CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

Gujrat High court notice on GST Transitional credit:

In its recent observation in the case of M/s Jay Chemical Industries Limited. The honorable high court sent the notice to the central government and GST […]

Detail Guide on GST audit by CA/CMA

Mandatory Audit under GST

Section 35(5) of CGST Act, provide for the GST audit of accounts for a taxpayer. This audit is to be conducted by a Chartered Accountant or Cost and […]

Refund of penalties in GST:

There may be some cases when the penalties are deposited in excess by taxpayers. Whether the refund of penalties in GST deposited wrongly will be available. Let us go through the […]

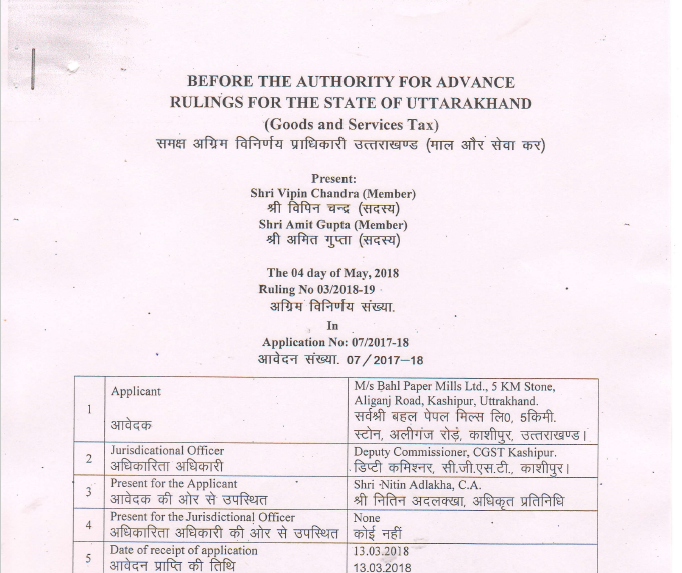

AAR ruling fuels fears of double GST

An order by the Authority for Advance Rulings (AAR) has sparked fears of double taxation under the goods and services tax (GST) for goods imported on the basis of cost, […]

Sale of Hotel Room to SEZ in GST

This is a controversial provision of the law, section 7(5)(b) provide for the nature of supply in cases where SEZ unit or SEZ developer are involved.

Section 7(5) of IGST […]

More power to anti-profiteering authority in GST

CGST fifth amendment rules introduced by CBIC via notification no. 26/2018. Rule 133 of CGST is amended and following provision is inserted.

“(3) Where the A […]

GST on Natural gas and ATF may be a reality soon:

GST council in its next meeting may decide for GST on natural gas and ATF. Petroleum products are outside the preview of GST. Levy section of GST has deferred the […]

In a recent advanced ruling it is clarified that coaching classes will be chargeable at 18% GST. Coaching classes dont have any specific exemption in GST. Thus these activities will be covered in general rate.

First GST anti-profiteering decision for Honda Cars:

First anti-profiteering application raised for Rs. 10,550 by a car buyer is quashed by authority. The buyer alleged that the tax on the car was 51% earlier […]

रास्ते में माल वाहनो को रोकने और जाँचने से संबंधित प्रक्रिया

GST में माल वाहनों को रोकने से संबंधित एक अधिसूचना जारी की गयी हैI GST सर्क्युलर क्रमांक 41/2018 में ईस विषय से संबंधित समस्याओ को दूर किया गया है I […]

Advance ruling on intermediary services in GST:

An advance ruling is given by AAR West Bengal. In GST export of service is required to fulfil five basic conditions.One of those conditions is that place of supply […]

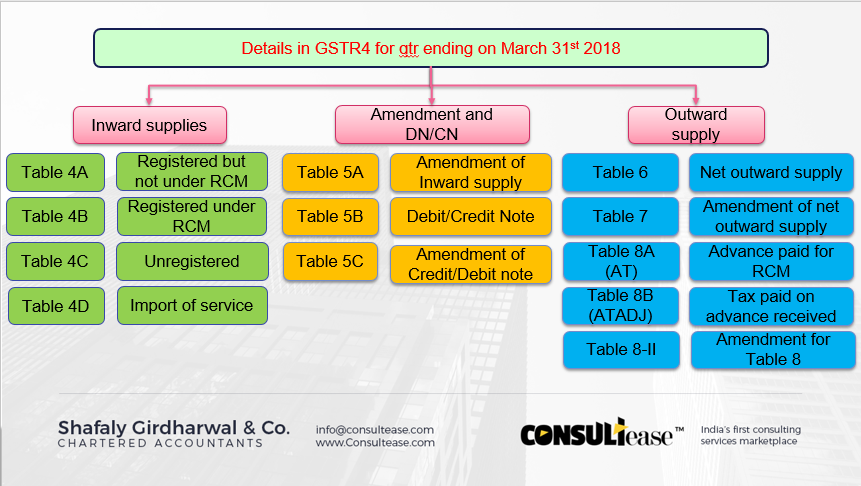

Filing of GSTR 4 for qtr ended on 31st March:

New utility for the filing of GSTR 4 is released by CBIC.This utility is named as GST offline utility v2.1.Let us discuss some important points related to this […]

How to file LUT for exports for FY 2018-19:

LUT is required to be filed by all exporters in India. It is required for export of goods and/or services without payment of IGST. Its validity is year wise so for the […]

How to know about the e-way bills generated on his GSTIN by other person/party?

As per the rule, the taxpayer orrecipient can reject the e-way bill generated on his GSTIN by other parties. The following options […]

Who can reject the e-way bill and Why?

The person who causes transport of goods shall generate the e-way bill specifying the details of other person as a recipient of goods. There is a provision in the common […]

Due dates for filing GSTR 1 of April to June 2018:

In a recent notification CBEC has notified the due dates for filing the GSTR 1 from April to June 2018. Following will be the date sheet for filing the GSTR 1 […]

CA Shafaly Girdharwal

CA

Paid User

@shaifalygirdharwal

active 6 years, 5 months agoCA Shafaly Girdharwal

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

5.0Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by CA Shafaly Girdharwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Gujrat High court notice on GST Transitional credit 7 years, 6 months ago

Gujrat High court notice on GST Transitional credit:

In its recent observation in the case of M/s Jay Chemical Industries Limited. The honorable high court sent the notice to the central government and GST […]

CA Shafaly Girdharwal wrote a new post, Detail Guide on GST audit by CA/CMA 7 years, 6 months ago

Detail Guide on GST audit by CA/CMA

Mandatory Audit under GST

Section 35(5) of CGST Act, provide for the GST audit of accounts for a taxpayer. This audit is to be conducted by a Chartered Accountant or Cost and […]

CA Shafaly Girdharwal‘s profile was updated 7 years, 7 months ago

CA Shafaly Girdharwal wrote a new post, Refund of penalties in GST 7 years, 7 months ago

Refund of penalties in GST:

There may be some cases when the penalties are deposited in excess by taxpayers. Whether the refund of penalties in GST deposited wrongly will be available. Let us go through the […]

CA Shafaly Girdharwal wrote a new post, AAR ruling fuels fears of double GST 7 years, 7 months ago

AAR ruling fuels fears of double GST

An order by the Authority for Advance Rulings (AAR) has sparked fears of double taxation under the goods and services tax (GST) for goods imported on the basis of cost, […]

CA Shafaly Girdharwal wrote a new post, Sale of Hotel Room to SEZ in GST 7 years, 7 months ago

Sale of Hotel Room to SEZ in GST

This is a controversial provision of the law, section 7(5)(b) provide for the nature of supply in cases where SEZ unit or SEZ developer are involved.

Section 7(5) of IGST […]

CA Shafaly Girdharwal wrote a new post, More power to anti profiteering authority in GST 7 years, 8 months ago

More power to anti-profiteering authority in GST

CGST fifth amendment rules introduced by CBIC via notification no. 26/2018. Rule 133 of CGST is amended and following provision is inserted.

“(3) Where the A […]

CA Shafaly Girdharwal wrote a new post, CBIC released list of items liable for fast disposal on seizure 7 years, 8 months ago

CBIC released list of items liable for fast disposal on seizure

(1) Salt and hygroscopic substances

(2) Raw (wet and salted) hides and skins

(3) Newspapers and periodicals

(4) Menthol, Camphor, […]

CA Shafaly Girdharwal wrote a new post, GST on Natural gas and ATF may be a reality soon 7 years, 8 months ago

GST on Natural gas and ATF may be a reality soon:

GST council in its next meeting may decide for GST on natural gas and ATF. Petroleum products are outside the preview of GST. Levy section of GST has deferred the […]

CA Shafaly Girdharwal wrote a new post, Coaching classes are liable for 18% GST:AAR 7 years, 9 months ago

In a recent advanced ruling it is clarified that coaching classes will be chargeable at 18% GST. Coaching classes dont have any specific exemption in GST. Thus these activities will be covered in general rate.

CA Shafaly Girdharwal wrote a new post, First GST anti profiteering decision for Honda Cars 7 years, 9 months ago

First GST anti-profiteering decision for Honda Cars:

First anti-profiteering application raised for Rs. 10,550 by a car buyer is quashed by authority. The buyer alleged that the tax on the car was 51% earlier […]

CA Shafaly Girdharwal wrote a new post, रास्ते में माल वाहनो को रोकने और जाँचने से संबंधित प्रक्रिया 7 years, 9 months ago

रास्ते में माल वाहनो को रोकने और जाँचने से संबंधित प्रक्रिया

GST में माल वाहनों को रोकने से संबंधित एक अधिसूचना जारी की गयी हैI GST सर्क्युलर क्रमांक 41/2018 में ईस विषय से संबंधित समस्याओ को दूर किया गया है I […]

CA Shafaly Girdharwal wrote a new post, Circular No. 41 CGST: Interception of vehicle 7 years, 10 months ago

Circular No. 41 CGST Interception of vehicle:

Some new forms are also issued via this notification:

Subject: Procedure for interception of conveyances for inspection of goods in movement, and detention, […]

CA Shafaly Girdharwal wrote a new post, Advance ruling on intermediary services in GST 7 years, 10 months ago

Advance ruling on intermediary services in GST:

An advance ruling is given by AAR West Bengal. In GST export of service is required to fulfil five basic conditions.One of those conditions is that place of supply […]

CA Shafaly Girdharwal wrote a new post, Filing of GSTR 4 for qtr ended on 31st March 7 years, 10 months ago

Filing of GSTR 4 for qtr ended on 31st March:

New utility for the filing of GSTR 4 is released by CBIC.This utility is named as GST offline utility v2.1.Let us discuss some important points related to this […]

CA Shafaly Girdharwal wrote a new post, How to file LUT for exports for FY 2018-19 7 years, 10 months ago

How to file LUT for exports for FY 2018-19:

LUT is required to be filed by all exporters in India. It is required for export of goods and/or services without payment of IGST. Its validity is year wise so for the […]

CA Shafaly Girdharwal wrote a new post, How to know about the e-way bills generated by other person/party? 7 years, 10 months ago

How to know about the e-way bills generated on his GSTIN by other person/party?

As per the rule, the taxpayer orrecipient can reject the e-way bill generated on his GSTIN by other parties. The following options […]

CA Shafaly Girdharwal wrote a new post, Who can reject the e-way bill and Why? 7 years, 10 months ago

Who can reject the e-way bill and Why?

The person who causes transport of goods shall generate the e-way bill specifying the details of other person as a recipient of goods. There is a provision in the common […]

CA Shafaly Girdharwal wrote a new post, Updates for GST various filing on 28-08-2018 7 years, 10 months ago

Updates for GST various filing on 28-08-2018:

CBEC released four notifications for important changes in filing dates:

Notification No.

Form/return

due date

Notification No. 17/2018 – Central Tax […]

CA Shafaly Girdharwal wrote a new post, Due dates for filing GSTR 1 of April to June 2018 7 years, 10 months ago

Due dates for filing GSTR 1 of April to June 2018:

In a recent notification CBEC has notified the due dates for filing the GSTR 1 from April to June 2018. Following will be the date sheet for filing the GSTR 1 […]