Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Instruction No. 1914 dated 21.3.1996 contains guidelines issued by the Board regarding procedure to be followed for recovery of outstanding demand, including procedure for grant of stay of demand.

Vide O.M. […]

When filing of income tax return is mandatory

Every individual or HUF whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to […]

After GST MRP of Urea has decreased by 71 paise per bag

After GST MRP of Urea is down. As per the release by PIB.

(Text from PIB)

All India weighted average MRP of Urea has decreased by 71 paise per bag […]

sec 16 IGST to apply on compensation also

sec 16 IGST to apply on compensation also. Circular no. 1/1/2017 provide that provisions related to Zero rated supply will be applicable on compensation cess also.

Text […]

Only applicable HSN in TRAN 1 and TRAN 2

Only applicable HSN in TRAN 1 and TRAN 2 vide notification number Notification No. 17/2017 – Central Tax. earlier it was an issue. But now you need to mention only the […]

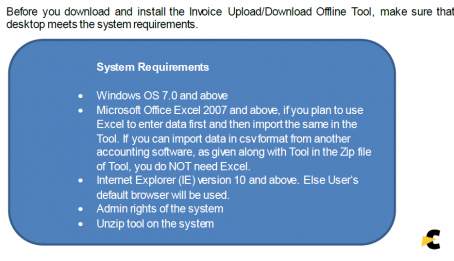

How to use GST invoice upload utility

How to use GST invoice upload utility. First of all let us check the system requirement for this utility.

[embedyt] […]

GST offline Invoice upload utility:

GST offline Invoice upload utility issued by GSTIN. Important FAQ related to this utility.

1. How can I download and install the Invoice Upload/Download Offline Tool in my […]

Free samples and promotional items in GST

Free samples and promotional items in GST, what will be there treatment in GST? It is a big question at this point of time what will happen to the free samples in GST. […]

List of Documents for GST registration

List of Documents for GST registration for company:

Proof of Constitution

Depending on the nature of entity proof is required. For a company you will need following […]

Date for composition option extended:

It was a concern of composition dealers for extention of last date for choosing the option of composition levy. GSTIN has responded with an order extending the date for […]

Increase in GST Compensation Cess rate on cigarettes

Increase in GST Compensation Cess rate on cigarettes

In pursuance of the recommendations of the GST Council in its 14th Meeting held on 18.05.2017 and 19 […]

GST on builders: Notification No. 11/2017 rate

GST rates on builders as notified by CBEC. Value of land will be excluded and will be assumed as 33%.

Inclusion of value of land for GST on builders:

In case of […]

Penalties in GST

Let us start from a brief on penalties in GST first. Then we will drill down to all offences which will fetch that penalty.

Note: You can download this article in PDF.See link in the end of […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Disposal of first appeal on payment of 15% 8 years, 6 months ago

Instruction No. 1914 dated 21.3.1996 contains guidelines issued by the Board regarding procedure to be followed for recovery of outstanding demand, including procedure for grant of stay of demand.

Vide O.M. […]

CA Shafaly Girdharwal wrote a new post, When filing of income tax return is mandatory 8 years, 6 months ago

When filing of income tax return is mandatory

Every individual or HUF whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to […]

CA Shafaly Girdharwal wrote a new post, After GST MRP of Urea has decreased by 71 paise per bag 8 years, 6 months ago

After GST MRP of Urea has decreased by 71 paise per bag

After GST MRP of Urea is down. As per the release by PIB.

(Text from PIB)

All India weighted average MRP of Urea has decreased by 71 paise per bag […]

CA Shafaly Girdharwal wrote a new post, sec 16 IGST to apply on compensation also 8 years, 6 months ago

sec 16 IGST to apply on compensation also

sec 16 IGST to apply on compensation also. Circular no. 1/1/2017 provide that provisions related to Zero rated supply will be applicable on compensation cess also.

Text […]

CA Shafaly Girdharwal wrote a new post, date for filing ITR for AY 2017-18 extended 8 years, 6 months ago

CA Shafaly Girdharwal wrote a new post, Only applicable HSN in TRAN 1 and TRAN 2 8 years, 6 months ago

Only applicable HSN in TRAN 1 and TRAN 2

Only applicable HSN in TRAN 1 and TRAN 2 vide notification number Notification No. 17/2017 – Central Tax. earlier it was an issue. But now you need to mention only the […]

CA Shafaly Girdharwal wrote a new post, Detail Guide on GTA in GST 8 years, 6 months ago

GTA in GST:

In this article we will cover following provisions related to GTA in GST

Provision

Notification/Section

Exemptions on transportation

Notification No. 12/2017- Central Tax (R […]

CA Shafaly Girdharwal wrote a new post, Free GST E-book in Hindi by CA Sudhir Halakhandi 8 years, 6 months ago

Here we are sharing the Free GST E-book in Hindi by CA Sudhir Halakhandi

प्रिय मित्रों,

नमस्कार !

इस पुस्तक के पिछले तीन संस्करण जिस उत्साह के साथ आपने स्वीकार किये उसके लिए आप सभी का हार्दिक आभा […]

CA Shafaly Girdharwal wrote a new post, How to use GST invoice upload utility 8 years, 6 months ago

How to use GST invoice upload utility

How to use GST invoice upload utility. First of all let us check the system requirement for this utility.

[embedyt] […]

CA Shafaly Girdharwal wrote a new post, GST offline Invoice upload utility: FAQ 8 years, 6 months ago

GST offline Invoice upload utility:

GST offline Invoice upload utility issued by GSTIN. Important FAQ related to this utility.

1. How can I download and install the Invoice Upload/Download Offline Tool in my […]

CA Shafaly Girdharwal wrote a new post, How to Export with Bond/LUT in GST 8 years, 6 months ago

How to Export with Bond/LUT in GST

In this article we will discuss:

Procedure for export under Bond/LUT in GST

Required Forms and formats

Relevant provisions for exports.

In this article we will […]

CA Shafaly Girdharwal wrote a new post, Free samples and promotional items in GST 8 years, 6 months ago

Free samples and promotional items in GST

Free samples and promotional items in GST, what will be there treatment in GST? It is a big question at this point of time what will happen to the free samples in GST. […]

CA Shafaly Girdharwal wrote a new post, List of Documents for GST registration of a company 8 years, 6 months ago

List of Documents for GST registration

List of Documents for GST registration for company:

Proof of Constitution

Depending on the nature of entity proof is required. For a company you will need following […]

CA Shafaly Girdharwal wrote a new post, Date for composition option extended by GSTIN 8 years, 6 months ago

Date for composition option extended:

It was a concern of composition dealers for extention of last date for choosing the option of composition levy. GSTIN has responded with an order extending the date for […]

CA Shafaly Girdharwal wrote a new post, Increase in GST Compensation Cess rate on cigarettes 8 years, 6 months ago

Increase in GST Compensation Cess rate on cigarettes

Increase in GST Compensation Cess rate on cigarettes

In pursuance of the recommendations of the GST Council in its 14th Meeting held on 18.05.2017 and 19 […]

CA Shafaly Girdharwal wrote a new post, GST on builders 18% excluding notional land value 8 years, 7 months ago

GST on builders: Notification No. 11/2017 rate

GST rates on builders as notified by CBEC. Value of land will be excluded and will be assumed as 33%.

Inclusion of value of land for GST on builders:

In case of […]

CA Shafaly Girdharwal wrote a new post, GST when refund of ITC not allowed Notification No.5/2017 8 years, 7 months ago

GST when refund of ITC not allowed Notification No.5/2017

GST credit of ITC not allowed Notification No.5/2017

G.S.R. (E).- In exercise of the powers conferred by clause (ii) of the proviso to sub-section ( […]

CA Shafaly Girdharwal wrote a new post, Composition scheme in GST 8 years, 11 months ago

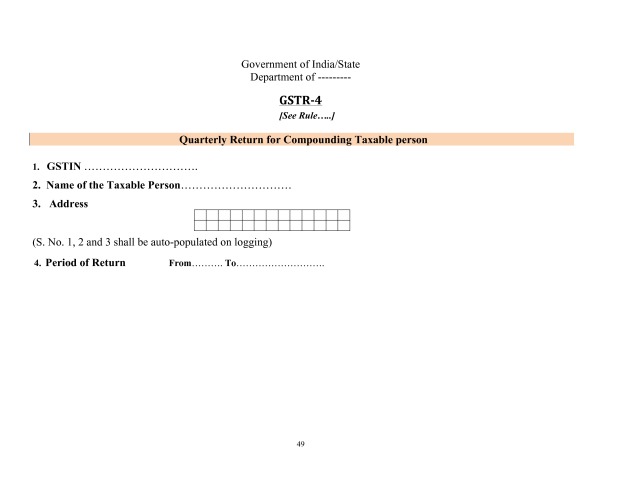

Composition scheme in GST

Basic conditions to be fulfilled to get Composition scheme in GST:

Following are the basic condition which are required to be fulfilled to be eligible for Composition scheme in […]

CA Shafaly Girdharwal‘s profile was updated 8 years, 11 months ago

CA Shafaly Girdharwal wrote a new post, Offence and penalties in GST Model law 8 years, 11 months ago

Penalties in GST

Let us start from a brief on penalties in GST first. Then we will drill down to all offences which will fetch that penalty.

Note: You can download this article in PDF.See link in the end of […]