Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

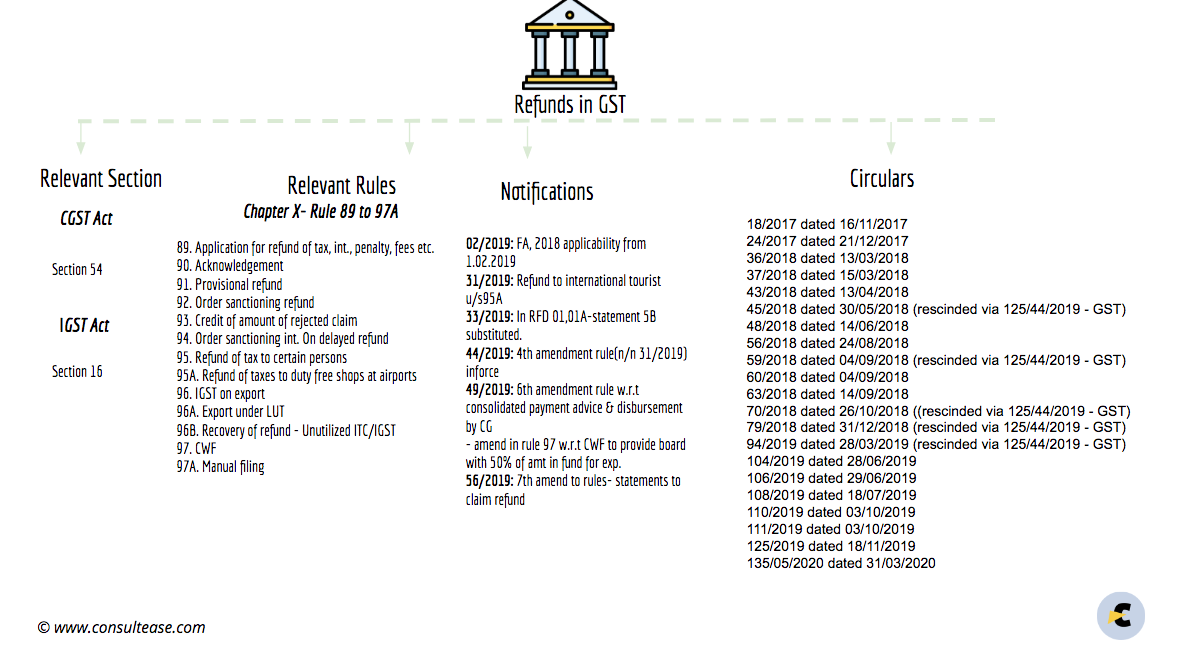

Refunds in GST –

Refunds in GST – In this article, I have tried to cover the various provisions related to refund in GST. I have incorporated the provisions from CGST & IGST Act, Rules, and various notifications. […]

The requirement of registration in GST-

There can be various instances to generate the liability to take registration in GST. Turnover is one of the criteria. In some cases, registration may be mandatory even […]

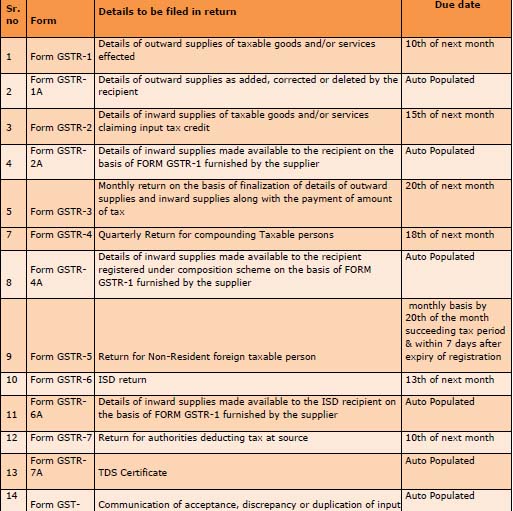

Type of returns in GST

We all know that in last meeting of GST council it adopted some draft rules. Format for GSTR were also one of them. Return forms in GST have changed and now take care to refer only amended […]

Impact of GST on Importers and Exporters

We are seventh largest economy in the world and presumably fastest growing. Imports and exports both show economic growth and the trends in domestic Indian demand for […]

Reverse charge provisions under the GST-Reverse charge is going to be an important aspect for GST as now reverse charge will be not only on services but also be applicable on Goods. We have summarized all the […]

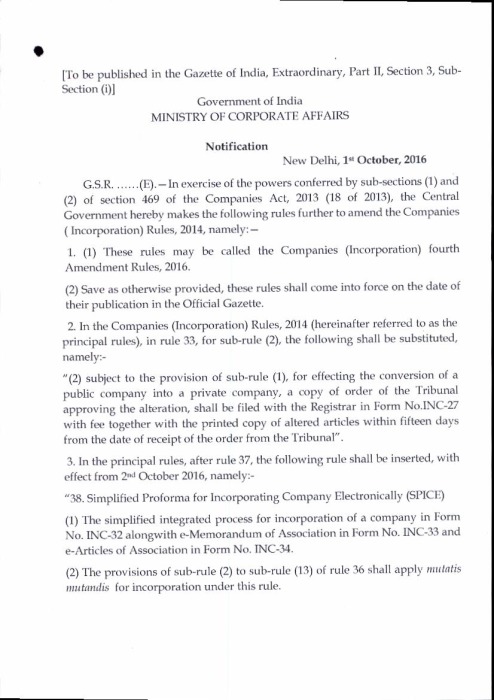

Companies (Incorporation) Fourth Amendment Rules-

MCA has released the Companies (Incorporation) Fourth Amendment Rules, 2016. These rules provide for the consolidated form for registration of the company. It is […]

Transition provisions for registration under GST-

GST council has recently adopted the procedures for the registration of taxpayers under GST. It has also released the format of all forms required to be filed […]

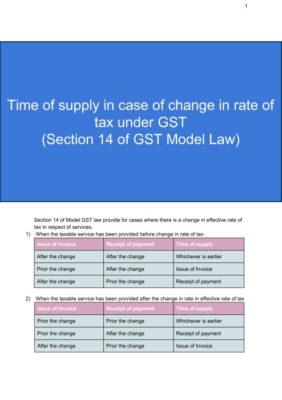

Time of supply is POT in GST regime which has replaced the all other POT in different Laws. In case of service tax taxpayer face a problem in past when there is change in tax rate. In GST regime the Law has […]

GST has redefined many concepts in direct and indirect tax law. We have here started this series to introduce them to you one by one. First term we have chosen is aggregate turnover. This term has been used at so […]

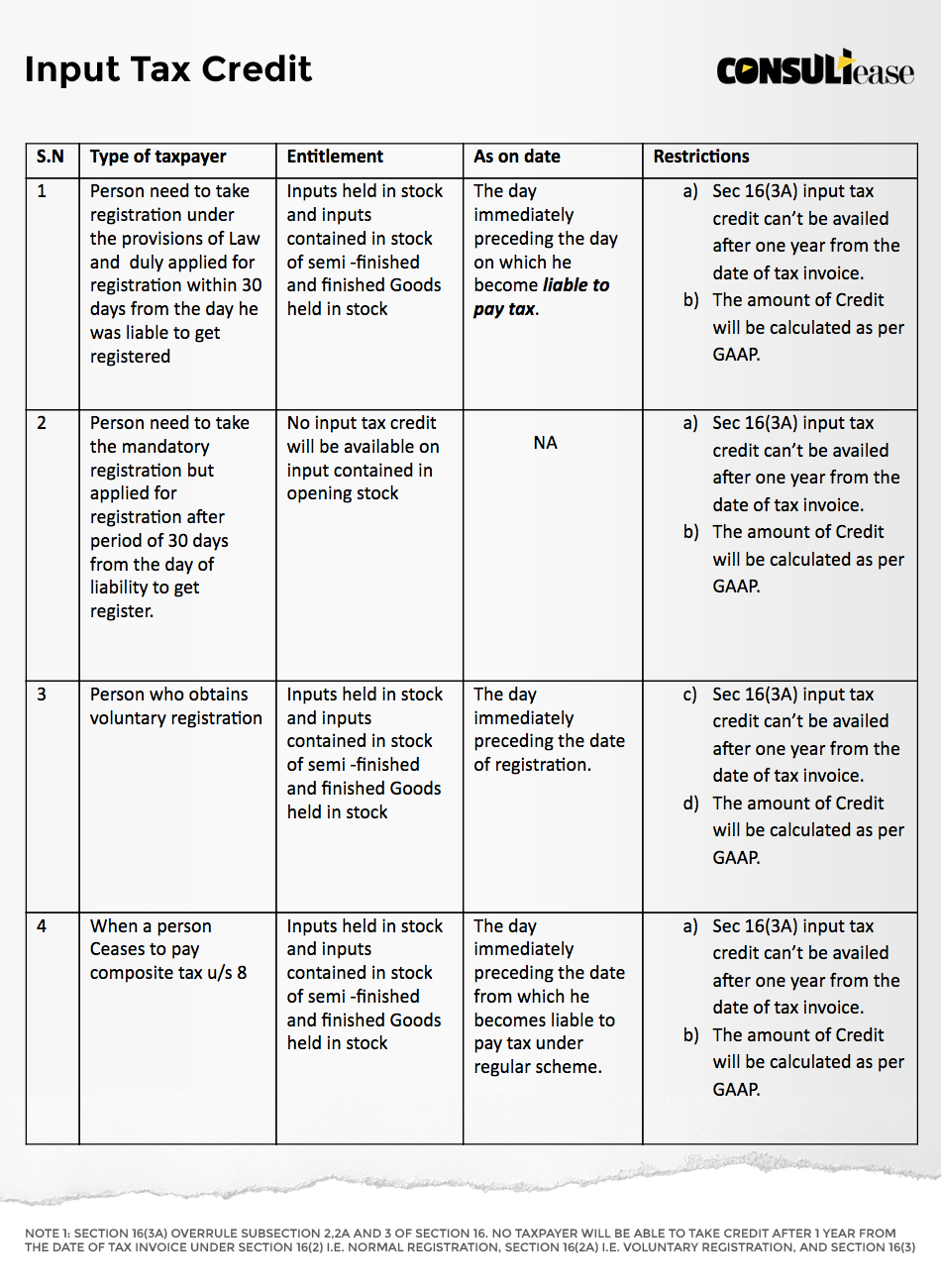

Section 16 of Model GST law provide for the input tax credit under GST. Manner to utilize input tax credit is given under section 35 of Model GST Law. Section 16 also provide for eligibility of input tax credit on […]

Section 9 of CGST/SGST Act speaks about the registration. (Although it belongs to taxable person). It reads as “Taxable Person means a person who carries on any business at any place in India /State of ____ and w […]

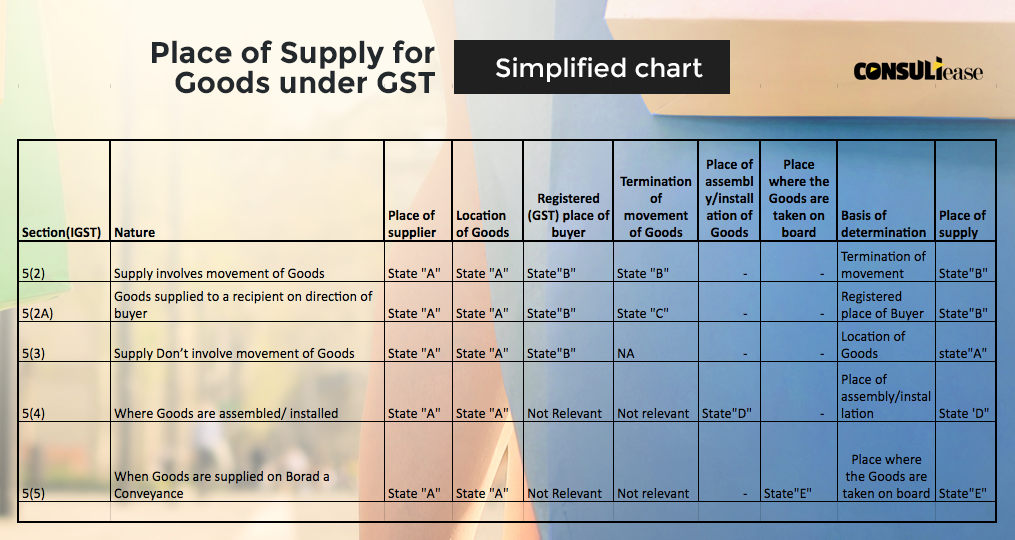

All of us are now getting the basic idea about GST. There will be two types of taxes first a set of CGST +SGST and other is IGST. Each transaction will be classified in either intra state or interstate supply of […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Analysis of provisions for refunds in GST 9 years, 3 months ago

Refunds in GST –

Refunds in GST – In this article, I have tried to cover the various provisions related to refund in GST. I have incorporated the provisions from CGST & IGST Act, Rules, and various notifications. […]

CA Shafaly Girdharwal wrote a new post, Determination and payment of taxes in GST 9 years, 3 months ago

What are the various types of taxes in GST?

There will be three types of taxes in GST levied on two types of supplies.

CGST and SGST on intra state supply

IGST on inter state supply

Determination of t […]

CA Shafaly Girdharwal wrote a new post, Registration in GST: all you need to know 9 years, 3 months ago

The requirement of registration in GST-

There can be various instances to generate the liability to take registration in GST. Turnover is one of the criteria. In some cases, registration may be mandatory even […]

CA Shafaly Girdharwal wrote a new post, Returns in GST as modified by Draft rules 9 years, 3 months ago

Type of returns in GST

We all know that in last meeting of GST council it adopted some draft rules. Format for GSTR were also one of them. Return forms in GST have changed and now take care to refer only amended […]

CA Shafaly Girdharwal‘s profile was updated 9 years, 3 months ago

CA Shafaly Girdharwal wrote a new post, Outcome of day one of third meeting of GST council 9 years, 3 months ago

Day one of third meeting of GST council was quite productive. Matters of prime importance were discussed and the consensus was made on some of them.

Four rate tax structure: GST council has agreed to a four […]

CA Shafaly Girdharwal wrote a new post, Detail analysis of GSTR-1 under GST Model Law, Draft GST returns rules and draft GST return formats 9 years, 3 months ago

Dear Learners

We have compiled this article for detailed knowledge of GSTR-1 required to be filed under section 25 of GST Model Law.

CA Shafaly Girdharwal wrote a new post, Impact of GST on Importers and Exporters: By CA Rashmi Jain 9 years, 3 months ago

Impact of GST on Importers and Exporters

We are seventh largest economy in the world and presumably fastest growing. Imports and exports both show economic growth and the trends in domestic Indian demand for […]

CA Shafaly Girdharwal wrote a new post, Detail analysis of Job work provisions under GST Model Law 9 years, 4 months ago

Job work provisions under GST Model Law.Detailed analysis as per draft GST Law. It is replaced by the CGST Act from 1st july 2017.

CA Shafaly Girdharwal wrote a new post, Reverse charge provisions under GST 9 years, 4 months ago

Reverse charge provisions under the GST-Reverse charge is going to be an important aspect for GST as now reverse charge will be not only on services but also be applicable on Goods. We have summarized all the […]

CA Shafaly Girdharwal wrote a new post, GST Glossary: Meaning of Services in GST 9 years, 4 months ago

What is the meaning of services in GST?

Section 2 (102) of the CGST Act defines the services in GST

“Services” means anything

other than goods, money and securities

but includes activities relating to the […]

CA Shafaly Girdharwal wrote a new post, Companies (Incorporation) Fourth Amendment Rules, 2016 9 years, 4 months ago

Companies (Incorporation) Fourth Amendment Rules-

MCA has released the Companies (Incorporation) Fourth Amendment Rules, 2016. These rules provide for the consolidated form for registration of the company. It is […]

CA Shafaly Girdharwal wrote a new post, Transition provisions for registration under GST 9 years, 4 months ago

Transition provisions for registration under GST-

GST council has recently adopted the procedures for the registration of taxpayers under GST. It has also released the format of all forms required to be filed […]

CA Shafaly Girdharwal wrote a new post, Time of supply in case of change in rate of tax under GST 9 years, 4 months ago

Time of supply is POT in GST regime which has replaced the all other POT in different Laws. In case of service tax taxpayer face a problem in past when there is change in tax rate. In GST regime the Law has […]

CA Shafaly Girdharwal wrote a new post, GST Glossary: Meaning and impact of “Aggregate Turnover” under GST Model Law 9 years, 5 months ago

GST has redefined many concepts in direct and indirect tax law. We have here started this series to introduce them to you one by one. First term we have chosen is aggregate turnover. This term has been used at so […]

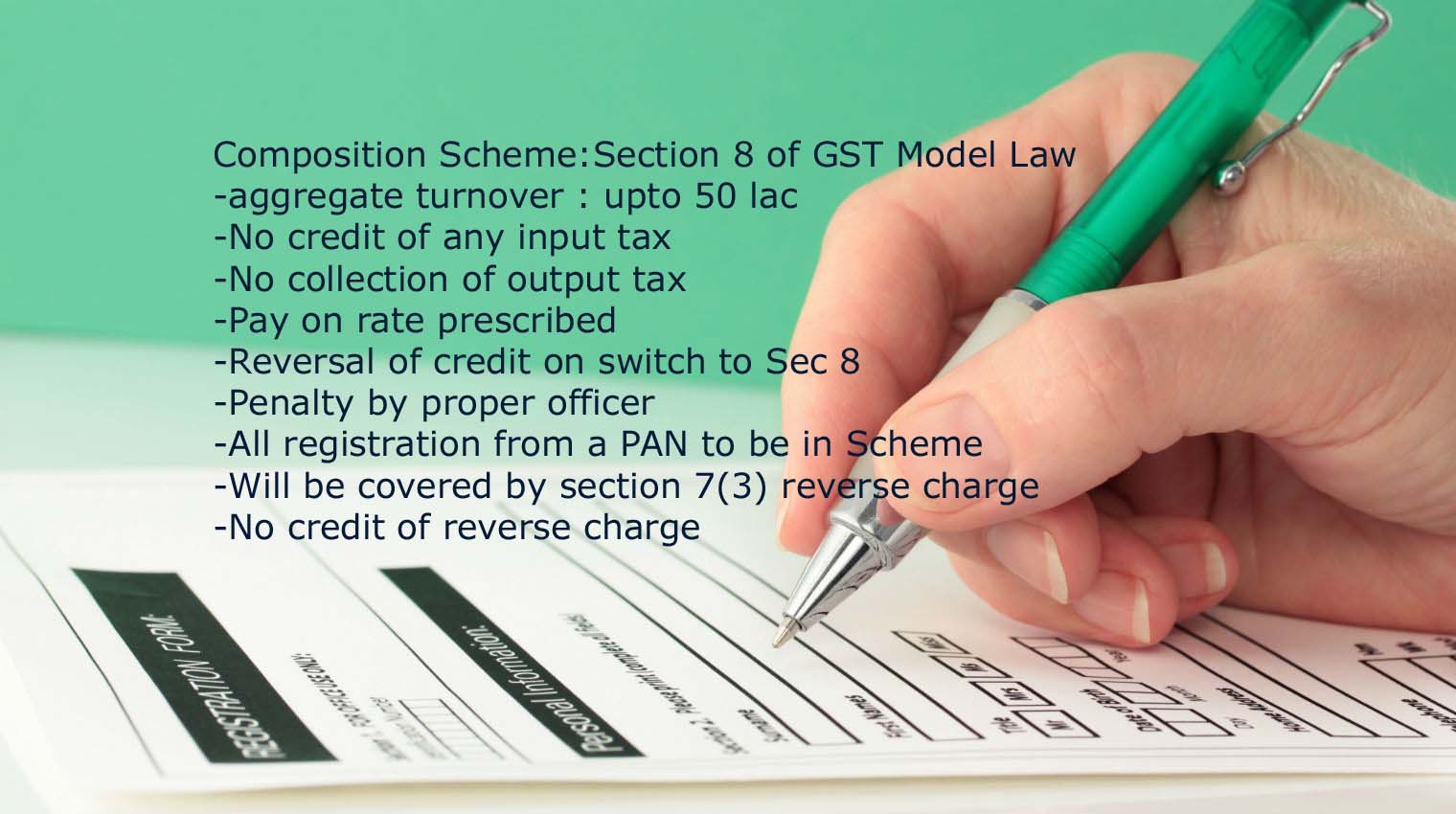

CA Shafaly Girdharwal wrote a new post, Composition Levy:Analysis of section 8 of GST model Law 9 years, 5 months ago

Section 8 of Model GST law provide for levy of composition scheme. The section read as

“Notwithstanding anything to the contrary contained in the Act but subject to subsection

(3) of section 7 on the […]

CA Shafaly Girdharwal wrote a new post, Eligibility on Input tax credit under GST on inputs held in stock 9 years, 5 months ago

Section 16 of Model GST law provide for the input tax credit under GST. Manner to utilize input tax credit is given under section 35 of Model GST Law. Section 16 also provide for eligibility of input tax credit on […]

CA Shafaly Girdharwal wrote a new post, Critical analysis of provision for registration under GST Model Law 9 years, 5 months ago

Section 9 of CGST/SGST Act speaks about the registration. (Although it belongs to taxable person). It reads as “Taxable Person means a person who carries on any business at any place in India /State of ____ and w […]

CA Shafaly Girdharwal wrote a new post, Input tax credit under GST: Chapter V of model GST Law 9 years, 5 months ago

Chapter V of CGST/SGST Act covers the provision of input tax credit under GST. Section 16 provide for the basic provisions for ITC.

Credit to electronic ledger: As per section 16(1) every taxpayer is eligible […]

CA Shafaly Girdharwal wrote a new post, GST Model Law: Determination of place of supply of Goods and services 9 years, 5 months ago

All of us are now getting the basic idea about GST. There will be two types of taxes first a set of CGST +SGST and other is IGST. Each transaction will be classified in either intra state or interstate supply of […]