Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Section 14 of CGST Act

Section 14 of CGST Act

Text of the Section :

Notwithstanding anything contained in section 12 or section 13, the time of supply, where there is a change in the rate of tax in respect of […]

The central issue in this case revolved around the applicability of service tax on the retention of freight amounts, specifically the profits retained by the taxpayer in freight trading. The tax department […]

The upcoming meeting of the Goods and Services Tax (GST) Council is set to include a review of the developments in anti-profiteering matters. During this meeting, the Council will receive an update on the […]

The author can be reached at shaifaly.ca@gmail.com

Background-

The issue of tax on corporate guarantee in GST is settled now. The personal guarantee given by the director is taxable now. Although many corporates […]

The GST Council held its 52nd meeting today. As we all know formation of a GST tribunal was pending for a long. In recent times the government has issued a […]

A lot of you may be suffering due to this issue in GST. Many taxpayers failed to file their appeal because they didn’t find the notice or order on time. A big […]

All updates related to the GST Council’s 52nd Meeting will be updated here

– No GST rate cut on EV batteries as the fitment committee rejected the proposal.

– Delhi minister Atishi Singh favoured the Online […]

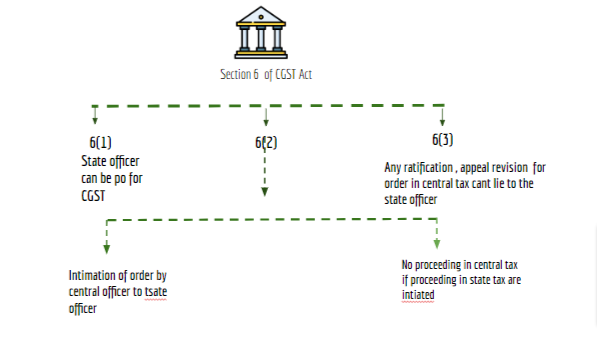

Section 6 of the CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

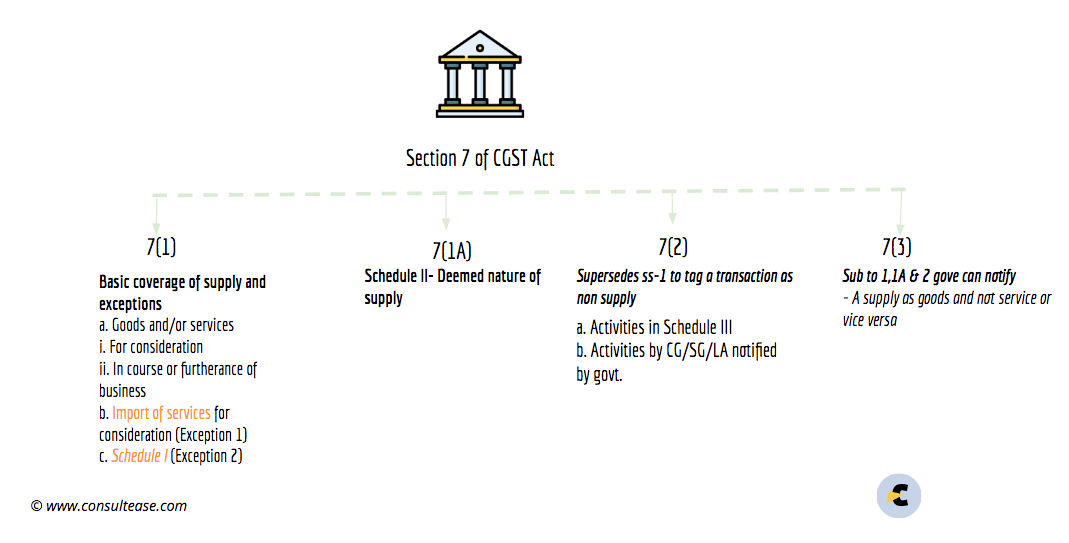

Scope of supply: section 7 of the CGST Act as amended by the Finance Act 2023

Note: The Scope of supply: section 7 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1 […]

Cases Covered

G.Moorthi

Vs.

1. The Recovery Officer

Facts of the cases:

In a recent case, the Madras High Court made a significant observation regarding the use of PAN (Permanent […]

The Department of Trade & Taxes has introduced a Centralized GST Registration Hub (Service Center) aimed at enhancing the efficiency of the GST Registration application process.

In a recent legal case that has garnered considerable attention, YouTuber Akshay, operating under the pseudonym “Dicapscoop” on YouTube and Instagram, found himself in a courtroom battle with a company […]

Introduction-

At the time of partition, the division was done in a very erroneous manner. Soon the governments of both countries decided to reach some type of agreement. A pact was signed between the then Prime […]

Short title, extent, and commencement: section 1 of the CGST Act as amended by the Finance Act 2023

Note: section 1 of the CGST Act is amended by the CGST Finance Act 2023.

TEXT Section:

(1) This Act may be […]

Introduction-

The province of Madras had issued a government order for reservation in medical seats. The applicant tried to get admission in one of the colleges but was denied due to her caste. She was aggrieved […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Govt will challange the judgement asking ED to give grounds of arrest 2 years, 4 months ago

SC judgment direction to ED to inform the grounds of arrest in Pankaj Bansal case will be challenged by Govt in review petition

Recently we have posted the judgment of Pankaj Bansal Vs Union of India. In this […]

ConsultEase Administrator wrote a new post, Section 14 of CGST Act: Change in rate of tax 2 years, 4 months ago

Section 14 of CGST Act

Section 14 of CGST Act

Text of the Section :

Notwithstanding anything contained in section 12 or section 13, the time of supply, where there is a change in the rate of tax in respect of […]

Prem wrote a new post, Service Tax on the Retention of Freight Amount 2 years, 4 months ago

The central issue in this case revolved around the applicability of service tax on the retention of freight amounts, specifically the profits retained by the taxpayer in freight trading. The tax department […]

ConsultEase Administrator wrote a new post, GST Council meeting scheduled for October 7 may entail a review of advancements in anti-profiteering cases. 2 years, 4 months ago

The upcoming meeting of the Goods and Services Tax (GST) Council is set to include a review of the developments in anti-profiteering matters. During this meeting, the Council will receive an update on the […]

CA Shafaly Girdharwal wrote a new post, [Just in] Big decision for GST on Corporate guarantee 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Background-

The issue of tax on corporate guarantee in GST is settled now. The personal guarantee given by the director is taxable now. Although many corporates […]

CA Shafaly Girdharwal wrote a new post, [Just in] Big decision on GST tribunal 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

The GST Council held its 52nd meeting today. As we all know formation of a GST tribunal was pending for a long. In recent times the government has issued a […]

CA Shafaly Girdharwal wrote a new post, Filing of Time Barred Appeals 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

A lot of you may be suffering due to this issue in GST. Many taxpayers failed to file their appeal because they didn’t find the notice or order on time. A big […]

ConsultEase Administrator wrote a new post, Live updates from 52nd GST council meeting press release attached 2 years, 4 months ago

All updates related to the GST Council’s 52nd Meeting will be updated here

– No GST rate cut on EV batteries as the fitment committee rejected the proposal.

– Delhi minister Atishi Singh favoured the Online […]

Prem wrote a new post, Section 6: Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances(updated till on October 2023) 2 years, 4 months ago

Section 6 of the CGST Act as amended by the Finance Act 2023

Note: Section 6 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended por […]

ConsultEase Administrator wrote a new post, Scope of supply : section 7 of the CGST Act (updated till on October 2023) 2 years, 4 months ago

Scope of supply: section 7 of the CGST Act as amended by the Finance Act 2023

Note: The Scope of supply: section 7 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1 […]

ConsultEase Administrator wrote a new post, Wrong PAN in order can’t be a reason for non payment 2 years, 4 months ago

Cases Covered

G.Moorthi

Vs.

1. The Recovery Officer

Facts of the cases:

In a recent case, the Madras High Court made a significant observation regarding the use of PAN (Permanent […]

ConsultEase Administrator wrote a new post, SOP for GST registration seva kendra 2 years, 4 months ago

The Department of Trade & Taxes has introduced a Centralized GST Registration Hub (Service Center) aimed at enhancing the efficiency of the GST Registration application process.

This initiative is designed to […]

Prem wrote a new post, YouTuber fined for Rs. 7 lac for giving false information 2 years, 4 months ago

In a recent legal case that has garnered considerable attention, YouTuber Akshay, operating under the pseudonym “Dicapscoop” on YouTube and Instagram, found himself in a courtroom battle with a company […]

CA Shafaly Girdharwal wrote a new post, 101 historical judgments of SC- Case -6 Can govt of India give any part of country to another nation? 2 years, 4 months ago

Introduction-

At the time of partition, the division was done in a very erroneous manner. Soon the governments of both countries decided to reach some type of agreement. A pact was signed between the then Prime […]

ConsultEase Administrator wrote a new post, Bombay HC in the case of Prushin Fintech Pvt. Ltd. Vs Union of India, 2 years, 4 months ago

Post credit to Advocate Bharat Raichandani

Cases Covered:

Prushin Fintech Pvt. Ltd. Vs Union of India

Facts of the cases:

The petitioner is a service provider. It filed returns for the period 2017-2018. […]

CA Shafaly Girdharwal wrote a new post, Intention to evade tax is mandatory for section 130 of CGST Act (Pdf Attach) 2 years, 4 months ago

Cases Covered:

M/S Shyam Sel And Power Limited Vs State Of U.P. And 2 Others

Citations:

1. Assistant Commissioner (ST) & Others Vs. M/s Satyam Shivam Papers Private Limited & Another

2. M/s Gobind Tobacco […]

CA Shafaly Girdharwal wrote a new post, Condonation in filing of appeal for genuine problem in checking GSTN dashboard (Pdf Attach) 2 years, 4 months ago

Cases Covered:

SRM Engineering Construction Corporation Limited vs. the Assistant Commissioner

Citations:

1. Assistant Commissioner (CT) LTU, Kakinada and others Vs. Glaxo Smith Kline Consumer Health Care […]

ConsultEase Administrator wrote a new post, Section 8 of CGST Act:Composite & mixed supply updated till date 2 years, 4 months ago

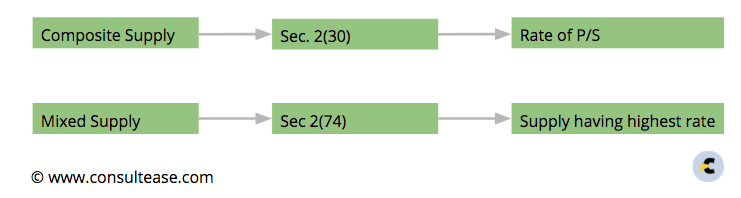

Section 8 of CGST Act: What it contains

Composite and mixed supply have different treatments. Section 8 of CGST Act provides for that treatment.

Supply in the CGST Act includes all the permutation and […]

CA Shafaly Girdharwal wrote a new post, Short title, extent and commencement: Section 1 of the CGST Act 2 years, 4 months ago

Short title, extent, and commencement: section 1 of the CGST Act as amended by the Finance Act 2023

Note: section 1 of the CGST Act is amended by the CGST Finance Act 2023.

TEXT Section:

(1) This Act may be […]

CA Shafaly Girdharwal wrote a new post, Case 5 which become the reason for first amendment in Constitution of India 2 years, 4 months ago

Introduction-

The province of Madras had issued a government order for reservation in medical seats. The applicant tried to get admission in one of the colleges but was denied due to her caste. She was aggrieved […]