Rule 1 of the CGST Act – Short title and Commencement

“(1) These rules may be called the Central Goods and Services Tax Rules, 2017. (2) They shall come into force with effect from 22nd June, 2017.”

Go To Rule 2

GST on Imported Goods: Practical & Constitutional Problems

IGST on Imported Goods: Duty of Customs or Tax on Supply?

Taxable Event

Tax can be levied on occurrence of a taxable event –

Excise duty is a tax o […]

Comprehensive Charts for all due dates

Here we have compiled Comprehensive Charts for all due dates. The dates for direct and indirect tax are covered. I hope it will be quite useful. You can simply refer it to […]

Notification No. 28/2017-Central Tax (Rate)

[TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(Department of Revenue) […]

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue )

[Central Board of Excise and […]

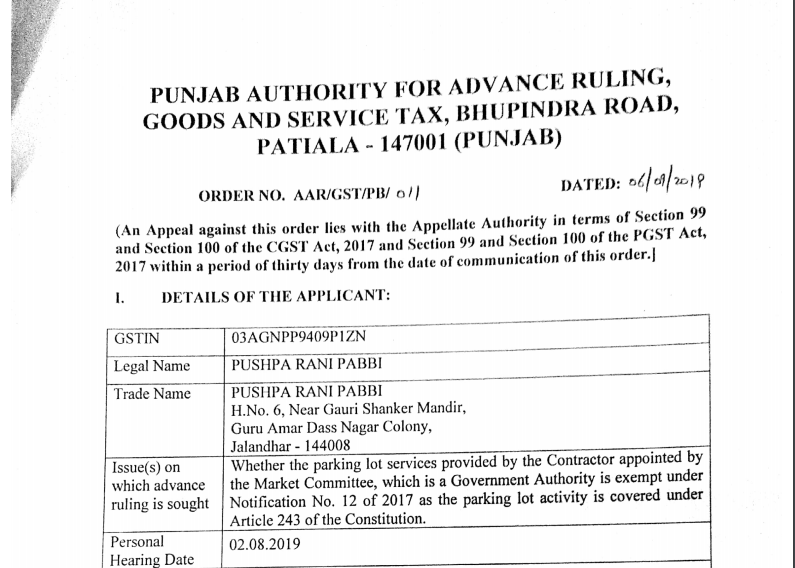

Case covered:

PUSHPA RANI PABBI

Facts of the case:

Pushpa Rani Pabbi(applicant) is a registered Proprietorship concern registered under the CGST Act,2017 and Punjab SGST Act, 2017 with GSTIN No. […]

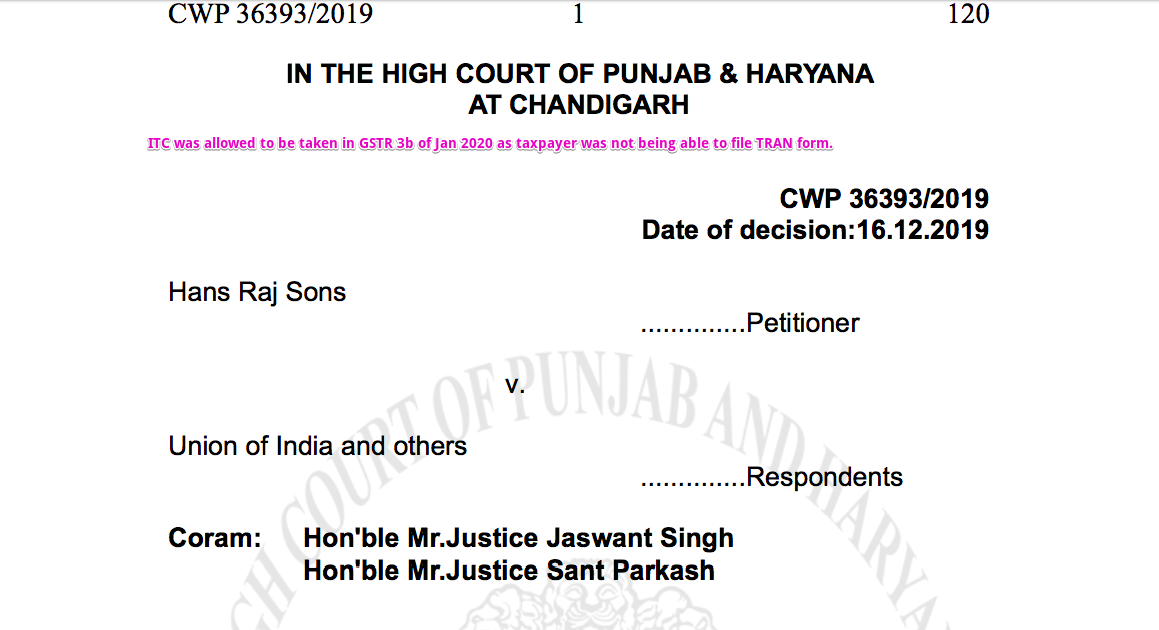

Case: Hans Raj Sons v. Union of India and others: Trans ITC can be claimed in 3b of 2020 jan

Facts of the Case: The taxpayer was not being able to take the transitional ITC as they were unable to fill form T […]

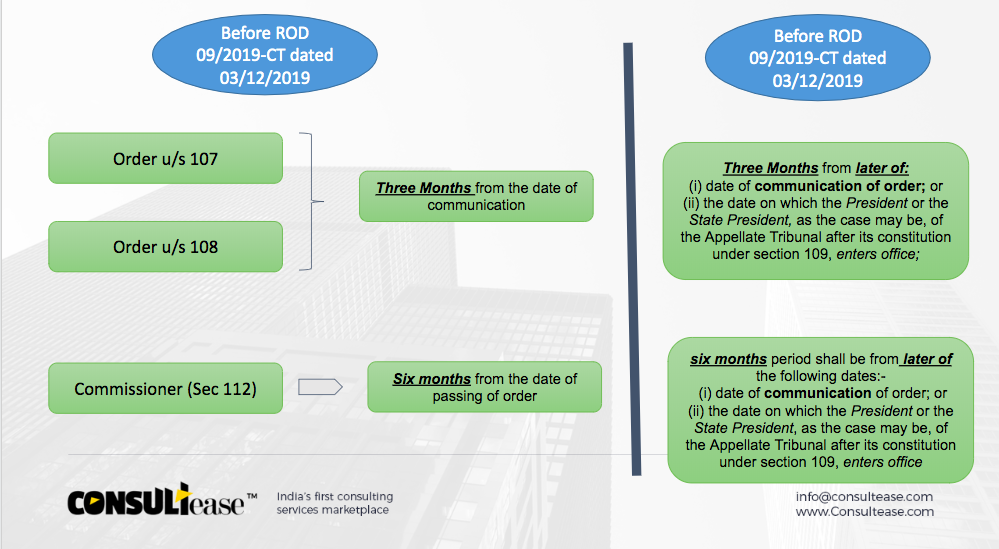

Time limit to file Applications in GST tribunal extended

S.O.(E).––WHEREAS, sub-section (1) of section 112 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this Order referred to as […]

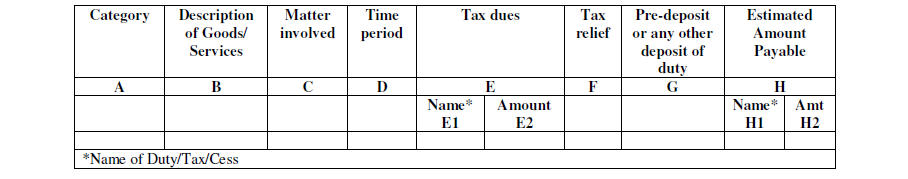

Form SVLDRS-2

This form is issued in response to form SVLDRS -1. It is a notice for a personal hearing.SVLDRS 2 is required to be issued within a prescribed time limit.

Form SVLDRS-2

[Estimate under section 127 […]

GSTN is doing a Disaster Recovery Drill of GST system on September 01, 2019 between 00:01 AM to 05:00 AM. The drill will take approximately 5 hours. The timing of the drill is chosen so that the taxpayer will not […]

GSTR-3B is not a return??

We bring you a brief write up on the latest judgment in GST, which gives immense relief to the assessees from various consequences under the law.

Is it true?? What are the […]

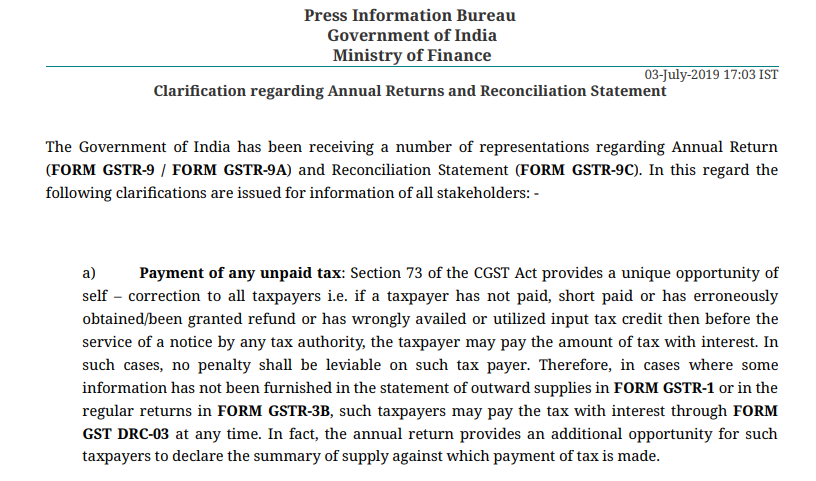

Introduction:

12 biggest Clarifications on Annual Return via press release by CBIC. This will definitely help all taxpayers. Major issues in GSTR 9 are clarified via these 12 biggest Clarifications on Annual […]

Opportune Time for Builders & Officials to Enrich Gracefully

Changes in Real Estate: Confusions Galore – Common Man @ Mercy

In the recent times there are Headline News and Flashes in many Electronic Media ab […]

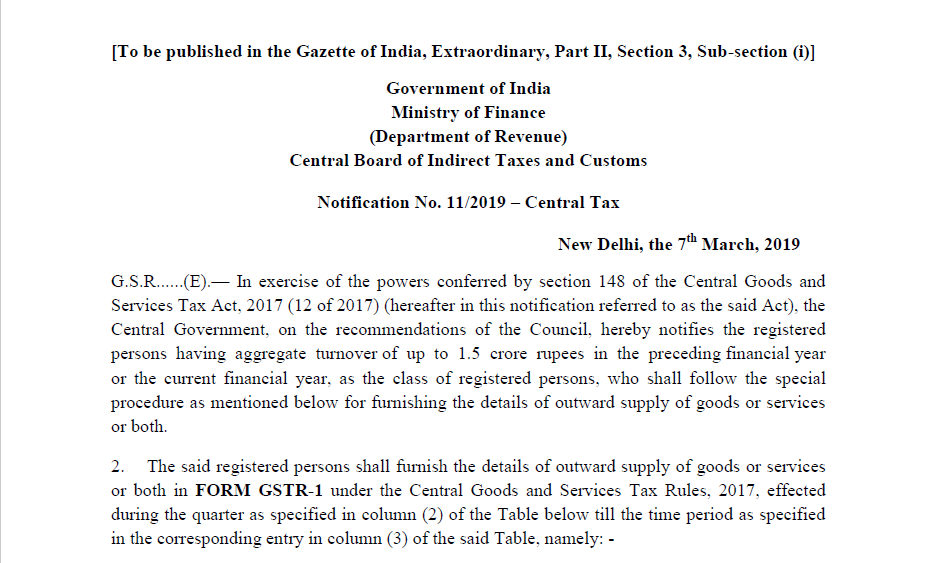

Notification No. 11/2019 – Central Tax

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 11/2019 – Central Tax

New Delhi, the […]

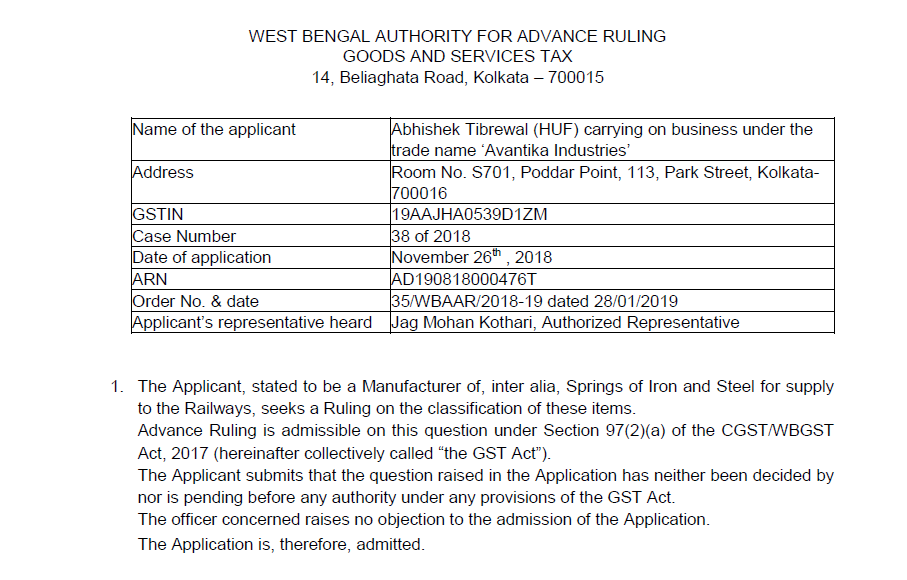

Original Copy of GST AAR of Avantika Industries

In the GST AAR of Avantika Industries, the applicant has raised the query regarding the classification of the Springs of Iron and Steel for supply to the R […]

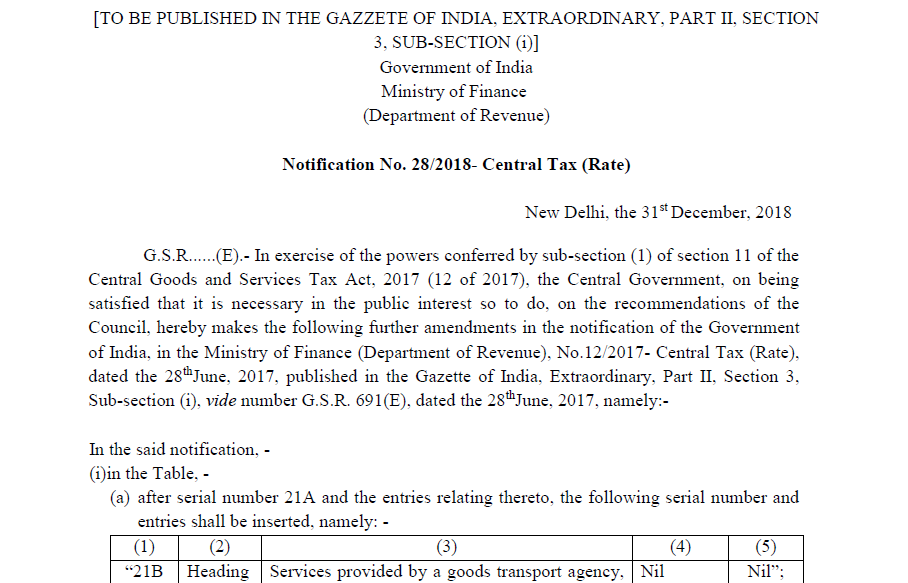

Notification No. 28/2018- Central Tax (Rate)

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 28/2018- Central Tax (Rate)

New Delhi, the 31st December 2018

G.S.R……(E).- […]

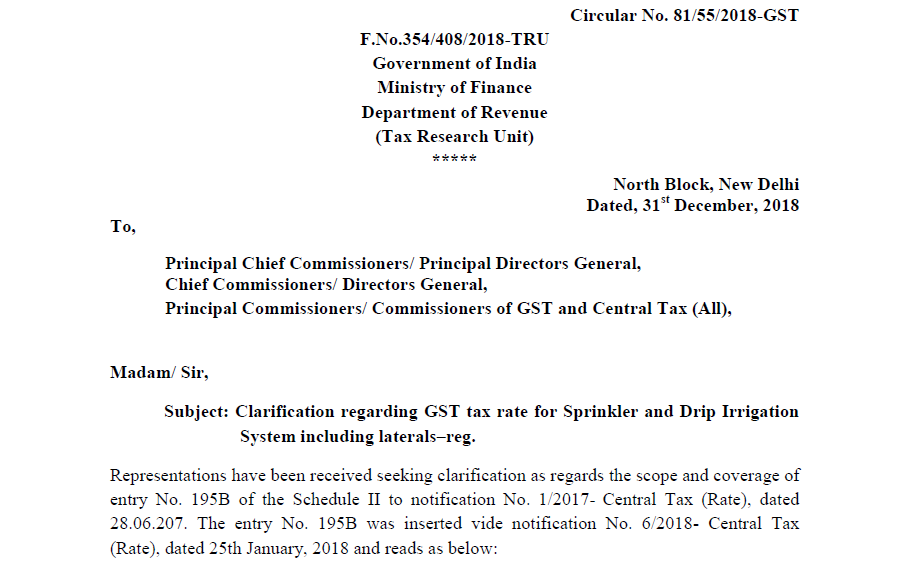

Circular No. 81/55/2018-GST

Circular No. 81/55/2018-GST

F.No.354/408/2018-TRU

Government of India

Ministry of Finance

Department of Revenue

(Tax Research Unit)

North Block, New Delhi

Dated, 31st December […]

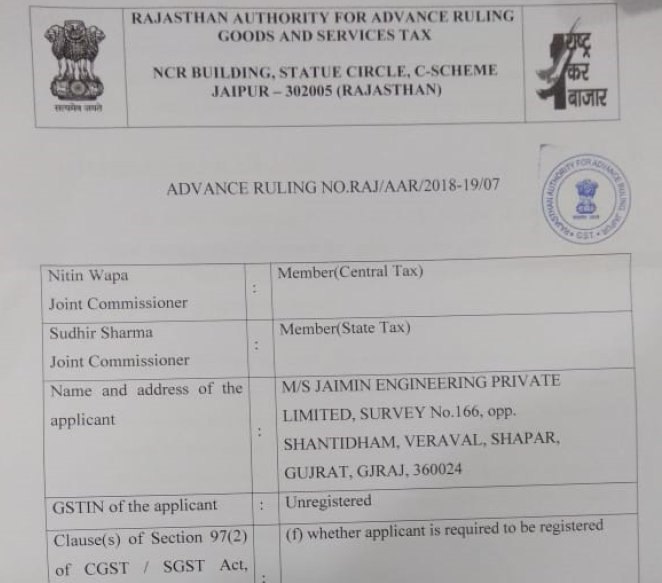

Original order of GST AAR of Jaimin Engineering Pvt Ltd

In the GST AAR of Jaimin Engineering Pvt Ltd. The applicant has raised the query regarding the liability to take the registration in the different state. F […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewNeeraj Kumar Rohila wrote a new post, Rule 1 of the CGST Act – Short title and Commencement 5 years, 6 months ago

Rule 1 of the CGST Act – Short title and Commencement

“(1) These rules may be called the Central Goods and Services Tax Rules, 2017. (2) They shall come into force with effect from 22nd June, 2017.”

Go To Rule 2

Neeraj Kumar Rohila wrote a new post, GST on Imported Goods: Practical & Constitutional Problems 5 years, 7 months ago

GST on Imported Goods: Practical & Constitutional Problems

IGST on Imported Goods: Duty of Customs or Tax on Supply?

Taxable Event

Tax can be levied on occurrence of a taxable event –

Excise duty is a tax o […]

Neeraj Kumar Rohila wrote a new post, Comprehensive Charts for all due dates in direct tax and indirect tax 5 years, 7 months ago

Comprehensive Charts for all due dates

Here we have compiled Comprehensive Charts for all due dates. The dates for direct and indirect tax are covered. I hope it will be quite useful. You can simply refer it to […]

Neeraj Kumar Rohila wrote a new post, Notification No. 28/2017-Central Tax (Rate) 5 years, 10 months ago

Notification No. 28/2017-Central Tax (Rate)

[TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(Department of Revenue) […]

Neeraj Kumar Rohila wrote a new post, Notification No. 37 /2017 – Central Tax 5 years, 10 months ago

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue )

[Central Board of Excise and […]

Neeraj Kumar Rohila wrote a new post, Market Committee is not a governmental authority: Parking services taxable 6 years ago

Case covered:

PUSHPA RANI PABBI

Facts of the case:

Pushpa Rani Pabbi(applicant) is a registered Proprietorship concern registered under the CGST Act,2017 and Punjab SGST Act, 2017 with GSTIN No. […]

Neeraj Kumar Rohila wrote a new post, Impact of Changes on 1st Jan on J&K and Ladakh 6 years, 1 month ago

Principal Place

Additional Place

Registration

ITC Balance on 31-12-2019

J&K

NIL

No New registration

No Transfer of ITC

J&K

Ladakh

Apply New UT registration in Ladakh

ITC ( […]

Neeraj Kumar Rohila wrote a new post, Trans ITC can be claimed in 3b of 2020 jan: Hans Raj Sons v. Union of India PDF attached 6 years, 2 months ago

Case: Hans Raj Sons v. Union of India and others: Trans ITC can be claimed in 3b of 2020 jan

Facts of the Case: The taxpayer was not being able to take the transitional ITC as they were unable to fill form T […]

Neeraj Kumar Rohila wrote a new post, Time limit to file Applications in GST tribunal 6 years, 2 months ago

Time limit to file Applications in GST tribunal extended

S.O.(E).––WHEREAS, sub-section (1) of section 112 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this Order referred to as […]

Neeraj Kumar Rohila wrote a new post, Format of Form SVLDRS-2 in PDF 6 years, 5 months ago

Form SVLDRS-2

This form is issued in response to form SVLDRS -1. It is a notice for a personal hearing.SVLDRS 2 is required to be issued within a prescribed time limit.

Form SVLDRS-2

[Estimate under section 127 […]

Neeraj Kumar Rohila wrote a new post, Disaster Recovery Drill of GST system 6 years, 5 months ago

GSTN is doing a Disaster Recovery Drill of GST system on September 01, 2019 between 00:01 AM to 05:00 AM. The drill will take approximately 5 hours. The timing of the drill is chosen so that the taxpayer will not […]

Neeraj Kumar Rohila wrote a new post, No Interest can be levied in GST|GSTR 3B is not a return 6 years, 6 months ago

GSTR-3B is not a return??

We bring you a brief write up on the latest judgment in GST, which gives immense relief to the assessees from various consequences under the law.

Is it true?? What are the […]

Neeraj Kumar Rohila wrote a new post, 12 biggest Clarifications on Annual Return by CBIC 6 years, 7 months ago

Introduction:

12 biggest Clarifications on Annual Return via press release by CBIC. This will definitely help all taxpayers. Major issues in GSTR 9 are clarified via these 12 biggest Clarifications on Annual […]

Neeraj Kumar Rohila wrote a new post, Recent Changes in Real Estate 6 years, 9 months ago

Opportune Time for Builders & Officials to Enrich Gracefully

Changes in Real Estate: Confusions Galore – Common Man @ Mercy

In the recent times there are Headline News and Flashes in many Electronic Media ab […]

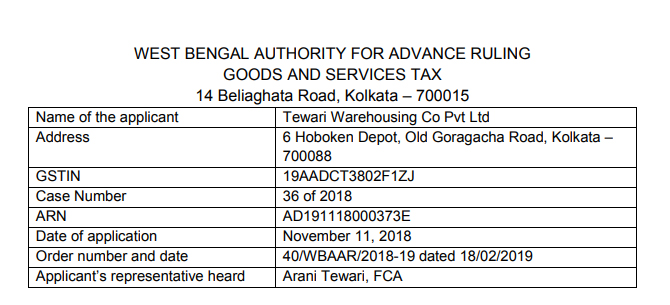

Neeraj Kumar Rohila wrote a new post, Original copy of GST AAR – Tewari Warehousing 6 years, 10 months ago

Download the full pdf of GST AAR – Tewari Warehousing by clicking the image below

The Applicant, stated to be supplying warehousing services, is constructing a warehouse on leasehold land, using […]

Neeraj Kumar Rohila wrote a new post, Notification No. 11/2019 – Central Tax 6 years, 11 months ago

Notification No. 11/2019 – Central Tax

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 11/2019 – Central Tax

New Delhi, the […]

Neeraj Kumar Rohila wrote a new post, Original Copy of GST AAR of Avantika Industries 6 years, 12 months ago

Original Copy of GST AAR of Avantika Industries

In the GST AAR of Avantika Industries, the applicant has raised the query regarding the classification of the Springs of Iron and Steel for supply to the R […]

Neeraj Kumar Rohila wrote a new post, Notification No. 28/2018- Central Tax (Rate) 7 years, 1 month ago

Notification No. 28/2018- Central Tax (Rate)

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 28/2018- Central Tax (Rate)

New Delhi, the 31st December 2018

G.S.R……(E).- […]

Neeraj Kumar Rohila wrote a new post, Circular No. 81/55/2018-GST 7 years, 1 month ago

Circular No. 81/55/2018-GST

Circular No. 81/55/2018-GST

F.No.354/408/2018-TRU

Government of India

Ministry of Finance

Department of Revenue

(Tax Research Unit)

North Block, New Delhi

Dated, 31st December […]

Neeraj Kumar Rohila wrote a new post, Original order of GST AAR of Jaimin Engineering Pvt Ltd 7 years, 2 months ago

Original order of GST AAR of Jaimin Engineering Pvt Ltd

In the GST AAR of Jaimin Engineering Pvt Ltd. The applicant has raised the query regarding the liability to take the registration in the different state. F […]