Residential status of certain individuals under the Income-tax Act, 1961

Section 6 of the Income-tax Act, 1961 (the Act) contains provisions relating to the determination of residency of a person. The status of […]

Commissioner of Central Tax (GST)

Facts of the Case:

Brief averments of the facts as per the bail application filed is that accused is Director of SPNN Business Serv […]

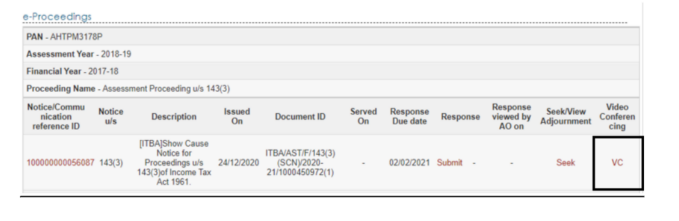

FAQs for seek VC & seek VC Adjournment

What is VC?

Answer: VC stands for ‘Video Conferencing’. Using the VC facility, an assessee is enabled to express or submit one’s response orally before an income Tax […]

SOP for physical of cases before the National Company Law Tribunal

The National Company Law Tribunal had earlier issued guidelines/circulars/ notifications regarding the functioning of the NCLT during the […]

The state of U.P.

Facts of the Case:

The allegation in the F.I.R lodged against the applicant and six other co-accused persons is that a web series is being shown […]

MCA & CBIC sign MoU for exchange of data for enhancing Ease of Doing Business in India and improve overall regulatory enforcement

The Ministry of Corporate Affairs (MCA) and Central Board of Indirect Taxes and […]

Applicability of GSTR – 9 & GSTR – 9C

It is our last audit! yes, we need to finish it on time as there are remote chances of extension of due dates. We have compiled some quick issues for the GSTR 9 and 9C for […]

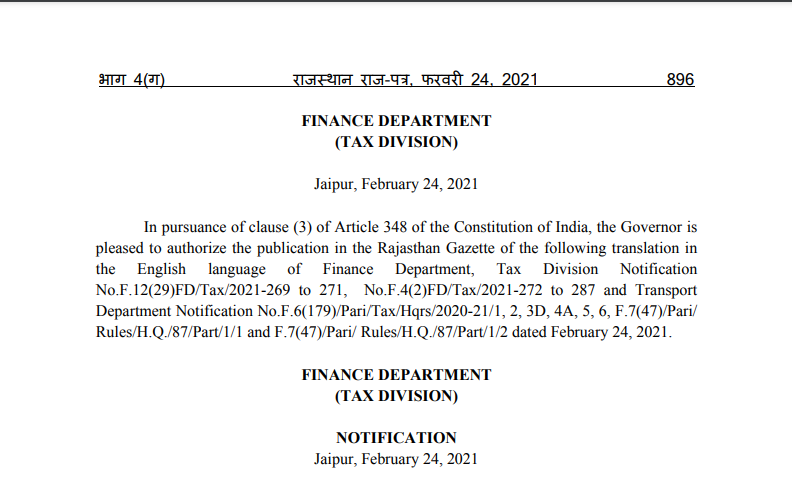

Rajasthan VAT Amnesty Scheme Notification

In pursuance of clause (3) of Article 348 of the Constitution of India, the Governor is pleased to authorize the publication in the Rajasthan Gazette of the following […]

About the Course:

Certificate course on GST 2021- By Consultease. It is updated with the changes introduced by FA 2021. Important notifications and circulars are also covered. Every section is covered in a […]

About the Course:

It is a well-known fact that the indirect tax structure of the Real Estate Sector always remains in highlights and in disputes between the tax authorities and taxpayers. The reason for the same […]

About the course:

Live online classes for Indirect taxes is a course covering all the provisions of the Goods and Services Tax legislation, Customs and Foreign Trade Policy Provisions, and is relevant for CA, […]

About the course:

This course from Ms. Sudha G. Bhushan, the person who conceptualized the due diligence under FEMA for the first time in 2013. Opportunity to learn from the expert who is an authority in the […]

Q1. What is Invoice Furnishing Facility (IFF)?

1. Invoice Furnishing Facility (IFF) is a facility where quarterly taxpayers can upload the details of their outward supplies in the first two months of the q […]

Union of India

Facts of the Case:

This petition under Article 226 of the Constitution of India challenges the constitutional validity of section 132(1) (b) of […]

Union of India

Common Order:

We have heard all the learned counsel appearing for the writ applicants. We have also heard Mr. Devang Vyas, the learned Additio […]

Overview of Data Analytics for Finance Professionals

Why Data Analytics

In today’s information age, data is everywhere and ever-increasing. We are leaving digital footprints when we use the internet right from d […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Circular No. 2 of 2021: CBDT 4 years, 11 months ago

Residential status of certain individuals under the Income-tax Act, 1961

Section 6 of the Income-tax Act, 1961 (the Act) contains provisions relating to the determination of residency of a person. The status of […]

ConsultEase Administrator wrote a new post, Patiala House Court in the case of Navneet Singh Versus Commissioner of Central Tax (GST) 4 years, 11 months ago

Case Covered:

Navneet Singh

Versus

Commissioner of Central Tax (GST)

Facts of the Case:

Brief averments of the facts as per the bail application filed is that accused is Director of SPNN Business Serv […]

ConsultEase Administrator wrote a new post, Jharkhand HC in the case of M/s. WS Retail Services Private Limited Versus The State of Jharkhand 4 years, 11 months ago

Case Covered:

M/s. WS Retail Services Private Limited

Versus

The State of Jharkhand

Facts of the Case:

The claim of refund of Rs. 61,74,899/- deposited between the period December 2014 to August 2015 by […]

ConsultEase Administrator wrote a new post, FAQs for seek VC & seek VC Adjournment 4 years, 11 months ago

FAQs for seek VC & seek VC Adjournment

What is VC?

Answer: VC stands for ‘Video Conferencing’. Using the VC facility, an assessee is enabled to express or submit one’s response orally before an income Tax […]

ConsultEase Administrator wrote a new post, Bombay HC in the case of Shree Ganesh Forging Limited Versus State of Maharashtra 4 years, 11 months ago

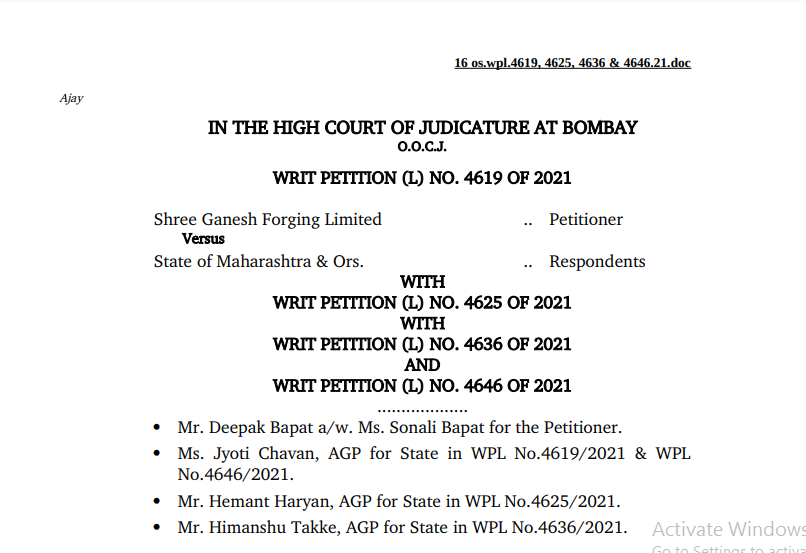

Case Covered:

Shree Ganesh Forging Limited

Versus

State of Maharashtra

Order:

Heard Mr. Deepak Bapat, learned counsel for the petitioner.

Issue notice.

Ms. Jyoti Chavan, Mr. Hemant Haryan, and Mr. […]

ConsultEase Administrator wrote a new post, SOP for physical of cases before the National Company Law Tribunal 4 years, 11 months ago

SOP for physical of cases before the National Company Law Tribunal

The National Company Law Tribunal had earlier issued guidelines/circulars/ notifications regarding the functioning of the NCLT during the […]

ConsultEase Administrator wrote a new post, Allahabad HC in the case of Aparna Purohit Versus The state of U.P. 4 years, 11 months ago

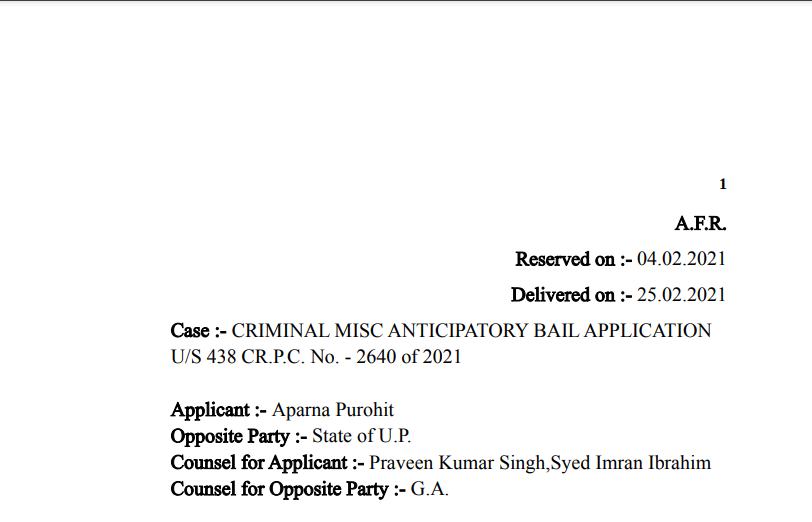

Case Covered:

Aparna Purohit

Versus

The state of U.P.

Facts of the Case:

The allegation in the F.I.R lodged against the applicant and six other co-accused persons is that a web series is being shown […]

ConsultEase Administrator wrote a new post, MCA & CBIC sign MoU for exchange of data for enhancing Ease of Doing Business in India and improve overall regulatory enforcement 4 years, 11 months ago

MCA & CBIC sign MoU for exchange of data for enhancing Ease of Doing Business in India and improve overall regulatory enforcement

The Ministry of Corporate Affairs (MCA) and Central Board of Indirect Taxes and […]

ConsultEase Administrator wrote a new post, Specific points for GSTR 9 and GSTR 9C for FY 2019-20 4 years, 11 months ago

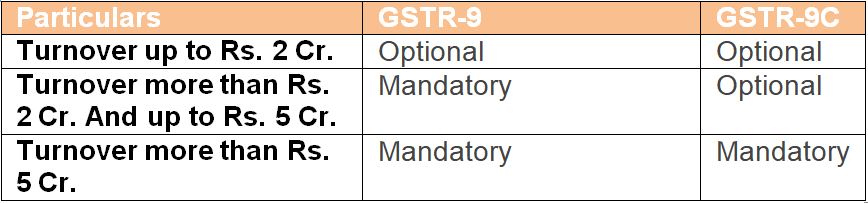

Applicability of GSTR – 9 & GSTR – 9C

It is our last audit! yes, we need to finish it on time as there are remote chances of extension of due dates. We have compiled some quick issues for the GSTR 9 and 9C for […]

ConsultEase Administrator wrote a new post, Rajasthan VAT Amnesty Scheme Notification 4 years, 11 months ago

Rajasthan VAT Amnesty Scheme Notification

In pursuance of clause (3) of Article 348 of the Constitution of India, the Governor is pleased to authorize the publication in the Rajasthan Gazette of the following […]

Prem posted an update 4 years, 11 months ago

Wednesday post

ConsultEase Administrator wrote a new post, Join our Certificate Course on GST – 2021 4 years, 12 months ago

About the Course:

Certificate course on GST 2021- By Consultease. It is updated with the changes introduced by FA 2021. Important notifications and circulars are also covered. Every section is covered in a […]

ConsultEase Administrator wrote a new post, Join our Certificate GST course for Real Estate Sector – Learn insides with Easy Approach by Adv. Pawan Arora 4 years, 12 months ago

About the Course:

It is a well-known fact that the indirect tax structure of the Real Estate Sector always remains in highlights and in disputes between the tax authorities and taxpayers. The reason for the same […]

ConsultEase Administrator wrote a new post, Course on Indirect Tax Course for CA Final Students and Professionals by CA Harini Sridharan. 4 years, 12 months ago

About the course:

Live online classes for Indirect taxes is a course covering all the provisions of the Goods and Services Tax legislation, Customs and Foreign Trade Policy Provisions, and is relevant for CA, […]

ConsultEase Administrator wrote a new post, Join our Comprehensive Course starting from 25th Feb. on Foreign Exchange Management Act by Sudha G Bhushan 4 years, 12 months ago

About the course:

This course from Ms. Sudha G. Bhushan, the person who conceptualized the due diligence under FEMA for the first time in 2013. Opportunity to learn from the expert who is an authority in the […]

ConsultEase Administrator wrote a new post, Invoice Furnishing Facility (IFF) Under GST 4 years, 12 months ago

Q1. What is Invoice Furnishing Facility (IFF)?

1. Invoice Furnishing Facility (IFF) is a facility where quarterly taxpayers can upload the details of their outward supplies in the first two months of the q […]

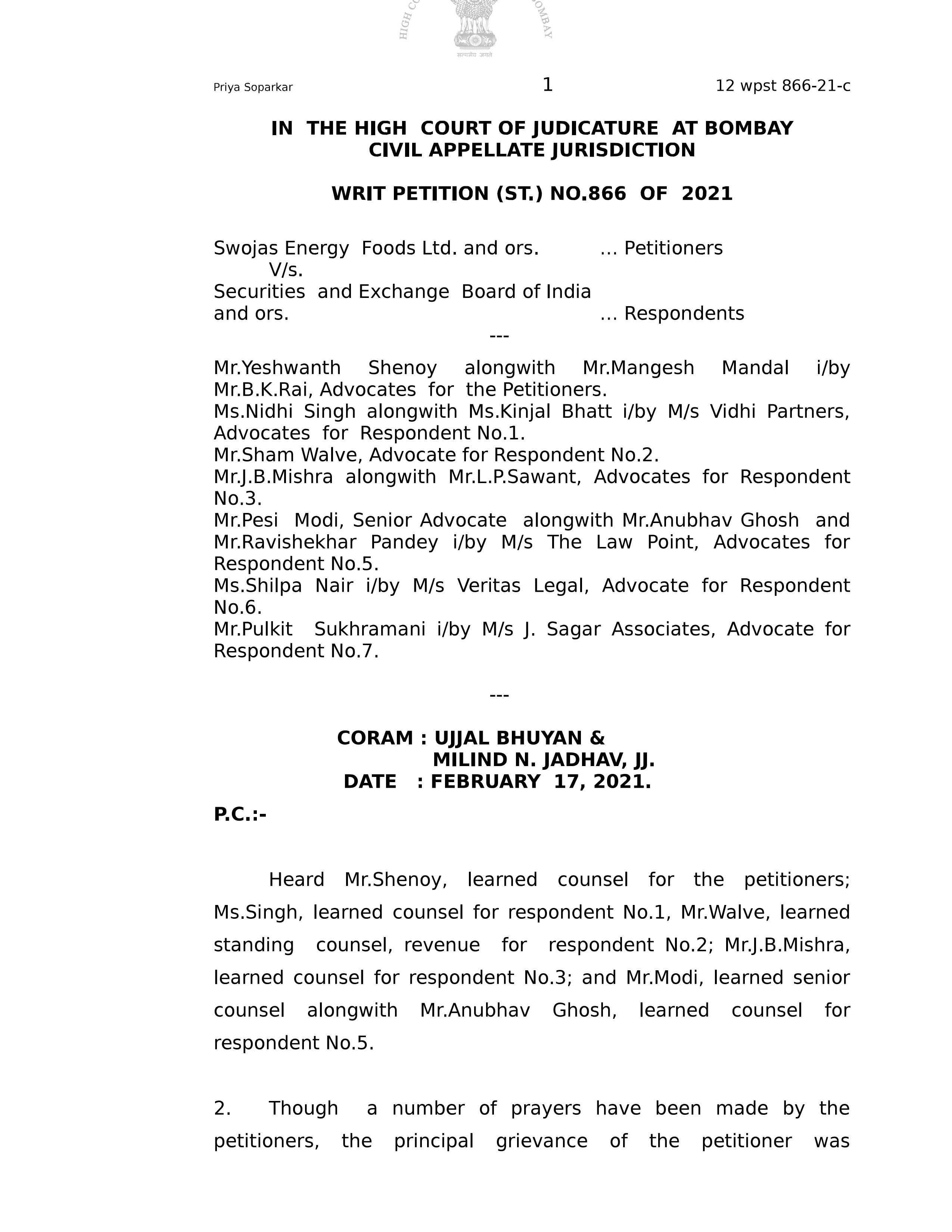

ConsultEase Administrator wrote a new post, Bombay HC in the Case of Swojas Energy Foods Ltd. & ors. V/s. SEBI & ors. 4 years, 12 months ago

Case Covered:

Swojas Energy Foods Ltd. and ors.

vs

Securities and Exchange Board of India

and ors.

Facts of the Case:

The Appeal has been filed by petitioners against the Freezing of their Demat […]

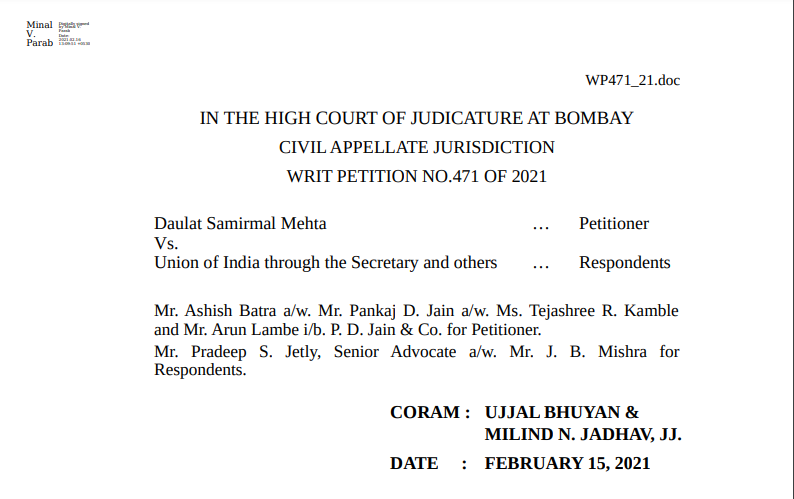

ConsultEase Administrator wrote a new post, Bombay HC in the case of Daulat Samirmal Mehta Versus Union of India 5 years ago

Case Covered:

Daulat Samirmal Mehta

Versus

Union of India

Facts of the Case:

This petition under Article 226 of the Constitution of India challenges the constitutional validity of section 132(1) (b) of […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of M/s Bhumi Associate Versus Union of India 5 years ago

Case Covered:

M/s Bhumi Associate

Versus

Union of India

Common Order:

We have heard all the learned counsel appearing for the writ applicants. We have also heard Mr. Devang Vyas, the learned Additio […]

ConsultEase Administrator wrote a new post, Overview of Data Analytics for Finance Professionals: ICAI 5 years ago

Overview of Data Analytics for Finance Professionals

Why Data Analytics

In today’s information age, data is everywhere and ever-increasing. We are leaving digital footprints when we use the internet right from d […]