Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

The GSTR 2A was introduced in GST in 2018. Many taxpayers had the confusion whether they can take the ITC if not appearing in GSTR 2A. At that time a clarification was given by the department that it is only to […]

Latest update- GST council in it’s 50th Meeting changed the provisions related to the online gaming. New definition is inserted. The tax rate on online gaming will be 28%. This was to nullify the effect of the […]

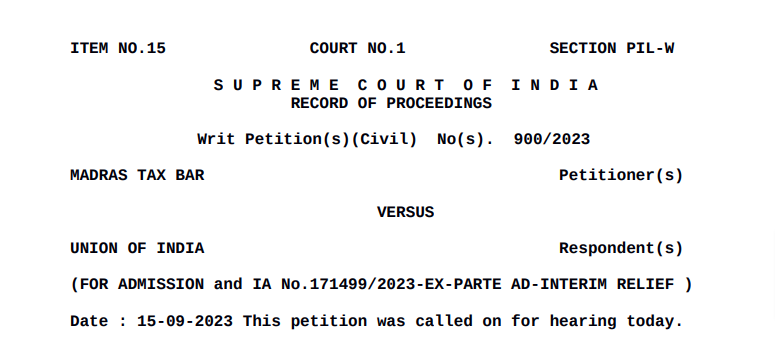

Madras tax bar association has challenged the composition of GSTAT

The Madras tax bar association challenged the constitutional validity of section 149 and […]

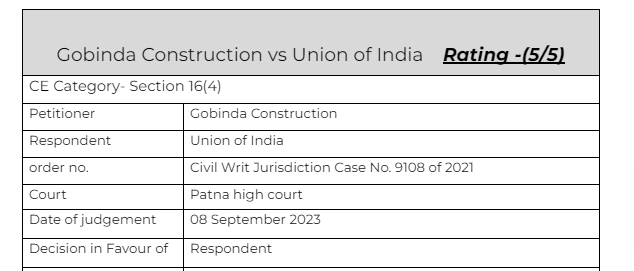

Case Covered:

Gobinda Construction vs Union of India

Citation:

1. Vinoy Viswam vs. Union of India & Ors

2. Modern Dental College and Research Centre & Ors. vs. State of Madhya Pradesh & Ors

3. K.T. Moopil […]

In compliance with the authority vested under subsection 4 of section 109 of the Central Goods and Services Tax Act, 2017 (12 of 2017), and as a replacement for Ministry of Finance, Department of Revenue’s […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewPrem wrote a new post, Adjournments should be given in case of genuine problem of Applicant(Pdf Attach) 2 years, 4 months ago

Cases covered:

M/s.Vadivel Pyro Works, VS The State Tax Officer

Citations:

Pinstar Automotive India Private Limited Vs. Additional Commissioner

Facts of the cases:

The audit of petitioner was conducted by […]

CA Shafaly Girdharwal wrote a new post, Cancellation of registration order should be reasoned(Pdf Attach) 2 years, 4 months ago

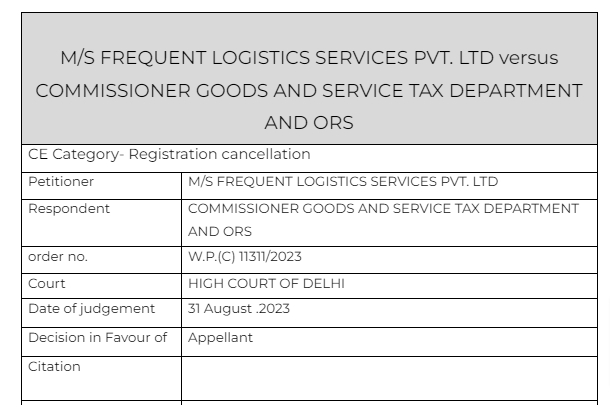

Cases covered:

M/S FREQUENT LOGISTICS SERVICES PVT. LTD versus COMMISSIONER GOODS AND SERVICE TAX DEPARTMENT AND ORS

Facts of the cases:

A SCN was sent to the appellant for cancellation of their […]

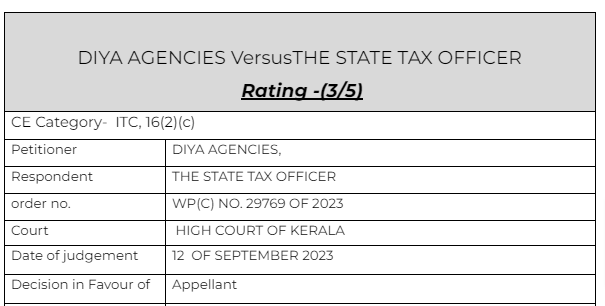

CA Shafaly Girdharwal wrote a new post, Only production of invoice and payment proof are not enough for ITC (Pdf Attach) 2 years, 4 months ago

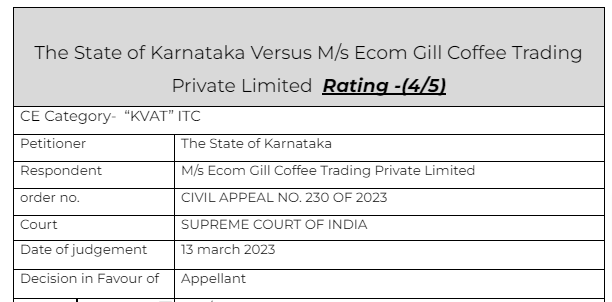

Cases covered:

The State of Karnataka Versus M/s Ecom Gill Coffee Trading Private Limited

Citations:

1. M/s. Bhagadia Brothers Vs.Additional Commissioner of Commercial Taxes,

2. Madhav Steel Corporation […]

CA Shafaly Girdharwal wrote a new post, ITC cant be denied for non appearance in GSTR 2A (Breaking) (Pdf Attach) 2 years, 4 months ago

The GSTR 2A was introduced in GST in 2018. Many taxpayers had the confusion whether they can take the ITC if not appearing in GSTR 2A. At that time a clarification was given by the department that it is only to […]

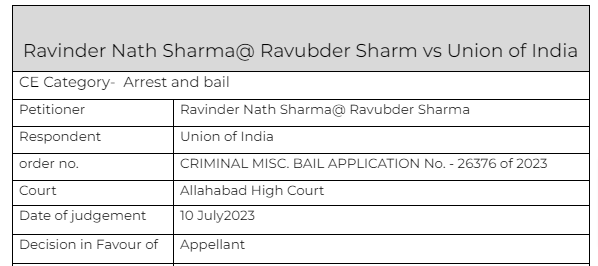

CA Shafaly Girdharwal wrote a new post, Bail granted on conditions by High court(Pdf Attach) 2 years, 5 months ago

Cases Covered:

Ravinder Nath Sharma@ Ravubder Sharm vs Union of India

Facts of the cases:

Learned counsel for the applicant submits that the applicant is innocent and has been falsely implicated in the […]

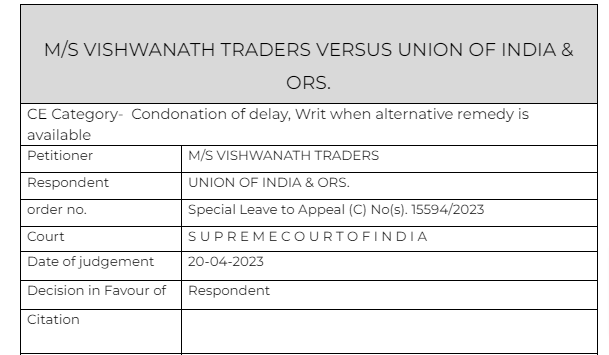

CA Shafaly Girdharwal wrote a new post, SLP rejected by Honorable Supreme court when the alternate remedy was time lapsed(Pdf Attach) 2 years, 5 months ago

Cases Covered:

M/S VISHWANATH TRADERS VERSUS UNION OF INDIA & ORS.

Facts of the cases:

In this case the Patna high court was approached by the petitioner. They received a notice but the date for filing an […]

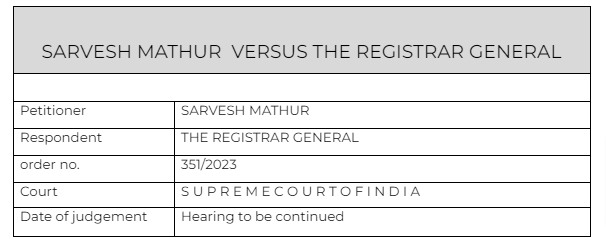

ConsultEase Administrator wrote a new post, SC asked HC’s why virtual hearing shouldn’t be allowed regularly 2 years, 5 months ago

Cases Covered:

SARVESH MATHUR VERSUS THE REGISTRAR GENERAL

Facts of the cases:

The petitioner, representing themselves in court, expresses dissatisfaction with the underutilization of Video Conferencing […]

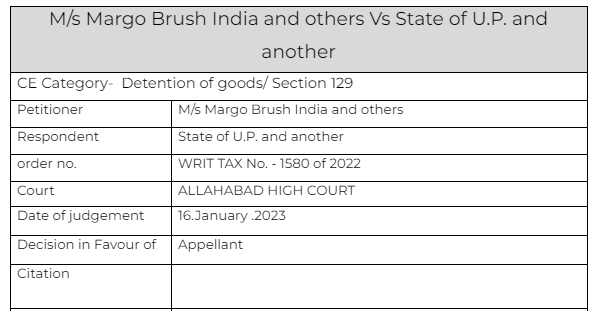

CA Shafaly Girdharwal wrote a new post, Detention order set aside by the court (Pdf Attach) 2 years, 5 months ago

Cases Covered:

M/s Margo Brush India and others Vs State of U.P. and another

Facts of the cases:

It is a case in which the goods in transit were accompanied by proper documents. When show cause notice was […]

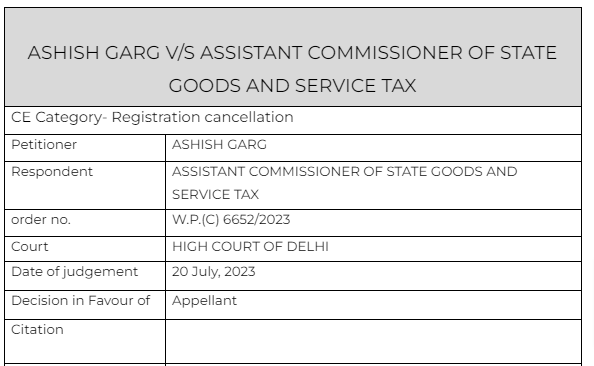

CA Shafaly Girdharwal wrote a new post, Cancellation of registration when returns were filed set aside by the court (Pdf Attach) 2 years, 5 months ago

Cases Covered:

ASHISH GARG V/S ASSISTANT COMMISSIONER OF STATE GOODS AND SERVICE TAX

Facts of the cases:

It is the petitioner’s case that the respondent took no immediate steps to process the said a […]

CA Shafaly Girdharwal wrote a new post, Interest on loan given for eligibility of Credit card is not chargeable to tax 2 years, 5 months ago

Cases Covered:

Ramesh Kumar Patodia Vs. City Bank N.A. and Ors.

Facts of the cases:

The bank offered the loan to the petitioner. It was given due to his eligibility on the credit card. The loan was […]

CA Shafaly Girdharwal wrote a new post, Prosecution in GST and FIR under IPC both can be done simultaneously (Pdf Attach) 2 years, 5 months ago

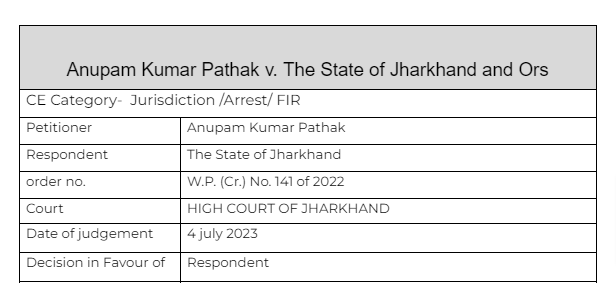

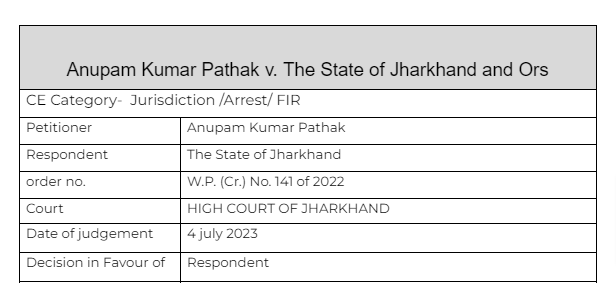

Cases Covered:

Anupam Kumar Pathak v. The State of Jharkhand and Ors

Citations:

1. Ramesh Chandra Jain & another v. State of Jharkhand

2. The State of Maharashtra & another v. Sayyed Hassan Sayyed […]

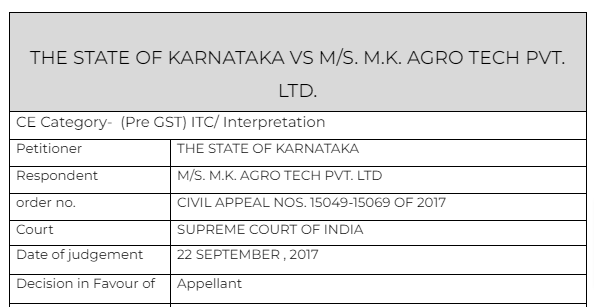

CA Shafaly Girdharwal wrote a new post, Exempted by product is also liable for ITC reversal (Pdf Attach) 2 years, 5 months ago

Cases Covered:

THE STATE OF KARNATAKA VS M/S. M.K. AGRO TECH PVT. LTD.

Citations:

1. Commissioner of Central Excise, Jaipur v. Mahavir Aluminum Ltd.

2. Ravi Prakash Refineries Private Ltd. v. State of […]

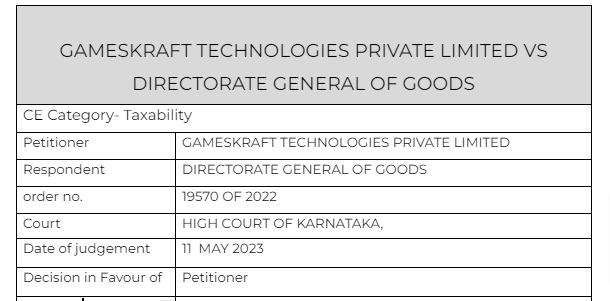

CA Shafaly Girdharwal wrote a new post, Tax on online gaming big judgement and its after effects (Pdf Attach) 2 years, 5 months ago

Latest update- GST council in it’s 50th Meeting changed the provisions related to the online gaming. New definition is inserted. The tax rate on online gaming will be 28%. This was to nullify the effect of the […]

ConsultEase Administrator wrote a new post, Petition in SC against the composition of GST appellate Tribunal (Pdf Attach) 2 years, 5 months ago

Cases Covered:

Madras tax bar VS Union of India

Madras tax bar association has challenged the composition of GSTAT

The Madras tax bar association challenged the constitutional validity of section 149 and […]

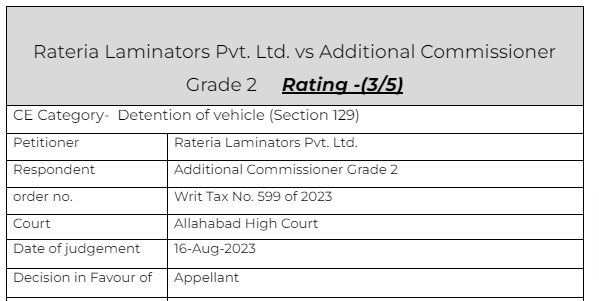

Prem wrote a new post, Detention memo should be a speaking order (Pdf Attach) 2 years, 5 months ago

Case Covered:

Rateria Laminators Pvt. Ltd. vs Additional Commissioner Grade 2

Citation:

1. Bharti Airtel Ltd. vs. State of U.P.

2. Assistant Commissioner (ST) vs. Satyam Shivam Papers Pvt. Ltd.

3. […]

CA Shafaly Girdharwal wrote a new post, 6 important questions about section 16(4) answered by the Court in case of Gobinda Construction 2 years, 5 months ago

Case Covered:

Gobinda Construction vs Union of India

Citation:

1. Vinoy Viswam vs. Union of India & Ors

2. Modern Dental College and Research Centre & Ors. vs. State of Madhya Pradesh & Ors

3. K.T. Moopil […]

ConsultEase Administrator wrote a new post, State Benches of the Goods and Services Tax Appellate Tribunal constituted by Govt (Read Notification) 2 years, 5 months ago

In compliance with the authority vested under subsection 4 of section 109 of the Central Goods and Services Tax Act, 2017 (12 of 2017), and as a replacement for Ministry of Finance, Department of Revenue’s […]

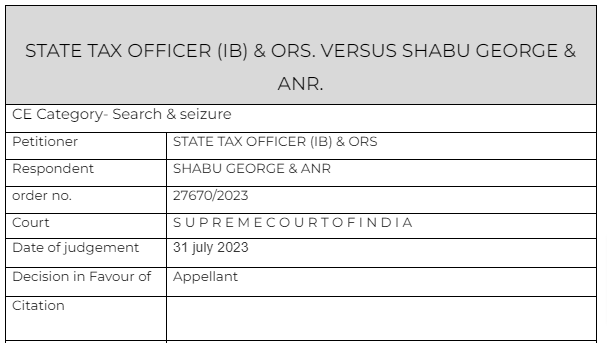

CA Shafaly Girdharwal wrote a new post, Cash cant be seized during search in GST (Pdf Attach) 2 years, 5 months ago

Cases Covered

STATE TAX OFFICER (IB) & ORS. VERSUS SHABU GEORGE & ANR.

Facts of the cases :

The writ is filed for the release of the cash that was seized from his premises in connection with an i […]

CA Shafaly Girdharwal wrote a new post, Animal feed and feed supplements constitute one class of products (Pdf Attach) 2 years, 5 months ago

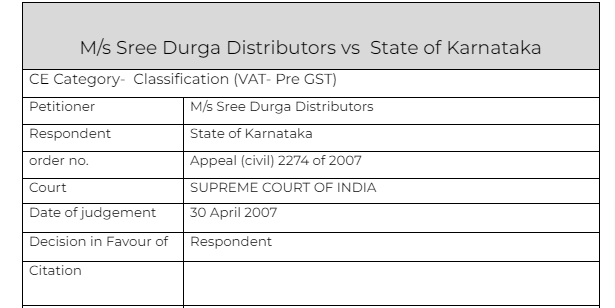

Cases Covered

M/s Sree Durga Distributors vs State of Karnataka

Facts of the cases :

According to the appellant, dog feed and cat feed are the products which would fall in the category of animal feed u […]

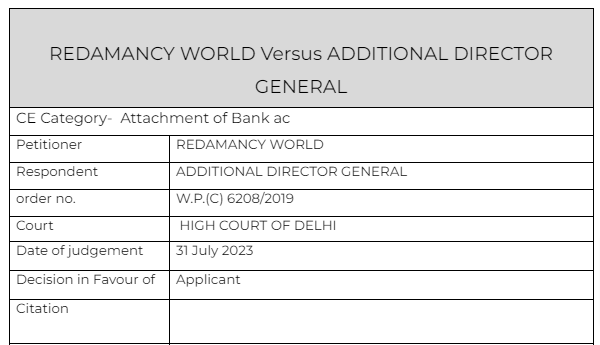

CA Shafaly Girdharwal wrote a new post, Attachment should be done only when it is necessary for protection of revenue (Pdf Attach) 2 years, 5 months ago

Cases Covered:

REDAMANCY WORLD Versus ADDITIONAL DIRECTOR GENERAL

Facts of the cases :

The petitioner became aware that its bank account was directed to be frozen by an communication dated 29.04.2019 […]