Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Notification No. 76/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 2nd July 2021

G.S.R. 470(E).—In exercise of the powers conferred by section 4 […]

Every business has benefits and drawbacks; it is all about finding the finest business ideas to generate money. It all comes down to whatever business you have the desire and ambition to succeed in. Your skillset […]

Introduction:

Ministry vides General Circular No. 09/2021 dated 30th June 2021 has extended the timeline for filing of certain Forms under the Companies Act, 2013/ LLP Act, 2008 (other than Form CHG-1, Form CHG-4 […]

Case Covered:

M/s Sachdeva Colleges Limited

Facts of the Case:

M/s Sachdeva college Ltd. is a Limited company incorporated under the Companies Act (hereinafter referred to as the ‘Applicant”) having its Regd. […]

Just a decade ago filing an ITR was considered a herculean task for the normal taxpayer It was some kind of rocket science to be performed by a few professionals. Undoubtedly, with the advent of income tax r […]

Circular No 12 of 2021

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, Dated 25 June 2021

Subject: Extension of time limits of certain compliances […]

MCA vide its General Circular No. 10/2021 dated 23.06.2021 has extended the timeline for allowing companies to conduct their EGMs Through Video Conferencing (VC) or Other Audio Visual Means(OAVM) up to 31st […]

About GST Training Course in English

What is more important for a successful business? Technical knowledge or Sales or marketing? All of these are important but the most important thing is handling Taxation and […]

Finance Act 2021, Section 206AB, and 206CCA are inserted in the Income-tax Act,1961 (effective from 1st July 2021). The government inserted these sections to trigger ITR filling among the defaulters.

CBDT issued a circular regarding the use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961. Two new sections are introduced, Section 206AB (Tax Deduction) and 206CCA (Tax Collection). By […]

Section 206AB and 206CCA are inserted in the income tax Act. These sections belong to TDS. Some more taxpayers will fall under the TDS provisions. It is introduced to increase tax compliance. Many taxpayers […]

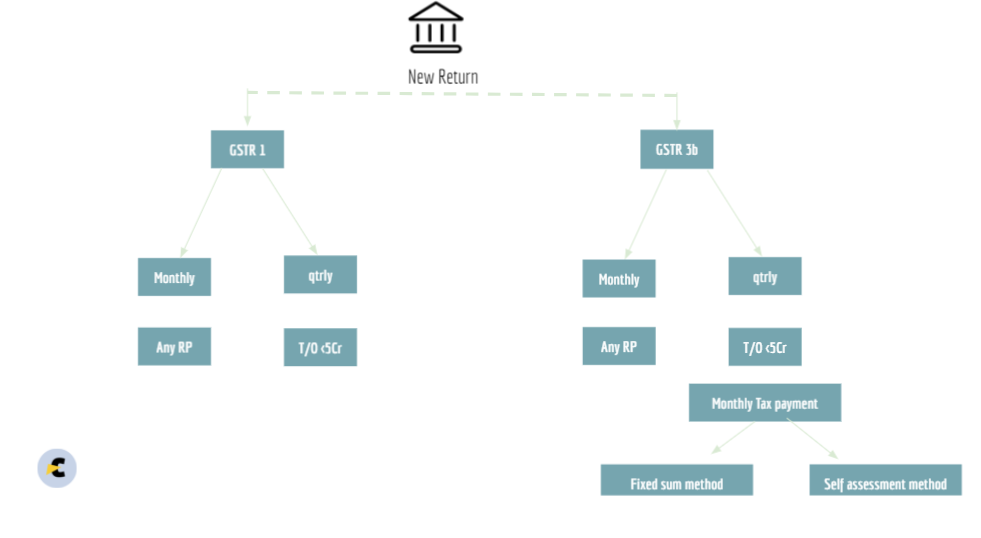

GST returns are a mechanism of self-assessment. Government desire that taxpayer should file it on time. Many events are connected with the late filing of GST returns. Here we have incorporated all the important […]

Union of India

Facts of the Case:

By filing this petition under Article 226 of the Constitution of India, the petitioner has prayed for a declaration that section […]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 14th June 2021

PRESS RELEASE

Relaxation in electronic filing of Income Tax Forms 15CA / 15CB

The audit is getting complex day by day. The responsibility attached to it is increasing. But so many changes in law and compliance make it very hard. ICAI is giving access to its members to free digital audit […]

State of Gujarat

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicants have prayed for the following […]

Introduction

CBDT has introduced a new income tax return filing portal. Return filing is now way simpler than earlier. In the case of small taxpayers, it can be filed without the help of any professional. It is […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, CBDT Notified Rule 8AB 4 years, 7 months ago

Notification No. 76/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 2nd July 2021

G.S.R. 470(E).—In exercise of the powers conferred by section 4 […]

ConsultEase Administrator wrote a new post, Best Business To Start In India With Low Investment 4 years, 7 months ago

Every business has benefits and drawbacks; it is all about finding the finest business ideas to generate money. It all comes down to whatever business you have the desire and ambition to succeed in. Your skillset […]

ConsultEase Administrator wrote a new post, MCA Relaxes the Additional Fee on Filing of Certain Forms under Co. Act, 2013/LLP Act, 2008 4 years, 7 months ago

Introduction:

Ministry vides General Circular No. 09/2021 dated 30th June 2021 has extended the timeline for filing of certain Forms under the Companies Act, 2013/ LLP Act, 2008 (other than Form CHG-1, Form CHG-4 […]

ConsultEase Administrator wrote a new post, Haryana AAR Order In the Case of M/s Sachdeva Colleges Limited 4 years, 7 months ago

Case Covered:

M/s Sachdeva Colleges Limited

Facts of the Case:

M/s Sachdeva college Ltd. is a Limited company incorporated under the Companies Act (hereinafter referred to as the ‘Applicant”) having its Regd. […]

ConsultEase Administrator wrote a new post, Finance Minister’s Press Conference 28th June, 2021 4 years, 7 months ago

Economic Relief From Pandemic

1.1 Lakh Cr Loan Guarantee Scheme for COVID Affected Sectors

Health Sector: Rs. 50,000 crore

Aimed at upscaling medical infrastructure targeting underserved areas.

• Gu […]

ConsultEase Administrator wrote a new post, Calculation Of Income Tax And Filing Of ITR On Income Tax Portal 4 years, 7 months ago

Just a decade ago filing an ITR was considered a herculean task for the normal taxpayer It was some kind of rocket science to be performed by a few professionals. Undoubtedly, with the advent of income tax r […]

ConsultEase Administrator wrote a new post, Madras HC in the case of M/s. ARS Steels & Alloy International Pvt. Ltd 4 years, 7 months ago

Case covered:

M/s. ARS Steels & Alloy International Pvt. Ltd

Versus

The State Tax Officer

Common Order:

This batch of Writ Petitions relates to two sets of assessment orders passed in the case of two […]

ConsultEase Administrator wrote a new post, CBDT has extended the time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic 4 years, 7 months ago

Circular No 12 of 2021

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, Dated 25 June 2021

Subject: Extension of time limits of certain compliances […]

ConsultEase Administrator wrote a new post, MCA issued clarification on extended timeline for allowing companies to hold their EGM through Video Conferencing upto December 31, 2021. 4 years, 7 months ago

MCA vide its General Circular No. 10/2021 dated 23.06.2021 has extended the timeline for allowing companies to conduct their EGMs Through Video Conferencing (VC) or Other Audio Visual Means(OAVM) up to 31st […]

ConsultEase Administrator wrote a new post, Join our GST Training Course in English starting from 10th July, 2021 by CA Shafaly Girdharwal 4 years, 7 months ago

About GST Training Course in English

What is more important for a successful business? Technical knowledge or Sales or marketing? All of these are important but the most important thing is handling Taxation and […]

ConsultEase Administrator wrote a new post, Step by Step Process to Follow the Compliances for Section 206AB & 206AA 4 years, 7 months ago

Finance Act 2021, Section 206AB, and 206CCA are inserted in the Income-tax Act,1961 (effective from 1st July 2021). The government inserted these sections to trigger ITR filling among the defaulters.

Section […]

ConsultEase Administrator wrote a new post, CBDT issues Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961 4 years, 7 months ago

CBDT issued a circular regarding the use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961. Two new sections are introduced, Section 206AB (Tax Deduction) and 206CCA (Tax Collection). By […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on section 206AB and 206CCA on TDS 4 years, 7 months ago

Section 206AB and 206CCA are inserted in the income tax Act. These sections belong to TDS. Some more taxpayers will fall under the TDS provisions. It is introduced to increase tax compliance. Many taxpayers […]

ConsultEase Administrator wrote a new post, Late fees and interest for late filing of GST returns 4 years, 8 months ago

GST returns are a mechanism of self-assessment. Government desire that taxpayer should file it on time. Many events are connected with the late filing of GST returns. Here we have incorporated all the important […]

ConsultEase Administrator wrote a new post, Bombay HC in the case of Dharmendra M. Jani Versus Union of India 4 years, 8 months ago

Case Covered:

Dharmendra M. Jani

Versus

Union of India

Facts of the Case:

By filing this petition under Article 226 of the Constitution of India, the petitioner has prayed for a declaration that section […]

ConsultEase Administrator wrote a new post, Relaxation in electronic filing of Income Tax Forms 15CA / 15CB: CBDT 4 years, 8 months ago

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 14th June 2021

PRESS RELEASE

Relaxation in electronic filing of Income Tax Forms 15CA / 15CB

As per […]

ConsultEase Administrator wrote a new post, ICAI giving access to free digital audit tools 4 years, 8 months ago

The audit is getting complex day by day. The responsibility attached to it is increasing. But so many changes in law and compliance make it very hard. ICAI is giving access to its members to free digital audit […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of Messers SB Traders Versus State of Gujarat 4 years, 8 months ago

Case Covered:

Messers SB Traders

Versus

State of Gujarat

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicants have prayed for the following […]

ConsultEase Administrator wrote a new post, Guidelines for compulsory selection of returns for Complete Scrutiny during the Financial Year 2021- 22 4 years, 8 months ago

To

All Pr. Chief-Commissioners of Income-tax/Chief-Commissioner of Income-Tax

All Pr. Director-Generals of Income-tax/Director-Generals of Income-tax.

Madam/Sir

Subject: Guidelines for compulsory […]

CA Shafaly Girdharwal wrote a new post, How To File ITR Using The New Filing Portal of Income Tax 4 years, 8 months ago

Introduction

CBDT has introduced a new income tax return filing portal. Return filing is now way simpler than earlier. In the case of small taxpayers, it can be filed without the help of any professional. It is […]