Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

The Delhi GST department has taken the cognisance at many issues related to the notices in GST. The notices were issued in cases where the adjudication was already done via scrutiny or Audit. The department has […]

The Telecom Regulatory Authority of India (TRAI) has informed the Supreme Court that, following deactivation due to non-usage or at the subscriber’s request, a cellular mobile phone number remains unallocated to a […]

Section 35 of the CGST Act as amended by the Finance Act 2023

Note: Section 35 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended port […]

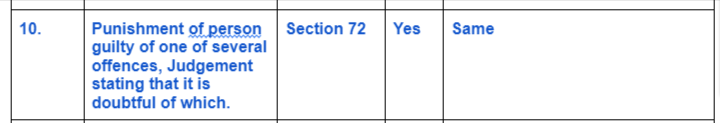

Section 10 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In all cases in which judgment is given that a person is guilty of one of several offences specified in the judgment, […]

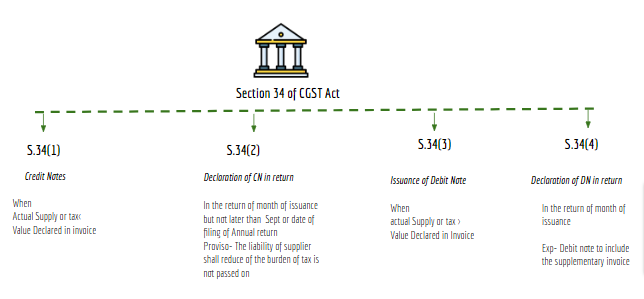

Section 34 of the CGST Act as amended by the Finance Act 2023

Note: Section 34 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

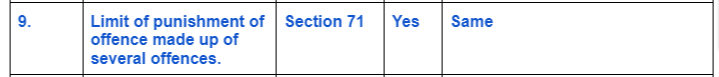

Section 9 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

(1) Where anything which is an offence is made up of parts, any of which parts is itself an offence, the offender shall […]

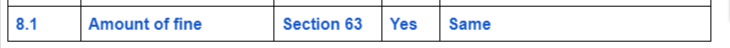

Section 8 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

(1) Where no sum is expressed to which a fine may extend, the amount of fine to which the offender is liable is […]

Section 33 of CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is d […]

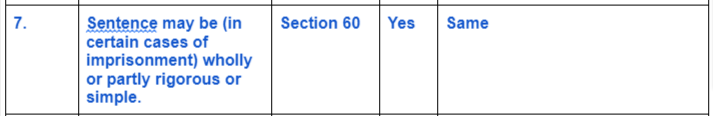

Section 7 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In every case in which an offender is punishable with imprisonment which may be of either description, it shall be […]

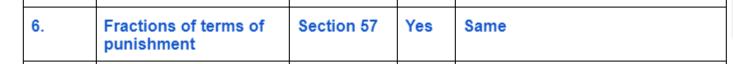

Section 6 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In calculating fractions of terms of punishment, imprisonment for life shall be reckoned

as equivalent to imprisonment […]

On November 3, the Supreme Court expressed reservations regarding the immediate implementation of the Constitution (One Hundred and Sixth Amendment) Act, 2023, which proposes women’s reservation in the Lok Sabha, […]

The Chief Justice of India (CJI) presented compelling data revealing a substantial number of adjournment requests, underscoring the inefficiency of this practice. CJI Chandrachud made a fervent plea to legal […]

S.O. 4767(E).—In exercise of the powers conferred by section 148 of the Central Goods and Services Tax

Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), the Central Government, on the r […]

During the concluding session of arguments in the case pertaining to the Electoral Bonds Scheme, the Supreme Court raised a critical question to the Union Government. They inquired whether there were intentions to […]

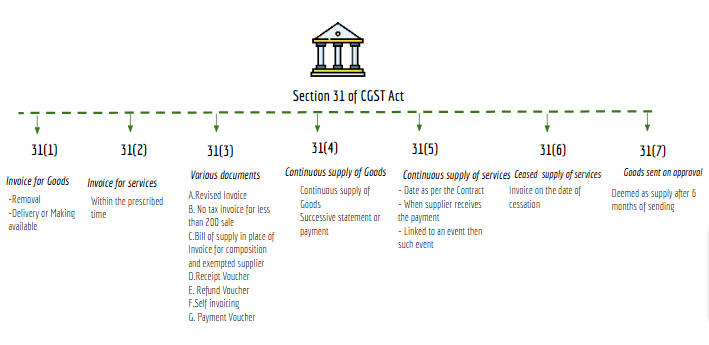

Section 31 of the CGST Act as amended by the Finance Act 2023

Note: Section 31 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

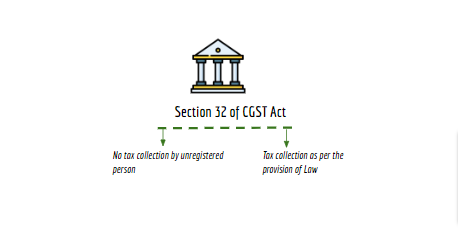

Section 32 of the CGST Act as amended by the Finance Act 2023

Note: Section 32 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

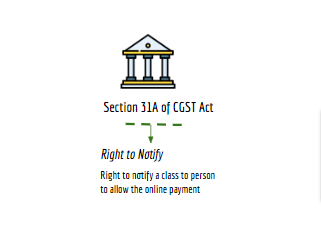

Section 31A of the CGST Act as amended by the Finance Act 2023

Note: Section 31A of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

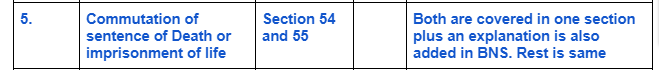

Section 5 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In every case in which sentence of,––

(a) death has been passed, the appropriate Government may, without the cons […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, 8 Important clarification by Delhi GST department related to the issuance of notice 2 years, 3 months ago

The Delhi GST department has taken the cognisance at many issues related to the notices in GST. The notices were issued in cases where the adjudication was already done via scrutiny or Audit. The department has […]

ConsultEase Administrator wrote a new post, TRAI clarified that 90 days gap is kept before making allotment of a deactivated number 2 years, 3 months ago

The Telecom Regulatory Authority of India (TRAI) has informed the Supreme Court that, following deactivation due to non-usage or at the subscriber’s request, a cellular mobile phone number remains unallocated to a […]

ConsultEase Administrator wrote a new post, Amended Section 35 of CGST Act updated till jan 2024 2 years, 3 months ago

Section 35 of the CGST Act as amended by the Finance Act 2023

Note: Section 35 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended port […]

ConsultEase Administrator wrote a new post, Section 10 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 10 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In all cases in which judgment is given that a person is guilty of one of several offences specified in the judgment, […]

ConsultEase Administrator wrote a new post, Section 34 of CGST Act: Debit and Credit note (updated till on October 2023) 2 years, 3 months ago

Section 34 of the CGST Act as amended by the Finance Act 2023

Note: Section 34 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Section 9 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 9 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

(1) Where anything which is an offence is made up of parts, any of which parts is itself an offence, the offender shall […]

ConsultEase Administrator wrote a new post, Section 8 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 8 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

(1) Where no sum is expressed to which a fine may extend, the amount of fine to which the offender is liable is […]

ConsultEase Administrator wrote a new post, Section 33 of CGST Act:Amount on tax documents (updated till on October 2023) 2 years, 3 months ago

Section 33 of CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is d […]

ConsultEase Administrator wrote a new post, Section -7 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 7 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In every case in which an offender is punishable with imprisonment which may be of either description, it shall be […]

ConsultEase Administrator wrote a new post, Section -6 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 6 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In calculating fractions of terms of punishment, imprisonment for life shall be reckoned

as equivalent to imprisonment […]

ConsultEase Administrator wrote a new post, Women reservation cant be implemented immediately- SC (Pdf Attach) 2 years, 3 months ago

On November 3, the Supreme Court expressed reservations regarding the immediate implementation of the Constitution (One Hundred and Sixth Amendment) Act, 2023, which proposes women’s reservation in the Lok Sabha, […]

ConsultEase Administrator wrote a new post, CJI requested lawyers to not to take too many adjournments 2 years, 3 months ago

The Chief Justice of India (CJI) presented compelling data revealing a substantial number of adjournment requests, underscoring the inefficiency of this practice. CJI Chandrachud made a fervent plea to legal […]

ConsultEase Administrator wrote a new post, New amnesty scheme for belated appeals is not applicable on all notices 2 years, 3 months ago

S.O. 4767(E).—In exercise of the powers conferred by section 148 of the Central Goods and Services Tax

Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), the Central Government, on the r […]

ConsultEase Administrator wrote a new post, SC express concern over electoral bonds 2 years, 3 months ago

During the concluding session of arguments in the case pertaining to the Electoral Bonds Scheme, the Supreme Court raised a critical question to the Union Government. They inquired whether there were intentions to […]

ConsultEase Administrator wrote a new post, Section 31 of CGST Act: Tax invoice in GST (updated till on October 2023) 2 years, 3 months ago

Section 31 of the CGST Act as amended by the Finance Act 2023

Note: Section 31 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Section 32 of CGST Act: Unauthorized collection (updated till October 2023) 2 years, 3 months ago

Section 32 of the CGST Act as amended by the Finance Act 2023

Note: Section 32 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Section 31A : Facility of digital payment to recipient. 2 years, 3 months ago

Section 31A of the CGST Act as amended by the Finance Act 2023

Note: Section 31A of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

CA Shafaly Girdharwal wrote a new post, The reply of taxpayer should be considered before passing the order (Pdf Attach) 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/s.The Chennai Silks, Vs The Assistant Commissioner

Facts of the cases:

The respondent sent a reminder DRC-01A on 10.3.2022. […]

CA Shafaly Girdharwal wrote a new post, Judgment of Pankaj Bansal for ground of arrest in PMLA is applicable retrospectively 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

Roop Bansal Vs Union of India and another

Citations:

Vijay Madanlal Choudhary Versus Union of India & Ors

Pankaj Bansal Versus Union of […]

ConsultEase Administrator wrote a new post, Section -5 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 5 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In every case in which sentence of,––

(a) death has been passed, the appropriate Government may, without the cons […]