Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

GST was introduced in India as a resource for free flow of credit in India. Input tax credit availability in revised Model GST draft law is somehow more restricted then the earlier draft. In this article we will […]

Section 20 of revised Model Law provide for the input tax credit in respect of goods sent for job work. Salient features of the scheme of input tax credit on goods sent for job work are as follows.Provisions for […]

Revised draft of Model GST Law has been on public domain now. There are some changes in the provisions of ITC. New restrictions are there on input tax credit in GST revised draft. The main reason for emergence of […]

Revised draft of revised Model GST law is released by cbec some days back. On first time reading we found that e-commerce operators are going to have a sigh of relief after changes in law. E-commerce operators […]

There will two type of transactions covered in GST namely intra state and inter state. On these two type of transaction three taxes will be levied, namely CGST, SGST and IGST. CGST and SGST will be levied on intra […]

Salient features on new composition levy in revised Model GST draft

Basic condition: Registered taxable person covered under the new composition levy will be subject to the provisions of section 8(3) that is the […]

Definition for CGST/SGST levy has been changed in the revised draft of Model GST Law. Erstwhile section 7 of CGST/SGST law has been shifted to section 8 in the revised draft. Some new provisions are inserted […]

Relevance of composite and mixed supply in revised draft of Model GST law: Composite and mixed supply both of these terms have been inserted into the definition of supply. Section 3 of the Model GST law covers the […]

Definition of supply in revised model GST draft provide covers the Schedule III and IV. Schedule III mentions the activities or transactions which shall be treated neither as a supply of goods nor services. In the […]

Schedule IV of revised Model GST draft law has been mentioned by the definition of supply. Schedule IV covers the activities or transactions by the CG,SG or any local authority which shall be treated neither as a […]

This is the revised presentation on registration in Model GST Law. Revised Model GST law has been released on public domain. Provisions of registration under GST were earlier covered by section 19 of The model GST […]

Revised model GST law has inserted Schedule II into the definition of term Supply which covers the matters to be treated as supply of goods or services.Here we will provide the text of Schedule II as given in […]

Supply is the taxable event for the levy of GST. The definition of supply has been changed to include some more clarity and type of transactions. The new definition of supply in new model GST law is given in […]

Here we have uploaded the New revised model IGST law. It is published by the government of India. It will replace the earlier law which was released in June . This new draft publish in November 2016 will be passed […]

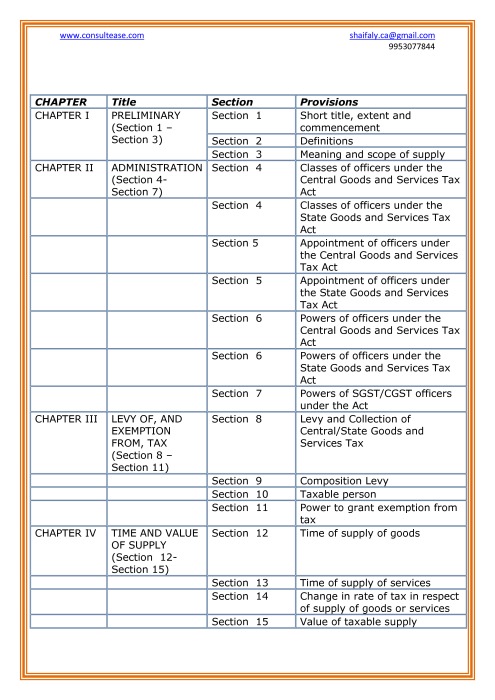

There were some posts on web about the new Model GST law and experts were expecting new law on public domain very soon. Two days back this new Model GST law alongwith two other laws was posted on the website of […]

New GST Model Law is here. It as expected from some days and there were some posts in media from undisclosed sources. But today the amended Law has been placed on the website of CBEC itself.

Here I will share the PPT on GST registration. Provisions of registration are contained in section 19 of GST. Section 19 simply refer the scedule III of GST model law […]

We all are aware that E-commerce operators would be treated differently in GST. In this article we will understand the meaning or an E-commerce operator and how it is different from an aggregator. There are […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Input tax credit availability in revised GST Law 9 years, 2 months ago

GST was introduced in India as a resource for free flow of credit in India. Input tax credit availability in revised Model GST draft law is somehow more restricted then the earlier draft. In this article we will […]

CA Shafaly Girdharwal wrote a new post, Input tax credit on goods sent for job work 9 years, 2 months ago

Section 20 of revised Model Law provide for the input tax credit in respect of goods sent for job work. Salient features of the scheme of input tax credit on goods sent for job work are as follows.Provisions for […]

CA Shafaly Girdharwal wrote a new post, Restriction on Input Tax Credit in GST draft 9 years, 2 months ago

Revised draft of Model GST Law has been on public domain now. There are some changes in the provisions of ITC. New restrictions are there on input tax credit in GST revised draft. The main reason for emergence of […]

CA Shafaly Girdharwal wrote a new post, E-commerce operators in new Modle GST law 9 years, 2 months ago

Revised draft of revised Model GST law is released by cbec some days back. On first time reading we found that e-commerce operators are going to have a sigh of relief after changes in law. E-commerce operators […]

CA Shafaly Girdharwal wrote a new post, IGST levy in revised model GST Law 9 years, 2 months ago

There will two type of transactions covered in GST namely intra state and inter state. On these two type of transaction three taxes will be levied, namely CGST, SGST and IGST. CGST and SGST will be levied on intra […]

CA Shafaly Girdharwal wrote a new post, New Composition levy in revised Model GST Law 9 years, 2 months ago

Salient features on new composition levy in revised Model GST draft

Basic condition: Registered taxable person covered under the new composition levy will be subject to the provisions of section 8(3) that is the […]

CA Shafaly Girdharwal wrote a new post, Changes in CGST/SGST levy in Model GST Law 9 years, 2 months ago

Definition for CGST/SGST levy has been changed in the revised draft of Model GST Law. Erstwhile section 7 of CGST/SGST law has been shifted to section 8 in the revised draft. Some new provisions are inserted […]

CA Shafaly Girdharwal wrote a new post, Composite and mixed supply in revised GST law 9 years, 2 months ago

Relevance of composite and mixed supply in revised draft of Model GST law: Composite and mixed supply both of these terms have been inserted into the definition of supply. Section 3 of the Model GST law covers the […]

CA Shafaly Girdharwal wrote a new post, Revised Model GST law schedule III 9 years, 2 months ago

Definition of supply in revised model GST draft provide covers the Schedule III and IV. Schedule III mentions the activities or transactions which shall be treated neither as a supply of goods nor services. In the […]

CA Shafaly Girdharwal wrote a new post, Revised Model GST Law Schedule IV 9 years, 2 months ago

Schedule IV of revised Model GST draft law has been mentioned by the definition of supply. Schedule IV covers the activities or transactions by the CG,SG or any local authority which shall be treated neither as a […]

CA Shafaly Girdharwal wrote a new post, Registration in revised Model GST law: PPT 9 years, 2 months ago

This is the revised presentation on registration in Model GST Law. Revised Model GST law has been released on public domain. Provisions of registration under GST were earlier covered by section 19 of The model GST […]

CA Shafaly Girdharwal wrote a new post, SCHEDULE II of revised draft GST Model law 9 years, 2 months ago

Revised model GST law has inserted Schedule II into the definition of term Supply which covers the matters to be treated as supply of goods or services.Here we will provide the text of Schedule II as given in […]

CA Shafaly Girdharwal wrote a new post, Supply in new model GST Law 9 years, 2 months ago

Supply is the taxable event for the levy of GST. The definition of supply has been changed to include some more clarity and type of transactions. The new definition of supply in new model GST law is given in […]

CA Shafaly Girdharwal wrote a new post, Draft of revised Model IGST law 9 years, 2 months ago

Here we have uploaded the New revised model IGST law. It is published by the government of India. It will replace the earlier law which was released in June . This new draft publish in November 2016 will be passed […]

CA Shafaly Girdharwal wrote a new post, Basic Scheme of Revised Draft Model GST Law 9 years, 2 months ago

There were some posts on web about the new Model GST law and experts were expecting new law on public domain very soon. Two days back this new Model GST law alongwith two other laws was posted on the website of […]

CA Shafaly Girdharwal wrote a new post, New GST Model law November 2016 9 years, 2 months ago

New GST Model Law is here. It as expected from some days and there were some posts in media from undisclosed sources. But today the amended Law has been placed on the website of CBEC itself.

You can download […]

CA Shafaly Girdharwal wrote a new post, PPT on GST registration and enrolment 9 years, 2 months ago

PPT on GST registration updated till date

Here I will share the PPT on GST registration. Provisions of registration are contained in section 19 of GST. Section 19 simply refer the scedule III of GST model law […]

CA Shafaly Girdharwal wrote a new post, GST Enrolment in 7 states from tomorrow 9 years, 3 months ago

Phasewise GST Enrolment has already started. On 15th November 2016 the enrolment for

Gujarat,

Maharashtra,

Goa,

Daman and Diu,

Dadra and Nagar Haveli,

Chhattisgarh

Will start from t […]

CA Shafaly Girdharwal wrote a new post, Impact analysis of GST on E-commerce operator 9 years, 3 months ago

We all are aware that E-commerce operators would be treated differently in GST. In this article we will understand the meaning or an E-commerce operator and how it is different from an aggregator. There are […]

CA Shafaly Girdharwal wrote a new post, Detail analysis of refund process for exports in GST 9 years, 3 months ago

In this post we will cover the provisions for refund of IGST for:

Export of Goods

Export of services

Deemed Exports