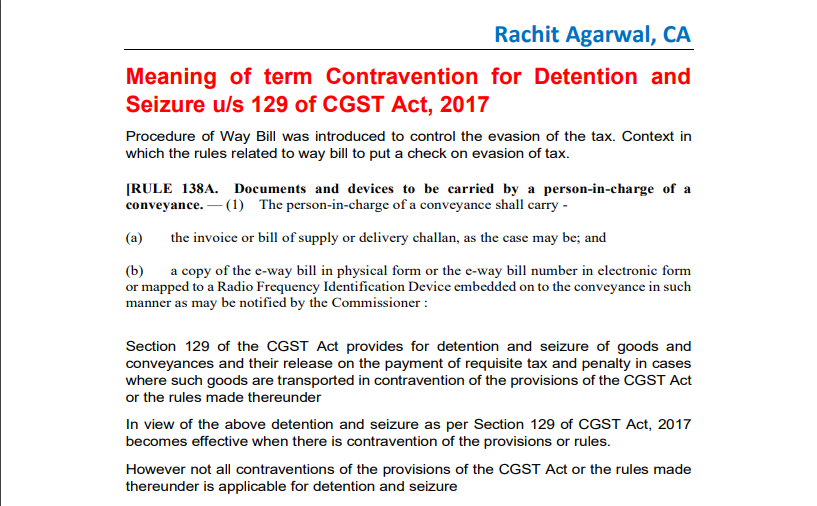

Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017

The procedure of Way Bill was introduced to control the evasion of the tax. The context in which the rules related to waybill to […]

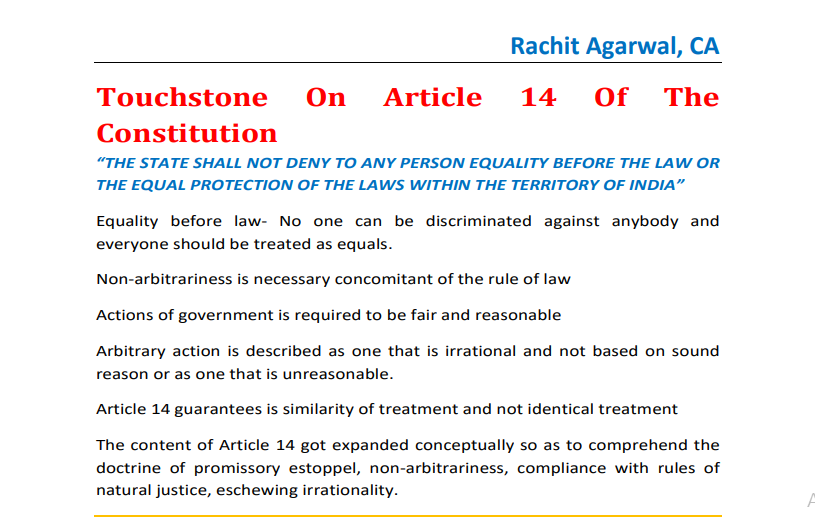

Touchstone On Article 14 Of The Constitution

“THE STATE SHALL NOT DENY TO ANY PERSON EQUALITY BEFORE THE LAW OR THE EQUAL PROTECTION OF THE LAWS WITHIN THE TERRITORY OF INDIA”

Discount Received Is A Supply?

It has been observed from time to time that Department took the view that the discounts received in various forms are to be treated as service being in the nature of commission and […]

Works Contract Services For Use Other Than Commerce

In an Application filed before AAR under GST, Rajasthan by M/S ARG Electricals Pvt. Ltd [2020 (6) TMI 489]

Facts:

The applicant received the work order from […]

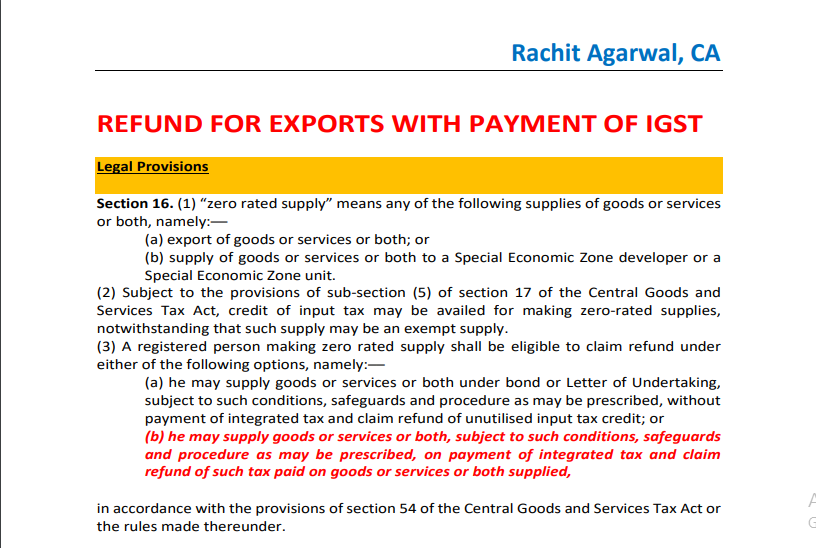

Refund For Exports With Payment of IGST

Legal Provisions

Section 16.(1) “zero-rated supply” means any of the following supplies of goods or services or both, namely:––

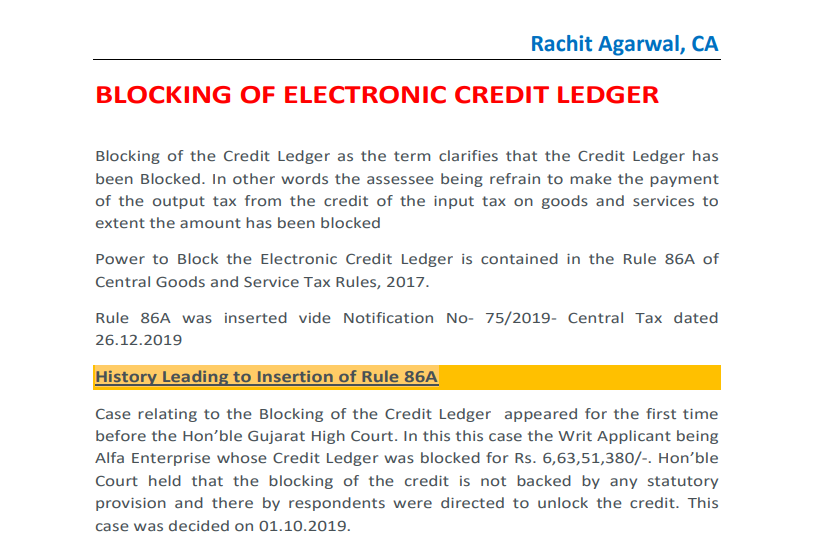

Blocking of Electronic Credit Ledger

Blocking of the Credit Ledger as the term clarifies that the Credit Ledger has been Blocked. In other words, the assessee being refrain to make the payment of the output tax […]

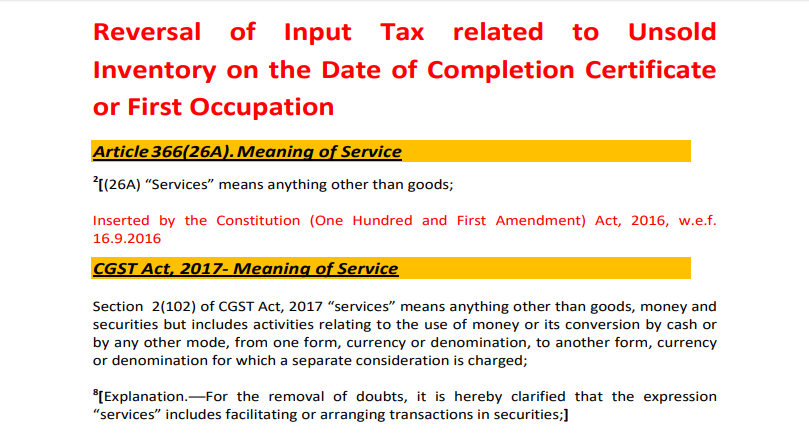

Reversal of Input Tax related to Unsold Inventory on the Date of Completion Certificate or First Occupation

Article 366(26A). Meaning of Service

[(26A) “Services” means anything other than goods;

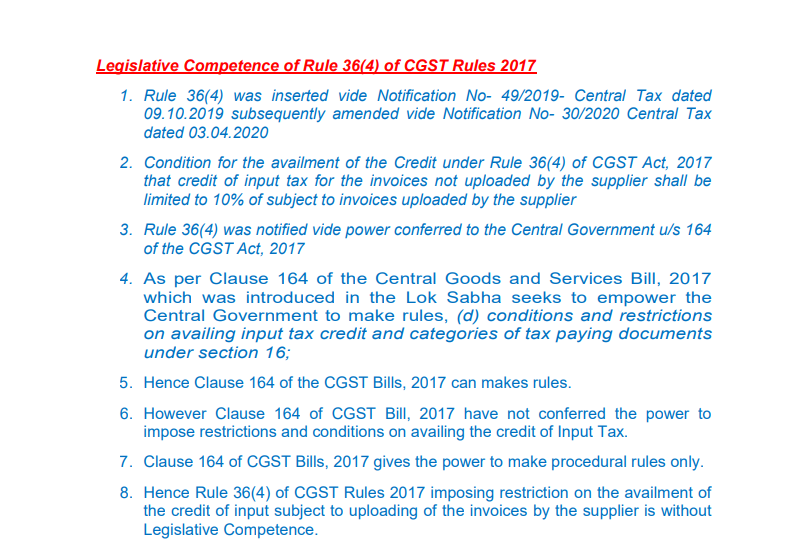

Legislative Competence of Rule 36(4) of CGST Rules 2017

1. Rule 36(4) was inserted vide Notification No- 49/2019- Central Tax dated 09.10.2019 subsequently amended vide Notification No- 30/2020 Central Tax dated […]

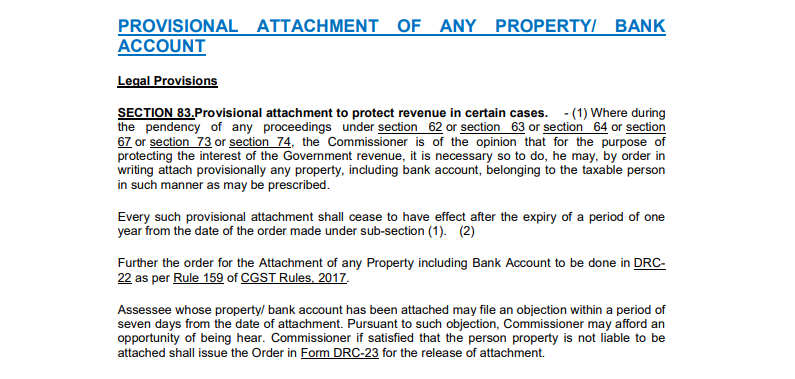

Provisional Attachment of Property including Bank Account

Legal Provisions

SECTION 83.Provisional attachment to protect revenue in certain cases. – (1) Where during the pendency of any proceedings under section […]

SEARCH, SEIZURE, AND RELEASE OF SEIZED GOODS

CONSTITUTIONAL VALIDITY OF SEARCH AND SEIZURE

A search by itself is not a restriction on the right to hold and enjoy the property. No doubt a seizure and carrying […]

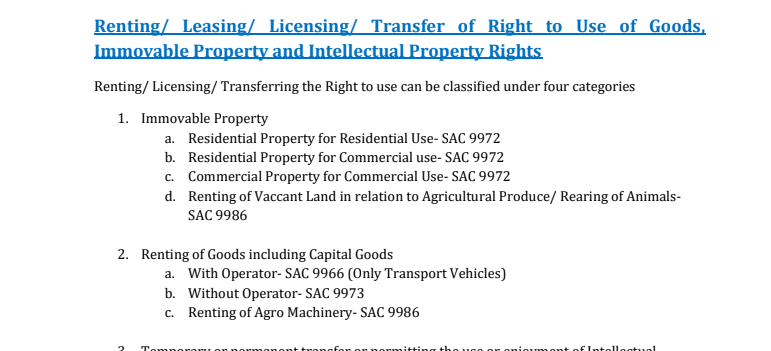

Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights

Renting/ Licensing/ Transferring the Right to use can be classified under four categories

Input Tax Credit Reversal on Discount Received

DISCOUNT RECEIVED- ITC REVERSAL?

As a matter of Trade Policy, the suppliers allows the discounts on the goods supplied. Discounts may in nature of

RESTAURANT AND OUTDOOR CATERING SERVICE

RESTAURANT SERVICE

Restaurant Service as the term denotes is not limited to service from the restaurant but covers all the services supplied from the restaurant, eating […]

CA Rachit Agarwal

@ca-rachit-agarwal

active 4 years, 6 months agoCA Rachit Agarwal

OOPS!

No Packages Added by CA Rachit Agarwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Rachit Agarwal wrote a new post, Detention of Goods on account for Discrepancy in Address of Actual Supply and Address as per Way Bill 3 years, 9 months ago

Detention of Goods on account for Discrepancy in Address of Actual Supply and Address as per Way Bill

Telangana High Court in M/S. Sree Rama Steels Versus The Deputy State Tax Officer And 3 Others

Facts

The […]

CA Rachit Agarwal wrote a new post, Taxability on Retention of Advance Money upon Cancellation of Contract 3 years, 9 months ago

Taxability on Retention of Advance Money upon Cancellation of Contract

2019 (7) TMI 767 – CESTAT New Delhi in M/S Lemon Tree Hotel Versus Commissioner, Goods & Service Tax, Central Excise & Custom […]

CA Rachit Agarwal wrote a new post, Relaxations Not Available For FY 2019-20 And Onwards In Filing GSTR 9 And 9C 3 years, 10 months ago

Relaxations Not Available For FY 2019-20 And Onwards In Filing GSTR 9 And 9C

Furnishing of Annual Return by Small Supplier

Registered Person had the option not to file the Annual Return GSTR 9 provided the […]

CA Rachit Agarwal wrote a new post, Violation of Natural Justice, Petitioner Plea Rejected Without Any Reasons 3 years, 10 months ago

Violation of Natural Justice, Petitioner Plea Rejected Without Any Reasons

2021 (1) TMI 59 – Madras High Court in M/S. Sangeeteha Match Works, Versus The State Tax Officer (Inspection Cell), […]

CA Rachit Agarwal wrote a new post, Analysis of amendments notified vide notification no. 94/2020 3 years, 11 months ago

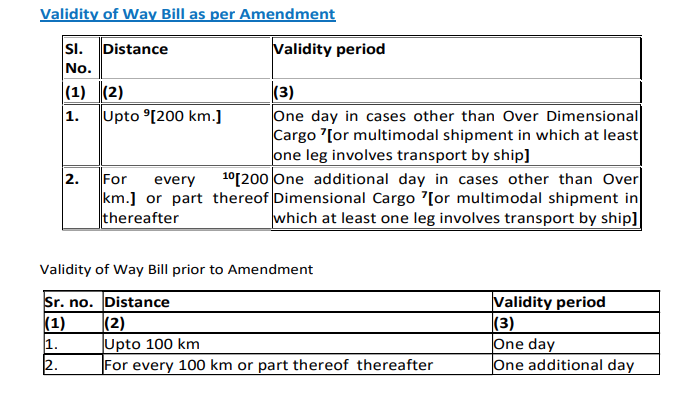

Amendments notified vide notification no. 94/2020

1. Payment of tax,

2. Credit Availment,

3. Restriction on Filing of GSTR 1

4. Way Bill And

5. Suspension of Registration

New Rule 86B for Payment […]

CA Rachit Agarwal wrote a new post, 5 Definition of Things During Seizure and Retracted Confessional Statements 4 years ago

5 Definition of Things During Seizure and Retracted Confessional Statements

2020 (42) G.S.T.L 52 (M.P) Madhya Pradesh High Court in Smt. Kanishka Matta Versus Union Of India And Others

Whether the expression […]

CA Rachit Agarwal wrote a new post, Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017 4 years ago

Meaning of term Contravention for Detention and Seizure u/s 129 of CGST Act, 2017

The procedure of Way Bill was introduced to control the evasion of the tax. The context in which the rules related to waybill to […]

CA Rachit Agarwal wrote a new post, Touchstone On Article 14 Of The Constitution 4 years, 4 months ago

Touchstone On Article 14 Of The Constitution

“THE STATE SHALL NOT DENY TO ANY PERSON EQUALITY BEFORE THE LAW OR THE EQUAL PROTECTION OF THE LAWS WITHIN THE TERRITORY OF INDIA”

Equality before law- No one can […]

CA Rachit Agarwal wrote a new post, Discount Received- Whether Liable to GST? 4 years, 4 months ago

Discount Received Is A Supply?

It has been observed from time to time that Department took the view that the discounts received in various forms are to be treated as service being in the nature of commission and […]

CA Rachit Agarwal wrote a new post, Works Contract Services For Use Other Than Commerce 4 years, 5 months ago

Works Contract Services For Use Other Than Commerce

In an Application filed before AAR under GST, Rajasthan by M/S ARG Electricals Pvt. Ltd [2020 (6) TMI 489]

Facts:

The applicant received the work order from […]

CA Rachit Agarwal wrote a new post, Sale of Plot of Land With Basic Amenities 4 years, 5 months ago

Sale of Plot of Land With Basic Amenities

In an Application filed before AAR under GST, Gujarat by Shree Dipesh Anilkumar Naik [2020 (6) TMI 448]

The applicant is the owner of the land, who develops the land […]

CA Rachit Agarwal wrote a new post, Refund For Exports With Payment of IGST 4 years, 5 months ago

Refund For Exports With Payment of IGST

Legal Provisions

Section 16.(1) “zero-rated supply” means any of the following supplies of goods or services or both, namely:––

(a) export of goods or services […]

CA Rachit Agarwal wrote a new post, Blocking of Electronic Credit Ledger 4 years, 5 months ago

Blocking of Electronic Credit Ledger

Blocking of the Credit Ledger as the term clarifies that the Credit Ledger has been Blocked. In other words, the assessee being refrain to make the payment of the output tax […]

CA Rachit Agarwal wrote a new post, Reversal of Input Tax related to Unsold Inventory on the Date of Completion Certificate or First Occupation 4 years, 6 months ago

Reversal of Input Tax related to Unsold Inventory on the Date of Completion Certificate or First Occupation

Article 366(26A). Meaning of Service

[(26A) “Services” means anything other than goods;

Inserted by […]

CA Rachit Agarwal wrote a new post, Legislative Competence of Rule 36(4) of CGST Rules 2017 4 years, 6 months ago

Legislative Competence of Rule 36(4) of CGST Rules 2017

1. Rule 36(4) was inserted vide Notification No- 49/2019- Central Tax dated 09.10.2019 subsequently amended vide Notification No- 30/2020 Central Tax dated […]

CA Rachit Agarwal wrote a new post, Provisional Attachment of Property including Bank Account 4 years, 6 months ago

Provisional Attachment of Property including Bank Account

Legal Provisions

SECTION 83.Provisional attachment to protect revenue in certain cases. – (1) Where during the pendency of any proceedings under section […]

CA Rachit Agarwal wrote a new post, SEARCH, SEIZURE AND RELEASE OF SEIZED GOODS 4 years, 6 months ago

SEARCH, SEIZURE, AND RELEASE OF SEIZED GOODS

CONSTITUTIONAL VALIDITY OF SEARCH AND SEIZURE

A search by itself is not a restriction on the right to hold and enjoy the property. No doubt a seizure and carrying […]

CA Rachit Agarwal wrote a new post, Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights 4 years, 6 months ago

Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights

Renting/ Licensing/ Transferring the Right to use can be classified under four categories

1. […]

CA Rachit Agarwal wrote a new post, Input Tax Credit Reversal on Discount Received 4 years, 6 months ago

Input Tax Credit Reversal on Discount Received

DISCOUNT RECEIVED- ITC REVERSAL?

As a matter of Trade Policy, the suppliers allows the discounts on the goods supplied. Discounts may in nature of

1. Turnover […]

CA Rachit Agarwal wrote a new post, RESTAURANT AND OUTDOOR CATERING SERVICE 4 years, 7 months ago

RESTAURANT AND OUTDOOR CATERING SERVICE

RESTAURANT SERVICE

Restaurant Service as the term denotes is not limited to service from the restaurant but covers all the services supplied from the restaurant, eating […]