Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

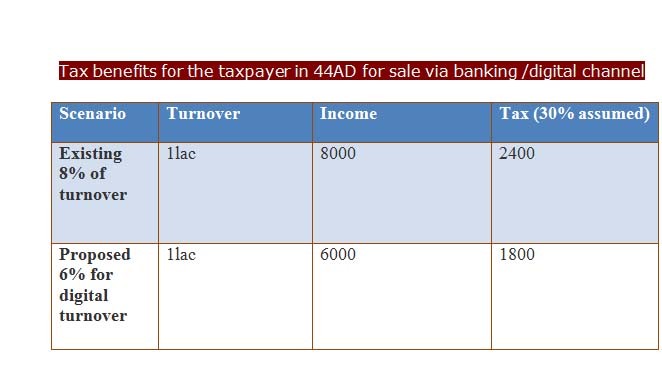

What is the benefit in 44AD available for sale via banking/digital means

This benefit will be available to the taxpayers paying tax availing the benefit in 44AD of Income Tax Act. As per the current provisions […]

HSN Codes for textile and textile articles

This section contains the HSN codes for the textile and textile articles.It contains 13 chapters. These chapters covers the HSN codes for textile and textile articles in […]

GST HSN codes for WOOD AND ARTICLES OF WOOD; WOOD CHARCOAL; CORK AND ARTICLES OF CORK; MANUFACTURES OF STRAW, OF ESPARTO OR OF OTHER PLAITING MATERIALS; BASKETWARE AND WICKERWORK.

In this section the HSN codes […]

GST HSN codes for plastic and rubber and articles thereof

This section contains two chapters.These chapters contain the products made by plastic and rubber.

GST HSN codes for the PRODUCTS OF THE CHEMICAL OR ALLIED INDUSTRIES

This section covers the HSN codes for chemicals or allied products. This section covers the chapters from 28 to 38.Following is the title wise […]

GST HSN codes for mineral products

This section covers the HSN codes for mineral products.This section contains the three chapters. Details of each chapter is given in table below.These HSN codes are required for […]

GST HSN codes for ANIMAL OR VEGETABLE FATS AND OIL AND THEIR CLEAVAGE PRODUCTS; PREPARED EDIBLE FATS; ANIMAL OR VEGETABLE WAXES

Section III of this list containing only one chapter with 22 teriff items. Here you […]

HSN Code for GST: Section 1

This section contains the five chapters. We have divided al them in five tables. Title of each chapter is compiled in following table.

Sectionwise list of HSN codes for GST

Here we have compiled the list of all HSN codes required in GST Enrolment.You can choose the type of product from this section and click on it. You will be taken to the […]

When GST enrolment in Delhi will start?

Migration of Dvat dealers will start from the 16th December 2016. This process is already done at states of Maharastra, Gujarat, Goa and some others. Here in this article […]

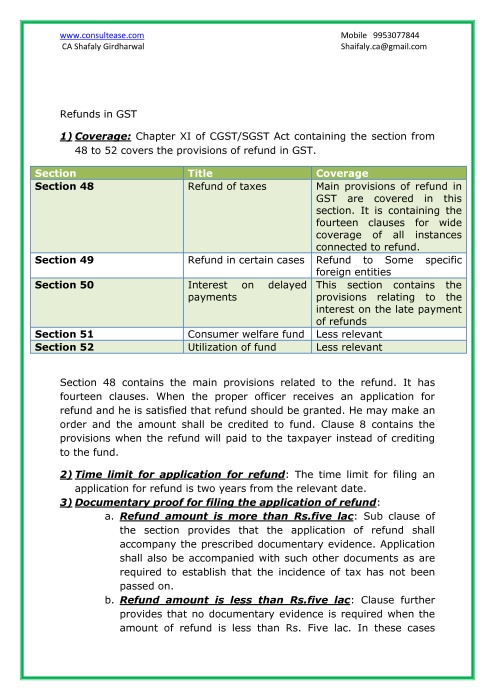

Coverage of refund in GST (PDF of this article is also attached in the end)

We can broadly segregate the refunds in two parts. Refund for the exports and refund for domestic sales. Chapter XI of CGST/SGST Act […]

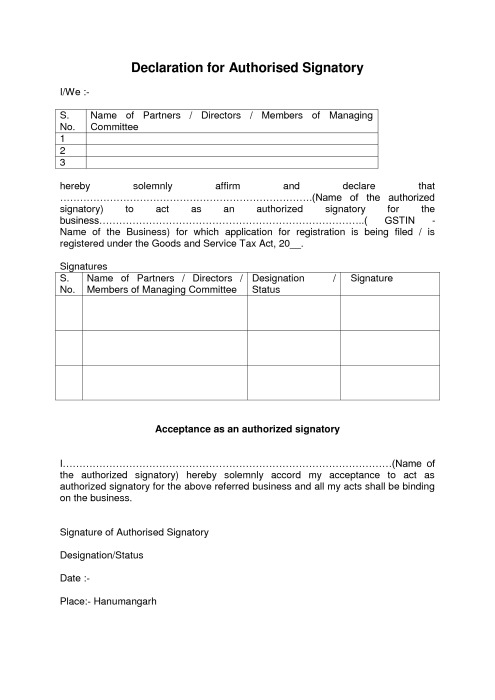

Format for declaration of authorized signatory

GST enrolment is already started in some states. You can online draft your authorization letter on this link.GST enrolment for the service tax assessee and excise […]

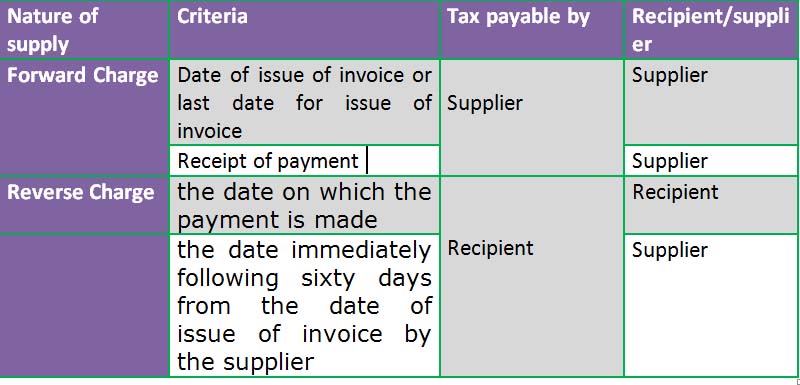

Why we need to determine the time of supply

Time of supply is an importance concept in GST. Levy of GST is generated by section 8 of CGST/SGST and section 5 of IGST Act. The time of payment of tax will be […]

Why we need to determine the time of supply of services in GST?

Levy of GST in derived from Section 8 of CGST/SGST Act(For intra states sales ) and section 5 of IGST Act (For inter-state and import and export […]

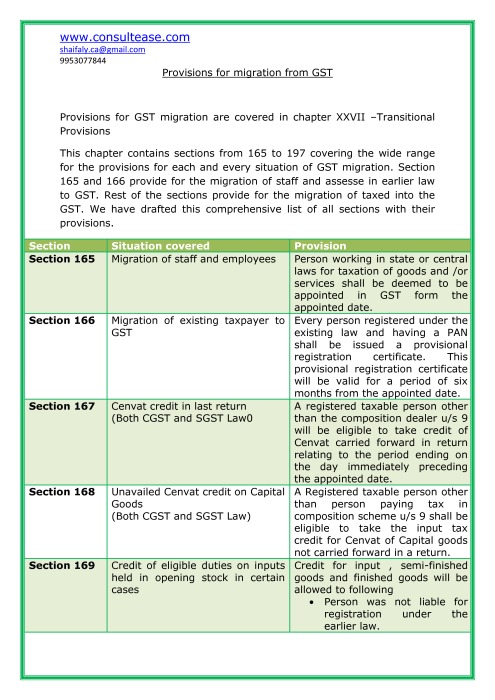

Provisions for GST migration are covered in chapter XXVII –Transitional Provisions

This chapter contains sections from 165 to 197 covering the wide range for the provisions for each and every situation of GST m […]

Special provision for payment of tax by a supplier of online information and database access or retrieval services located outside India to specified person in the taxable territory.

Definition of online […]

Revised provisions covering import and export of Goods and /or services

There are major changes in the revised draft of Model GST law meaning of import and export of Goods. Section 3 and section 4 of IGST Act […]

What is an aggregate turnover in GST?

Aggregate turnover is the criterion for many compliances. It is the limit we check for various thresholds in GST. It is defined in Section 2(6) of CGST Act.

“(6) […]

Meaning of zero rated supply:

Section 16 of revised IGST Act provide for the Zero rated supply. This section will cover the provisions related to the benefit provided to the exporters. “zero rated supp […]

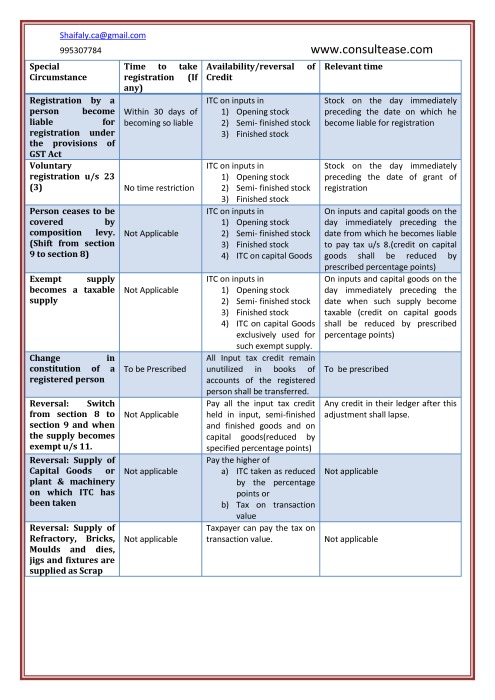

Section of the revised draft of Model GST law provide for the availability of ITC in special cases. We can sum up all of them in the following table. Download PDF here

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Benefit in 44AD for sale through banking channel 9 years, 1 month ago

What is the benefit in 44AD available for sale via banking/digital means

This benefit will be available to the taxpayers paying tax availing the benefit in 44AD of Income Tax Act. As per the current provisions […]

CA Shafaly Girdharwal wrote a new post, SECTION XI:HSN codesTEXTILE 9 years, 1 month ago

HSN Codes for textile and textile articles

This section contains the HSN codes for the textile and textile articles.It contains 13 chapters. These chapters covers the HSN codes for textile and textile articles in […]

CA Shafaly Girdharwal wrote a new post, Section IX: HSN codes for wood and charcoal 9 years, 1 month ago

GST HSN codes for WOOD AND ARTICLES OF WOOD; WOOD CHARCOAL; CORK AND ARTICLES OF CORK; MANUFACTURES OF STRAW, OF ESPARTO OR OF OTHER PLAITING MATERIALS; BASKETWARE AND WICKERWORK.

In this section the HSN codes […]

CA Shafaly Girdharwal wrote a new post, Section VII: GST HSN codes for plastic and rubber 9 years, 1 month ago

GST HSN codes for plastic and rubber and articles thereof

This section contains two chapters.These chapters contain the products made by plastic and rubber.

Chapter 39

Plastics and articles t […]

CA Shafaly Girdharwal wrote a new post, Section VI: HSN codes for chemicals 9 years, 1 month ago

GST HSN codes for the PRODUCTS OF THE CHEMICAL OR ALLIED INDUSTRIES

This section covers the HSN codes for chemicals or allied products. This section covers the chapters from 28 to 38.Following is the title wise […]

CA Shafaly Girdharwal wrote a new post, Section V: HSN Codes for mineral products 9 years, 1 month ago

GST HSN codes for mineral products

This section covers the HSN codes for mineral products.This section contains the three chapters. Details of each chapter is given in table below.These HSN codes are required for […]

CA Shafaly Girdharwal wrote a new post, Section III: HSN Codes for GST enrolment 9 years, 1 month ago

GST HSN codes for ANIMAL OR VEGETABLE FATS AND OIL AND THEIR CLEAVAGE PRODUCTS; PREPARED EDIBLE FATS; ANIMAL OR VEGETABLE WAXES

Section III of this list containing only one chapter with 22 teriff items. Here you […]

CA Shafaly Girdharwal wrote a new post, Section 1 of HSN Codes for GST 9 years, 1 month ago

HSN Code for GST: Section 1

This section contains the five chapters. We have divided al them in five tables. Title of each chapter is compiled in following table.

SECTION I. LIVE ANIMALS, ANIMAL […]

CA Shafaly Girdharwal wrote a new post, Section wise list of all HSN codes for GST 9 years, 1 month ago

Sectionwise list of HSN codes for GST

Here we have compiled the list of all HSN codes required in GST Enrolment.You can choose the type of product from this section and click on it. You will be taken to the […]

CA Shafaly Girdharwal wrote a new post, How to get GST enrolment in Delhi 9 years, 1 month ago

When GST enrolment in Delhi will start?

Migration of Dvat dealers will start from the 16th December 2016. This process is already done at states of Maharastra, Gujarat, Goa and some others. Here in this article […]

CA Shafaly Girdharwal wrote a new post, Detail analysis of provisions of refund in GST 9 years, 1 month ago

Coverage of refund in GST (PDF of this article is also attached in the end)

We can broadly segregate the refunds in two parts. Refund for the exports and refund for domestic sales. Chapter XI of CGST/SGST Act […]

CA Shafaly Girdharwal wrote a new post, Declaration of authorized signatory format in GST 9 years, 1 month ago

Format for declaration of authorized signatory

GST enrolment is already started in some states. You can online draft your authorization letter on this link.GST enrolment for the service tax assessee and excise […]

CA Shafaly Girdharwal wrote a new post, Time of supply of Goods under GST 9 years, 2 months ago

Why we need to determine the time of supply

Time of supply is an importance concept in GST. Levy of GST is generated by section 8 of CGST/SGST and section 5 of IGST Act. The time of payment of tax will be […]

CA Shafaly Girdharwal wrote a new post, Time of supply of services under GST 9 years, 2 months ago

Why we need to determine the time of supply of services in GST?

Levy of GST in derived from Section 8 of CGST/SGST Act(For intra states sales ) and section 5 of IGST Act (For inter-state and import and export […]

CA Shafaly Girdharwal wrote a new post, Provisions for GST Migration 9 years, 2 months ago

Provisions for GST migration are covered in chapter XXVII –Transitional Provisions

This chapter contains sections from 165 to 197 covering the wide range for the provisions for each and every situation of GST m […]

CA Shafaly Girdharwal wrote a new post, online information and database access or retrieval services in GST 9 years, 2 months ago

Special provision for payment of tax by a supplier of online information and database access or retrieval services located outside India to specified person in the taxable territory.

Definition of online […]

There is a tax rate list….check IGST notifications

CA Shafaly Girdharwal wrote a new post, Import and export of Goods/Services in GST 9 years, 2 months ago

Revised provisions covering import and export of Goods and /or services

There are major changes in the revised draft of Model GST law meaning of import and export of Goods. Section 3 and section 4 of IGST Act […]

CA Shafaly Girdharwal wrote a new post, What is aggregate turnover in GST? 9 years, 2 months ago

What is an aggregate turnover in GST?

Aggregate turnover is the criterion for many compliances. It is the limit we check for various thresholds in GST. It is defined in Section 2(6) of CGST Act.

“(6) […]

CA Shafaly Girdharwal wrote a new post, Zero rated supply under revised IGST law 9 years, 2 months ago

Meaning of zero rated supply:

Section 16 of revised IGST Act provide for the Zero rated supply. This section will cover the provisions related to the benefit provided to the exporters. “zero rated supp […]

CA Shafaly Girdharwal wrote a new post, Availability of Input tax credit in special cases 9 years, 2 months ago

Section of the revised draft of Model GST law provide for the availability of ITC in special cases. We can sum up all of them in the following table. Download PDF here

Following is the brief table on […]