Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

The Haryana government has taken a significant step in bolstering its administrative infrastructure with the appointment of new members to the Value Added Tax (VAT) Tribunal. In a recent […]

Introduction

In an ongoing battle against fraudulent Input Tax Credit (ITC) activities, the Directorate General of GST Intelligence (DGGI) has intensified its efforts, resulting in significant breakthroughs. […]

Introduction

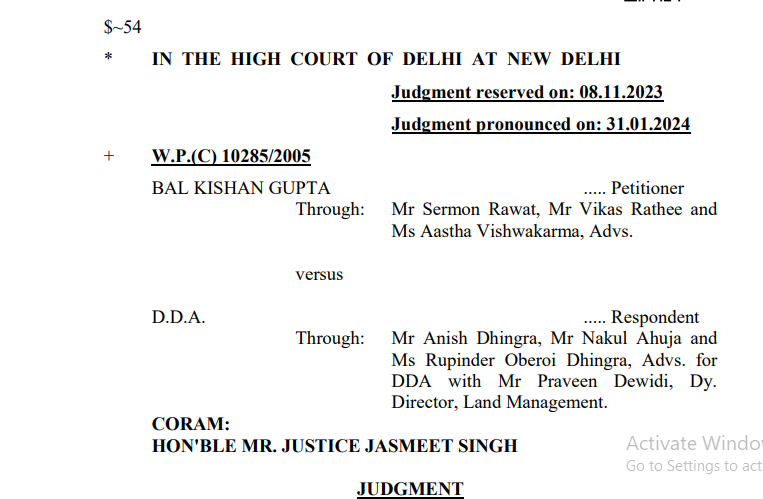

In a recent ruling, the Delhi High Court underscored the imperative for the Delhi Development Authority (DDA) to adhere to principles of natural […]

Comment

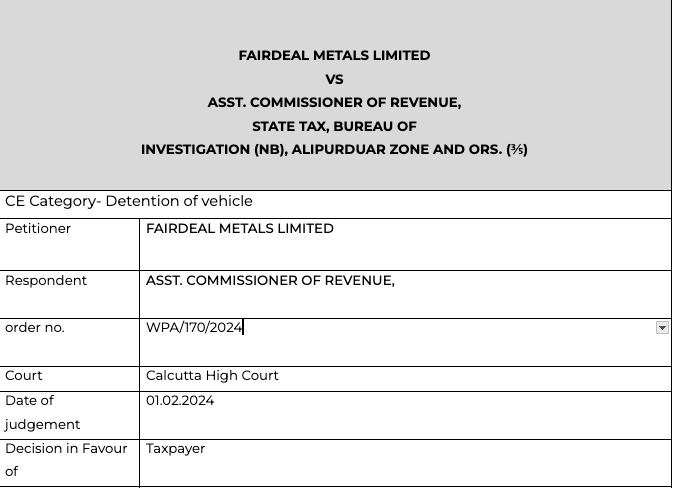

There were differences in various documents but that was corrected by the taxpayer. In case the correct documents are presented before the authorized before passing the order then it should be accepted by […]

Comment

The specific case of the petitioner is that there is no allegation against the petitioner but the entire allegation has been made against the supplier from whom the petitioner procured the goods.

Details […]

Comment

The petition filed challenging the constitutional validity of Anti profiteering provisions of GST is hereby quashed by the SC. The provisions of anti profiteering are upheld by the supreme court.

Details […]

Comment

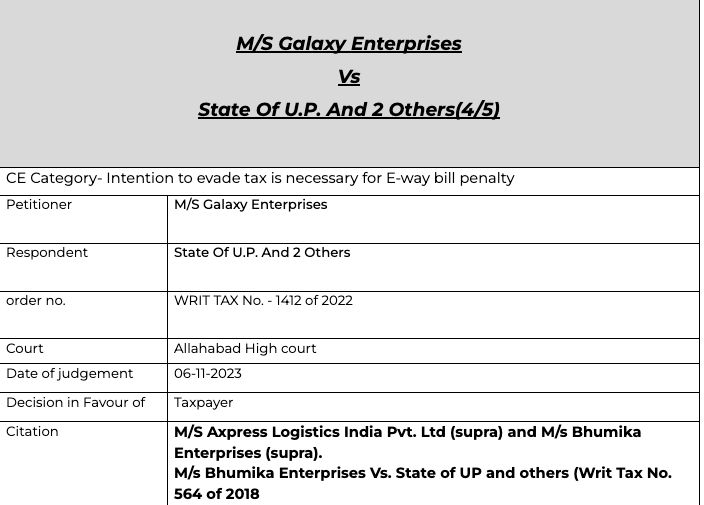

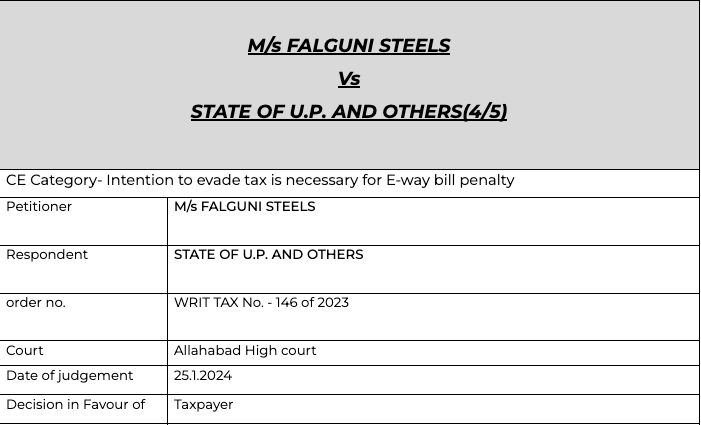

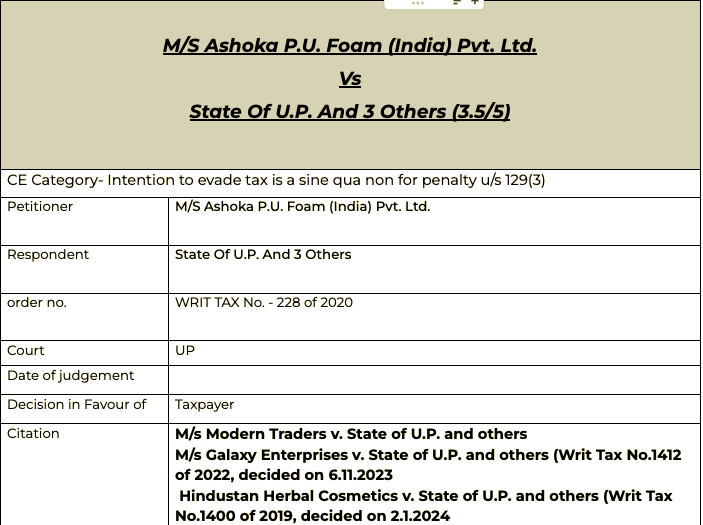

In many judgments it is clarified that there should not be a levy of penalty without an intention to evade tax. In this judgment court again clarified that the penalty should only be levied when there is […]

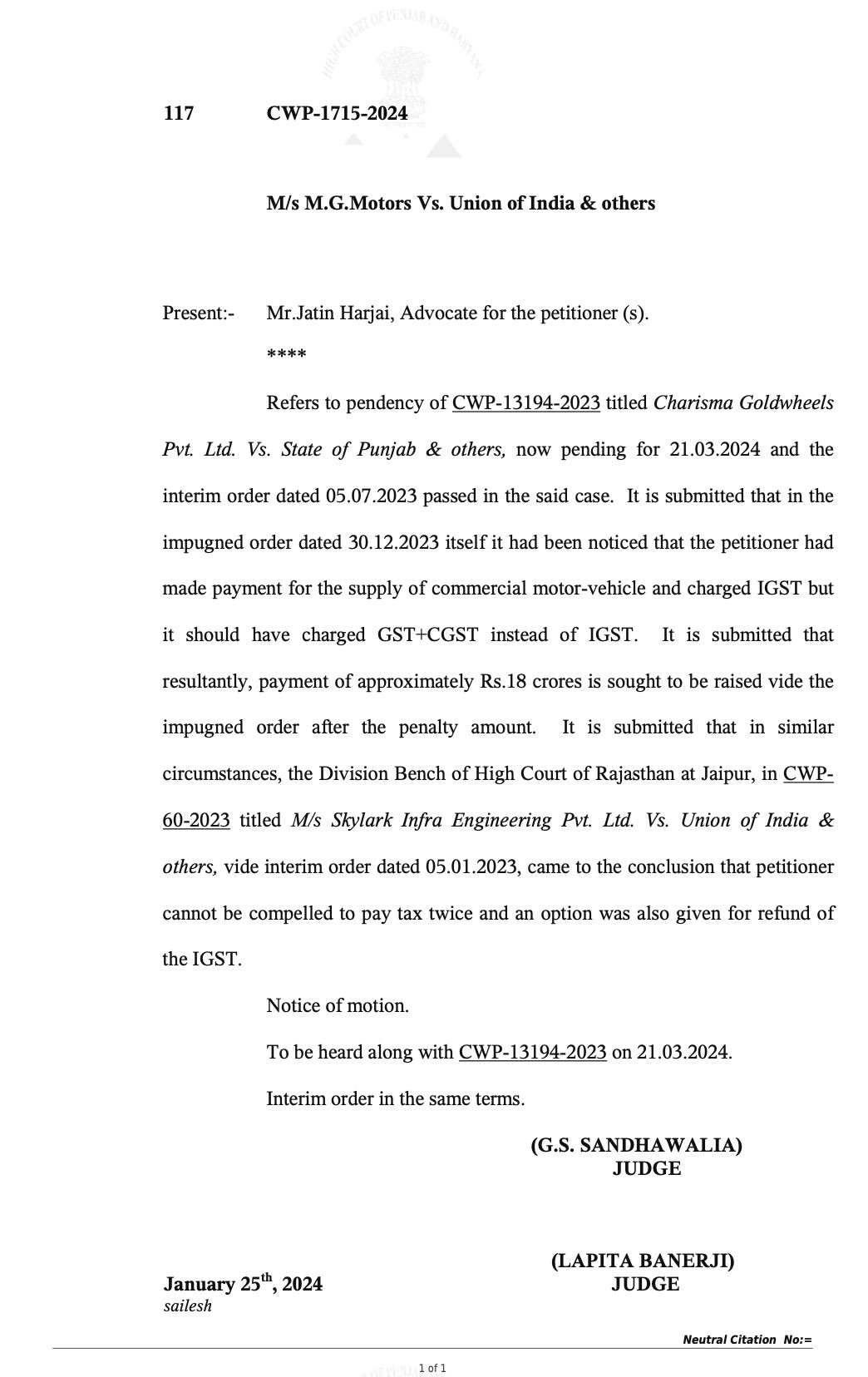

In a recent judgement the court has stayed the notice asking for the tax amount of Rs. 18 Cr for the sale of vehicles. The trucks sold to the inter state customers was charged for IGST. Lateron the department […]

Brief of the case-

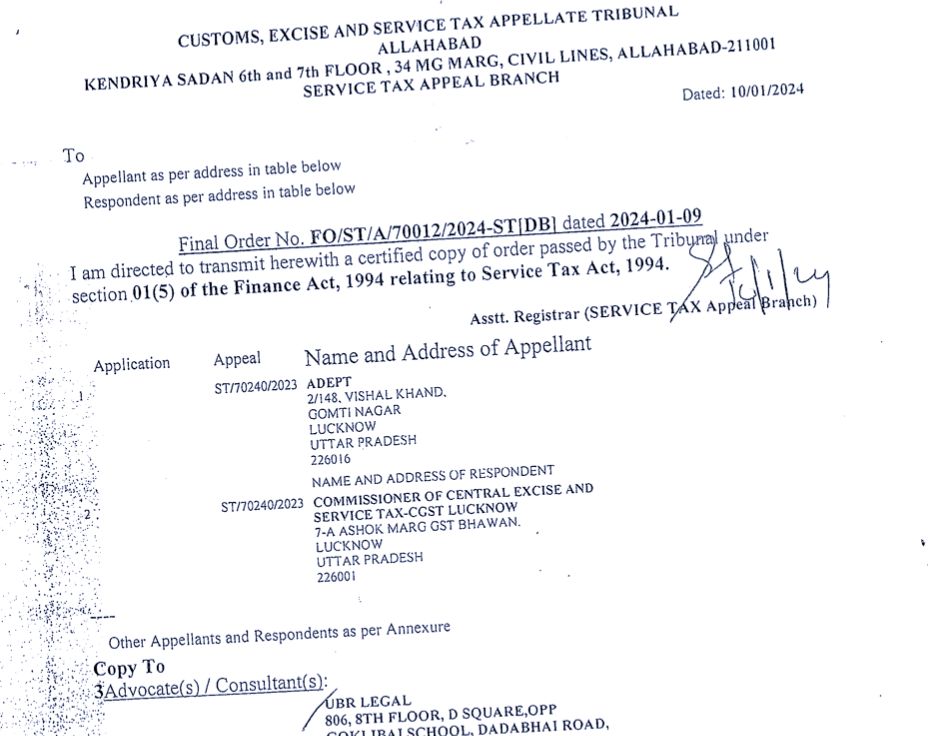

The appellant is providing operation and maintenance service to mobile tower companies. It pays service tax on such activity. It is also engaged in filling diesel in power generators. A demand […]

Intention to evade tax is essential for penalty

The most litigated issue. Good are moving and are held by the authorities. In many cases the court has put an emphasis that intention to evade tax is important. […]

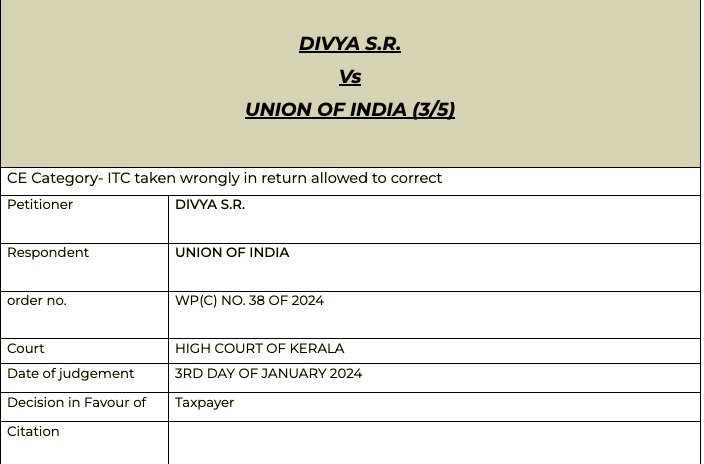

ITC taken in wrong head allowed by the court.

It was one of the very common issue in the initial period. People were not allowed to amend the return. But the ITC taken in wrong head should have been allowed to be […]

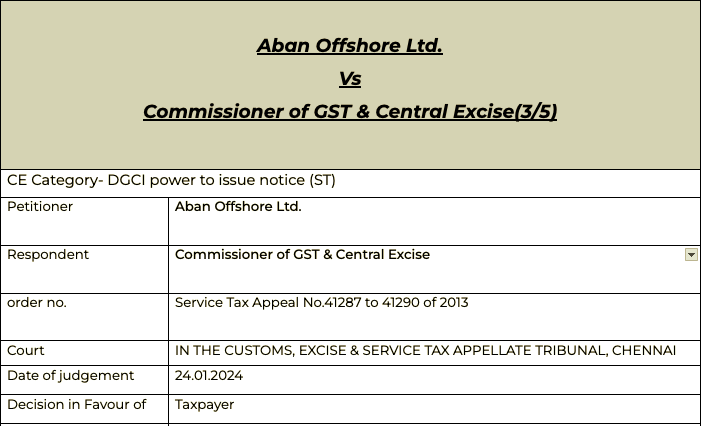

DGCI power to issue notices-

Very important decision and I would like to give it a 4/5 for importance. Many time the question is raised on the power of DGCI. Here the answer is given in detail by the honourable […]

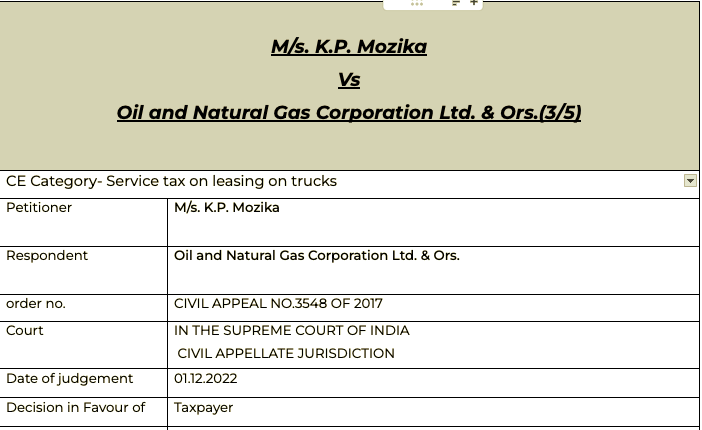

The judgment of high court are reversed. In this case the honourable SC outs and end to the age old controversy. Cases like Gannon Drunkly came to picture again.

Around 50 petitions were bunched together. They […]

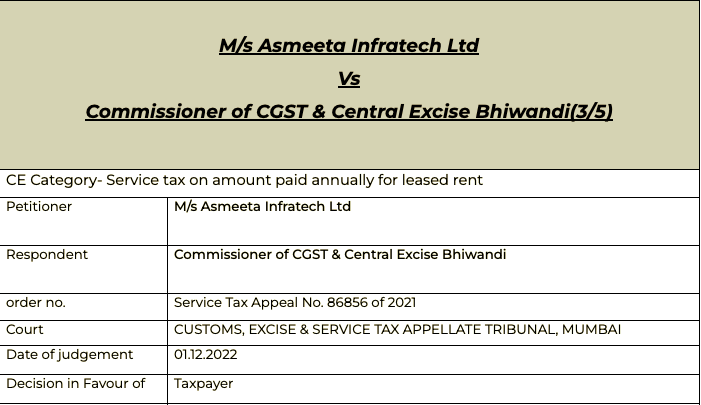

Amount paid monthly will be considered as rent?

In a recent ruling the CESTAT held that the amount paid annually for leased land is not rent. The amount is premium/salami. It is not taxable under the service […]

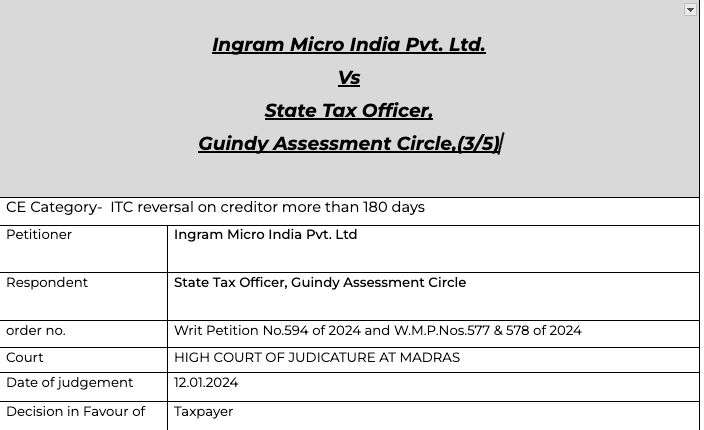

ITC reversal for non payment of creditors in 180 days

In some of the cases the department asks the taxpayer to reverse the ITC for non payment of creditors. In many cases the aging of creditors is not available […]

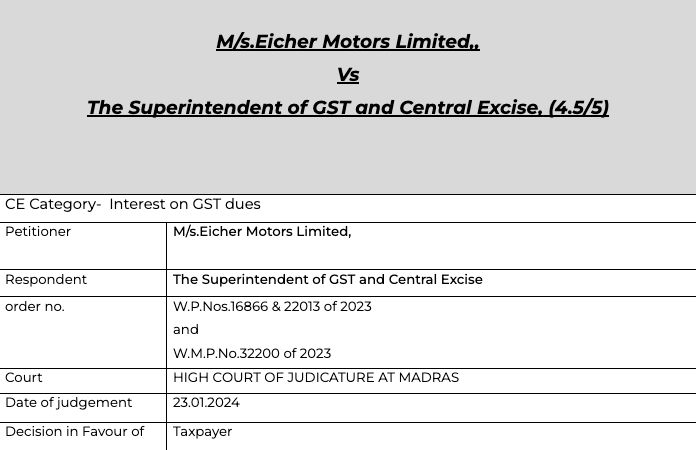

When tax is deemed to be paid?

In this case the return was not filed by the taxpayer as he was facing difficulty in transitional credit.They were unable to file the July 2017 return. Now GST portal doesn’t allow […]

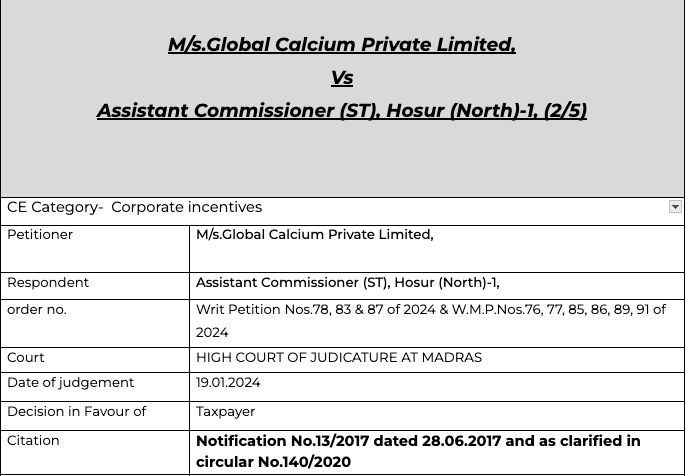

Incentives paid to WTD in form of salary-

Even after clarification by the CBIC via Notification No.13/2017 dated 28.06.2017 and as clarified in circular No.140/2020 the deptt passed the order against the […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewPrem wrote a new post, Haryana Government Appoints New VAT Tribunal Members 2 years ago

The Haryana government has taken a significant step in bolstering its administrative infrastructure with the appointment of new members to the Value Added Tax (VAT) Tribunal. In a recent […]

Prem wrote a new post, DGGI’s Crackdown: Exposing Fake ITC Syndicates and Apprehending Tax Evaders 2 years ago

Introduction

In an ongoing battle against fraudulent Input Tax Credit (ITC) activities, the Directorate General of GST Intelligence (DGGI) has intensified its efforts, resulting in significant breakthroughs. […]

CA Shafaly Girdharwal wrote a new post, “Delhi High Court’s Procedural Fairness Ruling” 2 years ago

Introduction

In a recent ruling, the Delhi High Court underscored the imperative for the Delhi Development Authority (DDA) to adhere to principles of natural […]

CA Shafaly Girdharwal wrote a new post, No Penalty if the documents are produced before passing the order 2 years ago

Comment

There were differences in various documents but that was corrected by the taxpayer. In case the correct documents are presented before the authorized before passing the order then it should be accepted by […]

CA Shafaly Girdharwal wrote a new post, Yet another case to drop the E -way bill penalty 2 years ago

Comment

The specific case of the petitioner is that there is no allegation against the petitioner but the entire allegation has been made against the supplier from whom the petitioner procured the goods.

Details […]

CA Shafaly Girdharwal wrote a new post, Anti profiteering provisions are constitutionally valid- SC 2 years ago

Comment

The petition filed challenging the constitutional validity of Anti profiteering provisions of GST is hereby quashed by the SC. The provisions of anti profiteering are upheld by the supreme court.

Details […]

CA Shafaly Girdharwal wrote a new post, Penalty in absence of any evasion is bound to drop 2 years ago

Comment

In many judgments it is clarified that there should not be a levy of penalty without an intention to evade tax. In this judgment court again clarified that the penalty should only be levied when there is […]

ConsultEase Administrator wrote a new post, (no title) 2 years ago

IMPS Transfers via Mobile Numbers: NPCI’s Game-Changing Move

Starting on February 1, 2024, the National Payments Corporation of India (NPCI) is poised to revolutionize digital transactions with the launch of […]

CA Shafaly Girdharwal wrote a new post, High court stayed 18 crore demand on tax paid as IGST 2 years ago

In a recent judgement the court has stayed the notice asking for the tax amount of Rs. 18 Cr for the sale of vehicles. The trucks sold to the inter state customers was charged for IGST. Lateron the department […]

CA Shafaly Girdharwal wrote a new post, Supply of diesel in O&M contract is not chargeable to ST- CESTAT 2 years ago

Brief of the case-

The appellant is providing operation and maintenance service to mobile tower companies. It pays service tax on such activity. It is also engaged in filling diesel in power generators. A demand […]

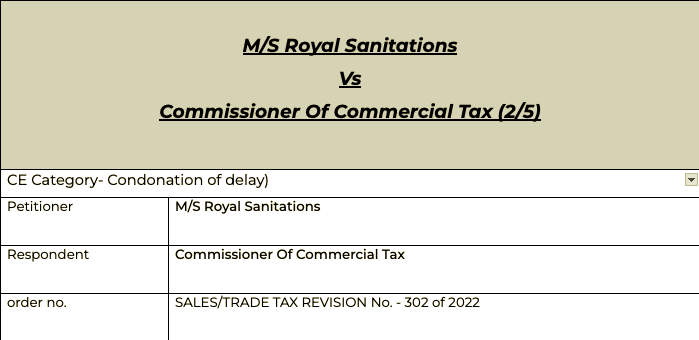

CA Shafaly Girdharwal wrote a new post, Condonation of 1365 days allowed by court 2 years ago

The question was of right to give condonation of delay. Not one or two day but of 1365 days.

In this judgment the court allowed the CoD.

citatio

Citations

M/s Anil Enterprises v. Commissioner of […]

CA Shafaly Girdharwal wrote a new post, Intention to evade tax is a sine quo non for penalty u/s 129(3)- HC 2 years ago

Intention to evade tax is essential for penalty

The most litigated issue. Good are moving and are held by the authorities. In many cases the court has put an emphasis that intention to evade tax is important. […]

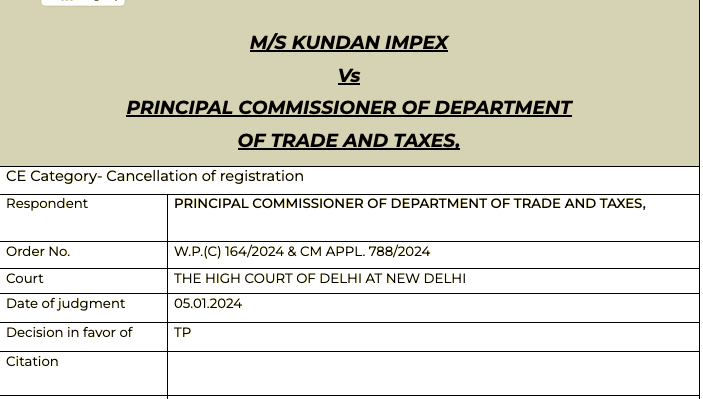

CA Shafaly Girdharwal wrote a new post, Cancellation of registration set aside by the court – read order 2 years ago

The cancellation of registration was dropped by the honourable high court.

Pleading

Petitioner impugns show cause notice dated 05.07.2023 whereby the registration of the petitioner has been s […]

CA Shafaly Girdharwal wrote a new post, ITC taken in wrong hear in 3b, Court allowed to correct even for 2017-18 2 years ago

ITC taken in wrong head allowed by the court.

It was one of the very common issue in the initial period. People were not allowed to amend the return. But the ITC taken in wrong head should have been allowed to be […]

CA Shafaly Girdharwal wrote a new post, Comprehansive judgment on Rights of DGCI to issue notice- Must read 2 years ago

DGCI power to issue notices-

Very important decision and I would like to give it a 4/5 for importance. Many time the question is raised on the power of DGCI. Here the answer is given in detail by the honourable […]

CA Shafaly Girdharwal wrote a new post, SC puts a end to old controversy of VAT on trucks leased to ONGC 2 years ago

The judgment of high court are reversed. In this case the honourable SC outs and end to the age old controversy. Cases like Gannon Drunkly came to picture again.

Around 50 petitions were bunched together. They […]

CA Shafaly Girdharwal wrote a new post, Annual amount paid for land leased by MIDC is premium/Salami and not interest- CESTAT 2 years ago

Amount paid monthly will be considered as rent?

In a recent ruling the CESTAT held that the amount paid annually for leased land is not rent. The amount is premium/salami. It is not taxable under the service […]

CA Shafaly Girdharwal wrote a new post, HC- ITC reversal for non payment in 180 days cant be forced on closing balance of creditor 2 years ago

ITC reversal for non payment of creditors in 180 days

In some of the cases the department asks the taxpayer to reverse the ITC for non payment of creditors. In many cases the aging of creditors is not available […]

Prem wrote a new post, [Breaking]No Interest if the amount was deposited in cash ledger even if 3b isn’t filed 2 years ago

When tax is deemed to be paid?

In this case the return was not filed by the taxpayer as he was facing difficulty in transitional credit.They were unable to file the July 2017 return. Now GST portal doesn’t allow […]

CA Shafaly Girdharwal wrote a new post, TDS u/s 192 is not conclusive proof of incentives given to WTD is salary 2 years ago

Incentives paid to WTD in form of salary-

Even after clarification by the CBIC via Notification No.13/2017 dated 28.06.2017 and as clarified in circular No.140/2020 the deptt passed the order against the […]