Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

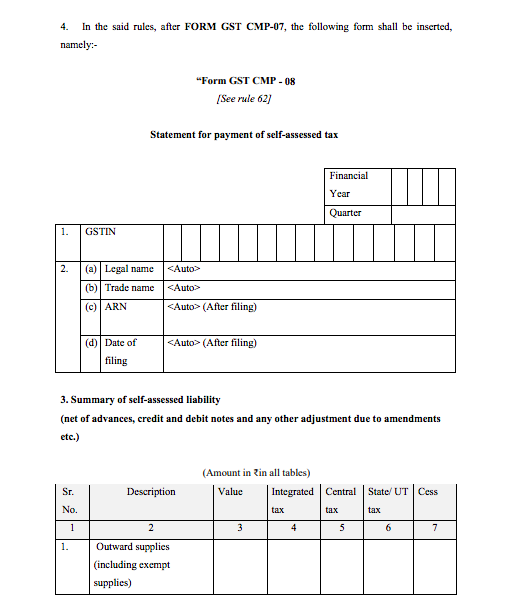

New returns for composition dealers:

Notification No. 20/2019 – Central Tax New Delhi, the 23rd April, 2019 introduced CGST (Third amendment rules). These rules have changed the returns to be filed by a c […]

Cant make E-way bill if GST returns are not filed

Quantum of non filing of returns to fall in this provision

Rescue from this default

consequences on non -filing of return

10 facts about composition annual return :

Here we have compiled 10 important facts about the composition annual return. Pls file it within time. Late filing of GST annual return for composition dealer is liable […]

Who can file nil composition annual return:

Only the following persons are allowed to file the nil composition annual return. It is important to note that all of the following conditions shall be fulfilled. Only […]

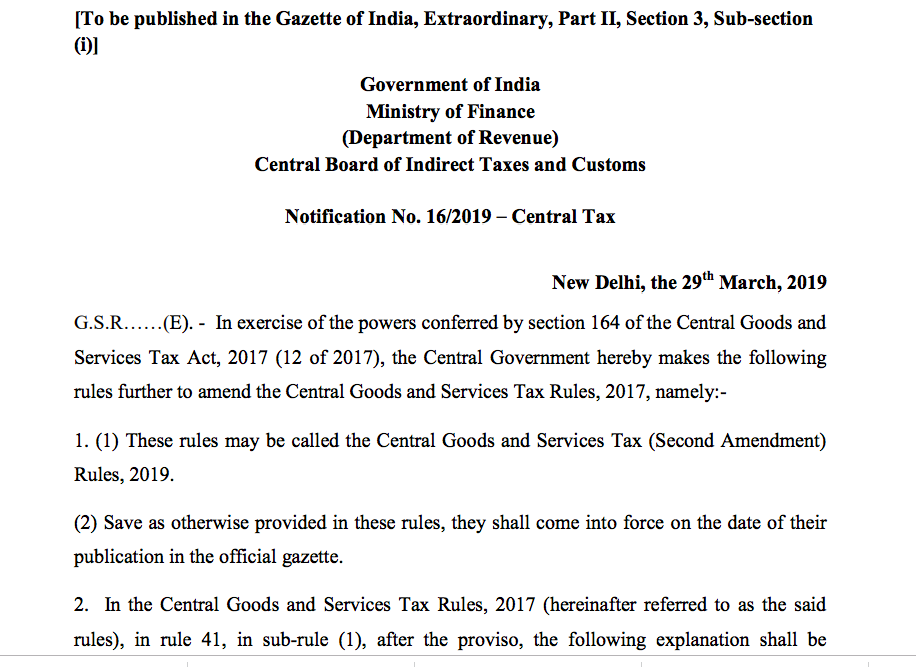

CGST (Second amendment rules) 2019:

CGST (Second amendment rules) 2019 bring into major changes for taxpayers. They are bring into force via Notification No. 16/2019 – Central Tax dated 29th March 2019. We ca […]

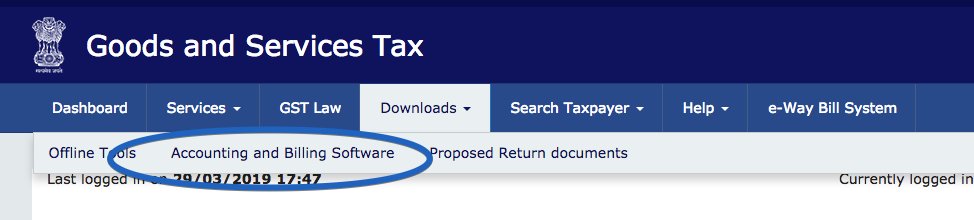

6 Free accounting softwares by GSTIN:

6 Free accounting softwares by GSTIN are recommended. Here we will give you a comparative table of all features of these softwares. You can access this list by following […]

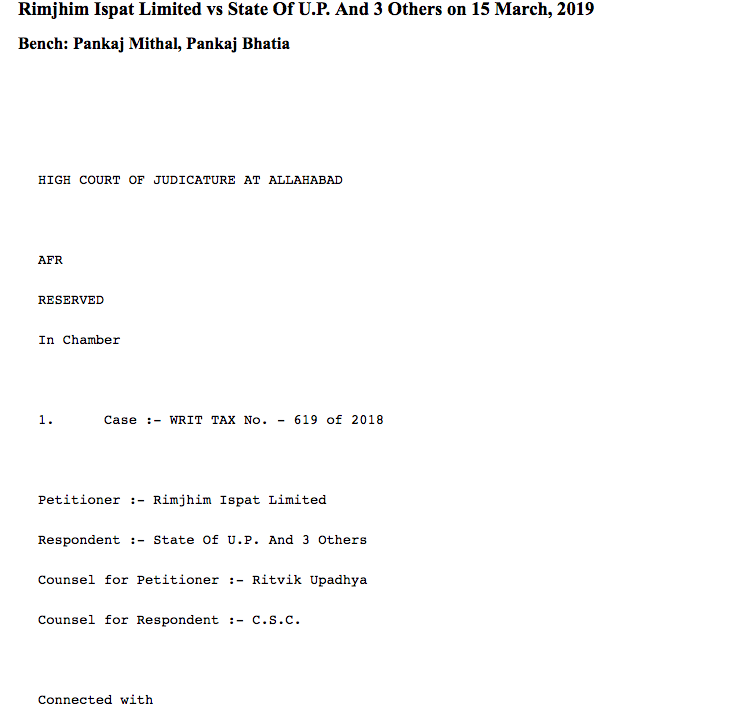

Reasons to believe is required for search & Seizure: HC:

Reasons to believe is very important for any search and seizure.It is important to have a reason to believe to record.

Case: Rimjhim Ispat Limited vs […]

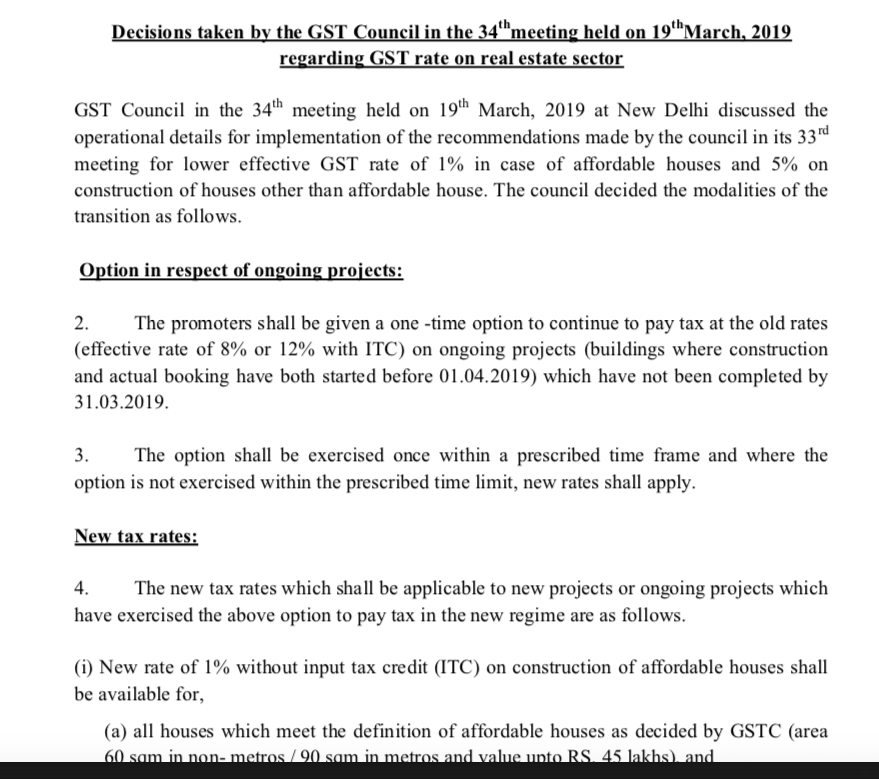

GST council 34th meeting updates for housing:

GST council in it’s 34th Meeting paved the way for new GST composition scheme for housing projects. Real estate was really worried for the taxation in GST. In last […]

Dilemma over ITC adjustment for Feb month is persisting. CGST amendment Act is applicable form 1st Feb 2019. Section 49A of the said section covers the manned […]

Taxation of restaurant services in GST

It is a long story of nature of foods supply with serving. In pre GST regime also it was a big confusion. It persisted for years. In GST schedule II was specifically […]

New Composition levy of GST:

New composition levy of GST is introduced by CBIC via notification No. 2/2019 CTR dated 7th March 2019. This Composition levy is for goods and service providers. Its important to […]

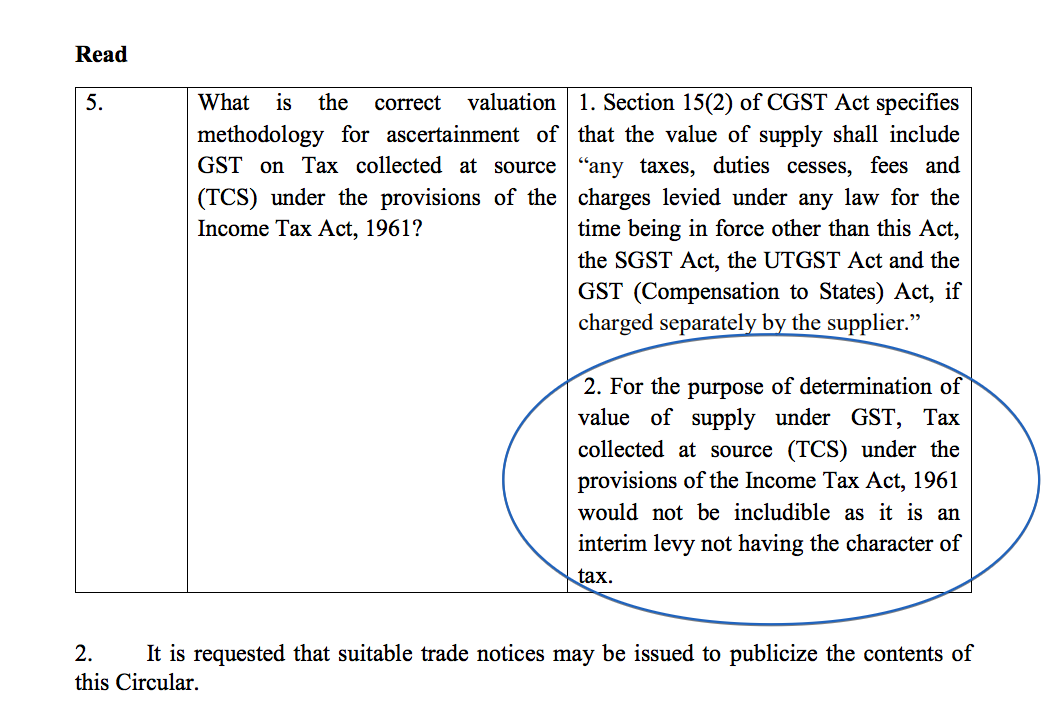

GST will not be levied on TCS: CBIC clarification:

GST will not be levied on TCS.Corrigendum to Circular No. 76/50/2018-GST dated 31st December, 2018 issued vide F.No. CBEC- 20/16/04/2018-GST- Reg. The […]

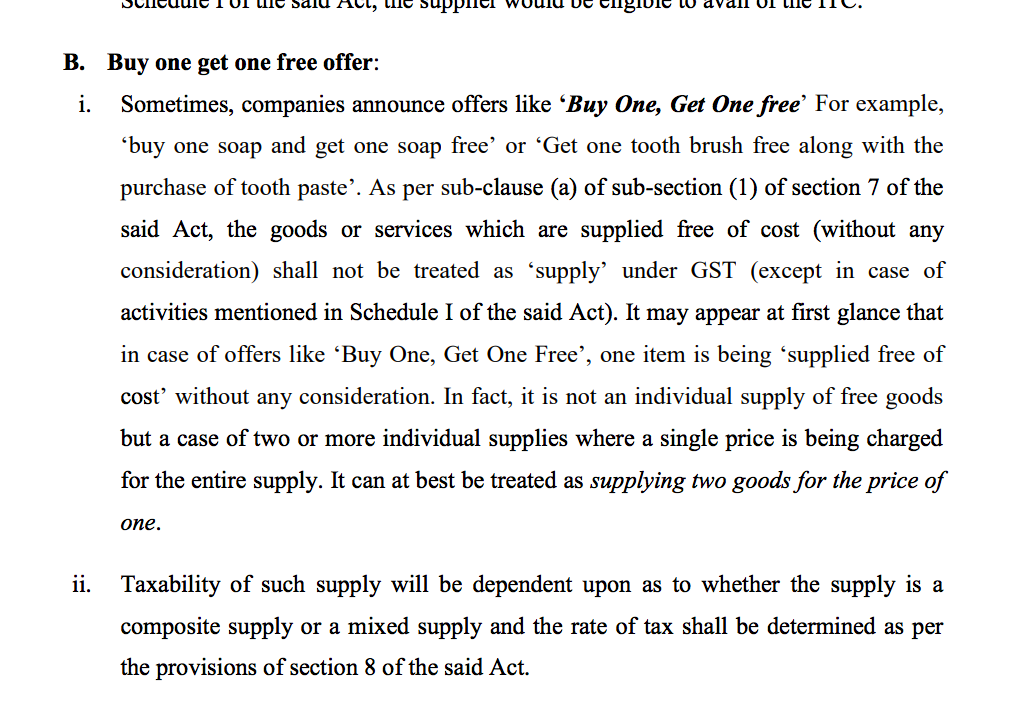

Circular on Discounts & promotion schemes in GST

CBIC via their Circular No. 92/11/2019-GST Dated 7 th March, 2019 clarified the issues related to Discounts & promotion schemes. Industry was in dilemma in […]

Analysis of new provisions of ITC for a motor vehicle:

Some modifications in this entry were in demand. Bad drafting of earlier provision was leading to following confusions.

Important changes by CGST Amendment Act 2018:

Dear all

We have compiled the section wise analysis of CGST Amendment Act 2018. This Act has introduced many important changes into CGST Amendment Act. Most of t […]

Compilation of important AAR’s: Volume I

Important AAR Volume I

Important AAR Volume I

We have compiled the important AAR’s in GST. This is first publication. The rulings covered in this edition […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, New returns for composition dealers 6 years, 9 months ago

New returns for composition dealers:

Notification No. 20/2019 – Central Tax New Delhi, the 23rd April, 2019 introduced CGST (Third amendment rules). These rules have changed the returns to be filed by a c […]

CA Shafaly Girdharwal wrote a new post, Cant make E-way bill if GST returns are not filed 6 years, 9 months ago

Cant make E-way bill if GST returns are not filed

Quantum of non filing of returns to fall in this provision

Rescue from this default

consequences on non -filing of return

Cant make E-way bill if GST re […]

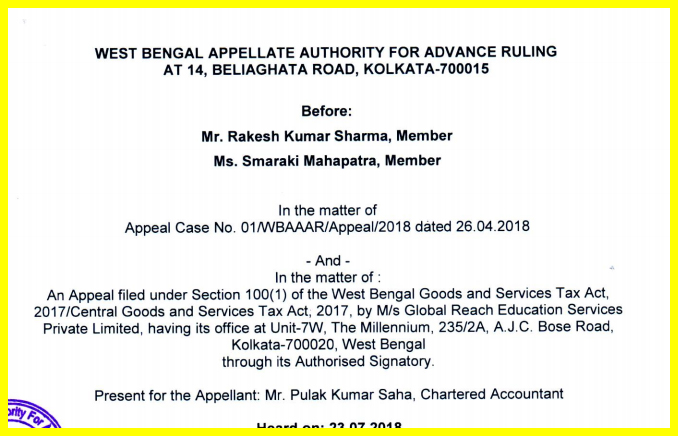

CA Shafaly Girdharwal wrote a new post, AAAR of global reach education #intermediary 1 6 years, 9 months ago

AAAR of global reach education

Facts of the case

Argument by the applicant

Observation of authority

AAAR of global reach education:

The appellant already tried the AAR of west Bengal. Where the […]

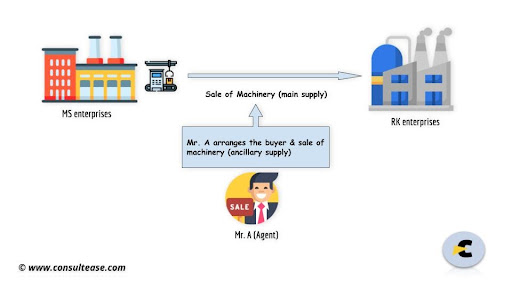

CA Shafaly Girdharwal wrote a new post, Intermediary service in GST with relevant cases 6 years, 9 months ago

Latest update

The Government has Clarified via Circular No. 159/15/2021-GST dated 20th September 2021 that

an intermediary service provider is a person who arranges or facilitates (Ancillary supply) the […]

CA Shafaly Girdharwal wrote a new post, composition annual return: 10 facts 6 years, 10 months ago

10 facts about composition annual return :

Here we have compiled 10 important facts about the composition annual return. Pls file it within time. Late filing of GST annual return for composition dealer is liable […]

CA Shafaly Girdharwal wrote a new post, Who can file nil composition annual return? 6 years, 10 months ago

Who can file nil composition annual return:

Only the following persons are allowed to file the nil composition annual return. It is important to note that all of the following conditions shall be fulfilled. Only […]

CA Shafaly Girdharwal wrote a new post, CGST (Second amendment rules) 2019 6 years, 10 months ago

CGST (Second amendment rules) 2019:

CGST (Second amendment rules) 2019 bring into major changes for taxpayers. They are bring into force via Notification No. 16/2019 – Central Tax dated 29th March 2019. We ca […]

CA Shafaly Girdharwal wrote a new post, 6 Free accounting softwares by GSTIN 6 years, 10 months ago

6 Free accounting softwares by GSTIN:

6 Free accounting softwares by GSTIN are recommended. Here we will give you a comparative table of all features of these softwares. You can access this list by following […]

CA Shafaly Girdharwal wrote a new post, Reasons to believe for GST search 6 years, 10 months ago

Reasons to believe is required for search & Seizure: HC:

Reasons to believe is very important for any search and seizure.It is important to have a reason to believe to record.

Case: Rimjhim Ispat Limited vs […]

CA Shafaly Girdharwal wrote a new post, GST council 34th meeting updates for housing 6 years, 10 months ago

GST council 34th meeting updates for housing:

GST council in it’s 34th Meeting paved the way for new GST composition scheme for housing projects. Real estate was really worried for the taxation in GST. In last […]

CA Shafaly Girdharwal wrote a new post, Dilemma over ITC adjustment for Feb Month 6 years, 10 months ago

Dilemma over ITC adjustment for Feb Month :

Dilemma over ITC adjustment for Feb month is persisting. CGST amendment Act is applicable form 1st Feb 2019. Section 49A of the said section covers the manned […]

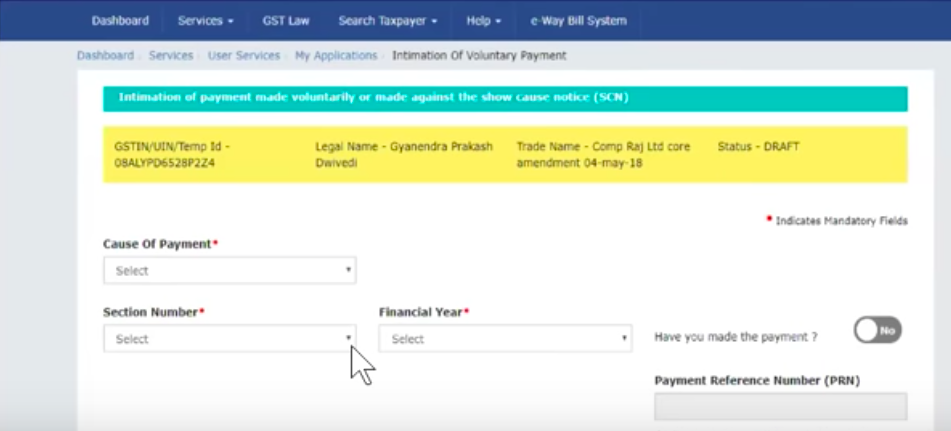

CA Shafaly Girdharwal wrote a new post, New returns of GST mandatory from 1st July 6 years, 10 months ago

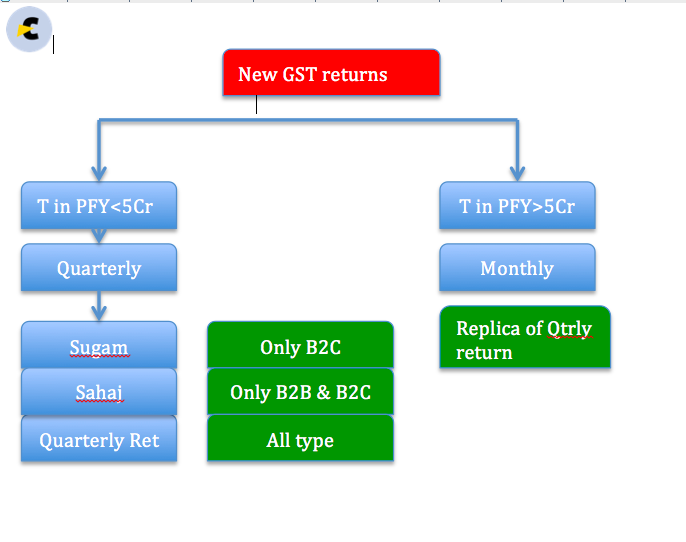

New returns of GST mandatory from 1st July:

Basic scheme of new returns of GST:

Have you seen the new returns of GST. They are named as Sahaj and Sugam. Honestly when I try to understand them. I found it […]

CA Shafaly Girdharwal wrote a new post, Taxation of restaurant services in GST 6 years, 10 months ago

Taxation of restaurant services in GST

It is a long story of nature of foods supply with serving. In pre GST regime also it was a big confusion. It persisted for years. In GST schedule II was specifically […]

CA Shafaly Girdharwal wrote a new post, New Composition levy of GST 6 years, 11 months ago

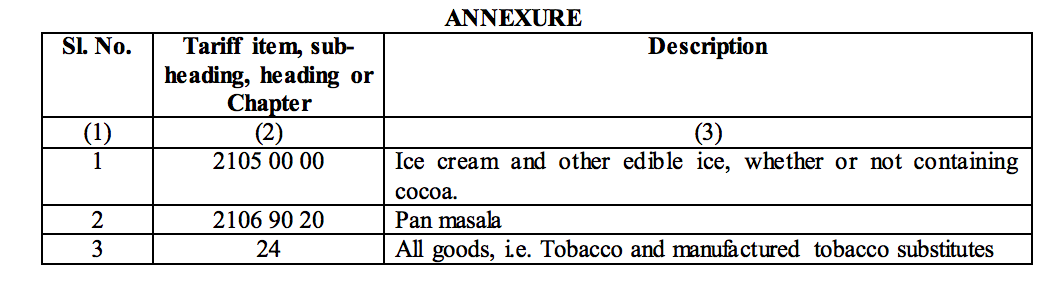

New Composition levy of GST:

New composition levy of GST is introduced by CBIC via notification No. 2/2019 CTR dated 7th March 2019. This Composition levy is for goods and service providers. Its important to […]

CA Shafaly Girdharwal wrote a new post, GST will not be levied on TCS: CBIC clarification 6 years, 11 months ago

GST will not be levied on TCS: CBIC clarification:

GST will not be levied on TCS.Corrigendum to Circular No. 76/50/2018-GST dated 31st December, 2018 issued vide F.No. CBEC- 20/16/04/2018-GST- Reg. The […]

CA Shafaly Girdharwal wrote a new post, Circular on Discounts & promotion schemes in GST 6 years, 11 months ago

Circular on Discounts & promotion schemes in GST

CBIC via their Circular No. 92/11/2019-GST Dated 7 th March, 2019 clarified the issues related to Discounts & promotion schemes. Industry was in dilemma in […]

CA Shafaly Girdharwal wrote a new post, GST on slump sale in the light of amendment in Supply 6 years, 11 months ago

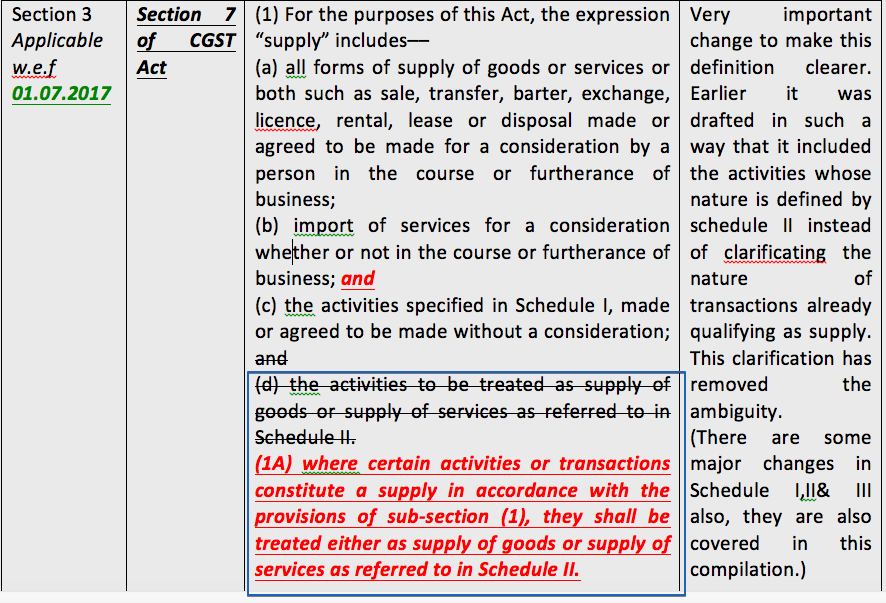

GST on slump sale in the light of amendment in definition of Supply

Coverage of transfer of business in the definition of supply:

It is interesting to see that definition of supply is changed […]

CA Shafaly Girdharwal wrote a new post, Analysis of new provisions of ITC for a motor vehicle 6 years, 12 months ago

Analysis of new provisions of ITC for a motor vehicle:

Some modifications in this entry were in demand. Bad drafting of earlier provision was leading to following confusions.

Whether the input tax credit of […]

CA Shafaly Girdharwal wrote a new post, Important changes by CGST Amendment Act 2018 7 years ago

Important changes by CGST Amendment Act 2018:

Dear all

We have compiled the section wise analysis of CGST Amendment Act 2018. This Act has introduced many important changes into CGST Amendment Act. Most of t […]

CA Shafaly Girdharwal wrote a new post, Compilation of important AAR’s: Volume I 7 years ago

Compilation of important AAR’s: Volume I

Important AAR Volume I

Important AAR Volume I

We have compiled the important AAR’s in GST. This is first publication. The rulings covered in this edition […]