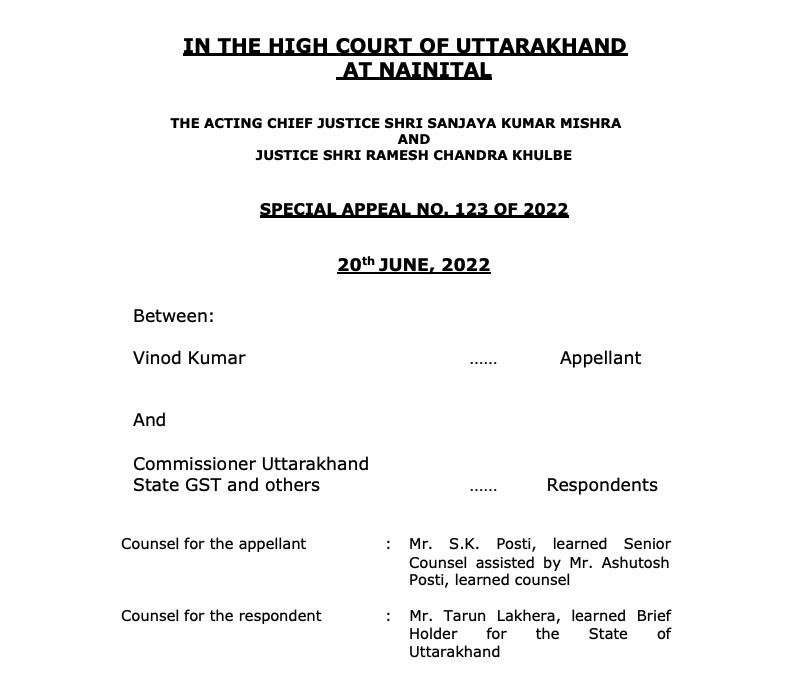

Appeal against the order of commissioner/AC

In a recent judgment the Uttaranchal High court has restricted the appeals against the orders of commissioner and AC.The issue under the consideration of the […]

When people fall in love and get married, it’s often their hope that the union will last ’till death do them part.’ However, many things happen in between, and for one reason or the other, the union comes to a […]

Section 45 of the Prevention of Money Laundering Act (PMLA) poses a significant challenge by mandating the Court to conduct a preliminary review of the evidence to establish a prima facie case against the accused. […]

The petitioner, a proprietary firm, has invoked the jurisdiction under Article 226 of the Constitution of India. The prayer is to issue a writ of certiorari or any other appropriate writ to annul and set aside the […]

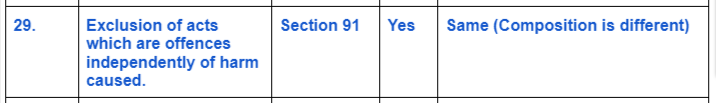

Section 26 of Bhartiya Nyay Sanhita on TEXT :

The exceptions in sections 21, 22 and 23 do not extend to acts which are offences independently of any harm which they may cause, or be intended to cause, or be known […]

Section 20 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on TexT:

Nothing is an offence which is done by a child under seven years of age.

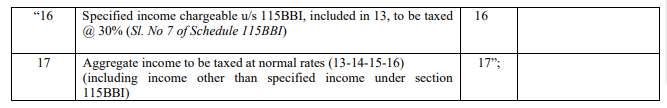

This amendment is effective from 1st day of April, 2023 and applies to assessment year 2023-24 relevant to the previous year 2022-23. It is hereby certified that no person is being adversely affected by giving […]

a. Individuals subject to taxation who were unable to file an appeal against an adjudication order issued on or before March 31, 2023, and where such an appeal wasn’t […]

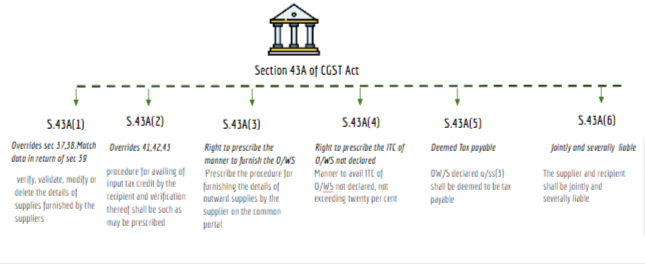

Section 43A of the CGST Act as amended by the Finance Act 2023

Note: Section 40 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended port […]

While the elected branch of government aims to be responsive to the will of the people, the Chief Justice of India emphasized the vital importance of judges adhering to Constitutional principles. He pointed […]

Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a Judge when acting judicially in the exercise of any power which is, or which […]

At present, the Income-Tax Department is grappling with approximately 3.5 million pending refund cases due to issues related to mismatched and unverified bank account details of taxpayers. CBDT Chairperson Nitin […]

After leading a cabinet meeting, Chief Minister Khattar disclosed that a multitude of meticulously planned initiatives, encompassing rehabilitation and town planning schemes, have been […]

In a recent development, a Delhi Court has ordered the detention of Prabir Purkayastha, the founder of NewsClick, and the company’s Human Resources (HR) head, Amit Chakraborty, for a period of ten days under the […]

The central issue in this case revolved around the applicability of service tax on the retention of freight amounts, specifically the profits retained by the taxpayer in freight trading. The tax department […]

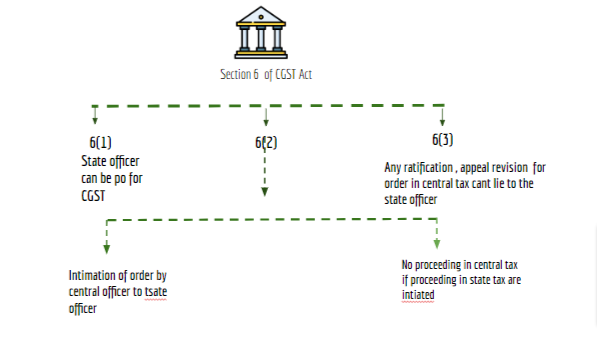

Section 6 of the CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

In a recent legal case that has garnered considerable attention, YouTuber Akshay, operating under the pseudonym “Dicapscoop” on YouTube and Instagram, found himself in a courtroom battle with a company […]

The Women’s Reservation Bill will not necessitate state approval if it secures passage in parliament with a special majority. According to Article 368 of the Indian Constitution, achieving a special majority […]

Prem

designer

Paid User

@prem

active 1 week agoPrem

gst taxation

2.0Registered Categories

Location

Adilabad, India

OOPS!

No Packages Added by Prem. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewPrem wrote a new post, No appeal against the order of Commissioner /AC – Uttaranchal HC 1 year, 11 months ago

Appeal against the order of commissioner/AC

In a recent judgment the Uttaranchal High court has restricted the appeals against the orders of commissioner and AC.The issue under the consideration of the […]

Prem wrote a new post, Understanding Alimony: What You Need To Know 1 year, 11 months ago

When people fall in love and get married, it’s often their hope that the union will last ’till death do them part.’ However, many things happen in between, and for one reason or the other, the union comes to a […]

Prem wrote a new post, The Unusual Reasoning Behind the Supreme Court’s Decision to Refuse Bail for Manish Sisodia 2 years ago

Section 45 of the Prevention of Money Laundering Act (PMLA) poses a significant challenge by mandating the Court to conduct a preliminary review of the evidence to establish a prima facie case against the accused. […]

Prem wrote a new post, Tender for the Implementation of Spraying and Fogging Utilizing Falsified Chartered Accountant Certification 2 years ago

The petitioner, a proprietary firm, has invoked the jurisdiction under Article 226 of the Constitution of India. The prayer is to issue a writ of certiorari or any other appropriate writ to annul and set aside the […]

Prem wrote a new post, Section 29 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years ago

Section 26 of Bhartiya Nyay Sanhita on TEXT :

The exceptions in sections 21, 22 and 23 do not extend to acts which are offences independently of any harm which they may cause, or be intended to cause, or be known […]

Prem wrote a new post, Section 20 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years ago

Section 20 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on TexT:

Nothing is an offence which is done by a child under seven years of age.

Prem wrote a new post, Rate amended retrospectively for tax on specified income of Trust u/s 115BBI 2 years ago

This amendment is effective from 1st day of April, 2023 and applies to assessment year 2023-24 relevant to the previous year 2022-23. It is hereby certified that no person is being adversely affected by giving […]

Prem wrote a new post, GST Amnesty scheme for time barred appeals 2 years ago

Who Qualifies for Amnesty Benefits?

a. Individuals subject to taxation who were unable to file an appeal against an adjudication order issued on or before March 31, 2023, and where such an appeal wasn’t […]

Prem wrote a new post, Section 43A. of CGST Act :Procedure for furnishing return and availing input tax credit(Updated Till October 2023 ) 2 years, 1 month ago

Section 43A of the CGST Act as amended by the Finance Act 2023

Note: Section 40 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended port […]

Prem wrote a new post, In contrast to elected officials in government, judges base their decisions on constitutional morality rather than popular opinion. 2 years, 1 month ago

While the elected branch of government aims to be responsive to the will of the people, the Chief Justice of India emphasized the vital importance of judges adhering to Constitutional principles. He pointed […]

Prem wrote a new post, Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 1 month ago

Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a Judge when acting judicially in the exercise of any power which is, or which […]

Prem wrote a new post, Order rejecting the GST refund for amount not paid by client on account of insolvency set aside. 2 years, 1 month ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

GLOBUS REAL INFRA PVT LTD VS ADDITIONAL COMMISSIONER, CGST APPEALS II

Facts of the cases:

On 18.11.2020, the petitioner filed a Refund […]

Prem wrote a new post, 35 lakh income tax refund cases pending due to bank account mismatch and validation 2 years, 1 month ago

At present, the Income-Tax Department is grappling with approximately 3.5 million pending refund cases due to issues related to mismatched and unverified bank account details of taxpayers. CBDT Chairperson Nitin […]

Prem wrote a new post, Haryana allowed easy conversion of residential property into commercial 2 years, 1 month ago

After leading a cabinet meeting, Chief Minister Khattar disclosed that a multitude of meticulously planned initiatives, encompassing rehabilitation and town planning schemes, have been […]

Prem wrote a new post, A Delhi court has ordered Prabir Purkayastha and Amit Chakraborty to be placed in judicial custody for a duration of 10 days. 2 years, 1 month ago

In a recent development, a Delhi Court has ordered the detention of Prabir Purkayastha, the founder of NewsClick, and the company’s Human Resources (HR) head, Amit Chakraborty, for a period of ten days under the […]

Prem wrote a new post, Service Tax on the Retention of Freight Amount 2 years, 1 month ago

The central issue in this case revolved around the applicability of service tax on the retention of freight amounts, specifically the profits retained by the taxpayer in freight trading. The tax department […]

Prem wrote a new post, Section 6: Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances(updated till on October 2023) 2 years, 2 months ago

Section 6 of the CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

Prem wrote a new post, YouTuber fined for Rs. 7 lac for giving false information 2 years, 2 months ago

In a recent legal case that has garnered considerable attention, YouTuber Akshay, operating under the pseudonym “Dicapscoop” on YouTube and Instagram, found himself in a courtroom battle with a company […]

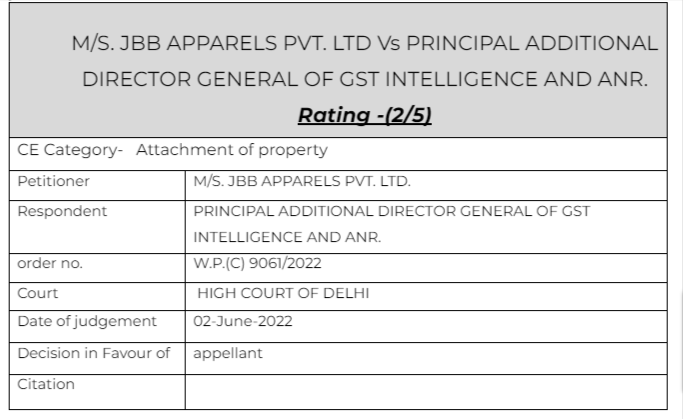

Prem wrote a new post, The order to freeze account was set aside by Court (Pdf Attach) 2 years, 2 months ago

Cases Covered:

M/S. JBB APPARELS PVT. LTD Vs PRINCIPAL ADDITIONAL DIRECTOR GENERAL OF GST INTELLIGENCE AND ANR.

Facts of the cases:

The appellant’s bank accounts were freezed. They went to get it […]

Prem wrote a new post, Analysis: The Absence of State Assembly Ratification for the Women’s Reservation Bill 2 years, 2 months ago

The Women’s Reservation Bill will not necessitate state approval if it secures passage in parliament with a special majority. According to Article 368 of the Indian Constitution, achieving a special majority […]