Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

CGST rules amended upto 15th Sept 2017

As issued by CBEC here is a compilation of CGST rules amended upto 15th Sept 2017. These will be useful for all professionals need to refer these rules time to […]

Basic provisions related to export of services in GST

In Model GST draft it was promised the GST refund on export of services within 7 days. There is a provision in CGST Act also to refund the 90% of GST […]

Refunds to exporters

Implementation of GST was announced with big bang, tall claims & commitments. One of the promises made at all levels was the smooth and lightening process of refunds for exporters. While the […]

Agriculture produce in GST

“agricultural produce” means any produce out of cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fibre, fuel, raw material or oth […]

Decision in GST council meeting on 9/09/2017

The GST Council, in its 21st meeting held at Hyderabad on 9th September 2017, has recommended the following measures to facilitate taxpayers:

Rajashthan court notice on GST issues

Hon’ble Rajasthan High Court today issued show cause notices to CG& SG on the Writ Petition. This petition was filed by Rajasthan Tax Consultants Association. It was in […]

GST case filed for removal of Bond/LUT

GST case filed for removal of Bond/LUT on export of services. A delhi based web development and IT company has filed a writ petition in Delhi High court. The matter is the […]

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central […]

Final E-way Bill rules notified by CBEC

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central […]

Temporary import of machinery and equipment:

This notification no. 72/2017 customs provide exemption to temporary import of goods from Customs duty leviable under First Schedule to the Customs Tariff Act, 1975 […]

Now 12% GST on GTA: Notification 22/2017

GSR……(E).- In exercise of the powers conferred by sub-section (3) of section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government […]

circular-33/2017 to decide the taxation of high sea sales in GST. The text of circular is following:

Subject: Leviability of Integrated Goods and Services Tax (IGST) on High Sea […]

Clarification on High sea sales in GST

Clarification on High sea sales in GST by CBEC vide Circular No. 33 /2017-Cus. It was a contentious issue from very beginning of GST regime. Now CBEC has clarified this […]

Date for filing of GSTR 3b and other GST returns for first two months:

Following is the date sheet for all GST returns for first two months including GSTR 3b.

GSTR 3b is required to be filed by 20th August […]

HSN code is mandatory in GST 1

New changes are there is GST every single day. Soon the CBIC is going to make it mandatory to mention the HSN code digits in GSTR1. There was an exemption for small taxpayers till […]

GST rates of 12% and 18% may get merged soon. FM Mr. Arun jaitely told that during a discussion on JK GST bill. It is expected that the tax rate slab of GST of and 18 % will be merged soon.

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, All CGST rules amended upto 15th Sept 2017 8 years, 4 months ago

CGST rules amended upto 15th Sept 2017

As issued by CBEC here is a compilation of CGST rules amended upto 15th Sept 2017. These will be useful for all professionals need to refer these rules time to […]

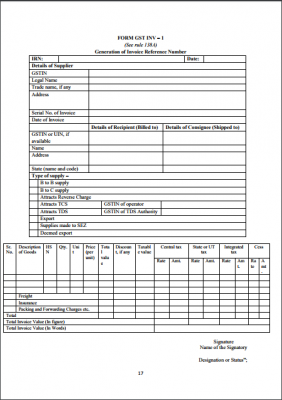

CA Shafaly Girdharwal wrote a new post, Latest invoice format issued by GSTIN 8 years, 4 months ago

Latest invoice format issued by GSTIN:

In their notification no. 27/2017 CBEC has issued new format of invoice in GST.

CA Shafaly Girdharwal wrote a new post, GST for exporters: no GST refund for Exporters of services 8 years, 4 months ago

Basic provisions related to export of services in GST

In Model GST draft it was promised the GST refund on export of services within 7 days. There is a provision in CGST Act also to refund the 90% of GST […]

CA Shafaly Girdharwal wrote a new post, Refunds to Exporters under GST- A Maze 8 years, 5 months ago

Refunds to exporters

Implementation of GST was announced with big bang, tall claims & commitments. One of the promises made at all levels was the smooth and lightening process of refunds for exporters. While the […]

CA Shafaly Girdharwal wrote a new post, Meaning of Agriculture produce in GST 8 years, 5 months ago

Agriculture produce in GST

“agricultural produce” means any produce out of cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fibre, fuel, raw material or oth […]

CA Shafaly Girdharwal wrote a new post, Decision in GST council meeting on 9/09/2017 8 years, 5 months ago

Decision in GST council meeting on 9/09/2017

The GST Council, in its 21st meeting held at Hyderabad on 9th September 2017, has recommended the following measures to facilitate taxpayers:

Date for filing o […]

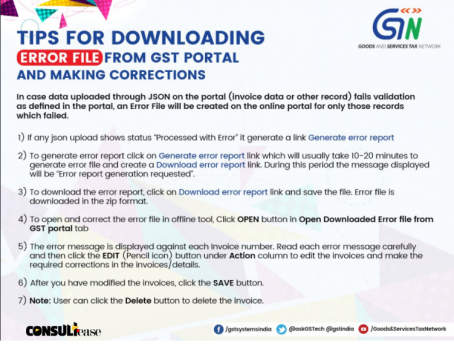

CA Shafaly Girdharwal wrote a new post, Tips for downloading ERROR FILE from GST PORTAL 8 years, 5 months ago

Tips for downloading ERROR FILE from GST PORTAL and making corrections

In case data uploaded through JSON on the portal (invoice data or other record) fails validation as defined in the portal, an Erro […]

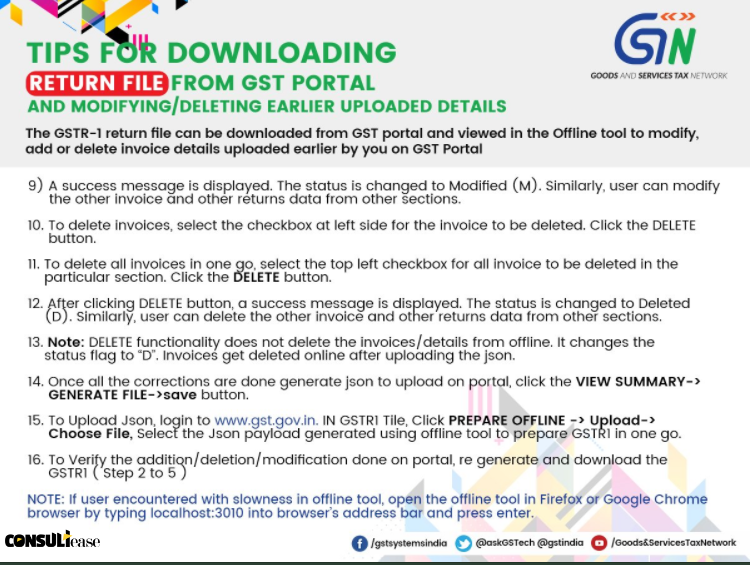

CA Shafaly Girdharwal wrote a new post, Tips for downloading return file from GST portal 8 years, 5 months ago

Tips for downloading return file from GSTN portal and modifying /deleting earlier uploaded detail

1) User can download the saved invoices/details from online portal

2) To generate file for download GSTRI […]

CA Shafaly Girdharwal wrote a new post, Tips for creating GSTR 1 using offline tool 8 years, 5 months ago

Tips for creating GSTR 1 using offline tool

Create and upload the Outward Supplies details in the GSTR 1 using the Returns Offline tool.

1. Before using the GSTR1 excel template for filling outward supply […]

CA Shafaly Girdharwal wrote a new post, Rajashthan court notice on GST issues 8 years, 5 months ago

Rajashthan court notice on GST issues

Hon’ble Rajasthan High Court today issued show cause notices to CG& SG on the Writ Petition. This petition was filed by Rajasthan Tax Consultants Association. It was in […]

CA Shafaly Girdharwal wrote a new post, GST case filed for removal of Bond/LUT 8 years, 5 months ago

GST case filed for removal of Bond/LUT

GST case filed for removal of Bond/LUT on export of services. A delhi based web development and IT company has filed a writ petition in Delhi High court. The matter is the […]

CA Shafaly Girdharwal wrote a new post, No late fee on late filing of GSTR 3B 8 years, 5 months ago

No late fee on late filing of GSTR 3B

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central […]

CA Shafaly Girdharwal wrote a new post, Final E-way Bill rules notified by CBEC 8 years, 5 months ago

Final E-way Bill rules notified by CBEC

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central […]

CA Shafaly Girdharwal wrote a new post, Temporary import of machinery and equipment 8 years, 5 months ago

Temporary import of machinery and equipment:

This notification no. 72/2017 customs provide exemption to temporary import of goods from Customs duty leviable under First Schedule to the Customs Tariff Act, 1975 […]

CA Shafaly Girdharwal wrote a new post, Now 12% GST on GTA: Notification 22/2017 8 years, 5 months ago

Now 12% GST on GTA: Notification 22/2017

GSR……(E).- In exercise of the powers conferred by sub-section (3) of section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government […]

CA Shafaly Girdharwal wrote a new post, Circular-33/2017 customs: High sea sales 8 years, 6 months ago

circular-33/20177 customs

circular-33/2017 to decide the taxation of high sea sales in GST. The text of circular is following:

Subject: Leviability of Integrated Goods and Services Tax (IGST) on High Sea […]

CA Shafaly Girdharwal wrote a new post, Clarification on High sea sales in GST 8 years, 6 months ago

Clarification on High sea sales in GST

Clarification on High sea sales in GST by CBEC vide Circular No. 33 /2017-Cus. It was a contentious issue from very beginning of GST regime. Now CBEC has clarified this […]

CA Shafaly Girdharwal wrote a new post, How to file GSTR 3b: First return of GST 8 years, 6 months ago

Date for filing of GSTR 3b and other GST returns for first two months:

Following is the date sheet for all GST returns for first two months including GSTR 3b.

GSTR 3b is required to be filed by 20th August […]

CA Shafaly Girdharwal wrote a new post, GST HSN Code List for Kirana Store, Grocery, General Store 8 years, 6 months ago

HSN code is mandatory in GST 1

New changes are there is GST every single day. Soon the CBIC is going to make it mandatory to mention the HSN code digits in GSTR1. There was an exemption for small taxpayers till […]

CA Shafaly Girdharwal wrote a new post, GST rates of 12% and 18% may get merged 8 years, 6 months ago

GST rates of 12% and 18% may get merged soon. FM Mr. Arun jaitely told that during a discussion on JK GST bill. It is expected that the tax rate slab of GST of and 18 % will be merged soon.