Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

On Monday, the Delhi High Court intervened by halting the enforcement of a trial court’s summons directed at Sunita Kejriwal, the wife of Chief Minister Arvind Kejriwal. The case revolved around allegations that […]

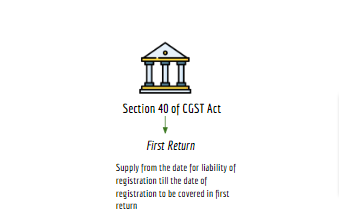

Section 40 of the CGST Act as amended by the Finance Act 2023

Note: Section 40 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

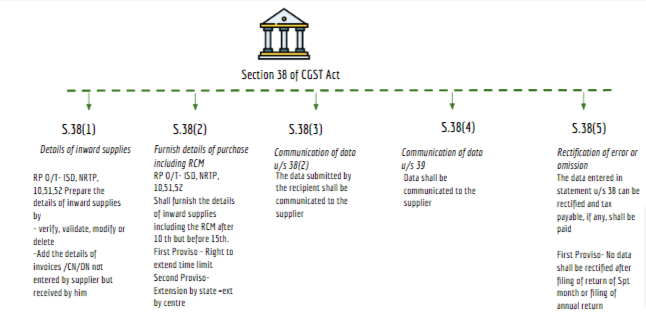

Section 38 of the CGST Act as amended by the Finance Act 2023

Note: Section 38 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

The Ministry of Steel and Steel Products (Quality Control) order under the BIS Act, 2016. Periodically the Ministry issue such QCO order to cover more grades of steel and related products.

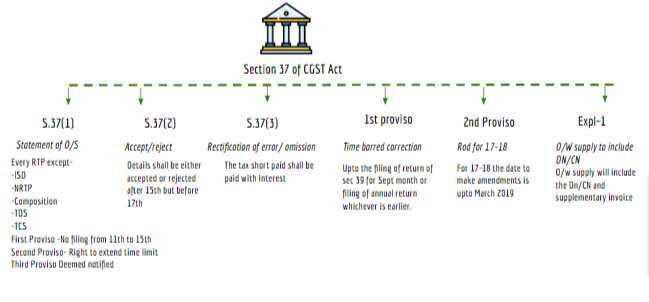

Section 37 of the CGST Act as amended by the Finance Act 2023

Note: Section 37 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

While the elected branch of government aims to be responsive to the will of the people, the Chief Justice of India emphasized the vital importance of judges adhering to Constitutional principles. He pointed […]

On November 3, the Indian Supreme Court strongly rebuked the Indian Army for its perceived arbitrary stance regarding the promotion of women officers who had been granted permanent […]

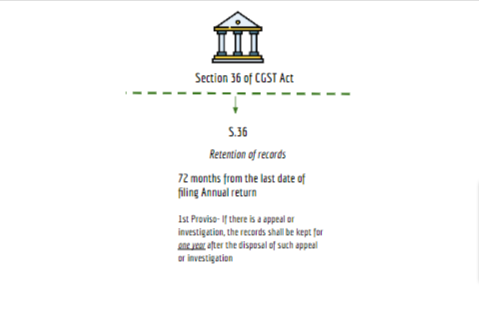

Section 36 of the CGST Act as amended by the Finance Act 2023

Note: Section 36 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

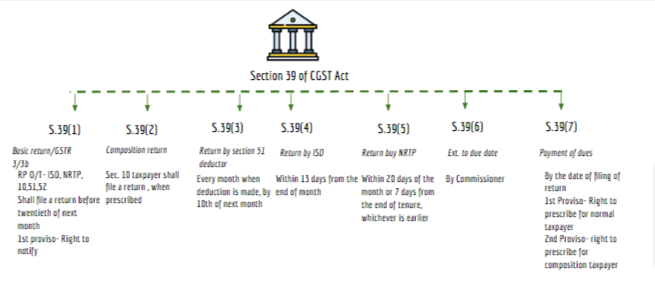

Section 39 of the CGST Act as amended by the Finance Act 2023

Note: Section 39 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

“The system is currently undergoing compliance checks for Form DRC-01C. If you encounter the message ‘Please try to file GSTR1 again after some time,’ rest assured that this can affect both NIL and non-NIL returns […]

A panel of Judges consisting of Justices Abhay S Oka and Pankaj Mithal presided over a special leave petition case, which challenged a Rajasthan High Court, Jaipur Bench’s unfavorable ruling. The ruling had been […]

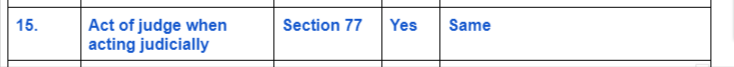

Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a Judge when acting judicially in the exercise of any power which is, or which […]

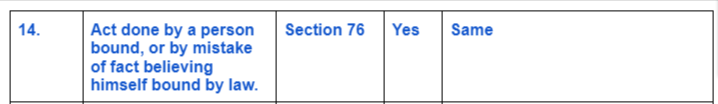

Section 14 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a person who is, or who by reason of a mistake of fact and not by reason of a […]

Section 13 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Whoever, having been convicted by a Court in India, of an offence punishable under Chapters X or Chapter XVII of this […]

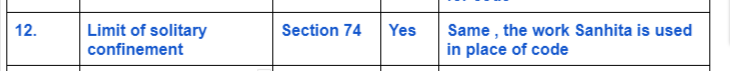

Section 12 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In executing a sentence of solitary confinement, such confinement shall in no case

exceed fourteen days at a time, […]

Section 11 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Whenever any person is convicted of an offence for which under this Sanhita the Court has power to sentence him to […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, No recovery for difference in GSTR 3b and 2A (Pdf Attach) 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

GEETHA AGENCIES Vs DEPUTY COMMISSIONER OF STATE TAX ,

Facts of the cases:

The petitioner’s input tax credit for an amount of Rs.1,10769/- ( […]

CA Shafaly Girdharwal wrote a new post, Gujarat high court stayed the recovery proceedings for non functioning of Tribunal (Pdf Attach) 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

RAJKALP MUDRANALYA PRIVATE LIMITED Vs SUPERINTENDENT

Facts of the cases:

The challenge in this petition is to the order passed by the […]

ConsultEase Administrator wrote a new post, Chief Minister Arvind Kejriwal’s Spouse Over Alleged Dual Voter IDs 2 years, 3 months ago

On Monday, the Delhi High Court intervened by halting the enforcement of a trial court’s summons directed at Sunita Kejriwal, the wife of Chief Minister Arvind Kejriwal. The case revolved around allegations that […]

ConsultEase Administrator wrote a new post, Section 40 of CGST Act: First return (updated till October 2023) 2 years, 3 months ago

Section 40 of the CGST Act as amended by the Finance Act 2023

Note: Section 40 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Section 38 of CGST Act: inward supplies (updated till October 2023) 2 years, 3 months ago

Section 38 of the CGST Act as amended by the Finance Act 2023

Note: Section 38 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Steel product imports need BIS License through QCO Portal for each and every imported steel consignment 2 years, 3 months ago

The Ministry of Steel and Steel Products (Quality Control) order under the BIS Act, 2016. Periodically the Ministry issue such QCO order to cover more grades of steel and related products.

The Quality Control […]

ConsultEase Administrator wrote a new post, Section 37 of CGST Act: outward supply details (updated till October 2023) 2 years, 3 months ago

Section 37 of the CGST Act as amended by the Finance Act 2023

Note: Section 37 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

Prem wrote a new post, In contrast to elected officials in government, judges base their decisions on constitutional morality rather than popular opinion. 2 years, 3 months ago

While the elected branch of government aims to be responsive to the will of the people, the Chief Justice of India emphasized the vital importance of judges adhering to Constitutional principles. He pointed […]

ConsultEase Administrator wrote a new post, GST Insight compliance before 31 march 2023 (CA Keshav Maloo & Associated) 2 years, 3 months ago

Post credit to CA Keshav Maloo & Associated

I. Compliances before 31st March 2023

A. File LUT for zero-rated supplies for F.Y .2023-24

Taxpayers are required to submit a Letter of Undertaking for […]

ConsultEase Administrator wrote a new post, Supreme Court Finds Indian Army’s Handling of Women Officers’ Promotion Arbitrary and Contrary to Previous Court Rulings 2 years, 3 months ago

On November 3, the Indian Supreme Court strongly rebuked the Indian Army for its perceived arbitrary stance regarding the promotion of women officers who had been granted permanent […]

ConsultEase Administrator wrote a new post, Is it possible to deny a refund when the tax rate on inputs is lower, even though.. 2 years, 3 months ago

Cases Covered:

M/s Nahar Industrial Enterprises Limited Vs Union of India,

Citation:

Union of India & Others Vs. VKC Footsteps India Private Limited

Commissioner of Income Tax, Madras Vs. Kasturi & Sons […]

ConsultEase Administrator wrote a new post, Section 36 of CGST Act: period of retention (updated till October 2023) 2 years, 3 months ago

Section 36 of the CGST Act as amended by the Finance Act 2023

Note: Section 36 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Section 39 of CGST Act: Furnishing of GSTR-3 ( updated till October 2023) 2 years, 3 months ago

Section 39 of the CGST Act as amended by the Finance Act 2023

Note: Section 39 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, “When Filing GSTR 1 for October 2023 Using Summary Generation” 2 years, 3 months ago

“The system is currently undergoing compliance checks for Form DRC-01C. If you encounter the message ‘Please try to file GSTR1 again after some time,’ rest assured that this can affect both NIL and non-NIL returns […]

ConsultEase Administrator wrote a new post, Legal Cases Disrupted by Lawyer Strikes” – Supreme Court Sends Notice to Rajasthan High Court Jaipur Bar Association(pdf Attach) 2 years, 3 months ago

A panel of Judges consisting of Justices Abhay S Oka and Pankaj Mithal presided over a special leave petition case, which challenged a Rajasthan High Court, Jaipur Bench’s unfavorable ruling. The ruling had been […]

Prem wrote a new post, Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 15 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a Judge when acting judicially in the exercise of any power which is, or which […]

ConsultEase Administrator wrote a new post, Section 14 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 14 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Nothing is an offence which is done by a person who is, or who by reason of a mistake of fact and not by reason of a […]

ConsultEase Administrator wrote a new post, Section -13 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 13 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Whoever, having been convicted by a Court in India, of an offence punishable under Chapters X or Chapter XVII of this […]

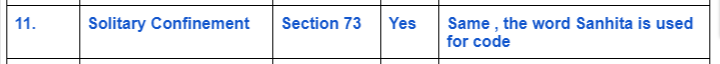

ConsultEase Administrator wrote a new post, Section -12 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 12 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In executing a sentence of solitary confinement, such confinement shall in no case

exceed fourteen days at a time, […]

ConsultEase Administrator wrote a new post, Section -11 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 11 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

Whenever any person is convicted of an offence for which under this Sanhita the Court has power to sentence him to […]