Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

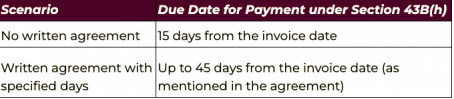

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

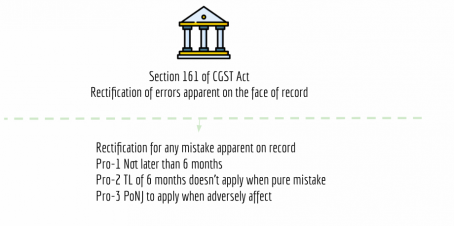

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

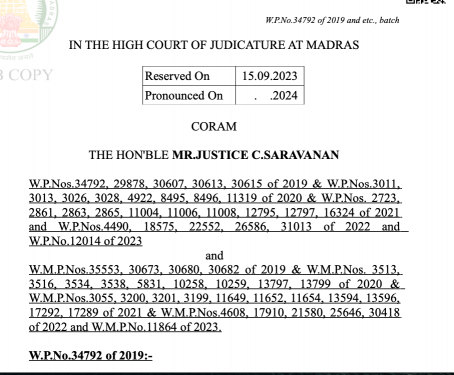

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]

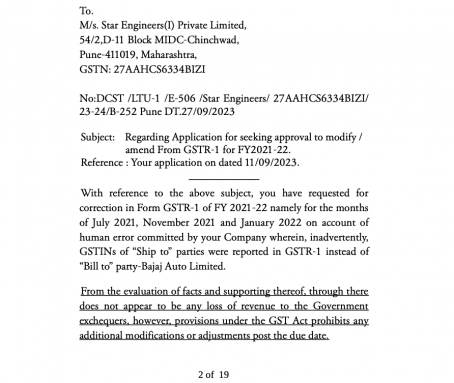

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Case Details-

Start Engineers Pvt Ltd

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

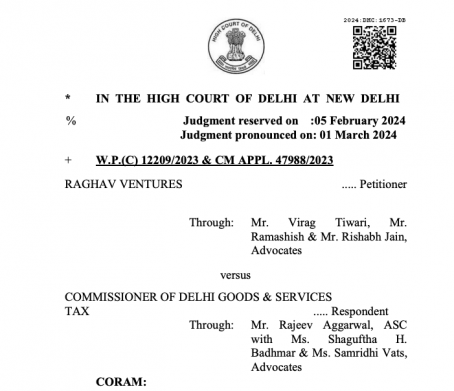

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

Comment

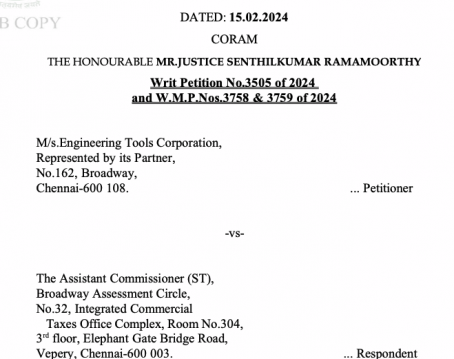

This case involves a writ petition filed by NRB Bearings Ltd. against various respondents, including the Commissioner of State Tax, Deputy Commissioner of SGST, State of Maharashtra, and Bajaj Auto Ltd., […]

Comment

The court is considering a civil writ jurisdiction case filed by Saurav Kumar against the Union of India and others regarding the cancellation of his registration under the Bihar Goods and Services Tax […]

Comment

The Court observed that the petitioner had fulfilled their obligations under the GST Act by generating digital documents and providing physical copies during inspection. The imposition of penalty was […]

Comment

The Court supported the petitioner’s argument, affirming that the Act establishes a distinct limitation period, thereby exempting the relevance of Section 5 of the Limitation Act.

Pleading

The […]

Comment

The assessing officer’s role is pivotal in determining the classification of goods and subsequent tax implications. It is imperative for the assessing officer to objectively consider all materials and […]

Comment

The court directs the lower court to promptly address the stay application and issue a reasoned order within two weeks. The judgment underscores the importance of timely resolution and procedural fairness […]

Comment

The court allows the present writ petition, setting aside the order dated 25.11.2022, and remits the matter to the Assistant Commissioner, State Tax, Sector-6, Aligarh, to issue a fresh notice with a […]

Comment

The Taxpayer wanted to file an appeal after the time mentioned in CGST Act. They argued that the limitation act is relevant here. The court denied their plea and said that the CGST Act is a complete […]

Comment

The court’s decision to allow compliance with the conditions stated in the notification, despite the petitioner’s situation, reflects a balanced approach to ensure fairness in tax appeal […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 6 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Kerala HC: Writs Not for Questioning Sufficiency of Evidence in Disciplinary Proceedings 1 year, 11 months ago

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

CA Shafaly Girdharwal wrote a new post, 16 FAQ’s on 43B(h) applicable from 1.04.2024 1 year, 11 months ago

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

In this […]

CA Shafaly Girdharwal wrote a new post, Court allowed refund when the tax was lateron paid by the Supplier 1 year, 11 months ago

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on rectification of orders in GST 1 year, 11 months ago

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

CA Shafaly Girdharwal wrote a new post, landmark judgment on jurisdiction of GST authorities – TVL Vardhan Infrastructure 1 year, 11 months ago

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]

CA Shafaly Girdharwal wrote a new post, Rectification of return allowed by Bombay high court 1 year, 11 months ago

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Case Details-

Start Engineers Pvt Ltd

Versus

Union of […]

CA Shafaly Girdharwal wrote a new post, 10 times when court allowed to rectify GST returns to claim ITC 1 year, 11 months ago

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

CA Shafaly Girdharwal wrote a new post, ITC shall not be rejected for cancellation of registration of supplier- HC 1 year, 11 months ago

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

CA Shafaly Girdharwal wrote a new post, Judgments on ITC reversal for retro cancellation of regitration of supplier 1 year, 11 months ago

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

When the […]

CA Shafaly Girdharwal wrote a new post, Judgments on Cryptic Notices which are invalid 1 year, 11 months ago

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

CA Shafaly Girdharwal wrote a new post, Interest is payable even if not asked by TP-HC 1 year, 11 months ago

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

CA Shafaly Girdharwal wrote a new post, NRB Bearings Ltd. v. Commissioner of State Tax: GST Return Rectification 1 year, 11 months ago

Comment

This case involves a writ petition filed by NRB Bearings Ltd. against various respondents, including the Commissioner of State Tax, Deputy Commissioner of SGST, State of Maharashtra, and Bajaj Auto Ltd., […]

CA Shafaly Girdharwal wrote a new post, Dispute Over GST Registration: Saurav Kumar v. Union of India 1 year, 11 months ago

Comment

The court is considering a civil writ jurisdiction case filed by Saurav Kumar against the Union of India and others regarding the cancellation of his registration under the Bihar Goods and Services Tax […]

CA Shafaly Girdharwal wrote a new post, Fair Enforcement: Quashing Unjust Penalties in GST Compliance 1 year, 11 months ago

Comment

The Court observed that the petitioner had fulfilled their obligations under the GST Act by generating digital documents and providing physical copies during inspection. The imposition of penalty was […]

CA Shafaly Girdharwal wrote a new post, Enhancing Time Constraints: M/S Garg Enterprises vs. CGST Appellate Authority 1 year, 11 months ago

Comment

The Court supported the petitioner’s argument, affirming that the Act establishes a distinct limitation period, thereby exempting the relevance of Section 5 of the Limitation Act.

Pleading

The […]

CA Shafaly Girdharwal wrote a new post, Challenging Unfair Tax Assessment: M/s.SL Lumax Limited’s Plea for Justice” 1 year, 11 months ago

Comment

The assessing officer’s role is pivotal in determining the classification of goods and subsequent tax implications. It is imperative for the assessing officer to objectively consider all materials and […]

CA Shafaly Girdharwal wrote a new post, Timely Justice: Urgency in Resolving Gurdeep Singh’s Appeal 1 year, 11 months ago

Comment

The court directs the lower court to promptly address the stay application and issue a reasoned order within two weeks. The judgment underscores the importance of timely resolution and procedural fairness […]

CA Shafaly Girdharwal wrote a new post, Fair Hearing: M/S Gaurav Enterprises vs. State of U.P. 1 year, 11 months ago

Comment

The court allows the present writ petition, setting aside the order dated 25.11.2022, and remits the matter to the Assistant Commissioner, State Tax, Sector-6, Aligarh, to issue a fresh notice with a […]

CA Shafaly Girdharwal wrote a new post, Taxpayer’s Appeal Denied: Department v. Taxpayer” 1 year, 11 months ago

Comment

The Taxpayer wanted to file an appeal after the time mentioned in CGST Act. They argued that the limitation act is relevant here. The court denied their plea and said that the CGST Act is a complete […]

CA Shafaly Girdharwal wrote a new post, “Equitable Tax Appeal: Nexus Motors Private Limited v. The State of Bihar” 1 year, 11 months ago

Comment

The court’s decision to allow compliance with the conditions stated in the notification, despite the petitioner’s situation, reflects a balanced approach to ensure fairness in tax appeal […]