Standing still is the fastest way to fall behind, the skills that earned you your last promotion are already on a countdown. The rapid pace of technological change, global economic shifts, and industry disruption […]

You might have heard that banks put profits over people, but what if we tell you there’s a type of bank that does the opposite? That’s where customer-owned banks come in. Unlike traditional banks that answer to […]

At RegisterKaro, we’re leading the charge in compliance innovation. We believe in leveraging cutting-edge technology to provide intelligent, efficient, and accurate solutions for your business. Whether you’re […]

QR codes have become a powerful tool for marketers, providing an easy and effective way to connect with audiences and streamline the customer journey. Whether you’re a small business owner launching your first […]

Starting out at an occupational therapy assistant university offers more than just classes and labs—it lays the foundation for navigating a career full of regulations, state laws, and certification h […]

Personal injury law is a detailed legal field that requires careful navigation, especially in the results of an accident. grasp the legal landscape, evidence requirements, and the role of expert representation is […]

Taxes are an inevitable part of life, but overpaying doesn’t have to be. With a clear understanding of allowances, deductions, and strategic planning, you can significantly reduce your tax liabilities and keep m […]

Using mobile payment applications on your smartphone to transfer and receive money might be a useful option. It enables migrants who work overseas to help their loved ones at home securely and economically. It […]

Studying MBBS in Georgia is a big step in your medical career. For many Indian students, Georgia has become an attractive destination due to its quality education, low fees, and friendly environment. However, […]

Countless individuals and businesses find themselves struggling under the weight of tax debt. The journey from financial distress to stability is fraught with challenges, yet understanding the implications and […]

Applying for a loan and preparing for it is a complicated task for most people. Before applying, it’s important to ask yourself questions like, “What is loan affordability?” and “Can you repay the loan on time?” […]

In the fast-paced world of B2B marketing, few channels hold more game-changing yet untapped potential than cold email outreach. Directly reaching key decision-makers at target companies to spark meaningful […]

As experienced tax professionals who help businesses claim their R&D tax credits, we can confidently say that this incentive is often ignored by small and medium-sized enterprises. This is due to a common […]

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

SC verdict on PMLA on non scheduled Offences-

The Supreme Court has rejected the review petitions filed against its previous judgment, which ruled that proceedings under the Prevention of Money Laundering Act […]

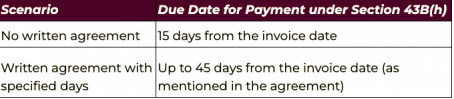

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

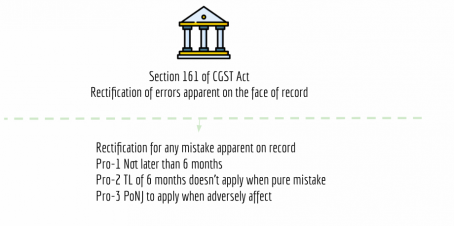

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Why Lifelong Learning Is the Best Career Investment You’ll Ever Make 4 days, 9 hours ago

Standing still is the fastest way to fall behind, the skills that earned you your last promotion are already on a countdown. The rapid pace of technological change, global economic shifts, and industry disruption […]

ConsultEase Administrator wrote a new post, What Is a Customer-Owned Bank? 3 months, 1 week ago

You might have heard that banks put profits over people, but what if we tell you there’s a type of bank that does the opposite? That’s where customer-owned banks come in. Unlike traditional banks that answer to […]

ConsultEase Administrator wrote a new post, The Compliance Evolution: How AI and Automation Are Shaping India Business Future 7 months, 2 weeks ago

At RegisterKaro, we’re leading the charge in compliance innovation. We believe in leveraging cutting-edge technology to provide intelligent, efficient, and accurate solutions for your business. Whether you’re […]

Prem wrote a new post, Beginner-Friendly QR Code Generator for Your First Marketing Campaign 7 months, 3 weeks ago

QR codes have become a powerful tool for marketers, providing an easy and effective way to connect with audiences and streamline the customer journey. Whether you’re a small business owner launching your first […]

Prem wrote a new post, Understanding Product Liability Lawsuits: A Guide for Product Liability Attorneys and Lawyers 8 months, 2 weeks ago

When someone gets injured by a defective product, product liability lawyers are often the first line of defense for justice.

They’re the ones who investigate the defect, determine who’s responsible, and take t […]

Prem wrote a new post, Legal Compliance Challenges for Occupational Therapy Assistant University Graduates 8 months, 2 weeks ago

Starting out at an occupational therapy assistant university offers more than just classes and labs—it lays the foundation for navigating a career full of regulations, state laws, and certification h […]

Prem wrote a new post, Personal Injury Law: A complete Guide For Your Accident 8 months, 3 weeks ago

Personal injury law is a detailed legal field that requires careful navigation, especially in the results of an accident. grasp the legal landscape, evidence requirements, and the role of expert representation is […]

Prem wrote a new post, Top 10 Tax-Saving Strategies Every UK Taxpayer Needs to Know 9 months, 2 weeks ago

Taxes are an inevitable part of life, but overpaying doesn’t have to be. With a clear understanding of allowances, deductions, and strategic planning, you can significantly reduce your tax liabilities and keep m […]

ConsultEase Administrator wrote a new post, Money Transfer Scams & How to Avoid Them 11 months, 3 weeks ago

Using mobile payment applications on your smartphone to transfer and receive money might be a useful option. It enables migrants who work overseas to help their loved ones at home securely and economically. It […]

ConsultEase Administrator wrote a new post, 10 Things You Should Consider Before Pursuing MBBS Abroad: A Comprehensive Guide for Indian Students Eyeing Georgia 1 year ago

Studying MBBS in Georgia is a big step in your medical career. For many Indian students, Georgia has become an attractive destination due to its quality education, low fees, and friendly environment. However, […]

ConsultEase Administrator wrote a new post, From Financial Slump to Success: Overcoming Tax Debt and Starting Fresh 1 year ago

Countless individuals and businesses find themselves struggling under the weight of tax debt. The journey from financial distress to stability is fraught with challenges, yet understanding the implications and […]

ConsultEase Administrator wrote a new post, Understanding Loan Affordability: An In-Depth Guide 1 year, 1 month ago

Applying for a loan and preparing for it is a complicated task for most people. Before applying, it’s important to ask yourself questions like, “What is loan affordability?” and “Can you repay the loan on time?” […]

ConsultEase Administrator wrote a new post, The Art of the Cold Email: Mastering Outreach for B2B Lead Generation 1 year, 10 months ago

In the fast-paced world of B2B marketing, few channels hold more game-changing yet untapped potential than cold email outreach. Directly reaching key decision-makers at target companies to spark meaningful […]

ConsultEase Administrator wrote a new post, How to Determine if Your Business Qualifies for R&D Tax Credits 1 year, 10 months ago

As experienced tax professionals who help businesses claim their R&D tax credits, we can confidently say that this incentive is often ignored by small and medium-sized enterprises. This is due to a common […]

CA Shafaly Girdharwal wrote a new post, Kerala HC: Writs Not for Questioning Sufficiency of Evidence in Disciplinary Proceedings 1 year, 10 months ago

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

ConsultEase Administrator wrote a new post, PMLA cant be invoked for non scheduled offence 1 year, 10 months ago

SC verdict on PMLA on non scheduled Offences-

The Supreme Court has rejected the review petitions filed against its previous judgment, which ruled that proceedings under the Prevention of Money Laundering Act […]

CA Shafaly Girdharwal wrote a new post, 16 FAQ’s on 43B(h) applicable from 1.04.2024 1 year, 10 months ago

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

In this […]

CA Shafaly Girdharwal wrote a new post, Court allowed refund when the tax was lateron paid by the Supplier 1 year, 10 months ago

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on rectification of orders in GST 1 year, 10 months ago

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

CA Shafaly Girdharwal wrote a new post, landmark judgment on jurisdiction of GST authorities – TVL Vardhan Infrastructure 1 year, 10 months ago

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]