Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Cases Covered:

M/s. M. L. Dalmiya & Co. Ltd. & Anr.

Vs

The Additional Commissioner CGST & CX

Facts of the Cases:

I’m pleased to announce that the Hon’ble Calcutta High Court, where the case was argued by […]

Under the leadership of Prime Minister Shri Narendra Modi, the Union Cabinet has granted approval for the implementation of Phase III of the eCourts Project. This project, categorized as a Central Sector Scheme, […]

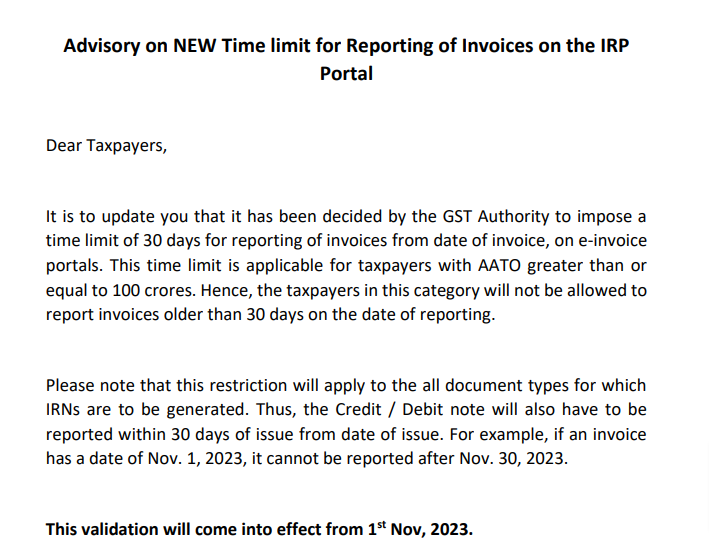

The GST e-invoice system issued an Update on September 11, 2023, indicating that, as per the directives of the GST Authority, a 30-day time limit for reporting invoices from the date of their issuance is now […]

A special parliament session is announced by the government. The parliamentary affairs minister Pralhad Joshi announce the session. The duration of the session will be 18th to 22nd September. This s […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

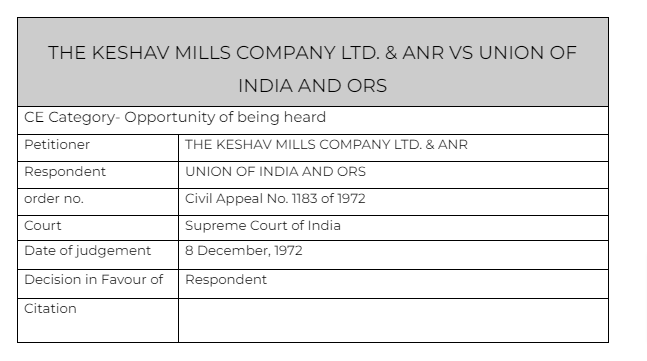

Read InterviewPrem wrote a new post, Exception for opportunity of being heard – Keshav Mills (Pdf Attach) 2 years, 5 months ago

Cases Covered:

THE KESHAV MILLS COMPANY LTD. & ANR VS UNION OF INDIA AND ORS

Facts of the Cases:

This is one of the historical cases related to the principle of natural justice. Every person should be […]

Prem wrote a new post, Service tax scn issued after GST 2 years, 5 months ago

Cases Covered:

M/s. M. L. Dalmiya & Co. Ltd. & Anr.

Vs

The Additional Commissioner CGST & CX

Facts of the Cases:

I’m pleased to announce that the Hon’ble Calcutta High Court, where the case was argued by […]

ConsultEase Administrator wrote a new post, The Cabinet has granted approval for a four-year implementation of eCourts Phase III. 2 years, 5 months ago

Under the leadership of Prime Minister Shri Narendra Modi, the Union Cabinet has granted approval for the implementation of Phase III of the eCourts Project. This project, categorized as a Central Sector Scheme, […]

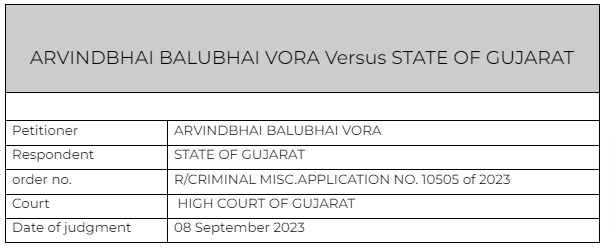

ConsultEase Administrator wrote a new post, High court give bail for ITC from a fake Supplier. 2 years, 5 months ago

Cases Covered:

ARVINDBHAI BALUBHAI VORA

Versus

STATE OF GUJARAT

Citation:

Sanjay Chandra v. Central Bureau of Investigation

Facts of the Cases:

The petitioner engaged in the procurement of goods and […]

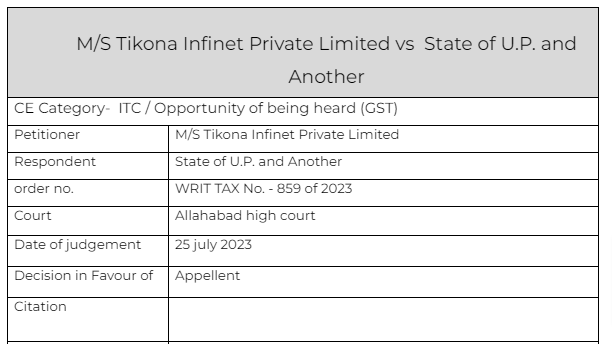

CA Shafaly Girdharwal wrote a new post, Deptt cant reverse ITC ignoring the fact that form was not available on the Portal (Pdf Attach) 2 years, 5 months ago

Cases Covered:

M/S Tikona Infinet Private Limited vs State of U.P. and Another

Facts of the case

The petitioner is a registered Company engaged in providing internet service across India from various […]

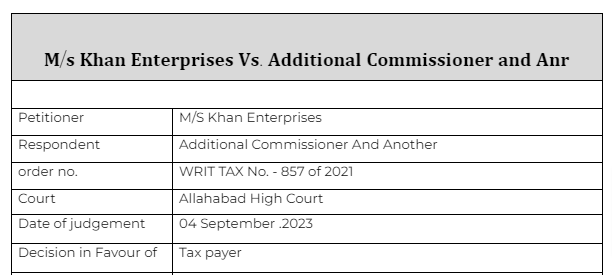

CA Shafaly Girdharwal wrote a new post, Detention of goods for wrong classification (Pdf Attach ) 2 years, 5 months ago

Cases Covered:

M/S Khan Enterprises Vs Additional Commissioner And Another

Citations:

Anandeshwar Traders vs. State of U.P.

Mohinder Singh Gill and another vs. The Chief Election Commissioner,New […]

ConsultEase Administrator wrote a new post, Creation a New Time limit for Reporting of invoice 2 years, 5 months ago

The GST e-invoice system issued an Update on September 11, 2023, indicating that, as per the directives of the GST Authority, a 30-day time limit for reporting invoices from the date of their issuance is now […]

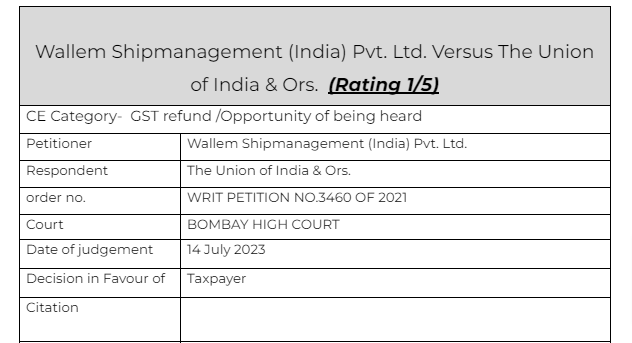

CA Shafaly Girdharwal wrote a new post, Department didn’t adjourned the time for reply and rejected refund- Rejection dropped by court 2 years, 5 months ago

Cases Covered:

Wallem Shipmanagement (India) Pvt. Ltd. Versus The Union of India & Ors

Facts of the case

A refund application was filed by the taxpayer. The respondent issued a SCN. The applicant […]

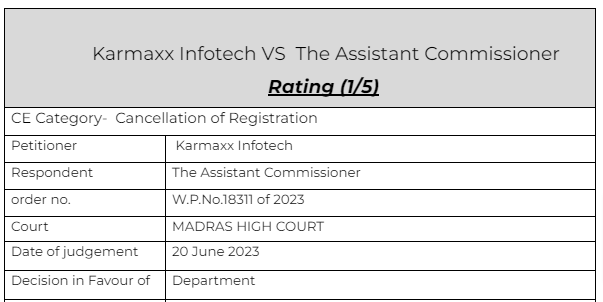

CA Shafaly Girdharwal wrote a new post, Assessee didnt responded to the Notices- Writ for cancelled registration set aside (Pdf Attach) 2 years, 5 months ago

Cases Covered:

Karmaxx Infotech VS The Assistant Commissioner

Citation:

1. Kaur & Singh v Collector of Central Excise,

Facts of the case

The principal place of business was changed by the taxpayer. B […]

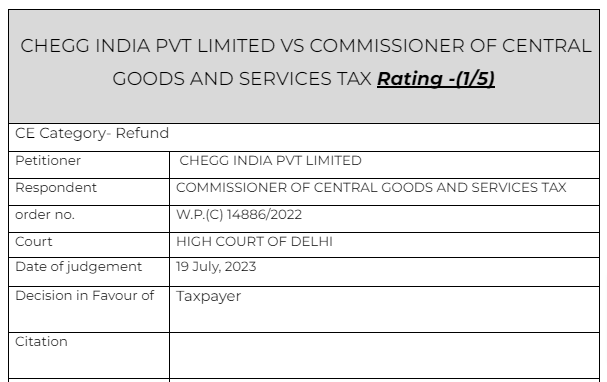

CA Shafaly Girdharwal wrote a new post, Refund rejected without proper reasons was set aside (Pdf Attach) 2 years, 5 months ago

Cases Covered:

CHEGG INDIA PVT LIMITED VS COMMISSIONER OF CENTRAL GOODS AND SERVICES TAX

Facts of the case

The petitioner is, inter alia, engaged in the business of software development, content […]

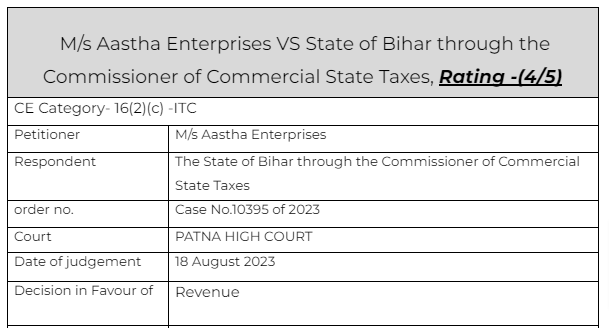

CA Shafaly Girdharwal wrote a new post, Mere payment via bank account wont make ITC eligible- Aastha Enterprises (PDF) 2 years, 5 months ago

Cases Covered:

M/s Aastha Enterprises VS State of Bihar through the Commissioner of Commercial State Taxes

Citation:

Sri Vinayaga Agencies v. The Assistant Commissioner (CT) & Anr.

M/s D.Y. Beathel […]

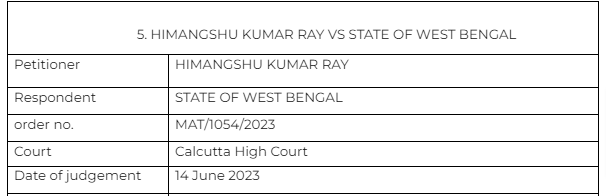

CA Shafaly Girdharwal wrote a new post, The information shared with lawyers is priviledged- Himangshu kumar (Pdf Attach) 2 years, 5 months ago

Case Covered:

HIMANGSHU KUMAR RAY VS STATE OF WEST BENGAL

Citation:

1. State of Punjab v. Sodhi Sukhdev Singh

2. Bakaulla Mollah v. Debiruddin Mollah

Facts of the case

An order was passed on the […]

CA Shafaly Girdharwal wrote a new post, Marketing the softwares sold by the foreign principal is not taxable in service tax (Pdf Attach ) 2 years, 5 months ago

Case Covered:

Sun Microsystems (I) PVT LTD., vs Commissioner of Central Excise & Service Tax , LTU

Citation:

1.M/s Arcelor Mittal Stainless India Pvt. Ltd. V/s Commissioner Service Tax, M […]

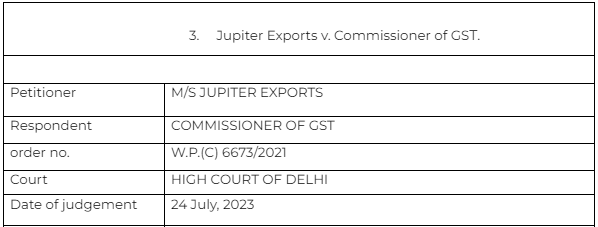

CA Shafaly Girdharwal wrote a new post, Rs. 5000 cost was levied on officer for not providing Opportunity of being heard- Jupiter Exports (PDF Attached) 2 years, 5 months ago

Case Covered:

Jupiter Exports v. Commissioner of GST

Citation:

1. Amman Match Company v. Assistant Commissioner of GST & C. Ex.

2. BA Continuum India Pvt. Ltd. v. Union of India and Others

3. Service […]

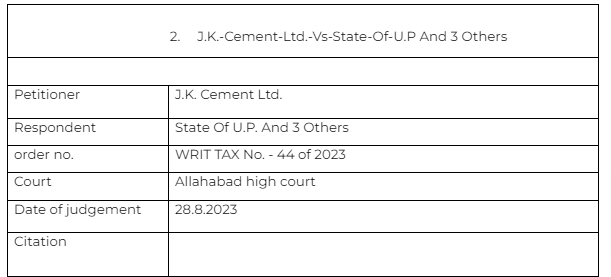

CA Shafaly Girdharwal wrote a new post, No penalty of E way bill when goods pass through the state and there is no evasion. (Pdf Attach) 2 years, 5 months ago

Case Covered:

J.K. Cement Ltd. Vs State Of U.P And 3 Others

Facts of the case

The petitioner being registered company incorporated under the Companies Act, 1956 is engaged in the manufacture and sale of […]

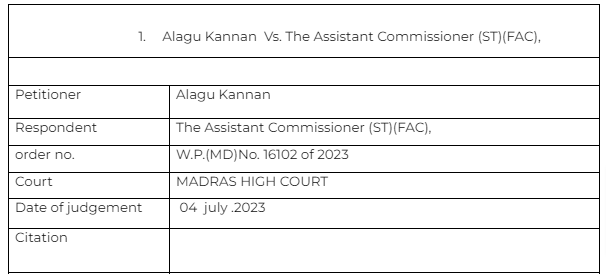

CA Shafaly Girdharwal wrote a new post, Period from 15.03.2020 till 28.02.2022 ought to be excluded from limitation- Alagu kannan (PDF attached) 2 years, 5 months ago

Case Covered:

Alagu Kannan Vs. The Assistant Commissioner (ST)

Facts of the case

The writ petition was filed challenging the impugned Assessment order, dated 09.03.2023. The taxpayer was registered in […]

CA Shafaly Girdharwal wrote a new post, Special parliament session from 18th to 22nd Sept may be Historic-See why? 2 years, 5 months ago

A special parliament session is announced by the government. The parliamentary affairs minister Pralhad Joshi announce the session. The duration of the session will be 18th to 22nd September. This s […]

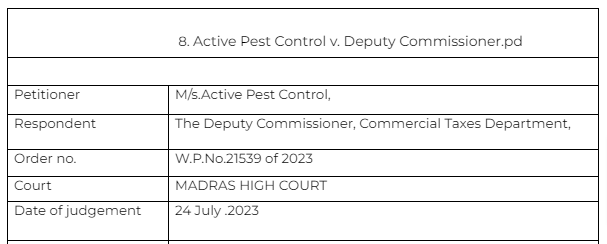

CA Shafaly Girdharwal wrote a new post, (Pdf Attact) The benefit of scheme of restoration of registration should be given to all taxpayers 2 years, 5 months ago

Case Covered:

Active Pest Control v. Deputy Commissioner.

Citation:

1. Suguna Cutpiece Centre Vs. The Appellate Joint Commissioner of GST

Facts of the case

In this the registration of petitioner was […]

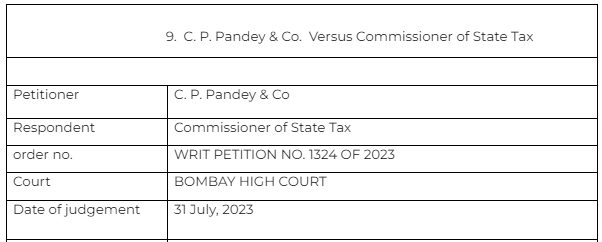

CA Shafaly Girdharwal wrote a new post, Registration cant be cancelled on the grounds not mentioned in SCN (Pdf Attach) 2 years, 5 months ago

Case Covered:

C. P. Pandey & Co. Versus Commissioner of State Tax

Citation:

Ramji Enterprises & Ors. Vs. Commissioner of State Tax & Ors

“Monit Trading Pvt. Ltd. Vs. Union of India & Or […]

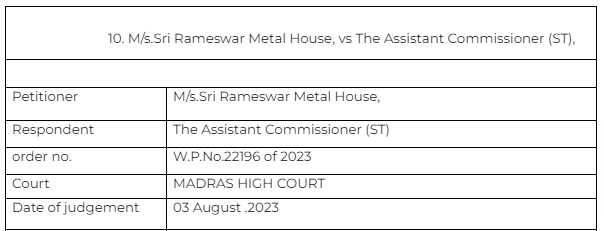

CA Shafaly Girdharwal wrote a new post, ITC ledger can be blocked multiple time (pdf Attach) 2 years, 5 months ago

Case Covered:

M/s. Sri Rameswar Metal House, vs The Assistant Commissioner (ST),

Citations :

Rajnandini Metal Limited Vs. Union of India

Facts of the case

The petitioner is a wholesale dealer […]