Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

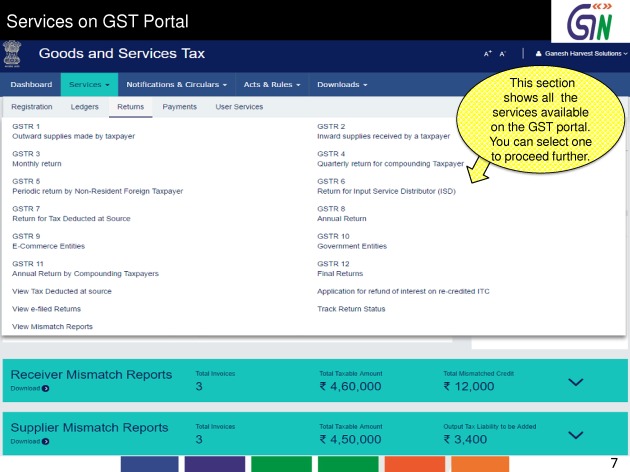

Basic flow for filing of returns in GST:

Although there are various returns in GST. Formats for the returns in GST are already on public domain.Broadly the entire exercise of filing of returns in GST can be […]

How Distinct person in GST will change the way we look at a business entity:

In all the central indirect taxes we pay a business entity is seen as consolidated. Untill the introduction of GST the taxable events […]

Why we need to analyse transaction value

Transaction value is accepted as basic valuation to tax supply in GST. Taxation under any tax law pass through a small journey. There are some important components to it. […]

Works contracts background:

Works contracts were always been a debatable issue.It is expected that works contracts in GST will be simplified. Since its inception it has suffered a lot of litigation. More of the […]

No requirement of documents for refund upto Rs. 5 lac

There will be no requirement to submit documents for refund application in GST if amount of refund is upto Rs. 5lac. Taxpayer will be required to submit a […]

What is revised tax invoice in revised GST model law:

Revised tax invoice is issued when there is some revision in the contents of invoice already issued.

When a taxpayer can issue a revised tax invoice in […]

What is supplementary tax invoice in revised Model GST Law:

A supplementary invoice is issued when the particulars given in original invoice are changed. In excise a supplementary tax invoice is generally issued […]

Why a tax invoice by input tax distributor is required

Section 21 of GST model Law covers the provisions for manner of distribution of credit by an ISD. The instrument for such distribution is tax invoice by […]

Why to generate the electronic Invoice reference number in revised GST

As we know in case of supply of goods we need to issue three copies of invoice. These copies are used in following manner.

(a) the or […]

Why You need to issue GST Tax invoice for Exports:

In revised GST model law you can avail tax benefit for export of supplies in two ways.

(a) First method is export without payment of IGST and claim ref […]

When to issue a GST Tax invoice

Section 28 of Chapter VII in revised GST draft provide for the timing for issuance of a GST TAX invoice.

Time limit for issuance of GST tax invoice in case of Goods:

In case of […]

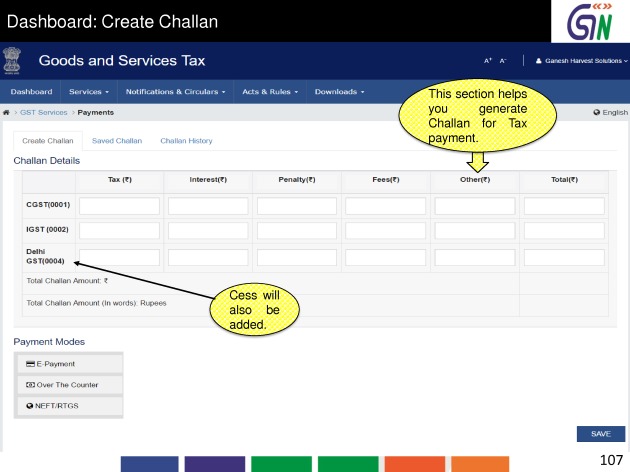

Tax payments on GSTIN:

The tax payments on GSTIN will be much simple and easy. In its first outlook of GSTIN the tax payments are also covered.

Create Challan for tax payment at GSTIN:

First thing we need to […]

This is the first look of GSTIN for return filing and payments on GSTIN. This will help users to understand how the system of GSTIN will work. It contains the detail […]

First look of GSTIN Dashboard:

GSTIN has released the first outlook of dashboard of GSTIN for suggestions. Here we will share that outlook with you. Although GSTIN has release a 115 slides pdf for GSTIN […]

HSN codes for work of art

This section contains the HSN codes for the works of art. This section contains two chapter. If your product is not in this section click on text to get section wise list.

Chapter 97: […]

HSN Codes for VEHICLES and AIRCRAFT; VESSELS & ASSOCIATED TRANSPORT EQUIPMENT

This section contains the HSN codes for VEHICLES and AIRCRAFT; VESSELS & ASSOCIATED TRANSPORT EQUIPMENT. These HSN codes will be r […]

HSN Codes for Machinery:

This section provide for the HSN codes of Machinery. It contains the following two chapters.If your item is not covered in this section you can find it on this article.

GST HSN Codes for base metal

This section contains the HSN codes for base metal and similar items.This chapter contains 12 chapters.Following is the table for same.

GST HSN Codes for pearls and stones:

This section contains the HSN codes for pearls and stones and similar items.NATURAL OR CULTURED PEARLS, PRECIOUS OR SEMI-PRECIOUS STONES, PRECIOUS METALS CLAD WITH PRECIOUS […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Simplified guide on filing of returns in GST 9 years ago

Basic flow for filing of returns in GST:

Although there are various returns in GST. Formats for the returns in GST are already on public domain.Broadly the entire exercise of filing of returns in GST can be […]

CA Shafaly Girdharwal wrote a new post, Importance of distinct person in GST 9 years ago

How Distinct person in GST will change the way we look at a business entity:

In all the central indirect taxes we pay a business entity is seen as consolidated. Untill the introduction of GST the taxable events […]

CA Shafaly Girdharwal wrote a new post, Transaction value in GST 9 years ago

Why we need to analyse transaction value

Transaction value is accepted as basic valuation to tax supply in GST. Taxation under any tax law pass through a small journey. There are some important components to it. […]

CA Shafaly Girdharwal wrote a new post, Guide on Works contracts in GST 9 years ago

Works contracts background:

Works contracts were always been a debatable issue.It is expected that works contracts in GST will be simplified. Since its inception it has suffered a lot of litigation. More of the […]

CA Shafaly Girdharwal wrote a new post, Documents for refund application in GST 9 years, 1 month ago

No requirement of documents for refund upto Rs. 5 lac

There will be no requirement to submit documents for refund application in GST if amount of refund is upto Rs. 5lac. Taxpayer will be required to submit a […]

CA Shafaly Girdharwal wrote a new post, 9.75% interest at Srei equipment finance NCD 2017 9 years, 1 month ago

Details on SREI Equipment Finance NCD 2017

ssuer

SREI Equipment Finance Limited

Issue Size

Public Issue of Secured, Redeemable Non-Convertible Debentures of the Company of NCDs aggregating up to Rs. […]

CA Shafaly Girdharwal wrote a new post, Revised tax invoice in GST 9 years, 1 month ago

What is revised tax invoice in revised GST model law:

Revised tax invoice is issued when there is some revision in the contents of invoice already issued.

When a taxpayer can issue a revised tax invoice in […]

CA Shafaly Girdharwal wrote a new post, Supplementary tax invoice or debit note in GST 9 years, 1 month ago

What is supplementary tax invoice in revised Model GST Law:

A supplementary invoice is issued when the particulars given in original invoice are changed. In excise a supplementary tax invoice is generally issued […]

CA Shafaly Girdharwal wrote a new post, Tax invoice by input services distributor in GST 9 years, 1 month ago

Why a tax invoice by input tax distributor is required

Section 21 of GST model Law covers the provisions for manner of distribution of credit by an ISD. The instrument for such distribution is tax invoice by […]

CA Shafaly Girdharwal wrote a new post, How to generate GST Invoice Reference Number 9 years, 1 month ago

Why to generate the electronic Invoice reference number in revised GST

As we know in case of supply of goods we need to issue three copies of invoice. These copies are used in following manner.

(a) the or […]

CA Shafaly Girdharwal wrote a new post, How to prepare GST Tax invoice for Exports 9 years, 1 month ago

Why You need to issue GST Tax invoice for Exports:

In revised GST model law you can avail tax benefit for export of supplies in two ways.

(a) First method is export without payment of IGST and claim ref […]

you will prepare two diff invoices…one will be for buyes and other GST invoice having Gst details

CA Shafaly Girdharwal wrote a new post, Details to be provided in GST Tax invoice 9 years, 1 month ago

When to issue a GST Tax invoice

Section 28 of Chapter VII in revised GST draft provide for the timing for issuance of a GST TAX invoice.

Time limit for issuance of GST tax invoice in case of Goods:

In case of […]

CA Shafaly Girdharwal wrote a new post, How to manage Tax payments on GSTIN 9 years, 1 month ago

Tax payments on GSTIN:

The tax payments on GSTIN will be much simple and easy. In its first outlook of GSTIN the tax payments are also covered.

Create Challan for tax payment at GSTIN:

First thing we need to […]

CA Shafaly Girdharwal wrote a new post, Return filing and payments on GSTIN 9 years, 1 month ago

Return filing and payments on GSTIN:

This is the first look of GSTIN for return filing and payments on GSTIN. This will help users to understand how the system of GSTIN will work. It contains the detail […]

CA Shafaly Girdharwal wrote a new post, How your GSTIN dashboard will look like 9 years, 1 month ago

First look of GSTIN Dashboard:

GSTIN has released the first outlook of dashboard of GSTIN for suggestions. Here we will share that outlook with you. Although GSTIN has release a 115 slides pdf for GSTIN […]

CA Shafaly Girdharwal wrote a new post, Section XXI: HSN codes for works of art 9 years, 1 month ago

HSN codes for work of art

This section contains the HSN codes for the works of art. This section contains two chapter. If your product is not in this section click on text to get section wise list.

Chapter 97: […]

CA Shafaly Girdharwal wrote a new post, Section XVII:HSN Codes for vehicles and aircraft 9 years, 1 month ago

HSN Codes for VEHICLES and AIRCRAFT; VESSELS & ASSOCIATED TRANSPORT EQUIPMENT

This section contains the HSN codes for VEHICLES and AIRCRAFT; VESSELS & ASSOCIATED TRANSPORT EQUIPMENT. These HSN codes will be r […]

CA Shafaly Girdharwal wrote a new post, Section XVI: HSN Codes for Machinery 9 years, 1 month ago

HSN Codes for Machinery:

This section provide for the HSN codes of Machinery. It contains the following two chapters.If your item is not covered in this section you can find it on this article.

Chapter […]

CA Shafaly Girdharwal wrote a new post, SECTION XV: GST HSN Codes for base metal 9 years, 1 month ago

GST HSN Codes for base metal

This section contains the HSN codes for base metal and similar items.This chapter contains 12 chapters.Following is the table for same.

Chapter 72

Iron and […]

CA Shafaly Girdharwal wrote a new post, Section XIV: HSN Codes for pearls and stones 9 years, 1 month ago

GST HSN Codes for pearls and stones:

This section contains the HSN codes for pearls and stones and similar items.NATURAL OR CULTURED PEARLS, PRECIOUS OR SEMI-PRECIOUS STONES, PRECIOUS METALS CLAD WITH PRECIOUS […]