Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

CA Shafaly Girdharwal wrote a new post, Department didn’t adjourned the time for reply and rejected refund- Rejection dropped by court 1 year, 10 months ago

Cases Covered:

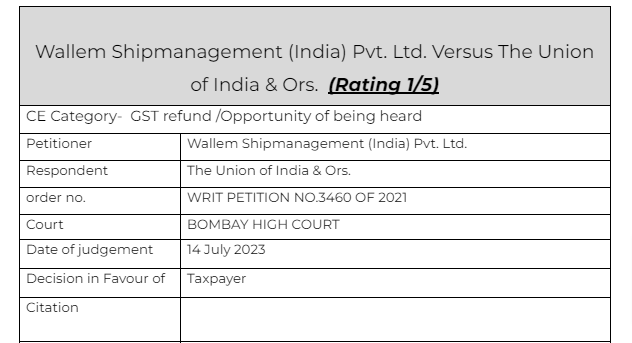

Wallem Shipmanagement (India) Pvt. Ltd. Versus The Union of India & OrsFacts of the case

A refund application was filed by the taxpayer. The respondent issued a SCN. The applicant […]

-

CA Shafaly Girdharwal wrote a new post, Assessee didnt responded to the Notices- Writ for cancelled registration set aside (Pdf Attach) 1 year, 10 months ago

Cases Covered:

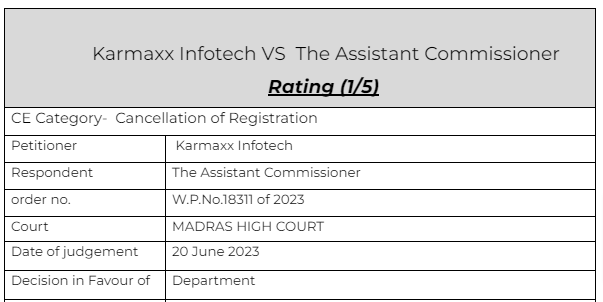

Karmaxx Infotech VS The Assistant CommissionerCitation:

1. Kaur & Singh v Collector of Central Excise,

Facts of the case

The principal place of business was changed by the taxpayer. B […]

-

CA Shafaly Girdharwal wrote a new post, Refund rejected without proper reasons was set aside (Pdf Attach) 1 year, 10 months ago

Cases Covered:

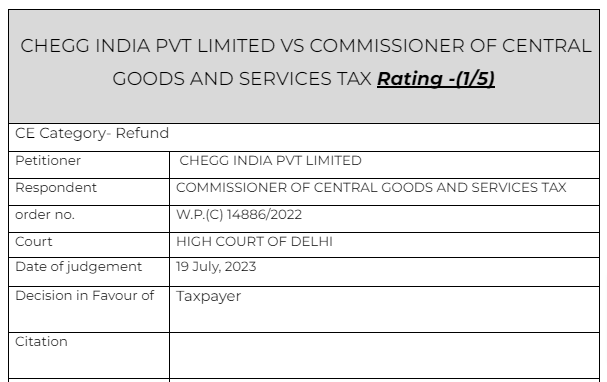

CHEGG INDIA PVT LIMITED VS COMMISSIONER OF CENTRAL GOODS AND SERVICES TAXFacts of the case

The petitioner is, inter alia, engaged in the business of software development, content […]

-

CA Shafaly Girdharwal wrote a new post, Mere payment via bank account wont make ITC eligible- Aastha Enterprises (PDF) 1 year, 10 months ago

Cases Covered:

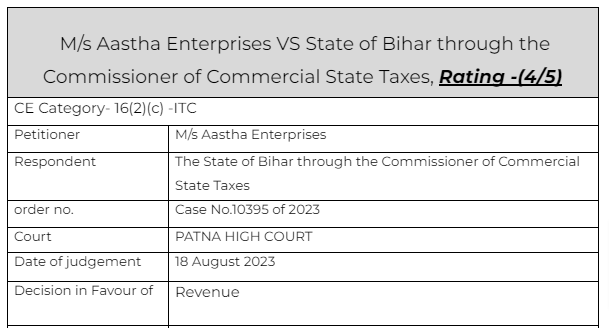

M/s Aastha Enterprises VS State of Bihar through the Commissioner of Commercial State TaxesCitation:

Sri Vinayaga Agencies v. The Assistant Commissioner (CT) & Anr.

M/s D.Y. Beathel […]

-

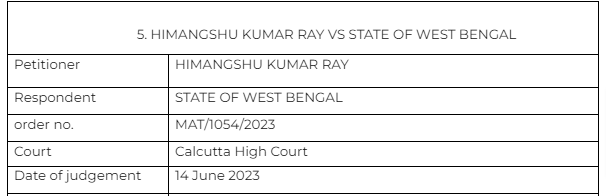

CA Shafaly Girdharwal wrote a new post, The information shared with lawyers is priviledged- Himangshu kumar (Pdf Attach) 1 year, 10 months ago

Case Covered:

HIMANGSHU KUMAR RAY VS STATE OF WEST BENGALCitation:

1. State of Punjab v. Sodhi Sukhdev Singh

2. Bakaulla Mollah v. Debiruddin Mollah

Facts of the case

An order was passed on the […]

-

CA Shafaly Girdharwal wrote a new post, Marketing the softwares sold by the foreign principal is not taxable in service tax (Pdf Attach ) 1 year, 10 months ago

Case Covered:

Sun Microsystems (I) PVT LTD., vs Commissioner of Central Excise & Service Tax , LTU

Citation:

1.M/s Arcelor Mittal Stainless India Pvt. Ltd. V/s Commissioner Service Tax, M […]

-

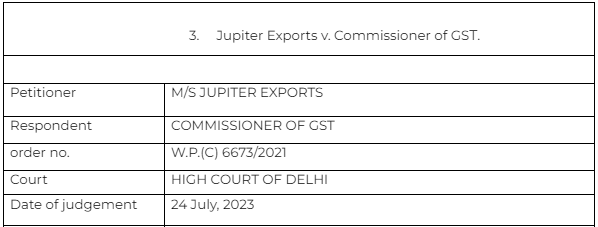

CA Shafaly Girdharwal wrote a new post, Rs. 5000 cost was levied on officer for not providing Opportunity of being heard- Jupiter Exports (PDF Attached) 1 year, 10 months ago

Case Covered:

Jupiter Exports v. Commissioner of GSTCitation:

1. Amman Match Company v. Assistant Commissioner of GST & C. Ex.

2. BA Continuum India Pvt. Ltd. v. Union of India and Others

3. Service […]

-

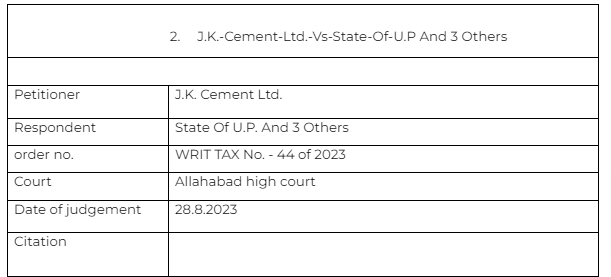

CA Shafaly Girdharwal wrote a new post, No penalty of E way bill when goods pass through the state and there is no evasion. (Pdf Attach) 1 year, 10 months ago

Case Covered:

J.K. Cement Ltd. Vs State Of U.P And 3 OthersFacts of the case

The petitioner being registered company incorporated under the Companies Act, 1956 is engaged in the manufacture and sale of […]

-

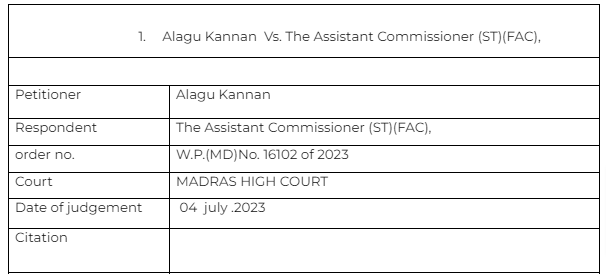

CA Shafaly Girdharwal wrote a new post, Period from 15.03.2020 till 28.02.2022 ought to be excluded from limitation- Alagu kannan (PDF attached) 1 year, 10 months ago

Case Covered:

Alagu Kannan Vs. The Assistant Commissioner (ST)Facts of the case

The writ petition was filed challenging the impugned Assessment order, dated 09.03.2023. The taxpayer was registered in […]

-

CA Shafaly Girdharwal wrote a new post, Special parliament session from 18th to 22nd Sept may be Historic-See why? 1 year, 10 months ago

A special parliament session is announced by the government. The parliamentary affairs minister Pralhad Joshi announce the session. The duration of the session will be 18th to 22nd September. This s […]

-

CA Shafaly Girdharwal wrote a new post, (Pdf Attact) The benefit of scheme of restoration of registration should be given to all taxpayers 1 year, 10 months ago

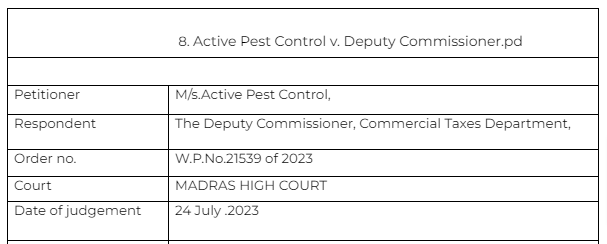

Case Covered:

Active Pest Control v. Deputy Commissioner.Citation:

1. Suguna Cutpiece Centre Vs. The Appellate Joint Commissioner of GST

Facts of the case

In this the registration of petitioner was […]

-

CA Shafaly Girdharwal wrote a new post, Registration cant be cancelled on the grounds not mentioned in SCN (Pdf Attach) 1 year, 10 months ago

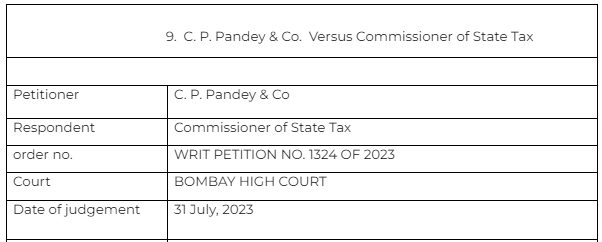

Case Covered:

C. P. Pandey & Co. Versus Commissioner of State Tax

Citation:Ramji Enterprises & Ors. Vs. Commissioner of State Tax & Ors

“Monit Trading Pvt. Ltd. Vs. Union of India & Or […]

-

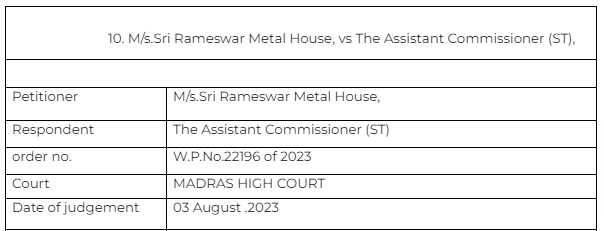

CA Shafaly Girdharwal wrote a new post, ITC ledger can be blocked multiple time (pdf Attach) 1 year, 10 months ago

Case Covered:

M/s. Sri Rameswar Metal House, vs The Assistant Commissioner (ST),

Citations :Rajnandini Metal Limited Vs. Union of India

Facts of the case

The petitioner is a wholesale dealer […]

-

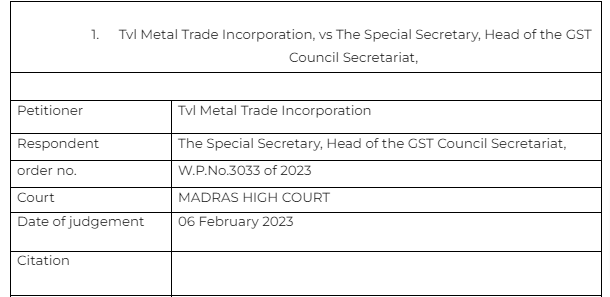

CA Shafaly Girdharwal wrote a new post, Taxpayer should appear for hearing in case of dual proceedings- TVL Metal 1 year, 10 months ago

Very controversial issue of GST. Many cases are pending on this issue. Jurisdiction of other authority when the TP is assigned to the other one. In a recent judgment the Madras high court has said that the […]

-

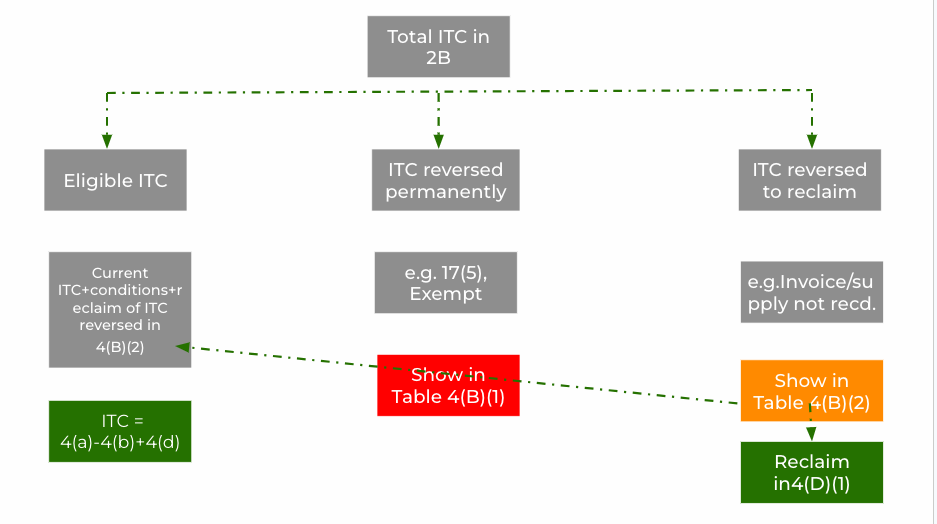

CA Shafaly Girdharwal wrote a new post, New scheme of claiming ITC in GST w.e.f. 01-09-2023 1 year, 10 months ago

New mechanism to report ITC in GSTR 3B

A new mechanism was introduced by notification no. 14/2022 read with circular no. 170/2/2022. This mechanism will ensure the proper reporting of ITC in GSTR 3B.

How it […]

-

CA Shafaly Girdharwal wrote a new post, FAQ’s on Arrest in GST 1 year, 10 months ago

Can we seek anticipatory bail in case of arrest in GST u/s 438 of CRPC?

No, CRPC is made applicable via section 69(3) of GST whereas the arrest is made via section 69(1). Thus Section 438 of anticipatory […]

-

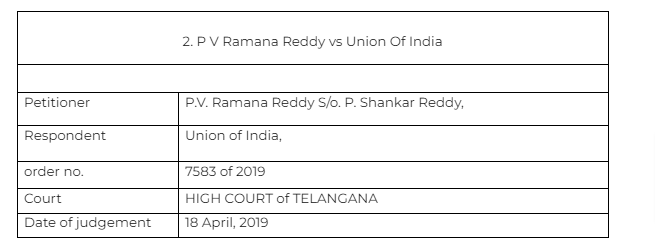

CA Shafaly Girdharwal wrote a new post, 7 Important outcome about arrest in GST in case of PV Ramanna Reddy 1 year, 10 months ago

Case Covered:

P V Ramana Reddy vs Union Of IndiaCitations :

Badaku Joti Savant v. State of Mysore

Ramesh Chandra Metha v. State of West Bengal

Illias v. Collector of Customs

Percy R […]

-

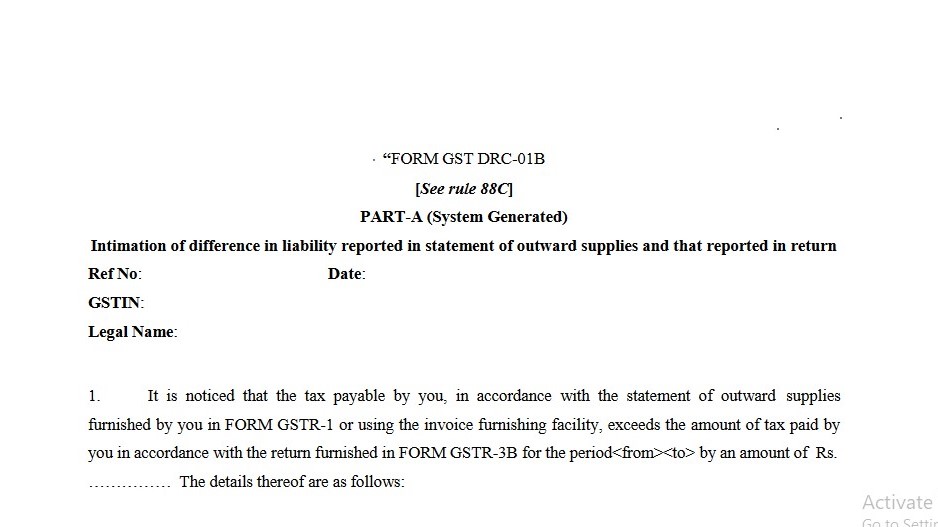

CA Shafaly Girdharwal wrote a new post, How an error in return will fetch you an instant notice in GST? 1 year, 10 months ago

Two new instant notices in GST

Well this for the good of taxpayers. Although it is taxing at the immediate level it will be helpful in future.Two new rules are inserted in GST provisions. The dynamics […]

-

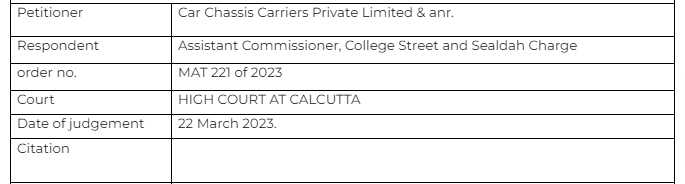

CA Shafaly Girdharwal wrote a new post, ITC in the case of Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge 1 year, 10 months ago

Case Covered:

Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah ChargeFacts of the case

The department sent a communication to the appellant to reverse t […]

-

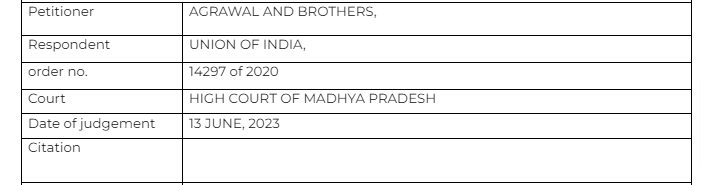

CA Shafaly Girdharwal wrote a new post, ITC in the case of Agrawal And Brothers Vs Union Of India 1 year, 10 months ago

Case Covered:

Agrawal And Brothers Vs Union Of IndiaFacts of the case

The invoices of the petitioner were not entered in the GSTR 1 of the supplier. The tax was deposited but it was mistakenly deposited […]

- Load More

Karan Sharma

GST Suvidha

Paid User

@magic123

active 5 years, 2 months ago