Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

On Monday (February 19), the Supreme Court stayed proceedings in the criminal case against Karnataka Chief Minister Siddaramaiah, related to a protest march conducted by him in 2022 demanding the […]

In a recent judicial pronouncement, the Madras High Court rendered a significant decision in the case of Ingram Micro India (P.) Ltd. v. State Tax Officer, highlighting the crucial importance of […]

Development Rights are leviable to GST – Telangana High Court

M/s. Prahitha Constructions Private Limited, WP No. 5493 of 2020

A. Limited contentions of the Petitioner

1. Transfer of Development Rights of land […]

Overview of the Central Board of Indirect Taxes and Customs (CBIC) Instruction No. 02/2024-Customs dated February 15, 2024.

Emphasis on timely sharing of incident reports to enhance risk […]

Navigating GST Compliance for E-commerce Entities: Recent Amendments and Implications

In the rapidly evolving landscape of e-commerce, adherence to Goods and Services Tax (GST) regulations is paramount. Recent […]

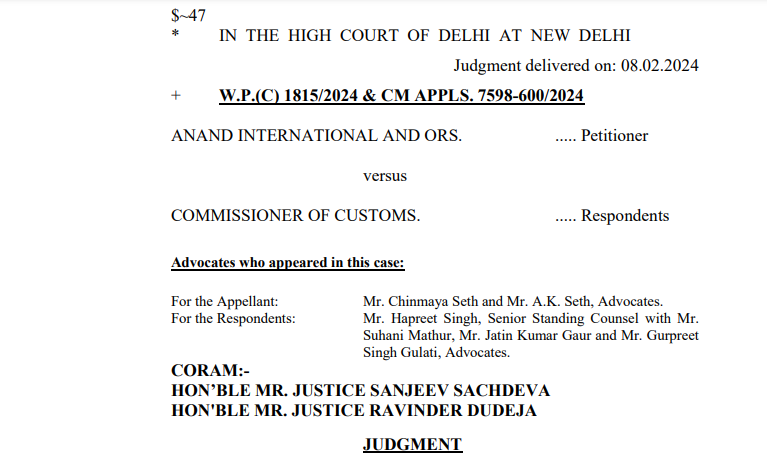

In a recent ruling, the Delhi High Court has clarified an important aspect regarding the calculation of time periods under Section 28(9) of the Customs Act. The bench comprising Justice […]

In a recent development the honourable SC has held that electoral bonds are unconstitutional. The court also made some observations regarding section 182 of Companies Act. This section was amended to go away with […]

In a notable legal development, the Hon’ble Calcutta High Court delivered a significant judgment in the case of PBL Transport Corporation (P) (Ltd.) v. Assistant Commissioner (ST), Writ Petition No. 33477 of […]

Introduction:

The Micro, Small, and Medium Enterprise (MSME) sector significantly contribute to India’s economic landscape. This article explores recent amendments to the Income Tax Act (ITA) related to MSMEs, f […]

The Allahabad High Court ruled that the principle of res judicata does not apply across different assessment years in tax matters. However, it held that the tax department cannot change its stance for the same […]

Supreme Court Declares Electoral Bond Scheme Unconstitutional

On February 15, the Supreme Court delivered its verdict on a series of petitions challenging the validity of the Electoral Bond scheme, which enables […]

In 2024, an aspiring business should look to identify the ongoing market trends and capitalize on them. This is the best way to keep your business growing and achieve your aspirations.

Pleading

The present petition has been filed to assail the order dated 21.2.2023 passed by the Joint Director (CGST) (Appeals), Noida. “The operative portion of the order reads as be […]

In a recent ruling by the Income Tax Appellate Tribunal, Nagpur Bench, the appeal of Mr. Sanjay Kisan Chopde against the Income Tax Department for the assessment year 2014-15 was meticulously […]

A senior official from the Finance Ministry has indicated that any significant changes to the Goods and Services Tax (GST) rates are likely to occur only after the upcoming Lok Sabha […]

Expat salary is under the lanses of Department. The supreme court already decided in a the case of Northern Operating Systems Private Limited (NOS). In this case the amount was deemed to be service and was made […]

The recent election of Manoj Sonkar, a Bharatiya Janata Party (BJP) candidate, as the Mayor of Chandigarh has been marred by controversy, with allegations of fraud and irregularities prompting legal challenges and […]

Overview of the Dispute

At the heart of the matter lies the verification of tax dues intertwined with claims over specific pieces of jewelry. The multiplicity of parties involved adds layers of complexity to the […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Case against Karnataka CM stayed by SC 1 year, 12 months ago

On Monday (February 19), the Supreme Court stayed proceedings in the criminal case against Karnataka Chief Minister Siddaramaiah, related to a protest march conducted by him in 2022 demanding the […]

ConsultEase Administrator wrote a new post, Madras High Court Emphasizes Evidence in Tax Assessments 1 year, 12 months ago

In a recent judicial pronouncement, the Madras High Court rendered a significant decision in the case of Ingram Micro India (P.) Ltd. v. State Tax Officer, highlighting the crucial importance of […]

Prem wrote a new post, Development Rights are leviable to GST – Telangana High Court 1 year, 12 months ago

Development Rights are leviable to GST – Telangana High Court

M/s. Prahitha Constructions Private Limited, WP No. 5493 of 2020

A. Limited contentions of the Petitioner

1. Transfer of Development Rights of land […]

Prem wrote a new post, Enhanced Reporting Guidelines for Customs Incidents and Arrests 1 year, 12 months ago

Introduction

Overview of the Central Board of Indirect Taxes and Customs (CBIC) Instruction No. 02/2024-Customs dated February 15, 2024.

Emphasis on timely sharing of incident reports to enhance risk […]

ConsultEase Administrator wrote a new post, “GST Compliance in E-commerce: Recent Changes and Impact” 1 year, 12 months ago

Navigating GST Compliance for E-commerce Entities: Recent Amendments and Implications

In the rapidly evolving landscape of e-commerce, adherence to Goods and Services Tax (GST) regulations is paramount. Recent […]

ConsultEase Administrator wrote a new post, Delhi High Court Rules on Customs Act Appeal Period Calculation 1 year, 12 months ago

In a recent ruling, the Delhi High Court has clarified an important aspect regarding the calculation of time periods under Section 28(9) of the Customs Act. The bench comprising Justice […]

CA Shafaly Girdharwal wrote a new post, Provisions of electoral bonds are unconstitutional- SC 2 years ago

In a recent development the honourable SC has held that electoral bonds are unconstitutional. The court also made some observations regarding section 182 of Companies Act. This section was amended to go away with […]

ConsultEase Administrator wrote a new post, Supreme Court Directives on Electoral Bonds: Key Points and Implications 2 years ago

The Supreme Court’s directives on Electoral Bonds:

A. State Bank of India (SBI) to halt issuance of electoral bonds.

B. SBI to furnish details of electoral bonds purchased since April 12, 2019, to the […]

ConsultEase Administrator wrote a new post, Calcutta High Court Rules on Audit Report in PBL Transport Case 2 years ago

In a notable legal development, the Hon’ble Calcutta High Court delivered a significant judgment in the case of PBL Transport Corporation (P) (Ltd.) v. Assistant Commissioner (ST), Writ Petition No. 33477 of […]

Prem wrote a new post, “Recent Income Tax Amendments and MSMEs: Implications” 2 years ago

Introduction:

The Micro, Small, and Medium Enterprise (MSME) sector significantly contribute to India’s economic landscape. This article explores recent amendments to the Income Tax Act (ITA) related to MSMEs, f […]

ConsultEase Administrator wrote a new post, Res judicata not to apply in tax cases – HC 2 years ago

The Allahabad High Court ruled that the principle of res judicata does not apply across different assessment years in tax matters. However, it held that the tax department cannot change its stance for the same […]

ConsultEase Administrator wrote a new post, Supreme Court Invalidates Electoral Bond Scheme 2 years ago

Supreme Court Declares Electoral Bond Scheme Unconstitutional

On February 15, the Supreme Court delivered its verdict on a series of petitions challenging the validity of the Electoral Bond scheme, which enables […]

ConsultEase Administrator wrote a new post, Content Marketing Trends You Need to Know in 2024 2 years ago

In 2024, an aspiring business should look to identify the ongoing market trends and capitalize on them. This is the best way to keep your business growing and achieve your aspirations.

Currently, the most […]

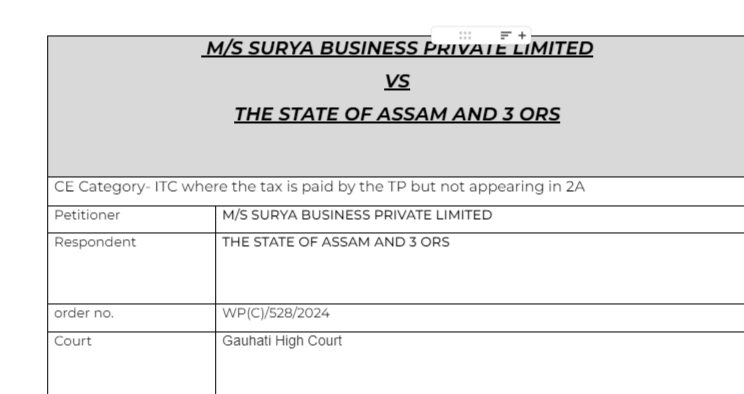

CA Shafaly Girdharwal wrote a new post, ITC can be claimed on invoices. HC dropped the notice 2 years ago

Details of the case

Citations

Suncraft Energy Private Limited and another vs. The Assistant Commissioner

Union of India vs. Bharti Airtel Limited and others

Pleading

To stay the SCN issued for recovery of […]

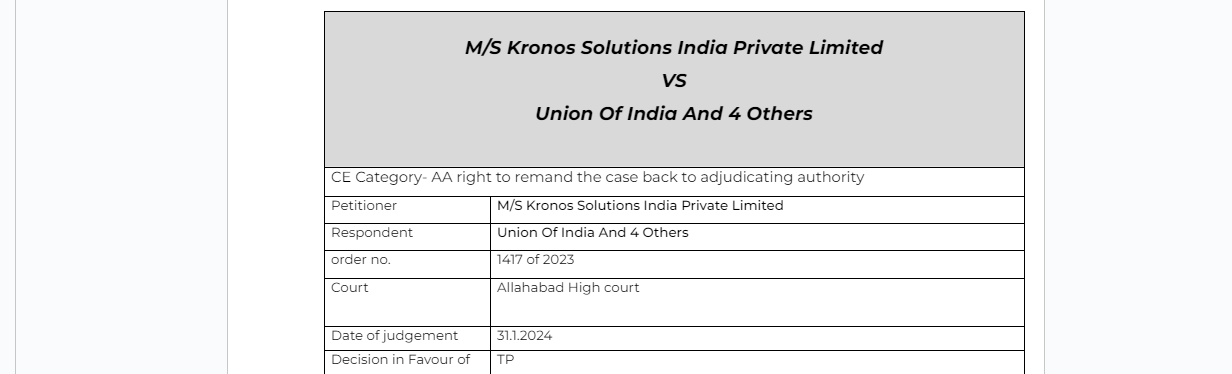

CA Shafaly Girdharwal wrote a new post, AA can’t remind back the case to adjudicating authority- HC 2 years ago

Details of the case

Pleading

The present petition has been filed to assail the order dated 21.2.2023 passed by the Joint Director (CGST) (Appeals), Noida. “The operative portion of the order reads as be […]

Prem wrote a new post, Merely entry in Form 26AS does not make it taxable, Revenue will have to prove income 2 years ago

In a recent ruling by the Income Tax Appellate Tribunal, Nagpur Bench, the appeal of Mr. Sanjay Kisan Chopde against the Income Tax Department for the assessment year 2014-15 was meticulously […]

Prem wrote a new post, “Finance Ministry Foresees Post-Election GST Rate Changes” 2 years ago

A senior official from the Finance Ministry has indicated that any significant changes to the Goods and Services Tax (GST) rates are likely to occur only after the upcoming Lok Sabha […]

CA Shafaly Girdharwal wrote a new post, Bombay High court stayed the order demanding tax on Expat Salary 2 years ago

Expat salary is under the lanses of Department. The supreme court already decided in a the case of Northern Operating Systems Private Limited (NOS). In this case the amount was deemed to be service and was made […]

Prem wrote a new post, Chandigarh Mayor Election Controversy: High Court Intervenes Amid Fraud Claims” 2 years ago

The recent election of Manoj Sonkar, a Bharatiya Janata Party (BJP) candidate, as the Mayor of Chandigarh has been marred by controversy, with allegations of fraud and irregularities prompting legal challenges and […]

Prem wrote a new post, Navigating Tax Disputes: Insights from the Bombay High Court Judgment 2 years ago

Overview of the Dispute

At the heart of the matter lies the verification of tax dues intertwined with claims over specific pieces of jewelry. The multiplicity of parties involved adds layers of complexity to the […]