QR codes have become a powerful tool for marketers, providing an easy and effective way to connect with audiences and streamline the customer journey. Whether you’re a small business owner launching your first […]

Starting out at an occupational therapy assistant university offers more than just classes and labs—it lays the foundation for navigating a career full of regulations, state laws, and certification h […]

Personal injury law is a detailed legal field that requires careful navigation, especially in the results of an accident. grasp the legal landscape, evidence requirements, and the role of expert representation is […]

Taxes are an inevitable part of life, but overpaying doesn’t have to be. With a clear understanding of allowances, deductions, and strategic planning, you can significantly reduce your tax liabilities and keep m […]

Introduction

The Union government’s recent filing of a transfer petition before the Supreme Court to consolidate pending cases challenging GST notices issued to real money gaming companies has […]

Introduction:

The Hon’ble Madras High Court, in the case of M/s. Great Heights Developers LLP v. Additional Commissioner Office of the Commissioner of CGST & Central Excise, Chennai, allowed a […]

At present, the taxpayers of the country are not only troubled but also unhappy and feeling offended by the continuous and large number of notices related to various issues related to both GST and Income Tax […]

In a significant development, the Punjab Excise and Taxation Department, in collaboration with the Fatehgarh Sahib police, has apprehended a GST fraudster for fraudulently claiming Rs 3.65 […]

Development Rights are leviable to GST – Telangana High Court

M/s. Prahitha Constructions Private Limited, WP No. 5493 of 2020

A. Limited contentions of the Petitioner

1. Transfer of Development Rights of land […]

Overview of the Central Board of Indirect Taxes and Customs (CBIC) Instruction No. 02/2024-Customs dated February 15, 2024.

Emphasis on timely sharing of incident reports to enhance risk […]

Introduction:

The Micro, Small, and Medium Enterprise (MSME) sector significantly contribute to India’s economic landscape. This article explores recent amendments to the Income Tax Act (ITA) related to MSMEs, f […]

In a recent ruling by the Income Tax Appellate Tribunal, Nagpur Bench, the appeal of Mr. Sanjay Kisan Chopde against the Income Tax Department for the assessment year 2014-15 was meticulously […]

A senior official from the Finance Ministry has indicated that any significant changes to the Goods and Services Tax (GST) rates are likely to occur only after the upcoming Lok Sabha […]

The recent election of Manoj Sonkar, a Bharatiya Janata Party (BJP) candidate, as the Mayor of Chandigarh has been marred by controversy, with allegations of fraud and irregularities prompting legal challenges and […]

Overview of the Dispute

At the heart of the matter lies the verification of tax dues intertwined with claims over specific pieces of jewelry. The multiplicity of parties involved adds layers of complexity to the […]

The Haryana government has taken a significant step in bolstering its administrative infrastructure with the appointment of new members to the Value Added Tax (VAT) Tribunal. In a recent […]

Introduction

In an ongoing battle against fraudulent Input Tax Credit (ITC) activities, the Directorate General of GST Intelligence (DGGI) has intensified its efforts, resulting in significant breakthroughs. […]

When tax is deemed to be paid?

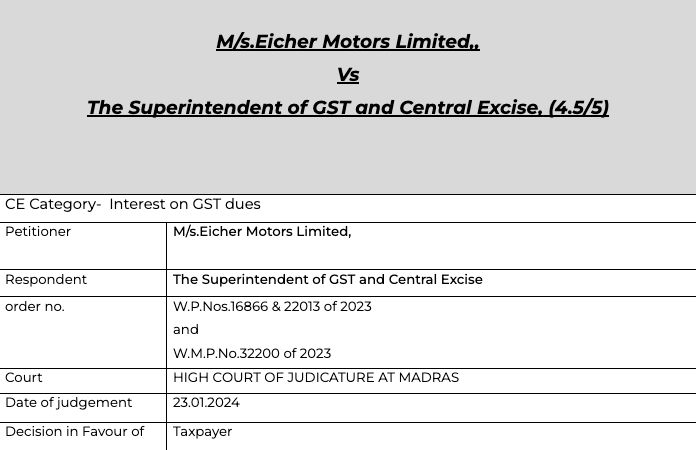

In this case the return was not filed by the taxpayer as he was facing difficulty in transitional credit.They were unable to file the July 2017 return. Now GST portal doesn’t allow […]

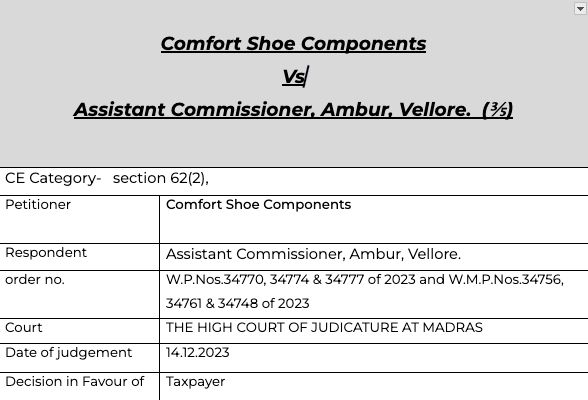

The time limit of section 62(2)-

In case of best judgment assessment, the proceedings are dropped if the TP files the return within 30 days. But if they file it after 30 days. Should it be allowed ? See what […]

Prem

designer

Paid User

@prem

active 1 week, 1 day agoPrem

gst taxation

2.0Registered Categories

Location

Adilabad, India

OOPS!

No Packages Added by Prem. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewPrem wrote a new post, Beginner-Friendly QR Code Generator for Your First Marketing Campaign 8 months ago

QR codes have become a powerful tool for marketers, providing an easy and effective way to connect with audiences and streamline the customer journey. Whether you’re a small business owner launching your first […]

Prem wrote a new post, Understanding Product Liability Lawsuits: A Guide for Product Liability Attorneys and Lawyers 8 months, 3 weeks ago

When someone gets injured by a defective product, product liability lawyers are often the first line of defense for justice.

They’re the ones who investigate the defect, determine who’s responsible, and take t […]

Prem wrote a new post, Legal Compliance Challenges for Occupational Therapy Assistant University Graduates 8 months, 3 weeks ago

Starting out at an occupational therapy assistant university offers more than just classes and labs—it lays the foundation for navigating a career full of regulations, state laws, and certification h […]

Prem wrote a new post, Personal Injury Law: A complete Guide For Your Accident 8 months, 3 weeks ago

Personal injury law is a detailed legal field that requires careful navigation, especially in the results of an accident. grasp the legal landscape, evidence requirements, and the role of expert representation is […]

Prem wrote a new post, Top 10 Tax-Saving Strategies Every UK Taxpayer Needs to Know 9 months, 2 weeks ago

Taxes are an inevitable part of life, but overpaying doesn’t have to be. With a clear understanding of allowances, deductions, and strategic planning, you can significantly reduce your tax liabilities and keep m […]

Prem wrote a new post, “Supreme Court Seeks Consolidation of GST Cases on Real Money Gaming” 1 year, 11 months ago

Introduction

The Union government’s recent filing of a transfer petition before the Supreme Court to consolidate pending cases challenging GST notices issued to real money gaming companies has […]

Prem wrote a new post, “Madras HC: Medical Reasons Valid for GST Appeal Delay” 1 year, 11 months ago

Introduction:

The Hon’ble Madras High Court, in the case of M/s. Great Heights Developers LLP v. Additional Commissioner Office of the Commissioner of CGST & Central Excise, Chennai, allowed a […]

Prem wrote a new post, Government should reduce the number of notices issued in Income Tax and GST 1 year, 11 months ago

At present, the taxpayers of the country are not only troubled but also unhappy and feeling offended by the continuous and large number of notices related to various issues related to both GST and Income Tax […]

Prem wrote a new post, “Punjab Excise Department’s Major GST Fraud Bust” 2 years ago

In a significant development, the Punjab Excise and Taxation Department, in collaboration with the Fatehgarh Sahib police, has apprehended a GST fraudster for fraudulently claiming Rs 3.65 […]

Prem wrote a new post, Development Rights are leviable to GST – Telangana High Court 2 years ago

Development Rights are leviable to GST – Telangana High Court

M/s. Prahitha Constructions Private Limited, WP No. 5493 of 2020

A. Limited contentions of the Petitioner

1. Transfer of Development Rights of land […]

Prem wrote a new post, Enhanced Reporting Guidelines for Customs Incidents and Arrests 2 years ago

Introduction

Overview of the Central Board of Indirect Taxes and Customs (CBIC) Instruction No. 02/2024-Customs dated February 15, 2024.

Emphasis on timely sharing of incident reports to enhance risk […]

Prem wrote a new post, “Recent Income Tax Amendments and MSMEs: Implications” 2 years ago

Introduction:

The Micro, Small, and Medium Enterprise (MSME) sector significantly contribute to India’s economic landscape. This article explores recent amendments to the Income Tax Act (ITA) related to MSMEs, f […]

Prem wrote a new post, Merely entry in Form 26AS does not make it taxable, Revenue will have to prove income 2 years ago

In a recent ruling by the Income Tax Appellate Tribunal, Nagpur Bench, the appeal of Mr. Sanjay Kisan Chopde against the Income Tax Department for the assessment year 2014-15 was meticulously […]

Prem wrote a new post, “Finance Ministry Foresees Post-Election GST Rate Changes” 2 years ago

A senior official from the Finance Ministry has indicated that any significant changes to the Goods and Services Tax (GST) rates are likely to occur only after the upcoming Lok Sabha […]

Prem wrote a new post, Chandigarh Mayor Election Controversy: High Court Intervenes Amid Fraud Claims” 2 years ago

The recent election of Manoj Sonkar, a Bharatiya Janata Party (BJP) candidate, as the Mayor of Chandigarh has been marred by controversy, with allegations of fraud and irregularities prompting legal challenges and […]

Prem wrote a new post, Navigating Tax Disputes: Insights from the Bombay High Court Judgment 2 years ago

Overview of the Dispute

At the heart of the matter lies the verification of tax dues intertwined with claims over specific pieces of jewelry. The multiplicity of parties involved adds layers of complexity to the […]

Prem wrote a new post, Haryana Government Appoints New VAT Tribunal Members 2 years ago

The Haryana government has taken a significant step in bolstering its administrative infrastructure with the appointment of new members to the Value Added Tax (VAT) Tribunal. In a recent […]

Prem wrote a new post, DGGI’s Crackdown: Exposing Fake ITC Syndicates and Apprehending Tax Evaders 2 years ago

Introduction

In an ongoing battle against fraudulent Input Tax Credit (ITC) activities, the Directorate General of GST Intelligence (DGGI) has intensified its efforts, resulting in significant breakthroughs. […]

Prem wrote a new post, [Breaking]No Interest if the amount was deposited in cash ledger even if 3b isn’t filed 2 years ago

When tax is deemed to be paid?

In this case the return was not filed by the taxpayer as he was facing difficulty in transitional credit.They were unable to file the July 2017 return. Now GST portal doesn’t allow […]

Prem wrote a new post, Time limit u/s 62(2) is not mandatory- TP have right to file return- HC 2 years, 1 month ago

The time limit of section 62(2)-

In case of best judgment assessment, the proceedings are dropped if the TP files the return within 30 days. But if they file it after 30 days. Should it be allowed ? See what […]